UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

ACORDA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

ACORDA THERAPEUTICS, INC.

420 Saw Mill River Road, Ardsley, New York 10502

April 23, 2021

Dear Stockholder:

You are cordially invited to attend the 2021 Annual Meeting of Stockholders of Acorda Therapeutics, Inc., which will be held at the Hilton Garden Inn, 201 Ogden Avenue, Dobbs Ferry, New York 10522, commencing at 9:00 a.m., local time, on June 2, 2021.

We are proceeding under the Securities and Exchange Commission rule that allows us to furnish proxy materials to our stockholders over the Internet, although we may choose to send a full set of proxy materials to some of our stockholders. We believe that this electronic proxy process expedites stockholders’ receipt of proxy materials and lowers the costs and reduces the environmental impact of our Annual Meeting.

On or about April 23, 2021, we will commence sending a Notice of Annual Meeting and Internet Availability to our stockholders along with instructions on how to access our 2021 Proxy Statement and Annual Report and authorize a proxy to vote your shares online. The Annual Report is not to be regarded as proxy solicitation material.

Matters to be considered and voted on at the 2021 Annual Meeting are set forth in the Proxy Statement. You are encouraged to carefully review the Proxy Statement and attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible by authorizing a proxy over the Internet or by telephone as described in the enclosed materials so that your shares will be represented at the Annual Meeting. If you receive a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. If you attend the Annual Meeting and wish to change your proxy vote, you may do so by voting in person at the Annual Meeting.

We look forward to meeting you on June 2, 2021 and discussing with you the business of our company.

|

|

|

Sincerely,

|

|

|

|

Ron Cohen, M.D.

|

|

President and Chief Executive Officer

|

ACORDA THERAPEUTICS, INC.

420 Saw Mill River Road, Ardsley, New York 10502

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

Time and Date:

|

9:00 a.m., local time, on June 2, 2021

|

|

Place:

|

Hilton Garden Inn, 201 Ogden Avenue, Dobbs Ferry, New York 10522

|

|

COVID-19 Contingencies:

|

We are actively monitoring developments related to the COVID-19 pandemic as well as protocols that U.S. federal, state and local governments may impose to reduce the risk of transmission. In the event that we determine it is not possible or advisable to hold the 2021 Annual Meeting at the date, time and/or location disclosed in this Proxy Statement, we will announce alternative arrangements for the meeting in a press release. Our press releases can be accessed on our corporate website free of charge at www.acorda.com, under the “News and Events” and then “Press Releases” captions. We will also post any updated information on our website under the “Investors” and then “Investor Events” captions. If you plan to attend the 2021 Annual Meeting in person, please check for our disclosure of this information prior to the currently-scheduled time and date for the 2021 Annual Meeting.

|

|

Items of Business:

|

(1)

|

To elect two Class I directors for a term expiring on the date of our 2024 Annual Meeting of Stockholders, or at such time as their successors have been duly elected and qualified.

|

|

|

(2)

|

To ratify the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2021.

|

|

|

(3)

|

An advisory vote to approve Named Executive Officer compensation.

|

|

|

(4)

|

To consider such other business as may properly come before the 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”).

|

|

Adjournments and Postponements:

|

Any action on the items of business described above may be considered at the 2021 Annual Meeting at the time and on the date specified above or at any time and date to which the 2021 Annual Meeting may be properly adjourned or postponed.

|

|

Record Date:

|

You are entitled to vote only if you were a stockholder of Acorda Therapeutics as of the close of business on April 5, 2021.

|

|

Meeting Admission:

|

You are entitled to attend the 2021 Annual Meeting only if you were an Acorda Therapeutics stockholder as of the close of business on the record date or hold a valid proxy for the 2021 Annual Meeting. You will need to present a valid government-issued or other acceptable photo identification for admittance. If you are not a stockholder of record but hold shares through a broker or other nominee (i.e., in street name), you will need to provide proof of beneficial ownership as of the record date, such as your most recent account statement dated as of or prior to April 5, 2021, a copy of the voting instruction form provided by your broker, trustee, or other nominee, or other similar evidence of ownership. If, upon request, you do not provide photo identification or provide the other materials described above, you will not be admitted to the 2021 Annual Meeting. In recognition of the serious and adverse effect of the COVID-19 pandemic, we will require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention, which will include recommended social distancing and personal protective equipment, such as face masks, as well as any applicable state or local governmental requirements which may be imposed. Cameras, recording devices and other similar electronic devices will not be permitted at the meeting.

|

|

Voting:

|

Your vote is very important. Whether or not you plan to attend the 2021 Annual Meeting, we strongly encourage you to read this Proxy Statement and submit your proxy or, if applicable, your voting instructions to your broker, trustee, or other nominee as soon as possible. If you received your proxy materials electronically, you may submit your proxy online or by telephone by following the instructions provided with the proxy materials. If you receive your proxy materials by mail, you may submit your proxy by completing, signing, dating and returning your proxy card or voting instructions form in the pre-addressed envelope provided, or by voting online or by telephone by following the instructions provided with the proxy materials. For specific instructions on how to vote, please refer to the “Questions and Answers” section beginning on page 1 of the Proxy Statement.

|

|

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting:

|

The Notice of Annual Meeting and the Proxy Statement for the 2021 Annual Meeting are available free of charge at www.proxyvote.com.

|

|

|

By the Order of the Board of Directors

|

|

|

|

|

|

Andrew Mayer

Deputy General Counsel and Corporate Secretary

|

April 23, 2021

TABLE OF CONTENTS

i

ii

ACORDA THERAPEUTICS, INC.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 2, 2021

QUESTIONS AND ANSWERS ABOUT

THE PROXY MATERIALS AND THE 2021 ANNUAL MEETING OF STOCKHOLDERS

|

Q:

|

Why am I receiving these materials?

|

|

A:

|

The Board of Directors (the “Board”) of Acorda Therapeutics, Inc., a Delaware corporation (which may be referred to in this proxy statement as “we,” “us,” “our,” the “Company” or “Acorda Therapeutics”), is providing these proxy materials to you in connection with our 2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”), which will take place on June 2, 2021. As a stockholder on the Record Date (as defined below), you are invited to attend the 2021 Annual Meeting and are entitled and requested to vote on the items of business described in this proxy statement (the “Proxy Statement”).

|

We are actively monitoring developments related to the COVID-19 pandemic as well as protocols that U.S. federal, state and local governments may impose to reduce the risk of transmission. In the event that we determine it is not possible or advisable to hold the 2021 Annual Meeting at the date, time and/or location disclosed in this Proxy Statement, we will announce alternative arrangements for the meeting in a press release. Our press releases can be accessed on our corporate website free of charge at www.acorda.com, under the “News and Events” and then “Press Releases” captions. We will also post any updated information on our website under the “Investors” and then “Investor Events” captions. If you plan to attend the 2021 Annual Meeting in person, please check for our disclosure of this information prior to the currently-scheduled time and date for the 2021 Annual Meeting.

|

Q:

|

How do I request a paper copy of this Proxy Statement if I have not received one?

|

|

A:

|

As permitted by the Securities and Exchange Commission (the “SEC”), we are delivering our Proxy Statement and Annual Report via the Internet, although we may choose to send a full set of proxy materials to some of our stockholders. The Notice of Annual Meeting and Internet Availability contains instructions on how to access our Proxy Statement and Annual Report and authorize a proxy to vote your shares online or by telephone. If you wish to request a printed or e-mail copy of the Proxy Statement and Annual Report, you should follow the instructions included in the Notice of Annual Meeting and Internet Availability.

