Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Certain statements contained in this Quarterly Report on Form 10-Q may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words or phrases “would be,” “will allow,” “intends to,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” or similar expressions, or the negative of such words or phrases, are intended to identify “forward-looking statements.” We have based these forward-looking statements on our current expectations and projections about future events. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to these differences include those below and elsewhere in this Quarterly Report on Form 10-Q, particularly in Part II – Item 1A, “Risk Factors,” in our Annual Report on Form 10-K in Part I, Item 1A, “Risk Factors,” and in our other filings with the Securities and Exchange Commission, or SEC. Statements made herein are as of the date of the filing of this Form 10-Q with the SEC and should not be relied upon as of any subsequent date. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim, any obligation to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes that appear in Item 1 of this Quarterly Report on Form 10-Q and with our audited consolidated financial statements and related notes for the year ended December 31, 2018, which are included in our Annual Report on Form 10-K filed with the SEC on March 18, 2019.

Overview

We are a physician-led biopharmaceutical company focused on immuno-inflammatory and dermatological diseases. We have two commercial products and a diverse pipeline of drug candidates.

Our first commercial product, ESKATA (hydrogen peroxide) topical solution, 40% (w/w), or ESKATA, is a proprietary formulation of high-concentration hydrogen peroxide topical solution which was approved by the U.S. Food and Drug Administration, or FDA, in December 2017 as an office-based prescription treatment for raised seborrheic keratosis, or SK, a

common non-malignant skin tumor.

W

e launched ESKATA in the United States in May 2018. We also submitted marketing authorization applications for ESKATA in select countries in the European Union, Norway and Iceland using a decentralized procedure. In February 2019, we received approval from the Swedish Medical Products Agency to market ESKATA (hydrogen peroxide) cutaneous solution, 685 mg for the treatment in adults of SKs that are not pedunculated and have up to a maximum diameter of 15 millimeters each. We have also received approval to market the medicine in Finland, Iceland, Netherlands, Norway, Belgium and Czech Republic under the brand name ESKATA, and in the United Kingdom, Germany and France under the brand name ESKERIELE. We are seeking a commercial partner or partners to market the medicine as an aesthetic skin treatment in various European countries.

In November 2018, we acquired RHOFADE

(oxymetazoline hydrochloride) cream, 1%,

or RHOFADE, which includes an exclusive license to certain intellectual property for RHOFADE, as well as additional intellectual property, from

Allergan Sales, LLC, or Allergan. RHOFADE was approved by the FDA in January 2017 for the topical treatment of persistent facial erythema (redness) associated with rosacea in adults. Persistent facial redness is the most common sign of rosacea in most skin types.

We currently rely on Allergan to distribute RHOFADE on our behalf pursuant to the terms of a transition services agreement while we develop our sales, marketing and distribution capabilities to support the commercialization of RHOFADE in the United States. Our current sales force alignment includes 50 territories in the United States, which we believe will allow us to reach the health care providers in the United States with the highest potential for prescribing our marketed products to their patients.

We are also developing another high-concentration formulation of hydrogen peroxide, A-101 45% Topical Solution, as a prescription treatment for common warts, also known as verruca vulgaris. On an annual basis, approximately 2.0 million people in the United States are diagnosed with common warts.

In our Phase 2 clinical trials, subjects treated with A-101 45% Topical Solution achieved clinically and statistically significant outcomes for the primary and secondary endpoints of each of the trials.

Based on the results from our Phase 2 clinical trials and our end of Phase 2 meeting with the FDA,

we are evaluating a twice-weekly dosing regimen in our two Phase 3 pivotal clinical trials, which we refer to as THWART-1 and THWART-2, of A-101 45% Topical Solution for the treatment of common warts, which we initiated in September 2018. We completed enrollment of more than 1,000 patients in these two trials. We expect to report data from both of these trials in the second half of 2019. In addition, in February 2019, we commenced an open-label safety extension trial investigating A-101 45% Topical Solution for the treatment of common warts, for which we expect to complete enrollment during the second quarter of 2019. If the results of these three ongoing trials are positive, we expect to submit a New Drug Application, or NDA, to the FDA for A-101 45% Topical Solution for the treatment of common warts in the first half of 2020.

Additionally, in 2015, we in-licensed exclusive, worldwide rights from Rigel Pharmaceuticals, Inc., or Rigel, to certain inhibitors of the Janus kinase, or JAK, family of enzymes for specified dermatological conditions, including alopecia areata, or AA. AA is an autoimmune dermatologic condition typically characterized by patchy non-scarring hair loss on the scalp and body. More severe forms of AA include total scalp hair loss, known as alopecia totalis, or AT, and total hair loss on the scalp and body, known as alopecia universalis, or AU. We are also developing these JAK inhibitors, which we refer to as ATI-501 and ATI-502, for the treatment of vitiligo, androgenetic alopecia, or AGA, also known as male or female pattern baldness, and atopic dermatitis.

