- Sale of Manufacturing Operations to Catalent with net proceeds

of ~$74 million

- Annual operating expenses cut by ~$40 million via sale,

restructuring, and other reductions

- Total 2021 non-GAAP operating expense expected to be $130-$140

million1

- AMPYRA® (dalfampridine) Extended Release Tablets, 10 mg 2021

net revenue expected to be $75-$85 million

- INBRIJA® (levodopa inhalation powder) 2020 net revenue $24

million

- AMPYRA 2020 net revenue $99 million

Acorda Therapeutics, Inc. (Nasdaq: ACOR) today provided a

business update and reported its financial results for the fourth

quarter and full year ended December 31, 2020.

“We have improved our financial position materially through the

sale of our manufacturing operations in Chelsea and our

restructuring, which also have reduced both our annual operating

expenses and cost of goods for INBRIJA,” said Ron Cohen, M.D.,

Acorda’s President and Chief Executive Officer. “In 2020, we

continued to improve access to INBRIJA and saw excellent results

from our new patient education and training programs; for example,

approximately 1,250 patients who had either never filled or had

discontinued their original INBRIJA prescriptions responded to our

educational outreach and training by returning to therapy. We also

saw quarter over quarter growth in INBRIJA despite the substantial

negative impact of COVID-19, and believe we are well-positioned for

further growth when the pandemic subsides. We also believe that the

reduced cost of goods for INBRIJA will help potentiate commercial

partnerships outside the US.”

Fourth Quarter 2020 Financial Results

For the fourth quarter ended December 31, 2020, the Company

reported AMPYRA net revenue of $25.3 million compared to $40.8

million for the same quarter in 2019 and INBRIJA net revenue of

$9.3 million compared to $6.1 million for the same quarter in

2019.

Research and development (R&D) expenses for the quarter

ended December 31, 2020 were $4.3 million, including $0.3 million

of share-based compensation, compared to $9.0 million, including

$0.6 million of share-based compensation, for the same quarter in

2019.

Sales, general and administrative (SG&A) expenses for the

quarter ended December 31, 2020 were $32.9 million, including $1.2

million of share-based compensation, compared to $41.2 million,

including $2.0 million of share-based compensation, for the same

quarter in 2019.

Benefit from income taxes for the quarter ended December 31,

2020 was $3.1 million, compared to a benefit from income taxes of

$0.8 million for the same quarter in 2019.

The Company recorded a loss on assets held for sale related to

the sale of the manufacturing operations in Chelsea, Massachusetts

to Catalent. The Company recorded a loss on the assets held for

sale of $57.9 million as of December 31, 2020, which represents the

amount by which the carrying value of the assets to be sold exceeds

the purchase price less estimated selling costs. The Company

segregated the assets held for sale on the balance sheet at the

resulting carrying amount of $71.8 million as of December 31,

2020.

The Company reported GAAP net loss of $83.0 million for the

quarter ended December 31, 2020, or $9.82 per diluted share. GAAP

net income in the same quarter of 2019 was $65.7 million, or $8.26

per diluted share.

Non-GAAP net loss for the quarter ended December 31, 2020 was

$21.1 million, or $2.50 per diluted share. Non-GAAP net loss in the

same quarter of 2019 was $7.1 million, or $0.89 per diluted share.

This quarterly non-GAAP net loss measure, more fully described

below under “Non-GAAP Financial Measures,” excludes share-based

compensation charges, non-cash interest charges on our debt,

restructuring expenses, changes in the fair value of acquired

contingent consideration, losses on assets held for sale, gain on

extinguishment of debt, and changes in the fair value of derivative

liability related to the 2024 convertible notes. A reconciliation

of the GAAP financial results to non-GAAP financial results is

included with the attached financial statements.

Full Year Ended December 31, 2020 Financial Results

For the full year ended December 31, 2020, the Company reported

AMPYRA net revenue of $98.9 million compared to $163.2 million for

the full year 2019 and INBRIJA net revenue of $24.2 million

compared to $15.3 million for the full year 2019.

Research and development (R&D) expenses for the full year

ended December 31, 2020 were $23.0 million, including $1.7 million

of share-based compensation, compared to $60.1 million, including

$2.8 million of share-based compensation for the full year

2019.