|

|

Q:

|

What information is contained in this Proxy Statement?

|

|

A:

|

The information included in this Proxy Statement relates to the proposals to be voted on at the 2021 Annual Meeting, the voting process, our corporate governance practices, the compensation of directors and the most highly paid executive officers, beneficial ownership of the Company’s common stock, and certain other required information.

|

|

Q:

|

What items of business will be voted on at the 2021 Annual Meeting?

|

|

A:

|

The items of business scheduled to be voted on at the 2021 Annual Meeting are:

|

|

|

•

|

The election of two Class I directors for a term expiring on the date of our 2024 Annual Meeting of Stockholders, or at such time as their successors have been duly elected and qualified.

|

|

|

•

|

The ratification of the appointment of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2021.

|

|

|

•

|

An advisory vote to approve Named Executive Officer compensation, referred to as a “say-on-pay” vote.

|

We will also consider other business that properly comes before the 2021 Annual Meeting.

|

Q:

|

How does the Board recommend that I vote?

|

|

A:

|

The Board unanimously recommends that you:

|

|

|

•

|

Vote your shares “FOR” the nominees to the Board.

|

|

|

•

|

Vote your shares “FOR” the ratification of the appointment of Ernst & Young LLP as our independent auditors for the 2021 fiscal year.

|

|

|

•

|

Vote your shares “FOR” the advisory say-on-pay vote to approve our Named Executive Officer compensation.

|

|

Q:

|

Who is entitled to vote at the 2021 Annual Meeting?

|

|

A:

|

Only stockholders of record at the close of business on April 5, 2021 are entitled to vote at the 2021 Annual Meeting. We refer to this date as our “Record Date.”

|

You may vote all shares of Acorda Therapeutics common stock you own as of the Record Date, including (1) shares that are held directly in your name as the stockholder of record, and (2) shares held for you as the beneficial owner through a broker, trustee, or other nominee, such as a bank.

On the Record Date, we had 9,489,032 shares of common stock issued and outstanding.

|

Q:

|

What are the voting rights of the Company’s holders of common stock? Do Stockholders have dissenters’ or appraisal rights?

|

|

A:

|

Each outstanding share of the Company’s common stock owned as of the Record Date will be entitled to one vote on each matter considered at the meeting.

|

|

|

Our stockholders are not entitled to dissenters’ or appraisal rights under the Delaware General Corporation Law with respect to any of the proposals being voted on at the 2021 Annual Meeting and described in this Proxy Statement.

|

|

Q:

|

What is the difference between holding shares as a stockholder of record and holding shares as a beneficial owner?

|

|

A:

|

Most of our stockholders hold their shares through a broker, trustee, or other nominee rather than directly in their own name. We have summarized below some of the distinctions between being a stockholder of record and being a beneficial owner:

|

Stockholder of Record

If your shares are registered directly in your name, or as a joint holder, with our transfer agent, Computershare, you are considered, with respect to those shares, the stockholder of record, and either written proxy materials or a Notice of Annual Meeting and Internet Availability are being sent to you directly by Acorda Therapeutics. As a stockholder of record, you have the right to grant your proxy directly to us or to vote in person at the 2021 Annual Meeting.

Beneficial Owner

If your shares are held in a brokerage account or by a trustee or another nominee, you are considered the beneficial owner of shares held in street name, and the Notice of Annual Meeting and Internet Availability, together with a voting instruction form, are being forwarded to you by your broker, trustee, or other nominee. As a beneficial owner, you have the right to direct your broker, trustee, or other nominee how to vote and are also invited to attend the 2021 Annual Meeting.

Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the broker, trustee, or other nominee that holds your shares, giving you the right to vote the shares at the 2021 Annual Meeting. Your broker, trustee, or other nominee

2

is responsible for providing voting instructions for you to use in directing the broker, trustee, or other nominee how to vote your shares.

|

Q:

|

How can I attend the 2021 Annual Meeting?

|

|

A:

|

You are entitled to attend the 2021 Annual Meeting only if you were a stockholder of record of our common stock as of the close of business on the Record Date or you hold a valid proxy for the 2021 Annual Meeting. You will need to present a valid government-issued or other acceptable photo identification for admittance. A list of stockholders eligible to vote at the 2021 Annual Meeting will be available for inspection at the 2021 Annual Meeting and for a period of 10 days prior to the 2021 Annual Meeting, during regular business hours, at our principal executive office, which is located at 420 Saw Mill River Road, Ardsley, New York 10502.

|

If you are not a stockholder of record but hold shares through a broker, trustee, or other nominee (i.e., in street name), you will need to provide proof of beneficial ownership on the Record Date, such as your most recent account statement dated as of or prior to April 5, 2021, a copy of the voting instruction form provided by your broker, trustee, or other nominee, or other similar evidence of ownership. If, upon request, you do not provide photo identification or the other materials described above, you will not be admitted to the 2021 Annual Meeting.

The 2021 Annual Meeting will begin promptly at 9:00 a.m., local time. Check-in will begin at 8:30 a.m., local time, and you should allow ample time for the check-in procedures. In recognition of the serious and adverse effect of the COVID-19 pandemic, we will require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention, which will include recommended social distancing and personal protective equipment, such as face masks, as well as any applicable state or local government requirements which may be imposed.

Cameras, recording devices and other similar electronic devices will not be permitted at the meeting.

Even if you plan to attend the 2021 Annual Meeting, we strongly encourage that you also submit your proxy or voting instructions as described above so that your vote will be counted if you later decide not to attend the 2021 Annual Meeting.

|

A:

|

Whether you hold shares directly as a stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the 2021 Annual Meeting.

|

|

|

If you are a stockholder of record, you may vote through one of the following means:

|

Internet: By accessing www.proxyvote.com and following the instructions on the proxy card.

Telephone: By calling toll-free 1 (800) 690-6903 and following the instructions on the proxy card.

Mail: If you receive your proxy materials by mail, by signing, dating, and mailing the enclosed proxy card.

If you authorize a proxy to vote your shares online, you should not return your proxy card. The Notice of Annual Meeting and Internet Availability is not a proxy card or ballot.