We are developing ATI-501 as an oral treatment for AA. We submitted an investigational new drug application, or IND, to the FDA for ATI-501 for the treatment of AA in October 2016. Since the filing of the IND, we have conducted several Phase 1 clinical trials to evaluate the pharmacokinetic and pharmacodynamic, or PK/PD, properties of various formulations of ATI-501. Based on the results from these clinical trials, we selected an oral suspension and initiated a Phase 2 dose-response clinical trial of ATI-501 for the treatment of AA.

We are developing ATI-502 as a topical treatment for AA, vitiligo, AGA and atopic dermatitis. We submitted an IND to the FDA for ATI-502 for the treatment of AA in July 2017. The following table summarizes the status of our ongoing Phase 2 clinical trials of ATI-501 and ATI-502, including their indications, trial objectives, number of subjects enrolled and expected timing for receipt of preliminary results:

|

|

|

|

|

|

|

Drug Candidate and Name of Trial

|

Indication

|

Objective

|

Subjects Enrolled

|

Preliminary Results Expected

|

|

|

|

|

|

|

|

ATI-501

|

|

|

|

|

|

AUAT-201

|

AA

|

Dose-ranging

|

87

|

2H 2019

|

|

|

|

|

|

|

|

ATI-502

|

|

|

|

|

|

AA-201

|

AA

|

Dose-ranging

|

129

|

2Q 2019

|

|

AA-202

|

AA

|

PK/PD

|

11

|

—

(1)

|

|

AA-203

|

AA

|

Open-label study

|

80

(2)

|

2021

|

|

AUATB-201

|

AA (Eyebrow)

|

Open-label study

|

12

|

—

(3)

|

|

VITI-201

|

Vitiligo

|

Open-label study

|

34

|

4Q 2019

(4)

|

|

AGA-201

|

AGA

|

Open-label study

|

31

|

2Q 2019

(5)

|

|

AD-201

|

Atopic Dermatitis

|

Open-label study

|

22

|

Mid-2019

|

(1)

AA-202 interim data reported in June 2018.

(2)

Approximate number of subjects per protocol.

(3)

AUATB-201 interim data reported in December 2018.

(4)

VITI-201 6-month interim data expected in mid-2019 and 12-month data expected in the fourth quarter of 2019.

(5)

AGA-201 6-month data expected in the second quarter of 2019 and 12-month data expected in the fourth quarter of 2019.

If the results from the AA-201 trial are positive, our next steps may include holding an end of Phase 2 meeting with the FDA, and initiating a Phase 3 trial of ATI-502 as a topical treatment for AA in the first half of 2020. If the results from the AGA-201 trial are positive, we expect to initiate an additional Phase 2 trial of ATI-502 for the topical treatment of AGA in the first half of 2020.

In 2016, in connection with the acquisition of Vixen Pharmaceuticals, Inc., or Vixen, we acquired additional intellectual property rights for the development and commercialization of certain JAK inhibitors for specified dermatological conditions. We intend to continue to in-license or acquire additional drug candidates and technologies to build a fully integrated biopharmaceutical company.

In 2017, we acquired Confluence Life Sciences, Inc. (now known as Aclaris Life Sciences, Inc.), or Confluence. The acquisition of Confluence added small molecule drug discovery and preclinical development capabilities that allowed us to bring early-stage research and development activities in-house that we previously outsourced to third parties.

We intend to leverage our proprietary drug discovery platform, called KINect, to identify potential drug candidates that we may develop either independently or in collaboration with third parties. We also earn revenue from Confluence’s provision of contract research services to third parties.

We also acquired several preclinical drug candidates, including additional topical JAK inhibitors known as soft-JAK inhibitors, inhibitors of the MK2 signaling pathway and inhibitors of interleukin-2-inducible T cell kinase, or ITK. Soft-JAK inhibitors may be topically applied and active in the skin, but will be rapidly metabolized and inactivated when they enter the bloodstream, which may result in significantly reduced systemic exposure.