Sales, general and administrative (SG&A) expenses for the

full year ended December 31, 2020 were $152.6 million, including

$6.0 million of share-based compensation, compared to $192.8

million, including $10.8 million of share-based compensation for

the full year 2019.

Benefit from income taxes for the full year ended December 31,

2020 was $8.0 million, compared to a benefit from income taxes of

$1.3 million for the full year 2019.

For the full year ended December 31, 2020, the Company reported

GAAP net loss of $99.6 million, or $12.32 per diluted share,

compared to a GAAP net loss for the full year 2019 of $273.0

million, or $34.43 per diluted share.

Non-GAAP net loss for the full year ended December 31, 2020 was

$72.9 million, or $9.02 per diluted share. Non-GAAP net loss for

the full year ended December 31, 2019 was $81.8 million, or $10.31

per diluted share. This full year non-GAAP net loss measure, more

fully described below under “Non-GAAP Financial Measures,” excludes

share-based compensation charges, non-cash interest charges on our

debt, restructuring expenses, changes in the fair value of acquired

contingent consideration, asset impairment charges, losses on

assets held for sale, gain on extinguishment of debt, and changes

in the fair value of derivative liability related to the 2024

convertible notes. A reconciliation of the GAAP financial results

to non-GAAP financial results is included with the attached

financial statements.

At December 31, 2020, the Company had cash, cash equivalents,

investments, and restricted cash of $102.9 million. Restricted cash

includes $31 million in escrow related to the 6% semi-annual

interest portion, payable in cash or stock, of the convertible note

exchange completed in December 2019. If the Company elects to pay

interest due in stock, the restricted cash will be released from

escrow.

Financial Guidance

- Operating expenses for the full year 2021 are expected to be

$130 - $140 million. This guidance is a non-GAAP projection that

excludes restructuring costs and share-based compensation as more

fully described below under “Non-GAAP Financial Measures.”

- AMPYRA net revenue for the full year 2021 is expected to be

$75-$85 million.

Recent Highlights

- In February 2021, the Company announced that it has closed the

deal to sell its manufacturing operations in Chelsea, Massachusetts

to Catalent. Under the terms of the agreement, Catalent has paid

Acorda $80 million in cash, resulting in expected net proceeds to

Acorda of approximately $74 million after transaction fees and

expenses and settlement of customary post-closing adjustments.

- In connection with the sale, Acorda and Catalent have entered

into a long-term global supply agreement under which Catalent will

manufacture and package INBRIJA for Acorda, ensuring an

uninterrupted drug supply for Acorda’s patients and continued

adherence to best-in-class manufacturing quality and safety

standards.

- In January 2021, the Company announced a corporate

restructuring, reducing its combined Ardsley, Waltham, and field

headcount by approximately 16%.

- The sale of the manufacturing operations, restructuring and

other operating expense reductions are expected to reduce annual

operating expenses by approximately $40 million.

- On December 31, 2020, Acorda implemented a 1-for-6 reverse

stock split of the Company’s shares of common stock and a

proportionate reduction in the number of authorized shares of

common stock. This was done to regain compliance with the $1.00 per

share minimum closing price required to maintain continued listing

on the Nasdaq Global Select Market.

Webcast and Conference Call

The Company will host a conference call and webcast in

conjunction with its fourth quarter/year end 2020 update and

financial results today at 4:30 p.m. EST.

To participate in the Webcast/Conference Call, please note there

is a new pre-registration process.

- To register for the Webcast, use the link below:

https://event.on24.com/wcc/r/2947830/F4FC65582F7AC5A2D3AF5880C359F67D

- To register for the Conference Call, use the link below:

http://www.directeventreg.com/registration/event/9854802

**When registering please type your phone number with no

special characters**

A replay of the call will be available from 7:30 p.m. EST on

March 4, 2021 until 11:59 p.m. EDT on April 4, 2021. To access the

replay, please dial (800) 585-8367 (domestic) or (416) 621-4642

(international); reference code 9854802. The archived webcast will

be available in the Investor Relations section of the Acorda

website at www.acorda.com.