If you hold your shares in street name, you may vote by following the instructions contained in the voting instruction form provided by your broker, trustee, or other nominee.

|

Q:

|

How are my votes cast when I return a proxy card?

|

|

A:

|

When you properly authorize a proxy online, by telephone or by signing a written proxy, you appoint Dr. Ron Cohen, our President and Chief Executive Officer, and Andrew Mayer, our Deputy General Counsel and Corporate Secretary, as your representatives at the 2021 Annual Meeting. Either Dr. Cohen or Mr. Mayer will vote your shares at the 2021 Annual Meeting as you have instructed them in the proxy. Dr. Cohen and Mr. Mayer are also entitled to appoint substitutes to act on their behalf.

|

3

|

A:

|

Yes. You may change your vote at any time prior to the vote at the 2021 Annual Meeting. If you are the stockholder of record, you may change your vote by granting a properly authorized new proxy with a later date by mail, telephone or online (which automatically revokes the earlier proxy), by providing a written notice of revocation to our Corporate Secretary prior to your shares being voted, or by attending the 2021 Annual Meeting and voting in person. For your written notice of revocation to be effective, it must be received by our Corporate Secretary at our principal executive offices no later than June 1, 2021. Attendance at the 2021 Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or you cast a new vote. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee, or other nominee, or, if you have obtained a legal proxy from your broker, trustee, or other nominee giving you the right to vote your shares, by attending the 2021 Annual Meeting and voting in person.

|

|

Q:

|

Who can help answer my questions?

|

|

A:

|

If you have any questions about the 2021 Annual Meeting or how to vote or revoke your proxy, you should contact our communications department at (914) 347-4300. You may also contact them if you need additional copies of this Proxy Statement or voting materials.

|

|

Q:

|

Is my vote confidential?

|

|

A:

|

Proxies, ballots and voting instructions and tabulations that identify individual stockholders will be tabulated by Broadridge Financial Solutions, Inc. (“Broadridge”) and will be handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Acorda Therapeutics or to third parties, except as necessary to meet applicable legal requirements and to allow for the tabulation of votes and certification of the vote.

|

|

Q:

|

How many shares must be present or represented to conduct business at the 2021 Annual Meeting?

|

|

A:

|

The quorum requirement for holding the 2021 Annual Meeting and transacting business is that holders of a majority of shares of Acorda Therapeutics’ common stock entitled to vote must be present in person or represented by proxy at the 2021 Annual Meeting. Abstentions are counted for the purpose of determining the presence of a quorum. Broker non-votes, which are explained below under “what is a broker non-vote?”, are counted for the purpose of determining the presence of a quorum if the broker exercises voting discretion on a routine matter at the meeting.

|

|

Q:

|

What if a quorum is not present at the 2021 Annual Meeting?

|

|

A:

|

If a quorum is not present or represented at the 2021 Annual Meeting, the stockholders present or represented at the meeting and entitled to vote, although less than a quorum, or if no stockholder is present, any officer entitled to preside or to act as secretary of such meeting, may adjourn the 2021 Annual Meeting until a quorum is present or represented. The time and place of the adjourned meeting will be announced at the time the adjournment is taken and no other notice will be given, unless the adjournment is for 30 or more days from the date of the original meeting or a new record date is set for the adjourned meeting.

|

|

Q:

|

What vote is required to approve each of the proposals and how are votes counted?

|

|

A:

|

In the election of the directors, you may vote “FOR ALL” nominees, you may “WITHHOLD ALL” authority to vote for the nominees or you may vote “FOR ALL EXCEPT” which allows you to withhold the authority to vote with respect to a particular nominee. A properly executed proxy marked “FOR ALL EXCEPT” will not be voted with respect to the nominee that you indicate, although it will be counted for purposes of determining whether there is a quorum. The affirmative vote of a plurality of the shares of common stock present in person or represented by proxy and entitled to vote at the 2021 Annual Meeting is required to elect the two nominees to the Board. Accordingly, the nominees receiving the highest number of “FOR” votes at the 2021 Annual Meeting will be elected as directors. However, our Bylaws incorporate a majority voting standard in uncontested elections of directors. This is an uncontested election of directors because the number of director nominees does not exceed the number of directors to be elected. As further described below under Proposal One, a director who is elected by a plurality vote in an uncontested election but who receives a greater number of “WITHHELD” votes than “FOR” votes must tender his or her resignation to the Board, which will consider whether to accept the resignation. Abstentions and broker

|

4

|

|

non-votes are not considered votes “FOR” any candidate or as a “WITHHELD” vote and therefore will not affect the outcome of this proposal.

|

For the ratification of the appointment of Ernst & Young LLP as our independent auditors for the 2021 fiscal year and the advisory say-on-pay vote to approve our Named Executive Officer compensation, you may vote “FOR” or “AGAINST” either or both of these proposals or you may “ABSTAIN” from the vote. The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and voting on these proposals at the 2021 Annual Meeting is required for approval of these proposals. Because abstentions and broker non-votes are not considered votes “FOR” or “AGAINST” a proposal, they will have no effect on the outcome of these proposals.

If you provide specific instructions with regard to certain items, your shares will be voted as you instruct on such items. If no instructions are specified, your shares will be voted in accordance with the recommendations of the Board as described above under “How does the Board recommend that I vote?” with respect to the three proposals described in this Proxy Statement and in the discretion of the proxy holders on any other matters that properly come before the 2021 Annual Meeting.

|

Q:

|

What is a broker non-vote?

|

|

A:

|

If you hold shares beneficially in street name and do not provide your broker with voting instructions, a “broker non-vote” will occur with respect to any matter on which your broker is not authorized or declines to vote without instructions from you. Under New York Stock Exchange rules that govern brokers, brokers have the discretion to vote on matters that the New York Stock Exchange considers to be “routine,” but not on matters that it considers to be “non-routine.” Under the New York Stock Exchange rules, the election of directors and the advisory say-on-pay vote are considered non-routine matters, and the ratification of the appointment of the Company’s independent auditors is considered a routine matter. Accordingly, brokers will not have discretionary authority to vote shares held in street name on the election of directors and the advisory say-on-pay vote. In the event you do not provide your broker with voting instructions on these matters, a broker non-vote will occur. On the other hand, brokers will have discretionary authority to vote shares held in street name on the ratification of the appointment of the Company’s independent auditors if they have not received voting instructions from you.

|

If you hold your shares in street name, it is critical that you provide voting instructions to your broker for each proposal. We strongly encourage you to provide voting instructions to the organization that holds your shares in order to allow your voice to be heard and to minimize the number of broker non-votes.

|

Q:

|

What happens if a nominee is unable to stand for election?

|

|

A:

|

If a nominee is unable to stand for election, the Board may either reduce the number of directors to be elected or substitute a nominee. If a substitute nominee is selected, the proxy holders, Dr. Cohen and Mr. Mayer, will vote your shares for the substitute nominee, unless you have withheld authority.

|

|

Q:

|

What happens if additional matters are presented at the 2021 Annual Meeting?

|

|

A:

|

Other than the three items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the 2021 Annual Meeting. If you grant a proxy, the persons named as proxyholders, Dr. Cohen and Mr. Mayer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the 2021 Annual Meeting.

|

|

Q:

|

Who will serve as inspector of elections?

|

|

A:

|

Broadridge will tabulate votes and a representative of Broadridge will act as inspector of elections.

|

|

Q:

|

What does it mean if I receive more than one Notice of Annual Meeting and Internet Availability and/or set of written proxy materials?

|

|

A:

|

If you receive more than one Notice of Annual Meeting and Internet Availability, and/or more than one set of written proxy materials, it means your shares are not all registered or held in the same way (for example, some are registered in your name and others are registered jointly with a spouse) and are in more than one account. In order to ensure that you vote all of the shares that you are entitled to vote, you should authorize a proxy to vote all proxy

|

5

|

|

cards to which you are provided access. Similarly, for all shares you hold in street name, you should follow the voting instructions provided by each broker, trustee, or other nominee for the shares held on your behalf by that broker, trustee, or other nominee.

|

|

Q:

|

Who will bear the cost of soliciting votes for the 2021 Annual Meeting?

|

|

A:

|

We are making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers, and employees. These individuals will not receive any additional compensation for such solicitation activities. We may, if appropriate, retain an independent proxy solicitation firm to assist in soliciting proxies. If we do retain a proxy solicitation firm, we would pay such firm’s customary fees and expenses. Upon request, we will also reimburse brokerage houses and other custodians, trustees, nominees and fiduciaries for forwarding proxy materials to stockholders.