We submitted an IND to the FDA for ATI-450, an oral MK2 inhibitor, for rheumatoid arthritis in April 2019. If the IND is allowed by the FDA, we expect to initiate a Phase 1 trial in approximately 80 patients in the second half of 2019. If we successfully complete the Phase 1 trial, we expect to advance ATI-450 into Phase 2 trials in patients with rheumatoid arthritis and an additional inflammatory indication. In addition to rheumatoid arthritis, we are considering developing ATI-450 for the treatment of psoriasis, hidradenitis suppurativa, cryopyrin-associated periodic syndrome (CAPS), and pyoderma gangrenosum. We expect to submit an IND to the FDA for ATI-1777, a soft-JAK inhibitor, by the end of the first half of 2020. If the IND is allowed by the FDA, we expect to initiate a Phase 1 and Phase 2 trial in the second half of 2020. We are considering developing ATI-1777 for the treatment of several dermatological conditions, including atopic dermatitis, vitiligo and AA. We are considering developing our ITK inhibitors as a potential treatment for psoriasis, inflammatory dermatoses, and inflammatory bowel disease.

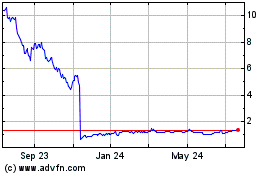

Since our inception, we have incurred significant operating losses. Our net loss was $37.6 million for the three months ended March 31, 2019 and $132.7 million for the year ended December 31, 2018. As of March 31, 2019, we had an accumulated deficit of $329.7 million. We expect to incur significant expenses and operating losses related to product manufacturing, marketing, sales and distribution over the next several years as we continue to commercialize our marketed products. In addition, our marketed products, and our drug candidates if approved, may not achieve commercial success. We also expect to incur significant expenses and operating losses for the foreseeable future as we advance our drug candidates from discovery through preclinical development and clinical trials. In addition, if we obtain marketing approval for any of our drug candidates, we expect to incur significant commercialization expenses related to product manufacturing, marketing, sales and distribution. We may also incur expenses in connection with the in-license or acquisition of additional drug candidates. Furthermore, we have incurred and expect to continue to incur significant costs associated with operating as a public company, including legal, accounting, investor relations and other expenses. As a result, we will need substantial additional funding to support our continuing operations and pursue our growth strategy.

We have historically financed our operations primarily with sales of our convertible preferred stock, as well as net proceeds from our initial public offering, or IPO, in October 2015, and subsequent public offerings of, and a private placement of, our common stock. Until such time as we can generate significant revenue from product sales, if ever, we

expect to finance our operations through the sale of equity, debt financings or other capital sources, including potential collaborations with other companies or other strategic transactions. We may be unable to raise additional funds or enter into such other agreements or arrangements when needed on commercially acceptable terms, or at all. If we fail to raise capital or enter into such agreements as, and when, needed, we may have to significantly delay, scale back or discontinue the development and commercialization of one or more of our products or drug candidates or delay our pursuit of potential in-licenses or acquisitions.

Components of Our Results of Operations

Revenue

Product Sales, net

Our current sales force alignment includes 50 territories in the United States, which we believe will allow us to reach the health care providers in the United States with the highest potential for prescribing our marketed products to their patients.

We sell ESKATA to one wholesaler, McKesson Specialty Care Distribution, or McKesson, which in turn resells ESKATA to health care providers. We have also entered into agreements with two group purchasing organizations, or GPOs, and may enter into additional agreements with other GPOs and corporate accounts that provide for administrative fees and discounted pricing in the form of volume-based rebates and chargebacks. We have no sales of ESKATA in countries outside of the United States.

We began commercializing RHOFADE in the United States in December 2018. We currently rely on Allergan to distribute RHOFADE on our behalf pursuant to the terms of a transition services agreement while we develop our sales, marketing and distribution capabilities to support the commercialization of RHOFADE in the United States. We sell RHOFADE to wholesalers in the United States, which, in turn, distribute it to pharmacies that will ultimately fill patient prescriptions. We may also enter into arrangements with health care providers, pharmacy benefit managers, third-party payors, and/or GPOs which provide for government mandated or privately negotiated rebates, chargebacks, and discounts with respect to the purchase of RHOFADE. We have no sales of RHOFADE in countries outside of the United States.

Contract Research

We earn revenue from the provision of laboratory services to clients through Confluence, our wholly-owned subsidiary. Contract research revenue is generally evidenced by contracts with clients which are on an agreed upon fixed-price, fee-for-service basis and are generally billed on a monthly basis in arrears for services rendered.

We have also received revenue from grants under the Small Business Innovation Research program of the National Institutes of Health, or NIH. During the three months ended March 31, 2018, we had two active grants from NIH which were related to early-stage research. There are no remaining funds available to us under the grants.

