|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

SEC FILE NUMBER

000-26372

|

|

FORM 12b –25

NOTIFICATION OF LATE FILING

|

CUSIP NUMBER

00547W208

|

Check One:

☐

Form 10-K ☐ Form 20-F ☐

Form 11-K ☒ Form 10-Q ☐

Form 10-D ☐ Form N-CEN ☐

Form N-CSR

For Period Ended: June 30, 2021

☐ Transition

Report on Form 10-K

☐ Transition

Report on Form 20-F

☐ Transition

Report on Form 11-K

☐ Transition

Report on Form 10-Q

☐ Transition

Report on Form N-SAR

For the Transition Period Ended: __________________________

Nothing in this form shall be construed to imply

that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing check

above, identify the Item(s) to which the notification relates:

PART I

-- REGISTRANT INFORMATION

Adamis Pharmaceuticals

Corporation

Full Name of Registrant

Former Name if Applicable

11682 El Camino Real,

Suite 300

Address of Principal Executive Office (Street and Number)

San Diego, CA 92130

City, State and Zip Code

PART II

-- RULES 12b - 25(b) and (c)

If the subject report could not be filed without unreasonable effort or

expense and the registrant seeks relief pursuant to Rule 12b - 25(b), the following should be completed. (Check box if appropriate.)

|

|

☒

|

(a)

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort expense;

|

|

|

|

|

|

|

|

☐

|

(b)

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or a portion thereof will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or subject distribution report on Form 10-D, or a portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

☐

|

(c)

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III

– NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K,

10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period. (Attach extra

sheets if needed.)

Adamis Pharmaceuticals Corporation (the “Registrant”

or the “Company”) is filing this Notification of Late Filing on Form 12b-25 with respect to its Quarterly Report on Form 10-Q

for the three- and six-month periods ended June 30, 2021 (the “Form 10-Q”). For the reasons described below, which cannot

be eliminated by the Company without unreasonable effort or expense, the Company has determined that it is unable to file the Form 10-Q

with the Securities and Exchange Commission (“SEC”) within the prescribed time period.

As previously disclosed, on May 11, 2021, each of the Company

and its US Compounding Inc. (“USC”) subsidiary received a grand jury subpoena from the U.S. Attorney’s Office for the

Southern District of New York issued in connection with a criminal investigation, requesting a broad range of documents and materials

relating to, among other matters, certain veterinary products sold by USC, certain practices, agreements and arrangements relating to

products sold by USC, including veterinary products, and certain regulatory and other matters relating to the Company and USC. The Audit

Committee of the Board of Directors of the Company has engaged outside counsel to conduct an independent internal investigation to review

these and other matters. The internal investigation is ongoing and the Company cannot predict its duration or outcome. The independent

investigation includes matters that could, depending on the outcome of the investigation, affect the Company’s financial statements

to be included in the Form 10-Q and other disclosures in the Form 10-Q. As a result, the Company will not be able, without unreasonable

effort or expense, to timely file the Form 10-Q by the deadline prescribed by applicable securities laws. The Company is working diligently

towards the goal of being in a position to file the Form 10-Q, the Quarterly Report on Form 10-Q for the period ended March 31, 2021,

and any other required prior reports, with the SEC, but at this time cannot predict with certainty

when the preparation and filing of those reports will be completed. However, the Company is committed to completing the Audit Committee

investigation, addressing any issues identified, and re-establishing timely financial reporting as soon as practicable. The

Company intends to cooperate fully with the U.S. Attorney’s Office. At this time, the Company is unable to determine what, if any,

proceedings the U.S. Attorney’s Office or other federal or state authorities may initiate, what, if any, remedies or remedial measures

the U.S. Attorney’s Office or other federal or state authorities may seek, or what, if any, impact the foregoing matters may have

on the Company’s business, previously reported financial results, financial results for the periods ended March 31, 2021 and June

30, 2021, or future financial results. The foregoing matters may divert management’s attention, cause the Company to suffer reputational

harm, require the Company to devote significant financial resources, subject the Company and its officers and directors to civil or criminal

proceedings, and depending on the resolution of the matters, result in fines, penalties, equitable remedies, and affect the Company’s

business, previously reported financial results, financial results for the periods ended March 31, 2021 and June 30, 2021, or future

financial results. The occurrence of any of these events could have a material adverse effect on the Company’s business, financial

condition and results of operations.

Forward-Looking Statements

This filing contains a number of forward-looking

statements. Words such as “expects,” “will,” “anticipates,” and variations of such words and similar

future or conditional expressions are intended to identify forward-looking statements. These forward-looking statements include, but are

not limited to, statements regarding our beliefs and expectations relating to the duration or outcome of the internal investigation described

above, actions by federal or state authorities or third parties regarding the matters described above, and the completion of matters necessary

to permit the filing of the Form 10-Q, the Quarterly Report on Form 10-Q for the period ended March 31, 2021, and any other required prior

reports, with the SEC. There can be no assurance that these forward-looking statements will be achieved, and actual results could differ

materially from those suggested by such forward-looking statements. We disclaim and do not undertake any obligation to update or revise

any forward-looking statement in this report, except as required by applicable law or regulation.

PART IV

– OTHER INFORMATION

|

|

(1)

|

Name and telephone number of person to contact in regard to this notification.

|

|

|

Dennis J. Carlo

|

(858) 997-2400

|

|

|

(Name)

|

(Area Code and Telephone Number)

|

|

|

(2)

|

Have all other periodic reports required under section 13 or 15(d) of the Securities Exchange Act of 1934 or section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If the answer is no, identify report(s).

|

☐ Yes ☒

No

Quarterly Report on Form 10-Q for the period

ended March 31, 2021.

|

|

(3)

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof?

|

☒

Yes ☐ No

If so, attach an explanation of the anticipated change, both narratively

and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company currently anticipates that the Form 10-Q will not

reflect a significant change in net revenue, and will reflect an increase in gross profit, a decrease in loss from operations, a decrease

in the expense relating to change in fair value of warrants and total other income (expense), net, and a decrease in net loss, for the

three months ended June 30, 2021 compared to the comparable period of 2020. However, the Company is unable to determine whether the investigation

and other matters described in Part III above will have an impact on the Company’s results of operations and financial information

relating to the periods included in the Form 10-Q. As a result, the Company is unable to provide an accurate quantitative estimate of

its results of operations for the three and six month periods ended June 30, 2021.

Adamis Pharmaceuticals

Corporation

(Name of Registrant as specified

in its charter)

has caused this notification to be signed on its behalf by the undersigned

thereunto duly authorized.

By: /s/ Dennis J. Carlo

Dennis J. Carlo

Chief Executive Officer

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

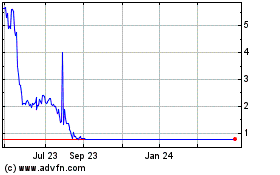

Adamis Pharmaceuticals (NASDAQ:ADMP)

Historical Stock Chart

From Apr 2023 to Apr 2024