|

|

Q:

|

Where can I find the voting results of the 2021 Annual Meeting?

|

|

A:

|

We intend to announce preliminary voting results at the 2021 Annual Meeting, and after the meeting we will publish final results in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission.

|

|

Q:

|

What if I have questions for Acorda Therapeutics’ transfer agent?

|

|

A:

|

Please contact our transfer agent, at the phone number or address listed below, if you are a registered stockholder and have questions concerning stock certificates, transfers or ownership or other matters pertaining to your stock account.

|

Computershare

P.O. Box 505000

Louisville, KY 40233-5000

Overnight correspondence:

Computershare

462 South 4th Street

Suite 1600

Louisville, KY 40202

Telephone: (800) 368-5948

Also, the Computershare shareholder website can be accessed at www.computershare.com/investor.

|

Q:

|

What is the deadline for submitting proposals for inclusion in Acorda Therapeutics’ proxy statement for the 2022 Annual Meeting of Stockholders?

|

|

A:

|

Pursuant to Securities and Exchange Commission Rule 14a-8 under the Securities Exchange Act of 1934, as amended, stockholders may present proper proposals for inclusion in our proxy statement relating to, and for consideration at, the 2022 Annual Meeting of Stockholders, by submitting their proposals to us no later than December 24, 2021. This deadline is determined under Rule 14a-8 and represents the 120th day prior to the anniversary of the date we filed and intend to commence distribution of this Proxy Statement to shareholders. Any proposal so submitted must comply with the rules and eligibility requirements of the Securities and Exchange Commission.

|

More information on how to submit proposals is set forth below under Requirements, Including Deadlines, for Submission of Proxy Proposals, Nomination of Directors and Other Business of Stockholders in the Additional Information section at the end of this Proxy Statement.

6

|

Q:

|

What is the deadline for submitting proposals to be presented on the floor of the 2022 Annual Meeting of Stockholders and not in Acorda Therapeutics’ proxy statement or to nominate individuals to serve as directors?

|

|

A:

|

Under our Bylaws, a stockholder may nominate a director or submit a proposal for consideration at an annual meeting by giving timely notice to Acorda Therapeutics. To be timely, that notice must contain information specified in our Bylaws and be received by us at our principal executive office at 420 Saw Mill River Road, Ardsley, New York 10502, not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting. If, however, the date of the annual meeting is advanced by more than 20 days, or delayed by more than 60 days, from the first anniversary of the preceding year’s annual meeting, a stockholder’s notice must be received no earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting and the tenth day following the day on which notice of the date of such annual meeting was mailed or public disclosure of the date of such annual meeting was made. Therefore, we must receive your nomination or proposal no sooner than February 2, 2022, and no later than March 4, 2022, unless the date of the 2022 Annual Meeting of Stockholders is advanced by more than 20 days, or delayed by more than 60 days, from the first anniversary of the 2021 Annual Meeting.

|

More information on how to submit proposals is set forth below under Requirements, Including Deadlines, for Submission of Proxy Proposals, Nomination of Directors and Other Business of Stockholders in the Additional Information section at the end of this Proxy Statement. You may contact the Corporate Secretary of Acorda Therapeutics, at our principal executive office, for a copy of the relevant provisions of our Bylaws regarding the requirements for making stockholder proposals and nominating director candidates.

7

PROPOSAL ONE:

ELECTION OF DIRECTORS

The Board of Directors currently consists of seven members and is divided into three classes. Each class holds office for a term of three years. These classes currently consist of authorized members in each of Classes I, II and III, whose terms expire at the 2021, 2022, and 2023 Annual Meetings of Stockholders, respectively. Steven Rauscher, formerly one of our Class III directors, resigned from the Board on September 30, 2020. Mr. Rauscher indicated that his decision to resign was not a result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. In light of Mr. Rauscher’s resignation, the Board subsequently reduced its size from eight to seven members, and reduced the size of Class III to two directors.

This year’s nominees for director, Barry Greene, and Catherine D. Strader, Ph.D., have been nominated by the Board as Class I directors for a term of three years expiring on the date of our 2024 Annual Meeting of Stockholders or at such time as their respective successors are duly elected and qualified. Mr. Greene and Dr. Strader are currently directors of the Company. Proxies cannot be voted for a greater number of persons than the number of nominees named above.

If any of those candidates should become unavailable for election, the shares represented by the proxies solicited for the 2021 Annual Meeting will be voted for such substitute nominee as may be determined by the Board. The Board has no reason to expect that Mr. Greene and Dr. Strader will not be a candidate for director at the 2021 Annual Meeting. In voting for directors, for each share of common stock held as of the Record Date, stockholders are entitled to cast one vote in favor of the candidate, or to withhold authority from voting for the candidate. Unless a stockholder requests that voting of the proxy be withheld for the nominee for director by so directing on the proxy card, the shares represented by the accompanying proxy will be voted “FOR” the election of Mr. Greene and Dr. Strader.

The election of a director requires the affirmative vote of a plurality of the shares of common stock present or represented and entitled to vote at the 2021 Annual Meeting. However, our Bylaws incorporate a majority voting standard in uncontested elections of directors. This is an uncontested election of directors because the number of nominees does not exceed the number of directors to be elected. Under our Bylaws, in the case of uncontested elections, a nominee who is elected but receives a greater number of “WITHHELD” votes than “FOR” votes will be required to tender his or her resignation following certification of the stockholder vote. Promptly thereafter, the Nominations and Governance Committee of the Board will consider the resignation and range of possible responses and make a recommendation to the Board, which will then act on the recommendation within 90 days after the certification of the stockholder vote. Nominees who tender their resignation will not be permitted to participate in the Nominations and Governance Committee or Board discussions regarding the stockholder vote or the resignation. We will disclose the Board’s decision-making process and decision regarding whether to accept the nominee’s resignation (and the reasons for rejecting a resignation, if applicable) in a Current Report on Form 8-K filed with the Securities and Exchange Commission, promptly following such decision.

Certain information concerning the nominees and those directors whose terms of office will continue following the 2021 Annual Meeting is set forth below.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” ALL NOMINEES IN PROPOSAL ONE.