Cost of Revenue

Cost of revenue consists of the cost of manufacturing the finished product forms of ESKATA and RHOFADE, as well as costs incurred in connection with the provision of contract research services to our clients through Confluence. Cost of revenue primarily includes:

Product sales

|

|

·

|

|

third-party cost of manufacturing and assembly of finished product forms of ESKATA and RHOFADE;

|

|

|

·

|

|

depreciation of manufacturing equipment;

|

|

|

·

|

|

product release and stability testing;

|

|

|

·

|

|

warehousing and insurance costs;

|

|

|

·

|

|

transition service costs payable to Allergan;

|

|

|

·

|

|

Prescription Drug User Fee Act, or PDUFA, fees;

|

|

|

·

|

|

non-cash charge to adjust the carrying-value of inventory to net realizable value;

|

|

|

·

|

|

non-cash charge related to the fair value step-up of acquired RHOFADE inventory; and

|

|

|

·

|

|

non-cash amortization of the intangible asset related to RHOFADE intellectual property.

|

Contract research

|

|

·

|

|

employee-related expenses, which include salaries, benefits and stock-based compensation;

|

|

|

·

|

|

outsourced professional scientific services;

|

|

|

·

|

|

depreciation of laboratory equipment;

|

|

|

·

|

|

facility-related costs; and

|

|

|

·

|

|

laboratory materials and supplies used to support the services provided.

|

Research and Development Expenses

Research and development expenses consist of expenses incurred in connection with the discovery and development of our drug candidates. These expenses primarily include:

|

|

·

|

|

expenses incurred under agreements with contract research organizations, or CROs, as well as investigative sites and consultants that conduct our clinical trials and preclinical studies;

|

|

|

·

|

|

manufacturing scale-up expenses and the cost of acquiring and manufacturing preclinical and clinical trial materials and commercial materials, including manufacturing validation batches;

|

|

|

·

|

|

outsourced professional scientific development services;

|

|

|

·

|

|

medical affairs expenses related to our drug candidates, including investigator-initiated studies;

|

|

|

·

|

|

employee-related expenses, which include salaries, benefits and stock-based compensation;

|

|

|

·

|

|

depreciation of manufacturing equipment;

|

|

|

·

|

|

payments made under agreements with third parties under which we have acquired or licensed intellectual property;

|

|

|

·

|

|

expenses relating to regulatory activities, including filing fees paid to regulatory agencies; and

|

|

|

·

|

|

laboratory materials and supplies used to support our research activities.

|

Research and development activities are central to our business model. Drug candidates in later stages of clinical development generally have higher development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later-stage clinical trials. We expect our research and development expenses to increase significantly over the next several years as we increase personnel costs, including stock-based compensation,

continue to conduct clinical trials of A-101 45% Topical Solution for the treatment of common warts, and conduct clinical trials and prepare regulatory filings for our other drug candidates. We expense research and development costs as incurred. Our direct research and development expenses primarily consist of external costs including fees paid to CROs, consultants, investigator sites, regulatory agencies and third parties that manufacture our preclinical and clinical trial materials, and are tracked on a program-by-program basis. We do not allocate personnel costs, facilities or other indirect expenses, to specific research and development programs.

The successful development of our drug candidates is highly uncertain. At this time, we cannot reasonably estimate or know the nature, timing and costs of the efforts that will be necessary to complete the remainder of the development of, or when, if ever, material net cash inflows may commence from any of our drug candidates. This uncertainty is due to the numerous risks and uncertainties associated with the duration and cost of clinical trials, which vary significantly over the life of a project as a result of many factors, including:

|

|

·

|

|

the number of clinical sites included in the trials;

|

|

|

·

|

|

the length of time required to enroll suitable patients;

|

|

|

·

|

|

the number of patients that ultimately participate in the trials;

|

|

|

·

|

|

the number of doses subjects receive;

|

|

|

·

|

|

the duration of subject follow-up; and

|

|

|

·

|

|

the results of our clinical trials.

|

Our expenditures are subject to additional uncertainties, including the terms and timing of marketing approvals, and the expense of filing, prosecuting, defending and enforcing any patent claims or other intellectual property rights. We may never succeed in achieving marketing approval for any of our drug candidates. We may obtain unexpected results from our clinical trials. We may elect to discontinue, delay or modify clinical trials of some drug candidates or focus on others. A change in the outcome of any of these variables with respect to the development of a drug candidate could mean a significant change in the costs and timing associated with the development of that drug candidate. For example, if the FDA or other regulatory authorities were to require us to conduct clinical trials beyond those that we currently anticipate, or if we experience significant delays in enrollment in any of our clinical trials, we could be required to expend significant additional financial resources and time on the completion of clinical development.

Sales and Marketing Expenses

Sales and marketing expenses include salaries and related costs for our field sales force, as well as personnel in our marketing and sales operations functions, including stock-based compensation, travel expenses, expenses related to leasing a fleet of vehicles for our field-based sales force, and recruiting expenses. Sales and marketing expenses also include costs of content development, advertising, sponsorships and attendance at dermatology conferences, and costs incurred under the transition services agreement with Allergan.

