Additional Proxy Soliciting Materials (definitive) (defa14a)

August 15 2022 - 6:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment No. _)

| Filed by the Registrant ☒ |

| |

| Filed by a Party other than the Registrant ☐ |

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☒ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

ADAMIS PHARMACEUTICALS CORPORATION

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other

than Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| |

|

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| |

|

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

| |

|

|

Adamis Pharmaceuticals Announces Results of Annual Meeting

of Stockholders

Meeting adjourned only with respect to reverse

stock split proposal until September 8, 2022

SAN DIEGO, August 12, 2022-- Adamis

Pharmaceuticals Corporation (NASDAQ: ADMP) today announced that its 2022 Annual Meeting of Stockholders (“Annual Meeting”)

was convened, as scheduled. At the Annual Meeting, all items of business were considered, with the exception of Proposal 2, the proposal

to adopt and approve a proposed amendment to the company’s restated certificate of incorporation authorizing the Board of Directors,

in its discretion, to effect a reverse stock split of Adamis’ outstanding shares of common stock at any time on or before December

31, 2022, as further described in the Company’s definitive proxy statement and any supplements thereto (the “Reverse Stock

Split Proposal”). Adamis expects to file the voting results regarding the other proposals considered today at the Annual Meeting

on a Form 8-K with the Securities and Exchange Commission no later than August 18, 2022.

At the Annual Meeting, approximately 60% of the Company’s outstanding

common shares and 100% of the Company’s outstanding preferred shares were represented in person or by proxy. Of the matters presented

for stockholder vote: all director nominees proposed for election in the Company’s definitive proxy statement were elected, stockholders

voted against the proposed amendment to the Company’s 2020 Equity Incentive Plan, stockholders voted against approving the compensation

of our named executive officers, the selection of BDO USA, LLP as the Company’s independent registered public accounting firm was

ratified, and the stockholders approved the proposal to adjourn the Annual Meeting, if necessary, to solicit additional proxies if there

were insufficient votes at the time of the Annual Meeting to adopt the Reverse Stock Split Proposal.

Based on feedback from Adamis stockholders related to the Reverse Stock

Split Proposal, the independent members of the Adamis Board believe it is in the best interests of its stockholders to extend the opportunity

for stockholders to vote on this important matter. Therefore, the meeting was adjourned to allow additional time for stockholders to submit

proxies with respect to the Reverse Stock Split Proposal. The Annual Meeting will be reconvened on Thursday, September 8, 2022 at 10:00

a.m. Pacific Time (the sole matter of business before the reconvened Annual Meeting will be the Reverse Stock Split Proposal).

The Adamis Board have determined, based on feedback from stockholders, that

it is necessary and appropriate to further clarify the Board’s intentions with respect to the Reverse Stock Split Proposal, in particular

related to (i) the timing for determining whether to implement a reverse stock split, and (ii) if the Board determines to effect a reverse

stock split, the criteria the Board anticipates using to select a split ratio. The Board intends to directly communicate a message to

stockholders in the next few days to provide additional clarification on both points. The Board members believe that maintaining

the Company’s continued listing on the Nasdaq Stock Market is of fundamental importance, and therefore, allowing additional time

for stockholders to meaningfully participate in the vote on a fully informed basis better represents their interests.

Adamis will continue to solicit proxies from stockholders with respect to

the Reverse Stock Split Proposal, and electronic voting platforms are expected to remain open. If you either did not vote, or previously

voted against the reverse split proposal, the Board of Directors urges you to reconsider your vote. The Board recommends that stockholders

vote “FOR” the Reverse Stock Split Proposal. Stockholders will be able to listen and participate in the adjourned meeting

as well as vote and submit questions during the live webcast by visiting www.virtualshareholdermeeting.com/ADMP2022. Stockholders will

need the control number found on their proxy card or in the instructions that accompanied their proxy materials to participate in the

virtual meeting. Only stockholders of record on the record date of July 6, 2022, are entitled to vote.

Adamis encourages any eligible stockholder that has not yet voted their

shares or provided voting instructions to their broker or other record holders to do so promptly. Stockholders who need help voting their

shares may call Adamis’ proxy solicitor, Saratoga Advisors, toll free at (888) 368-0379 or (212) 257-1311.

About Adamis Pharmaceuticals

Adamis Pharmaceuticals Corporation is

a specialty biopharmaceutical company primarily focused on developing and commercializing products in various therapeutic areas, including

allergy, opioid overdose, respiratory and inflammatory disease. The Company’s SYMJEPI® (epinephrine)

Injection products are approved by the FDA for use in the emergency treatment of acute allergic reactions, including anaphylaxis. The

Company’s ZIMHI™ (naloxone) Injection product is approved

for the treatment of opioid overdose. Tempol is in development for the treatment of patients with COVID-19 and a Phase 2/3 clinical trial

is underway. For additional information about Adamis Pharmaceuticals,

please visit our website and follow us on Twitter and LinkedIn.

Forward Looking Statements

This press

release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include those that express plans, anticipation, intent, contingencies, goals, targets or future development and/or otherwise

are not statements of historical fact. These statements are only predictions and involve known and unknown risks, uncertainties, and other

factors, which may cause Adamis’ actual results to be materially different from the results anticipated by such forward-looking

statements. You should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only

as of the date on which it is made, and except as may be required by applicable law, we undertake no obligation to update or release publicly

the results of any revisions to these forward-looking statements or to reflect events or circumstances arising after the date of this

press release. Certain of these risks and additional risks, uncertainties, and other factors are described in greater detail in Adamis’

filings from time to time with

the SEC,

including its annual report on Form 10-K for the year ended December 31, 2021,

and subsequent filings with the SEC, which Adamis strongly urges

you to read and consider, all of which are available free of charge on the SEC’s website

at http://www.sec.gov.

Contacts

Adamis Investor Relations

Robert Uhl

Managing Director

ICR Westwicke

619.228.5886

robert.uhl@westwicke.com

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

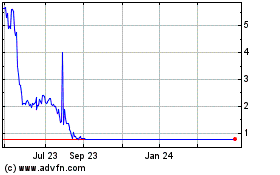

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024