8

The following table sets forth information as of April 23, 2021 with respect to our directors and nominees for election at the 2021 Annual Meeting.

|

Name

|

|

Age

|

|

Position(s)

|

|

Ron Cohen, M.D.

|

|

65

|

|

President, Chief Executive Officer, and Director

|

|

Barry Greene (1)

|

|

57

|

|

Director and Nominee

|

|

Peder K. Jensen, M.D. (2)

|

|

66

|

|

Director

|

|

John P. Kelley (3)

|

|

67

|

|

Director and non-executive Chair of the Board

|

|

Sandra Panem, Ph.D. (4)

|

|

74

|

|

Director

|

|

Lorin J. Randall (5)

|

|

77

|

|

Director

|

|

Catherine D. Strader, Ph.D. (6)

|

|

67

|

|

Director and Nominee

|

__________________________

|

(1)

|

Chair of the Ad Hoc Business Development Committee and member of the Compensation Committee.

|

|

(2)

|

Member of the Audit Committee and Ad Hoc Business Development Committee. Dr. Jensen was appointed to the Audit Committee on October 14, 2020, to replace the vacancy created by Mr. Rauscher’s resignation from the Board. Dr. Jensen was also formerly a member of the Compliance Committee until termination of the Committee on October 14, 2020.

|

|

(3)

|

Non-executive Chair of the Board, Chair of the Compensation Committee, member of the Audit Committee, and member of the Business Development Committee.

|

|

(4)

|

Chair of the Nominations and Governance Committee and member of the Compensation Committee.

|

|

(5)

|

Chair of the Audit Committee and member of the Nominations and Governance Committee.

|

|

(6)

|

Member of the Nominations and Governance Committee, and formerly a member of the Compliance Committee until termination of the Committee on October 14, 2020.

|

Directors Standing for Election for the Term Expiring in 2024 – Class I Directors

Barry Greene has been a member of the Board since January 2007. Mr. Greene currently serves as Chief Executive Officer of Sage Therapeutics, Inc., a position he has held since December 2020. From December 2007 to September 2020, Mr. Greene was President of Alnylam Pharmaceuticals, Inc. Also, from October 2003 to September 2016 he served as Chief Operating Officer, and from February 2004 to December 2005 he also served as Treasurer, of Alnylam. Prior to Alnylam, he was General Manager of Oncology at Millennium Pharmaceuticals, Inc., where he led the company’s global strategy and execution for its oncology business, including strategic business direction and execution, culminating in the successful approval and launch of VELCADE (bortezomib) in mid-2003. Prior to joining Millennium in February 2001, Mr. Greene served as Executive Vice President and Chief Business Officer for Mediconsult.com. Prior to Mediconsult.com, Mr. Greene’s past experiences included being Vice President of Marketing and Customer Services for AstraZeneca (formerly AstraMerck); Vice President Strategic Integration with responsibility for the AstraZeneca North American post-merger integration; and partner of Andersen Consulting, responsible for the pharmaceutical/biotechnology marketing and sales practice. Mr. Greene currently serves on the board of directors of Sage Therapeutics, Inc. and BCLS Acquisition Corp. Also, he is currently Lead Independent Director of the board of directors of Karyopharm Therapeutics Inc., where he serves as Chairperson of the Nominating, Governance and Compliance Committee, and a member of the Compensation Committee. Mr. Greene received his B.S. in Industrial Engineering from the University of Pittsburgh and served as a Senior Scholar at Duke University, Fuqua School of Business. Mr. Greene brings to the Board extensive experience in the healthcare industry as well as practical experience guiding new drugs through the commercialization process. Based on this experience, Mr. Greene serves as Chair of the Ad Hoc Business Development Committee.

Catherine D. Strader, Ph.D., has been a member of the Board of Directors since February 2017. Dr. Strader is a partner at Synergy Partners R&D Solutions, a consultancy network co-founded by Dr. Strader in 2014 which advises biotechnology companies on research and development strategies. Prior to co-founding Synergy Partners, Dr. Strader worked for Merck Research Laboratories, as Vice President and Site Head from 2009 to 2011, and as Vice President, External Basic Research from 2007 to 2009. Prior to that, Dr. Strader held leadership positions at Schering-Plough Corporation before

9

Schering-Plough was acquired by Merck in 2009, including Senior Vice President, Science and Technology in 2007, and Chief Scientific Officer from 2006 to 2007. Prior to that, Dr. Strader was Executive Vice President, Discovery Research from 2002 to 2007, and Vice President, CNS, Cardiovascular and Genomics Research from 1995 to 2001 at Schering-Plough Research Institute. Dr. Strader has guided more than 50 compounds through drug discovery and development during her career. Dr. Strader received a B.S. in Chemistry from the University of Virginia and a Ph.D. in Chemistry from the California Institute of Technology, followed by a Howard Hughes postdoctoral fellowship at Duke University. Dr. Strader is the author of more than 150 scientific publications. Dr. Strader’s extensive pharmaceutical research and development experience, combined with her specific knowledge of neuroscience, makes her well positioned to provide advice and guidance to the Company on developing and commercializing therapies for neurological disorders.

Directors Whose Term Expires in 2022 – Class II Directors

Peder K. Jensen, M.D., has been a member of the Board of Directors since April 2011. Dr. Jensen is currently president of Bay Way Consultants, LLC, a consulting firm founded by Dr. Jensen in 2010 that advises pharmaceutical and biotechnology companies. Dr. Jensen’s experience includes over 20 years with Schering-Plough Corporation, a global pharmaceutical company, and then Merck & Co., Inc. after the merger of Schering-Plough with Merck in 2009. During his tenure at Schering-Plough/Merck, Dr. Jensen held a number of global senior research and development positions, including Vice President Clinical Research, SPRI, Executive Vice President Worldwide Drug Development, SPRI, and most recently Corporate Senior Vice President, and General Manager, R&D for Japan and Asia/Pacific from 2006 to 2010. Dr. Jensen has more than 28 years of global drug development experience across a variety of therapeutic areas, including neurology, cardiovascular, anti-infective, oncology and immunology. Over the course of his career, Dr. Jensen has been responsible for more than 40 new drug approvals worldwide, including in the U.S., Europe and Japan. Dr. Jensen is currently a member of the board of directors of Five Prime Therapeutics, Inc., where he serves as Chairperson of the Compensation and Management Development Committee, and a member of the Research and Development Committee. Dr. Jensen received his M.D. from the University of Copenhagen. Dr. Jensen’s extensive global pharmaceutical experience, combined with his specific knowledge in developing new and innovative medical treatments in many different therapeutic areas, including neurology, makes him well positioned to provide advice and guidance to the Company on developing and commercializing therapies for neurological disorders.

John P. Kelley has been a member of the Board of Directors since December 2008 and was elected to serve as the non-executive Chair of the Board in November 2019. From November 2013 to April 2017, Mr. Kelley was Chief Executive Officer of Tenax Therapeutics, Inc. (formerly named Oxygen Biotherapeutics, Inc.), a company that focuses on developing products for the critical care market, where he also served as a member of the board of directors. From 2011 to 2013, Mr. Kelley was President, Chief Executive Officer, and a director of Phyxius Pharma, Inc., a privately-held development stage pharmaceutical company co-founded by Mr. Kelley in 2011 focused on developing products for use in acute care settings. Mr. Kelley became Chief Executive Officer of Tenax Therapeutics when it acquired Phyxius Pharma in 2013. Previously, Mr. Kelley was the President and Chief Operating Officer of The Medicines Company, a pharmaceutical company providing acute care hospital products worldwide, from 2004 to 2009. He also served on The Medicines Company’s board of directors from 2005 to 2009. From 2000 to 2004, Mr. Kelley held a series of positions at Aventis, a global pharmaceutical company, including Senior Vice President, Global Marketing and Medical, where he was accountable for worldwide brand management. Prior to the formation of Aventis, he held a series of positions at Hoechst Marion Roussel, Inc., a life sciences firm focused on pharmaceuticals, including, from 1998 to 1999, Vice President, Commercial Director, U.S. and, from 1995 to 1998, Vice President of Marketing. Mr. Kelley received a B.A. from Wilkes University and an M.B.A. from Rockhurst University. Mr. Kelley’s extensive knowledge of the pharmaceutical industry as well as his operations and marketing experience make him well positioned to provide advice and guidance to the Company at this stage of its development. The Board has determined that Mr. Kelley qualifies as an audit committee financial expert. Based on his public company and broad corporate experience, Mr. Kelley serves as Chair of the Compensation Committee.