Additionally, we anticipate incurring significant sales and marketing expenses as we continue to commercialize our marketed products in the United States.

General and Administrative Expenses

General and administrative expenses consist principally of salaries and related costs for personnel in executive, administrative, finance, investor relations and legal functions, including stock-based compensation, travel expenses and recruiting expenses. General and administrative expenses also include facility-related costs, patent filing and prosecution costs, professional fees for legal, auditing and tax services, insurance costs, costs incurred under the transition services agreement with Allergan, medical affairs activity related to marketed products, as well as payments made under a terminated related party sublease agreement and milestone payments under our finder’s services agreement. We anticipate that our general and administrative expenses will continue to increase as a result of increased personnel costs, including

stock-based compensation, expanded infrastructure and higher consulting, legal and tax-related services associated with maintaining compliance with Nasdaq and SEC requirements, accounting and investor relations costs, and director and officer insurance premiums associated with being a public company.

Other Income, Net

Other income, net consists of interest earned on our cash, cash equivalents and marketable securities, interest expense, and gains and losses on transactions denominated in foreign currencies.

Critical Accounting Policies and Significant Judgments and Estimates

This discussion and analysis of our financial condition and results of operations is based on our condensed consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and liabilities in our condensed consolidated financial statements. We base our estimates on historical experience, known trends and events and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. We evaluate our estimates and judgments on an ongoing basis. Our actual results may differ from these estimates under different assumptions or conditions. Except as described below, we believe there have been no material changes to our significant accounting policies and use of estimates as disclosed in the footnotes to our audited consolidated financial statements for the year ended December 31, 2018 included in our Annual Report on Form 10-K filed with the SEC on March 18, 2019.

Revenue Recognition

We account for revenue in accordance with Accounting Standards Codification, or ASC, Topic 606, Revenue from Contracts with Customers. Under ASC Topic 606, revenue is recognized when a customer obtains control of promised goods or services in an amount that reflects the consideration to which we expect to be entitled in exchange for those goods or services.

To determine revenue recognition in accordance with ASC Topic 606, we perform the following five steps: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract, and (v) recognize revenue when (or as) performance obligations are satisfied. We recognize revenue when collection of the consideration we are entitled to under a contract with a customer is probable. At contract inception, we assess the goods or services promised within a contract with a customer to identify the performance obligations, and to determine if they are distinct. We recognize revenue that is allocated to each distinct performance obligation when (or as) that performance obligation is satisfied.

Product Sales, net

We recognize revenue from product sales at the point the customer obtains control, which generally occurs upon delivery, and also include estimates of variable consideration in the same period revenue is recognized. Components of variable consideration include trade discounts and allowances, product returns, government rebates, discounts and rebates, other incentives such as patient co-pay assistance, and other fee for service amounts. Variable consideration is recorded on the consolidated balance sheet as either a reduction of accounts receivable, if payable to a customer, or as a current liability, if payable to a third party other than a customer. We consider all relevant information when estimating variable consideration such as current contractual and statutory requirements, specific known market events and trends, industry data and forecasted customer buying and payment patterns. The amount of net revenue we can recognize is constrained by estimates of variable consideration which are included in the transaction price. Payment terms with customers do not

exceed one year and, therefore, we do not account for a financing component in our arrangements. We expense incremental costs of obtaining a contract with a customer, including sales commissions, when incurred as the period of benefit is less than one year. Shipping and handling costs for product shipments to customers are recorded as sales and marketing expenses in the consolidated statement of operations.

Trade Discounts and Allowances

- We may provide customers with trade discounts, rebates, allowances or other incentives. We record an estimate for these items as a reduction of revenue in the same period the revenue is recognized.

Government and Payor Rebates

– We have contracted and may continue to contract with certain third-party payors, primarily health insurance companies, pharmacy benefit managers and/or government programs, for the payment of rebates with respect to utilization of our products. We also have agreements with GPOs that provide for administrative fees and discounted pricing in the form of volume-based rebates. We are also subject to discount obligations under state Medicaid programs and Medicare. We record an estimate for these rebates as a reduction of revenue in the same period the revenue is recognized.

Other Incentives

- Other incentives includes our co-pay assistance program which is intended to provide financial assistance to qualified commercially-insured patients with prescription drug co-payments required by payors. We estimate and record an accrual for these incentives as a reduction of revenue in the period the revenue is recognized. Our estimated amounts for co-pay assistance are based upon the number of claims and the cost per claim that we expect to receive associated with product that has been sold to customers but remains in the distribution channel at the end of each reporting period.