Non-GAAP Financial Measures

This press release includes financial results prepared in

accordance with accounting principles generally accepted in the

United States (GAAP), and also certain historical and

forward-looking non-GAAP financial measures. In particular, Acorda

has provided non-GAAP net loss, adjusted to exclude the items

below, and has provided 2021 operating expense guidance on a

non-GAAP basis. Non-GAAP financial measures are not an alternative

for financial measures prepared in accordance with GAAP. However,

the Company believes that the presentation of non-GAAP net loss,

when viewed in conjunction with actual GAAP results, provides

investors with a more meaningful understanding of our ongoing and

projected operating performance because this measure excludes (i)

non-cash compensation charges and benefits that are substantially

dependent on changes in the market price of our common stock, (ii)

non-cash interest charges related to the accounting for our

convertible debt which are in excess of the actual interest expense

owing on such convertible debt, as well as non-cash interest

related to the Fampyra monetization and acquired Biotie debt, (iii)

changes in the fair value of acquired contingent consideration

which do not correlate to our actual cash payment obligations in

the relevant periods, (iv) asset impairment charges that are not

routine to the operation of the business, (v) gain on

extinguishment of debt that pertains to an event that is not

routine to the operation of the business, (vi) expenses that

pertain to our 2019 restructuring, which is not routine to the

operation of the business, (vii) changes in the fair value of

derivative liability relating to the 2024 convertible notes, which

is a non-cash charge and not related to the operation of the

business, and (viii) losses on assets held for sale that pertain to

a non-routine sale of manufacturing operations. The Company

believes its non-GAAP net loss measure helps indicate underlying

trends in the Company's business and is important in comparing

current results with prior period results and understanding

projected operating performance. Also, management uses this

non-GAAP financial measure to establish budgets and operational

goals, and to manage the Company's business and to evaluate its

performance.

In addition to non-GAAP net loss, we have provided 2021

operating expense guidance on a non-GAAP basis, as the guidance

excludes restructuring costs and share-based compensation charges.

Due to the forward looking nature of this information, the amount

of compensation charges needed to reconcile these measures to the

most directly comparable GAAP financial measures is dependent on

future changes in the market price of our common stock and is not

available at this time. Non-GAAP financial measures are not an

alternative for financial measures prepared in accordance with

GAAP. However, the Company believes that the presentation of this

non-GAAP financial measure, when viewed in conjunction with actual

GAAP results, provides investors with a more meaningful

understanding of our ongoing and projected operating performance

because it excludes (i) expenses that pertain to non-routine

restructuring events, and (ii) non-cash charges that are

substantially dependent on changes in the market price of our

common stock. We believe this non-GAAP financial measure helps

indicate underlying trends in the Company’s business and is

important in comparing current results with prior period results

and understanding expected operating performance. Also, management

uses this non-GAAP financial measure to establish budgets and

operational goals, and to manage the Company's business and to

evaluate its performance.

About Acorda Therapeutics

Acorda Therapeutics develops therapies to restore function and

improve the lives of people with neurological disorders. INBRIJA is

approved for intermittent treatment of OFF episodes in adults with

Parkinson’s disease treated with carbidopa/levodopa. INBRIJA is not

to be used by patients who take or have taken a nonselective

monoamine oxidase inhibitor such as phenelzine or tranylcypromine

within the last two weeks. INBRIJA utilizes Acorda’s innovative

ARCUS® pulmonary delivery system, a technology platform designed to

deliver medication through inhalation. Acorda also markets the

branded AMPYRA® (dalfampridine) Extended Release Tablets, 10

mg.