Sandra Panem, Ph.D., has been a member of the Board since 1998. She is currently a partner at Cross Atlantic Partners, which she joined in 2000. She is also currently President of NeuroNetworks Fund, a not-for-profit venture capital fund focusing on neurodisorders which she co-founded in December 2014. From 1994 to 1999, Dr. Panem was President of Vector Fund Management, the then asset management affiliate of Vector Securities International. Prior thereto, Dr. Panem served as Vice President and Portfolio Manager for the Oppenheimer Global BioTech Fund, a mutual fund that invested in public and private biotechnology companies. Previously, she was Vice President at Salomon Brothers Venture Capital, a fund focused on early and later-stage life sciences and technology investments. Dr. Panem was also a Science and Public Policy Fellow in economic studies at the Brookings Institution, and an Assistant Professor of Pathology at the University of Chicago. She received a B.S. in biochemistry and a Ph.D. in microbiology from the University of Chicago. Dr. Panem currently serves on the board of directors of BioLineRx Ltd. Dr. Panem’s experience investing in life sciences companies,

10

and her long-standing relationship with the Company as a Board representative of one of its earliest investors, provides historical perspective on the Company and the life sciences industry. Based on her broad industry and corporate experience, Dr. Panem serves as Chair of the Nominations and Governance Committee.

Directors Whose Term Expires in 2023 – Class III Directors

Ron Cohen, M.D., has served as our President and Chief Executive Officer, and as a director, since he founded the Company in 1995. Dr. Cohen previously was a principal in the startup of Advanced Tissue Sciences, Inc., a biotechnology company engaged in the growth of human organ tissues for transplantation. Dr. Cohen received his B.A. with honors in Psychology from Princeton University, and his M.D. from the Columbia College of Physicians & Surgeons. He completed his residency in Internal Medicine at the University of Virginia Medical Center, and is Board Certified in Internal Medicine. Dr. Cohen currently serves on the board of directors of VBL Therapeutics. In addition, within the last five years, he previously served on the board of directors of Dyax Corp. Dr. Cohen previously served as Chair of the board of the Biotechnology Innovation Organization (BIO), as Chair of the Emerging Companies Section of the BIO board, and as a Director and Chairman of New York Biotechnology Association (NYBA). He also previously served as a member of the Columbia-Presbyterian Health Sciences Advisory Council and was awarded Columbia University’s Alumni Medal for Distinguished Service. In 2010, Dr. Cohen was named NeuroInvestment’s (now called NeuroPerspective) CEO of the Year and in 2009 he was recognized by PharmaVoice Magazine as one of the 100 Most Inspirational People in the Biopharmaceutical Industry. Dr. Cohen is a recipient of the Ernst & Young Entrepreneur of the Year Award for the New York Metropolitan Region, and is an inductee into the National Spinal Cord Injury Association’s “Spinal Cord Injury Hall of Fame.” In 2010, Dr. Cohen was recognized by NYBA as its "The Cure Starts Here" Business Leader of the Year and was named by MM&M and PR Week as one of the top 50 health influencers of 2017. Dr. Cohen is the principal strategist in the Company’s commitment to being a fully-integrated biopharmaceutical company that is a leading innovator in neurology. His extensive knowledge of the Company and its history provides the Board with valuable perspectives to advance our business and the interests of our stockholders.

Lorin J. Randall has been a member of the Board since January 2006. Mr. Randall, a financial consultant, was Senior Vice President and Chief Financial Officer of Eximias Pharmaceutical Corporation, a development-stage drug development company, from 2004 to 2006. From 2002 to 2004, Mr. Randall served as Senior Vice President and Chief Financial Officer of i-STAT Corporation, a publicly-traded manufacturer of medical diagnostic devices that was acquired by Abbott Laboratories in 2004. From 1995 to 2001, Mr. Randall was Vice President and Chief Financial Officer of CFM Technologies, Inc., a publicly-traded manufacturer of semiconductor manufacturing equipment. He currently serves on the board of directors of Athersys, Inc. where he serves as Chairperson of the Audit Committee and a member of the Compensation Committee. In addition, within the last five years, he previously served on the boards of directors of Aurinia Pharmaceuticals Inc. and Nanosphere, Inc. Mr. Randall received a B.S. in accounting from The Pennsylvania State University and an M.B.A. from Northeastern University. As a former Chief Financial Officer of a number of publicly-traded companies, Mr. Randall possesses financial acumen acquired through working experience, including an understanding of financial matters and the preparation and analysis of financial statements. The Board has determined that Mr. Randall qualifies as an audit committee financial expert. Based on his extensive financial experience, Mr. Randall serves as Chair of the Audit Committee.

Corporate Governance Guidelines and Other Governance Policies

The Board of Directors regularly evaluates all aspects of our corporate governance principles and practices, taking into consideration, among other things, recommended best practices, developing trends and practices among public companies generally as well as those at our peer companies, and investor input.

Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines to formally document certain Company governance principles and practices, and also to establish governance principles and practices in furtherance of sound corporate governance. The Guidelines cover, among other topics, director qualification and selection, the roles and responsibilities of the Board, Board and committee composition and performance, director access to management, Board and committee meeting procedures, director compensation and director and management stock ownership, leadership development, and confidential stockholder voting. The Guidelines were adopted to assist the Board in the exercise of its responsibilities, and also to increase transparency into our corporate governance. The Guidelines are intended to be a component of the framework within which the Board, assisted by its committees, establishes broad corporate policies, sets the Company’s strategic direction, and oversees management’s day-to-day operation of the Company’s business. The Board amended the Guidelines in March 2020 to reflect the Board’s decision to modify the Board leadership structure by appointing a non-executive Chair of the Board, as further described below under Board Leadership Structure. These Guidelines are

11

available on our website, www.acorda.com, under “Investors – Corporate Governance – Corporate Governance Guidelines.” Certain important aspects of the Guidelines are described below in this Proxy Statement.

Insider Trading and Anti-Hedging Policy. We have an Insider Trading Policy that is intended to ensure compliance with applicable securities laws and regulations by our officers, directors, and employees. This policy prohibits, among other things, trades in our common stock that would violate these laws and regulations, and it also imposes other restrictions such as trading blackout periods and prior notification and/or clearance requirements for trading intended to protect against inadvertent violations of these laws and regulations. This policy also prohibits officers, directors, employees, and their family members (and entities that they own or control) from engaging in any (or designating another person to engage in, on their behalf) transaction that hedges, or that is designed to hedge or offset, any decrease in the market value of our common stock, including without limitation short sales, purchases or sales of puts or calls, prepaid variable forward contracts, equity swaps, collars and exchange funds.

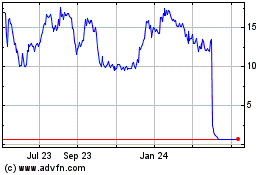

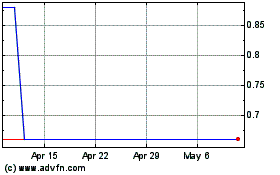

Termination of Stock Ownership Guidelines. We previously had Officer and Director Stock Ownership Guidelines that the Board implemented to encourage ownership of the Company’s common stock, promote the alignment of the long-term interests of the Company’s executive officers and directors with the long-term interests of the Company’s stockholders, and to further promote our commitment to sound corporate governance. The Guidelines were applicable to our executive officers, such other executives as were designated by our Chief Executive Officer, and our non-management directors. In March 2021, the Board determined that the Guidelines were no longer serving the purposes for which they were implemented and accordingly terminated the Guidelines. The Board made this determination after concluding that a sustained decline in the market price of our common stock in recent years had made it unrealistic to expect that any covered individuals could gain compliance with the Guidelines for the foreseeable future. The Board intends to evaluate appropriate stock ownership guidelines in the future and may adopt new stock ownership guidelines as circumstances warrant based on market developments.