Product Returns

- Consistent with industry practice, we have a product returns policy which may provide customers a right of return for product purchased within a specified period prior to and subsequent to the product’s expiration date. The right of return lapses upon shipment of the goods to a patient. We record an estimate for the amount of product which may be returned as a reduction of revenue in the period the related revenue is recognized. Our estimates for product returns are based upon available industry data and our own sales information, including visibility into the inventory remaining in the distribution channel. There is no returns liability associated with sales of ESKATA as we have a no returns policy for ESKATA.

Contract Research

Revenue related to laboratory services is generally recognized as the laboratory services are performed, based upon the rates specified in the contracts. Under ASC Topic 606, we elected to apply the “right to invoice” practical expedient when recognizing contract research revenue. We recognize contract research revenue in the amount to which we have the right to invoice.

We recognize revenue related to grants as amounts become reimbursable under each grant, which is generally when research is performed, and the related costs are incurred.

Inventory

Inventory includes the third-party cost of manufacturing and assembly of the finished product forms of ESKATA and RHOFADE, quality control and other overhead costs. Inventory is stated at the lower of cost or net realizable value. Inventory is adjusted for short-dated, unmarketable inventory equal to the difference between the cost of inventory and the estimated value based upon assumptions about future demand and market conditions. Our inventory is comprised primarily of finished goods.

Intangible Assets

Our intangible assets include both finite-lived and indefinite-lived assets. Finite-lived intangible assets are amortized over their estimated useful life based on the pattern over which the intangible assets are consumed or otherwise used up. If that pattern cannot be reliably determined, the straight-line method of amortization is used. Our finite-lived intangible assets consist of a research technology platform acquired through the acquisition of Confluence and the intellectual property rights related to RHOFADE. Our indefinite-lived intangible assets consist of an in-process research and development, or IPR&D, drug candidate acquired through the acquisition of Confluence. IPR&D assets are considered indefinite-lived until the completion or abandonment of the associated research and development efforts. The cost of IPR&D assets is either amortized over their estimated useful life beginning when the underlying drug candidate is approved and launched commercially, or expensed immediately if development of the drug candidate is abandoned.

Finite-lived intangible assets are tested for impairment when events or changes in circumstances indicate that the carrying value of the asset may not be recoverable. Indefinite-lived intangible assets are tested for impairment at least annually, which we perform during the fourth quarter, or when indicators of an impairment are present. We recognize an impairment loss when and to the extent that the estimated fair value of an indefinite-lived intangible asset is less than its carrying value.

Goodwill

Goodwill is not amortized, but rather is subject to testing for impairment at least annually, which we perform during the fourth quarter, or when indicators of an impairment are present. We consider each of our operating segments, dermatology therapeutics and contract research, to be a reporting unit since this is the lowest level for which discrete financial information is available. We have attributed the full amount of the goodwill in connection with the acquisition of Confluence, or $18.5 million, to our dermatology therapeutics segment. We perform an impairment test annually which is a qualitative assessment based upon current facts and circumstances related to operations of the dermatology therapeutics segment. If our qualitative assessment indicates an impairment may be present, we would perform the required quantitative analysis and an impairment charge would be recognized to the extent that the estimated fair value of the reporting unit is less than its carrying amount. However, any loss recognized would not exceed the total amount of goodwill allocated to that reporting unit.

Leases

Leases represent a company’s right to use an underlying asset and a corresponding obligation to make payments to a lessor for the right to use those assets. We evaluate leases at their inception to determine if they are an operating lease or a finance lease. A lease is accounted for as a finance lease if it meets one of the following five criteria: the lease has a purchase option that is reasonably certain of being exercised, the present value of the future cash flows are substantially all of the fair market value of the underlying asset, the lease term is for a significant portion of the remaining economic life of the underlying asset, the title to the underlying asset transfers at the end of the lease term, or if the underlying asset is of such a specialized nature that it is expected to have no alternative uses to the lessor at the end of the term. Leases that do not meet the finance lease criteria are accounted for as an operating lease.

We recognize assets and liabilities for leases at their inception based upon the present value of all payments due under the lease. We use an implicit interest rate to determine the present value of finance leases, and our incremental borrowing rate to determine the present value of operating leases. We determine incremental borrowing rates by referencing collateralized borrowing rates for debt instruments with terms similar to the respective lease. We recognize expense for operating and finance leases on a straight-line basis over the term of each lease, and interest expense related to finance leases is recognized over the lease term based on the effective interest method. We include estimates for any residual value guarantee obligations under our leases in lease liabilities recorded on our condensed consolidated balance sheet.

Right-of-use assets are included in other assets and property and equipment, net on our condensed consolidated balance sheet for operating and finance leases, respectively. Obligations for lease payments are included in current portion of lease liabilities and other liabilities on our condensed consolidated balance sheet for both operating and finance leases.

