Current Report Filing (8-k)

October 04 2021 - 4:31PM

Edgar (US Regulatory)

0000887247

false

0000887247

2021-09-30

2021-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September

30, 2021

ADAMIS PHARMACEUTICALS CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

0-26372

|

|

82-0429727

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

11682 El Camino Real, Suite 300

San Diego, CA

|

|

92130

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area

code: (858) 997-2400

(Former name or Former Address, if Changed Since Last

Report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of

the Exchange Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock

|

|

ADMP

|

|

NASDAQ Capital Market

|

|

|

Item 5.02

|

Departure of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

|

(d) Appointment of

Directors

On September 30, 2021,

the board of directors (the “Board”) of Adamis Pharmaceuticals Corporation (the “Company”) approved the appointment

of Meera J. Desai, Ph.D., as an independent director and member of the Board, effective October 1, 2021. Dr. Desai is a founder and managing

director of Karana Biotech, LLC, a boutique life science advisory firm founded in August 2018. She has over 15 years of pharmaceutical

industry experience in drug development and commercialization of products in multiple therapeutic areas, as well as corporate development

experience regarding a variety of transactions and relationships. From May 2014 to August 2018, she held positions of increasing responsibility

at AcelRx Pharmaceuticals, a public specialty pharmaceutical company, including Senior Director, Corporate Development. Prior to that

time, she held positions of increasing responsibility at Novartis Pharmaceuticals Corporation, an affiliate of Novartis AG, including

Associate Director, Pharmaceutical Development, and has also held responsible program manager positions at Nektar Therapeutics, and ALZA

Corporation, a Johnson & Johnson company. Dr. Desai holds a Bachelor’s degree in Chemistry from Drew University and a Ph.D.

in Analytical Chemistry from Iowa State University.

Dr. Desai has been appointed to the Audit Committee,

Compensation Committee, and Nominating and Governance Committee of the Board.

There is no arrangement

or understanding between Dr. Desai and any other person pursuant to which she was selected as a director of the Company, and there is

no family relationship between Dr. Desai and any of the Company’s other directors or executive officers. Dr. Desai does not have

any direct or indirect material interest in any transaction that is required to be disclosed under Item 404(a) of Regulation S-K.

In connection with her

appointment as a director of the Company, Dr. Desai was granted a cash stock appreciation right (the “SAR”). The SAR provides

for a reference price equal to the fair market value of the common stock of the Company of the date of grant of the SAR, and a reference

number of shares equal to 50,000 shares. The SAR vests with respect to 1/6 of the reference number of shares on the six-month anniversary

of the grant date and vests monthly thereafter in equal installments over a period of three years from the grant date, subject to the

recipient providing continuous service to the Company. The SAR has a term of seven years. The vested portion of the SAR may be settled

only in cash and may be exercised for a period of 12 months after the date of termination of the recipient’s service to the Company.

Upon settlement, the Company will pay to the recipient an amount of cash equal to the difference between the fair market value of the

common stock on the date of termination of service or, if lower, on the date of exercise, and the initial reference price, multiplied by

the number of shares as to which the SAR is being exercised. In the event of a change of control of the Company before the SAR is fully

vested, vesting and exercisability is accelerated.

Pursuant to the Company’s

policies regarding compensation for non-employee directors, as described under the heading “Compensation of Directors” in

the Company’s definitive proxy statement dated June 14, 2021, relating to its 2021 annual meeting of stockholders, Dr. Desai will

be entitled to receive an annual cash director fee and is also

entitled to reimbursement of reasonable expenses incurred in connection with Board-related activities. The Company will also enter into

an indemnity agreement with Dr. Desai.

|

|

Item 7.01

|

Regulation FD Disclosure

|

On October 4, 2021, the

Company issued a press release relating to the appointment of Dr. Desai to the Company’s board of directors and the matters described

in Item 5.02 above. A copy of the press release, which is attached to this Current Report on Form

8-K as Exhibit 99.1, is furnished pursuant to this Item 7.01. The information in this Item 7.01 and Exhibit 99.1 are furnished and shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any registration

statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing, except as shall be expressly incorporated by specific reference in such filing.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

ADAMIS PHARMACEUTICALS CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: October 4, 2021

|

By:

|

/s/ David C. Benedicto

|

|

|

Name:

|

David C. Benedicto

|

|

|

Title:

|

Chief Financial Officer

|

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

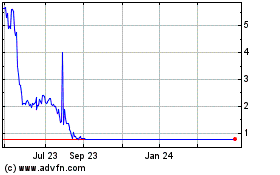

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024