Forward-Looking Statements

This press release includes forward-looking statements. All

statements, other than statements of historical facts, regarding

management's expectations, beliefs, goals, plans or prospects

should be considered forward-looking. These statements are subject

to risks and uncertainties that could cause actual results to

differ materially, including: we may not be able to successfully

market AMPYRA, INBRIJA or any other products under development; the

COVID-19 pandemic, including related quarantines and travel

restrictions, and the potential for the illness to affect our

employees or consultants or those that work for other companies we

rely upon, could have a material adverse effect on our business

operations or product sales; our ability to raise additional funds

to finance our operations, repay outstanding indebtedness or

satisfy other obligations, and our ability to control our costs or

reduce planned expenditures; risks associated with the trading of

our common stock and our reverse stock split; risks related to our

workforce, including our ability to realize the expected benefits

of our corporate restructuring; risks associated with complex,

regulated manufacturing processes for pharmaceuticals, which could

affect whether we have sufficient commercial supply of INBRIJA to

meet market demand; our reliance on third-party manufacturers for

the production of commercial supplies of AMPYRA and INBRIJA; third

party payers (including governmental agencies) may not reimburse

for the use of INBRIJA or our other products at acceptable rates or

at all and may impose restrictive prior authorization requirements

that limit or block prescriptions; competition for INBRIJA, AMPYRA

and other products we may develop and market in the future,

including increasing competition and accompanying loss of revenues

in the U.S. from generic versions of AMPYRA (dalfampridine)

following our loss of patent exclusivity; the ability to realize

the benefits anticipated from acquisitions, among other reasons

because acquired development programs are generally subject to all

the risks inherent in the drug development process and our

knowledge of the risks specifically relevant to acquired programs

generally improves over time; the risk of unfavorable results from

future studies of INBRIJA (levodopa inhalation powder) or from our

other research and development programs, or any other acquired or

in-licensed programs; the occurrence of adverse safety events with

our products; the outcome (by judgment or settlement) and costs of

legal, administrative or regulatory proceedings, investigations or

inspections, including, without limitation, collective,

representative or class action litigation; failure to protect our

intellectual property, to defend against the intellectual property

claims of others or to obtain third party intellectual property

licenses needed for the commercialization of our products; and

failure to comply with regulatory requirements could result in

adverse action by regulatory agencies.

These and other risks are described in greater detail in our

filings with the Securities and Exchange Commission. We may not

actually achieve the goals or plans described in our

forward-looking statements, and investors should not place undue

reliance on these statements. Forward-looking statements made in

this press release are made only as of the date hereof, and we

disclaim any intent or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this press release.

Financial Statements

Acorda Therapeutics,

Inc.

Condensed Consolidated Balance

Sheet Data

(in thousands)

December 30,

December 31,

2020

2019

(unaudited)

Assets

Cash, cash equivalents and short-term

investments

$

71,369

$

125,839

Restricted cash - short term

12,917

12,836

Trade receivable, net

20,193

22,083

Other current assets

16,384

15,134

Inventories, net

28,677

25,221

Assets held for sale - current

71,795

—

Property and equipment, net

7,263

142,527

Intangible assets, net

366,981

402,329

Restricted cash - long term

18,609

30,270

Right of use assets, net

18,481

23,450

Other assets

11

29

Total assets

$

632,680

$

799,718

Liabilities and stockholders'

equity

Accounts payable, accrued expenses and

other current liabilities

$

50,322

$

65,335

Current portion of lease liability

7,944

7,746

Current portion of royalty liability

8,731

10,836

Current portion of contingent

consideration

1,624

1,866

Current portion of loans payable

68,631

603

Convertible senior notes non-current

137,619

192,774

Derivative liability related to conversion

option

1,193

59,409

Non-current portion of acquired contingent

consideration

46,576

78,434

Non-current portion of lease liability

17,200

22,995

Non-current portion of royalty

liability

6,526

13,565

Non-current portion of loans payable

28,555

25,495

Deferred tax liability

19,116

9,581

Other long-term liabilities

688

259

Total stockholder's equity

237,955

310,820

Total liabilities and stockholders'

equity

$

632,680

$

799,718

Acorda Therapeutics,

Inc.

Consolidated Statements of

Operations

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2020

2019

2020

2019

Revenues:

Net product revenues

$

34,679

$

47,411

$

124,831

$

180,736

Milestone revenues

—

—

15,000

—

Royalty revenues

3,481

3,086

13,136

11,672

Total net revenues

38,160

50,497

152,967

192,408

Costs and expenses:

Cost of sales

10,842

8,666

33,513

34,849

Research and development

4,323

9,023

23,012

60,083

Selling, general and administrative

32,876

41,224

152,576

192,846

Amortization of intangible assets

7,691

7,691

30,763

25,636

Asset impairment

—

—

4,131

277,561

Loss on assets held for sale

57,896

—

57,896

—

Change in fair value of derivative

liability

361

—

(39,959

)