Clawback Policy. We have a Clawback Policy providing for recovery of certain incentive compensation from an executive officer if the Company is required to restate financial statements due to misconduct of that executive officer that significantly contributes to the need for the restatement. Generally, “incentive compensation” under the policy includes compensation in any form (e.g., cash or equity compensation) that is paid or awarded or which vests in whole or in part based on the achievement of specific financial targets or goals. The policy is applicable to incentive compensation awarded at the time of or after adoption of the policy by the Board in 2014. This Policy is discussed in further detail below in the Compensation Discussion and Analysis section of this Proxy Statement.

Removal of “Single Trigger” Provision from Employment Agreement Form. In 2013, the Compensation Committee and the Board made the decision to exclude “single trigger” equity acceleration provisions from new executive officer employment agreements. Pursuant to this type of provision, the vesting of equity awards would accelerate upon certain change in control and/or other transactions regardless of whether employment is terminated. Accordingly, our employment agreements with Burkhard Blank, M.D., our Chief Medical Officer and Head of R&D, and Lauren Sabella, our Chief Commercial Officer, exclude any single-trigger provision. Our employment agreement with Ron Cohen, M.D., our President and Chief Executive Officer, was entered into prior to 2013 and contains a single-trigger provision.

Board Leadership Structure

In November 2019, the Board of Directors made the decision that the Board should be led by one of the independent directors serving as the non-executive Chair, and subsequently in March 2020 the Board amended our Corporate Governance Guidelines to reflect this Board leadership structure change. Pursuant to the amended Corporate Governance Guidelines, the non-executive Chair is chosen by the other directors, and in this role the non-executive Chair: (i) provides independent leadership and oversight of the Board; (ii) serves as a liaison between the Board and senior management; (iii) sets Board meeting agendas in consultation with the CEO, the Corporate Secretary and the other independent directors; (iv) presides over Board and stockholder meetings when present; (v) presides over executive sessions of the non-management directors when present and sets the agenda for such meetings; (vi) engages with stockholders when appropriate, provided such engagement otherwise complies with the Guidelines and the Company’s other policies; and (vii) performs such other duties as specified in the Company’s Bylaws, the Guidelines, or as otherwise delegated from time to time by the Board.

Under the Corporate Governance Guidelines and the Nominations and Governance Committee Charter, the Board and the Nominations and Governance Committee are responsible for evaluating the Board leadership structure at least annually based on then-current facts and circumstances, with the goal of optimizing Board performance and following sound corporate governance practices. This review of the Board leadership structure is conducted in conjunction with a broadly-

12

scoped annual self-assessment of performance and effectiveness of the Board and all of its committees, which is managed by the Nominations and Governance Committee under its charter and our Corporate Governance Guidelines. The Nominations and Governance Committee and Board currently intend to continue the appointment of Mr. Kelley to the non-executive Chair position, based on a determination that the Board has substantially benefitted from Mr. Kelley’s leadership in this role.

In addition, the Board continues to follow sound corporate governance practices to ensure its independence and effective functioning. Most importantly, except for Dr. Cohen, the Board is composed entirely of directors deemed to be “independent” under applicable legal, regulatory, and stock market standards. Consistent with the requirements of our Corporate Governance Guidelines, the independent directors meet in a scheduled executive session without Dr. Cohen present at every regular meeting of the Board. The independent directors also engage in informal discussions outside of Board meetings without Dr. Cohen.

In addition, each of the Board’s committees is composed entirely of independent directors, which means that oversight of critical issues such as the integrity of the Company’s financial statements, non-financial legal and regulatory compliance, chief executive officer and senior management compensation, and Board evaluation and selection of directors are entrusted to independent directors.

Risk Oversight

The Board of Directors is generally responsible for overseeing management of the various operational, financial, and legal risks faced by the Company. Particular risk management matters are brought to the Board by management in connection with the Board’s general oversight and approval of corporate matters. The Board administers its risk oversight function as a whole and through its Board committees. For example, in addition to regular reviews of potential areas of risk by the full Board at its meetings, the Audit Committee regularly discusses with management our major financial risk exposures, their potential financial impact on our Company and our risk mitigation strategies and participates in regular reviews of our process to assess and manage enterprise risk management. The Audit Committee works closely with senior management to review and oversee our compliance with non-financial legal and regulatory requirements, including those related to product safety and quality and the development, manufacturing, distribution, marketing and sale of our products. In addition, the Audit Committee also reviews cyber-security risks. The individual Board committees report to the full Board, including when a matter rises to the level of a material risk. The Company’s management is responsible for day-to-day risk management. This oversight includes identifying, evaluating, and addressing potential risks that may exist at the strategic, financial, operational, compliance and reporting levels. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing our Company and that the Board leadership structure supports this approach.

Director Independence

The Board of Directors has determined that Mr. Greene, Dr. Jensen, Mr. Kelley, Dr. Panem, Mr. Randall, and Dr. Strader are “Independent Directors” as defined in Rule 5605(a)(2) of the Nasdaq listing rules.

To assist the Board in determining each director’s independence in accordance with Nasdaq listing rules, pursuant to our Corporate Governance Guidelines a director will be presumed independent unless he or she meets any of the following conditions:

|

|

•

|

a director who is, or within the preceding three years was, an employee of the Company;

|

|

|

•

|

a director who accepted or who has a Family Member who accepted any compensation from the Company totaling more than $120,000 during any period of 12 consecutive months within the three years preceding the determination of independence, other than compensation for board or board committee service; compensation paid to a Family Member who is an employee (other than an Executive Officer) of the Company; or benefits under a tax-qualified retirement plan, or non-discretionary compensation;

|

|

|

•

|

a director who is a Family Member of an individual who is, or at any time during the past three years was, employed by the company as an Executive Officer;

|

|

|

•

|

a director who is, or has a Family Member who is, a partner in, or a controlling shareholder or an Executive Officer of, any organization to which the Company made, or from which the Company received, payments for property or services in the current or any of the past three fiscal years that exceed 5% of the recipient’s consolidated gross revenues for that year, or $200,000, whichever is more, other than payments arising solely

|

13

|

|

|

from investments in the Company’s securities or payments under non-discretionary charitable contribution matching programs;

|

|

|

•

|

a director of the Company who is, or has a Family Member who is, employed as an Executive Officer of another entity where at any time during the past three years any of the Executive Officers of the Company serve on the compensation committee of such other entity; and

|

|

|

•

|

a director who is, or has a Family Member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years.

|

For purposes of the Guidelines, a “Family Member” means a person’s spouse, parents, children and siblings, whether by blood, marriage or adoption, or anyone residing in such person’s home. An “Executive Officer” means those officers covered in Rule 16a-1(f) under the Securities Exchange Act of 1934, as amended.