Contingent Consideration

We initially recorded the contingent consideration related to future potential payments based upon the achievement of specified development, regulatory and commercial milestones, resulting from the acquisition of Confluence, at its estimated fair value on the date of acquisition. Changes in fair value reflect new information about the likelihood of the payment of the contingent consideration and the passage of time. Future changes in the fair value of the contingent consideration, if any, will be recorded as income or expense in our consolidated statement of operations.

Recently Issued Accounting Pronouncements

In November 2018, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update, or ASU, 2018-18, Collaborative Arrangements (Topic 808): Clarifying the Interaction Between Topic 808 and Topic 606, which, among other things, provides guidance on how to assess whether certain collaborative arrangement transactions should be accounted for under Topic 606. The amendments in this ASU are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019, with early adoption permitted. We are evaluating the impact of ASU 2018-18 on our consolidated financial statements.

In August 2018, the FASB issued ASU 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40). ASU 2018-15 requires a customer in a cloud computing arrangement that is a service contract to follow the internal-use software guidance in Accounting Standards Codification, or ASC, 350-40 to determine which implementation costs to capitalize as assets or expense as incurred. The standard will be effective for fiscal years beginning after December 15, 2019, including interim periods within such fiscal years, with early adoption permitted. We are evaluating the impact of ASU 2018-15 on our consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820). The FASB developed the amendments to ASC 820 as part of its broader disclosure framework project, which aims to improve the effectiveness of disclosures in the notes to financial statements by focusing on requirements that clearly communicate the most important information to users of the financial statements. This update eliminates certain disclosure requirements for fair value measurements for all entities, requires public entities to disclose certain new information and modifies some of the existing disclosure requirements. The standard will be effective for fiscal years beginning after December 15, 2019, including interim periods within such fiscal years, with early adoption permitted. We are evaluating the impact of ASU 2018-13 on our consolidated financial statements.

In June 2018, the FASB, issued ASU 2018-07, Compensation-Stock Compensation (Topic 718). The amendments in this ASU expand the scope of Topic 718 to include stock-based compensation arrangements with non-employees except for specific guidance on option pricing model inputs and cost attribution. ASU 2018-07 was effective for annual reporting periods beginning after December 31, 2018, including interim periods within that year. We adopted this standard as of January 1, 2019, the impact of which on our consolidated financial statements was not significant.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). In July 2018, the FASB issued ASU 2018-10, Codification Improvements to Topic 842, Leases, and ASU 2018-11, Targeted Improvements, both of which included a number of technical corrections and improvements, including additional options for transition. The new standard establishes a right-of-use model that requires a lessee to record a right-of-use asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. ASU 2016-02 is effective for annual

periods beginning after December 15, 2018, including interim periods within those annual periods. The amendments in ASU 2016-02 must be applied to all leases existing at the date a company initially applies the standard.

We adopted the new standard on January 1, 2019, using the effective date as the date of initial application, and we used the modified retrospective approach. In addition, we elected the practical expedients permitted under the transition guidance within the new standard, which among other things, allowed us to carry forward the historical lease identification and classification. We also elected the practical expedient to not separate lease and non-lease components, as well as the short-term lease exemption which allowed us to not capitalize leases with terms less than 12 months that do not contain a reasonably certain purchase option. Our financial statements have not been updated, and disclosures required by the new standard have not been provided, for periods before January 1, 2019.

The adoption of ASU 2016-02 resulted in recording additional assets and liabilities of $2,132 and $2,317, respectively upon adoption on January 1, 2019. The adoption of ASU 2016-02 did not have a material impact on our consolidated statement of operations or cash flows.

Results of Operations

Comparison of Three Months Ended March 31, 2019 and 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

|

|

|

(In thousands)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

Product sales, net

|

|

$

|

3,778

|

|

$

|

—

|

|

$

|

3,778

|

|

|

Contract research

|

|

|

1,263

|

|

|

1,118

|

|

|

145

|

|

|

Total revenue, net

|

|

|

5,041

|

|

|

1,118

|

|

|

3,923

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (excludes amortization)

|

|

|

2,777

|

|

|

967

|

|

|

1,810

|

|

|

Research and development

|

|

|

19,919

|

|

|

13,606

|

|

|

6,313

|

|

|

Sales and marketing

|

|

|

9,828

|

|

|

11,233

|

|

|

(1,405)

|

|

|

General and administrative

|

|

|

8,193

|

|

|

6,260

|

|

|

1,933

|

|

|

Amortization of definite-lived intangible

|

|

|

1,659

|

|

|

—

|

|

|

1,659

|

|

|

Total costs and expenses

|

|

|

42,376

|

|

|

32,066

|

|

|

10,310

|

|

|

Loss from operations

|

|

|

(37,335)