—

Change in fair value of acquired

contingent consideration

2,566

(30,593

)

(30,889

)

(86,935

)

Total operating expenses

116,555

36,011

231,043

504,040

Operating (loss) income

$

(78,395

)

$

14,486

$

(78,076

)

$

(311,632

)

Gain on extinguishment of debt

—

55,073

—

55,073

Other expense, (net)

(7,764

)

(4,697

)

(29,591

)

(17,689

)

Loss (income) before income taxes

(86,159

)

64,862

(107,667

)

(274,248

)

Benefit from income taxes

3,111

798

8,073

1,282

Net (loss) income

$

(83,048

)

$

65,660

$

(99,594

)

$

(272,966

)

Net (loss) income per common share -

basic

$

(9.82

)

$

8.27

$

(12.32

)

$

(34.43

)

Net (loss) income per common share -

diluted

$

(9.82

)

$

8.26

$

(12.32

)

$

(34.43

)

Weighted average common shares - basic

8,454

7,938

8,084

7,927

Weighted average common shares -

diluted

8,454

7,947

8,084

7,927

Acorda Therapeutics,

Inc.

Non-GAAP Net (Loss) Income and

Net (Loss) Income per Common Share Reconciliation

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2020

2019

2020

2019

GAAP net (loss) income

$

(83,048

)

$

65,660

$

(99,594

)

$

(272,966

)

Pro forma adjustments:

Non-cash interest expense (1)

4,203

3,522

16,422

15,724

Change in fair value of acquired

contingent consideration (2)

2,566

(30,593

)

(30,889

)

(86,935

)

Restructuring costs (3)

—

4,401

343

4,401

Loss on assets held for sale (4)

57,896

—

57,896

—

Asset impairment charge (5)

—

—

4,131

277,561

Loss (gain) on change in fair value

of derivative liability (6)

361

—

(39,959

)

—

Gain on extinguishment of debt (7)

—

(55,073

)

—

(55,073

)

Share-based compensation expenses

included in Cost of Sales

75

118

335

624

Share-based compensation expenses

included in R&D

327

609

1,745

2,812

Share-based compensation expenses

included in SG&A

1,187

2,029

6,020

10,814

Total share-based compensation

expenses

1,589

2,756

8,100

14,250

Total pro forma adjustments

66,615

(74,987

)

16,045

169,928

Income tax effect of reconciling items

above (8)

4,698

(2,264

)

(10,634

)

(21,284

)

Non-GAAP net loss

$

(21,131

)

$

(7,063

)

$

(72,915

)

$

(81,754

)

Net loss per common share - basic and

diluted

$

(2.50

)

$

(0.89

)

$

(9.02

)

$

(10.31

)

Weighted average common shares - basic and

diluted

8,454

7,938

8,084

7,927

(1)

Non-cash interest expense related

to convertible senior notes, Biotie non-convertible and R&D

loans and Fampyra royalty monetization.

(2)

Changes in fair value of acquired

contingent consideration related to the Civitas acquisition.

(3)

Costs associated with the 2019

corporate restructuring.

(4)

Impairment loss on Chelsea

manufacturing assets held for sale at December 31, 2020.

(5)

Charges related to the 2020

impairment of BTT1023 acquired in the Biotie acquisition and the

2019 impairment of goodwill associated with the Civitas and Biotie

acquisitions.

(6)

Changes in the fair value of the

derivative liability related to the 2024 convertible senior

notes.

(7)

Gain on December 2019

extinguishment of a portion of the convertible senior notes due

June 2021.

(8)

Represents the tax effect of the non-GAAP

adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210304005901/en/

Tierney Saccavino (914) 326-5104 tsaccavino@acorda.com

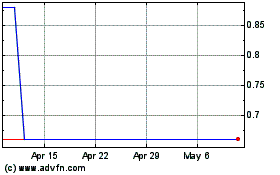

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

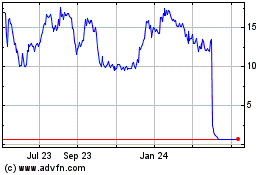

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Apr 2023 to Apr 2024