Pursuant to the Guidelines, the Board annually will review all commercial and charitable relationships between the directors and the Company (as required by the Company’s Related Party Transactions Policy) to determine whether the directors meet these independence tests. If a director has a relationship with the Company that is not covered by these independence guidelines, those Company directors who satisfy such guidelines will consider the relevant circumstances and make an affirmative determination regarding whether such relationship is material or immaterial, and whether the director would therefore be considered independent under applicable legal and regulatory requirements.

Attendance at Board, Committee and Stockholder Meetings

The Board of Directors met seventeen (17) times during 2020 excluding committee meetings. All of the members of the Board attended at least 75% of all Board meetings and meetings of the committees on which they served in 2020 (including Mr. Rauscher until his resignation in September 2020). Seven (7) of the eight (8) directors on the Board at the time of the 2020 Annual Meeting of Stockholders attended the meeting. Pursuant to our Corporate Governance Guidelines, each director is expected to attend all Board meetings, meetings of all committees to which he or she is appointed, and all annual meetings of stockholders, except in extenuating circumstances. Attendance in person is preferable, particularly for regularly scheduled meetings, but attendance via communications equipment is acceptable when needed due to individual circumstances. Since the outbreak of the COVID-19 pandemic, the Board has conducted its business virtually through teleconferences and video conferences for purposes of compliance with governmental regulations and orders and in light of recommendations issued by health authorities.

Committees of the Board of Directors

The Board of Directors has established an Audit Committee, a Compensation Committee, a Nominations and Governance Committee, and an ad hoc Business Development Committee, the members of which are all independent directors. Also, each member of the Audit Committee meets the independence requirements of Section 10A of the Securities Exchange Act of 1934, as amended, and SEC Rule 10A-3 promulgated thereunder.

The Board also previously established a Research and Development Committee. However, in December 2019, the Board suspended operation of this Committee and the corresponding cash retainer payable its members of the Committee until such time as the Company’s research and development activities warrant the oversight of the committee.

The Board also previously established a Compliance Committee. However, in October 2020, based on the recommendation of the Nominations and Governance Committee, the Board terminated the Compliance Committee and delegated the non-financial compliance oversight responsibilities of the Compliance Committee to the Audit Committee. As further described below under Audit Committee and Audit Committee Financial Experts, the Board subsequently amended the Audit Committee charter to incorporate these additional responsibilities. The Board made the decision to terminate the Compliance Committee after Mr. Rauscher’s resignation from the Board, considering factors such as size of the Board, the composition of its committees, the allocation of workload among the remaining directors, and the fees associated with committee memberships.

The following sections list the members of each active committee as well as the primary responsibilities of each such committee. Under the Nominations and Governance Committee Charter and our Corporate Governance Guidelines, the Nominations and Governance Committee recommends committee assignments to the full Board for approval. Under our Corporate Governance Guidelines, committee assignments should reflect the expertise and interests of Board members, with

14

the goal of ensuring that committee members have the requisite background and experience to participate fully on the committees to which they are appointed. The Board believes that consideration should be given to rotating committee members periodically, but does not believe that rotation should be mandated as a policy. The Board reviews Committee memberships annually, or more frequently as circumstances warrant, with the most recent annual review occurring in June 2020. Committee assignments were subsequently reconsidered in October 2020 due Mr. Rauscher’s resignation and in light of the Board’s decision to terminate the Compliance Committee. At that time, Dr. Jensen was appointed to the Audit Committee to replace Mr. Rauscher as the third member of the Audit Committee.

Audit Committee and Audit Committee Financial Experts

The Audit Committee currently consists of three members: Mr. Randall (Chair), Dr. Jensen, and Mr. Kelley. Mr. Randall and Mr. Kelley both qualify as an “audit committee financial expert” as that term is defined in Item 407(d) of U.S. Securities and Exchange Commission Regulation S-K. The designation of members of the Audit Committee as "audit committee financial experts" does not impose on those members any duties, obligations, or liabilities that are greater than are generally imposed on them as members of the Audit Committee and the Board, and does not affect the duties, obligations, or liabilities of any other member of the Audit Committee or the Board. Mr. Rauscher was a member of the Audit Committee until his September 30, 2020 resignation from the Board. Subsequently, on October 14, 2020, Dr. Jensen was appointed to replace Mr. Rauscher as the third member of the Audit Committee.

The Board has adopted a written charter for the Audit Committee, which is periodically reviewed. The charter is available on our website, www.acorda.com, under “Investors – Corporate Governance – Committee Charters.” The Audit Committee met six times in 2020.

In October 2020, the Board terminated its Compliance Committee and delegated the responsibilities of the Compliance Committee to the Audit Committee. Under its charter, the Compliance Committee was responsible for overseeing our compliance with non-financial legal and regulatory requirements, including those related to product safety and quality and the development, manufacturing, distribution and sale of our products. In March 2021, the Board amended the Audit Committee charter to incorporate these additional responsibilities. The Audit Committee is responsible for the following under its amended charter:

|

|

•

|

approving and retaining the independent auditors to conduct the annual audit of our books and records; and evaluating the independent auditors’ qualifications, performance, independence, and quality controls;

|

|

|

•

|

reviewing the proposed scope of audits and fees to be paid;

|

|

|

•

|

overseeing the independent auditor, including resolving disagreements with management, obtaining required reports from the independent auditor, and reviewing with the independent auditor matters such as audit problems or difficulties, internal control deficiencies, significant financial reporting issues or judgments, and the effect of regulatory and accounting initiatives or off-balance sheet structures on our financial statements;

|

|

|

•

|

reviewing and pre-approving the independent auditors’ audit and non-audit services in accordance with our pre-approval policy established by the Audit Committee;

|

|

|

•

|

reviewing our financial statements, and in the case of audited financial statements recommending them to the Board for inclusion in our Annual Report on Form 10-K;

|

|

|

•

|

coordinating the Board’s oversight of internal control over financial reporting and disclosure controls and procedures and our code of ethics;

|

|

|

•

|

reviewing and approving transactions between us and our directors, officers and affiliates;

|

|

|

•

|

recognizing and addressing potential prohibited non-audit services;

|

|

|

•

|

overseeing compliance with non-financial legal and regulatory requirements, including product safety and quality and the development, manufacturing, marketing, distribution and sale of our products;

|

|

|

•

|

establishing procedures for complaints received regarding accounting, internal accounting controls, or auditing matters, and for the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters;

|

|

|

•

|

overseeing our implementation of systems and processes for receipt, retention, and treatment of compliance-related complaints;

|

15

|

|

•

|

overseeing our management of cyber-security and data privacy risks; and

|

|

|

•

|

overseeing internal audit functions if and when implemented.

|

All audit services and non-audit services to be provided to us by our independent auditor must be approved in advance by the Audit Committee in accordance with our auditor pre-approval policy, which is described below in Proposal Two in this Proxy Statement under Pre-approval Policies and Procedures. Ernst & Young LLP currently serves as our independent auditor.

Compensation Committee

The Compensation Committee consists of three members: Mr. Kelley (Chair), Mr. Greene, and Dr. Panem. The Board has adopted a written charter for the Compensation Committee, which is periodically reviewed. The charter is available on our website, www.acorda.com, under “Investors – Corporate Governance – Committee Charters.” The Compensation Committee met three times in 2020.

The Compensation Committee is responsible for the following under its charter:

|

|

•

|