|

|

|

(30,948)

|

|

|

(6,387)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net

|

|

|

(230)

|

|

|

719

|

|

|

(949)

|

|

|

Net loss

|

|

$

|

(37,565)

|

|

$

|

(30,229)

|

|

$

|

(7,336)

|

|

Revenue

Revenue was $5.0 million for the three months ended March 31, 2019, compared to $1.1 million for the three months ended March 31, 2018. Product sales, net included $3.7 million and $0.1 million of net revenue from sales of RHOFADE and ESKATA, respectively, during the three months ended March 31, 2019. We acquired RHOFADE in November 2018. Contract research revenue of $1.3 million and $1.1 million for the three months ended March 31, 2019 and 2018, respectively, was comprised primarily of fees earned from the provision of laboratory services to clients through Confluence.

Cost of Revenue

Cost of revenue was $2.8 million for the three months ended March 31, 2019 and was comprised of $1.3 million and $0.3 million of costs related to RHOFADE and ESKATA product sales, net, respectively. We also incurred $1.2 million of costs related to providing laboratory services to our clients through Confluence. Cost of revenue was $1.0 million for the three months ended March 31, 2018 and was comprised entirely of costs incurred to provide laboratory services to our clients through Confluence.

Research and Development Expenses

The following table summarizes our research and development expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

|

|

(In thousands)

|

|

A-101 45% Topical Solution

|

|

$

|

5,460

|

|

$

|

1,019

|

|

$

|

4,441

|

|

JAK inhibitors

|

|

|

5,645

|

|

|

5,175

|

|

|

470

|

|

MK2 inhibitors

|

|

|

2,235

|

|

|

545

|

|

|

1,690

|

|

ESKATA

|

|

|

287

|

|

|

686

|

|

|

(399)

|

|

Personnel expenses

|

|

|

2,511

|

|

|

2,251

|

|

|

260

|

|

Change in contingent consideration

|

|

|

—

|

|

|

866

|

|

|

(866)

|

|

Other research and development expenses

|

|

|

2,187

|

|

|

1,337

|

|

|

850

|

|

Stock-based compensation

|

|

|

1,594

|

|

|

1,727

|

|

|

(133)

|

|

Total research and development expenses

|

|

$

|

19,919

|

|

$

|

13,606

|

|

$

|

6,313

|

Expenses related to A-101 45% Topical Solution increased primarily due to our ongoing Phase 3 clinical trials for the treatment of common warts which we initiated during the third quarter of 2018. Development expenses for our JAK inhibitors increased due to continued growth in both preclinical and clinical trial expenses as we continue to conduct multiple Phase 2 clinical trials of ATI-501 and ATI-502. The increase in expenses for our MK2 inhibitors resulted primarily from preclinical development activities as we prepared to file an IND for ATI-450 and initiate Phase 1 clinical trials later this year. Personnel expenses increased due to increased headcount. Other research and development expenses primarily included expenses for medical affairs activities related to RHOFADE and ESKATA as well as drug discovery. The change in contingent consideration during the three months ended March 31, 2018 was the result of updates to our assumptions related to drug discovery research on our soft-JAK inhibitors, which progressed more quickly than we had originally planned. The increase in other research and development expenses was primarily driven by discovery work related to our ITK inhibitors. The decrease in stock-based compensation was primarily driven by the timing of equity awards during the twelve months preceding March 31, 2019, as well as the relatively lower fair value of those awards.

Sales and Marketing Expenses

The following table summarizes our sales and marketing expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

|

|

|

(In thousands)

|

|

|

Direct marketing and professional fees

|

|

$

|

3,193

|

|

$

|

4,359

|

|

$

|

(1,166)

|

|

|

Personnel expenses

|

|

|

3,549

|

|

|

3,872

|

|

|

(323)

|

|

|

Other sales and marketing expenses

|

|

|

2,496

|

|

|

2,095

|

|

|

401

|

|

|

Stock-based compensation

|

|

|

590

|

|

|

907

|

|

|

(317)

|

|

|

Total sales and marketing expenses

|

|

$

|

9,828

|

|

$

|

11,233

|

|

$

|

(1,405)

|

|

Direct marketing and professional fees decreased primarily due to expenses we incurred in the three months ended March 31, 2018 preparing for the commercial launch of ESKATA, which were not present in the current year period. Personnel expenses decreased primarily due to higher recruiting and incentive compensation costs included in the three months ended March 31, 2018 which resulted from the hiring of our field sales force. Other sales and marketing expenses included sales operations, travel costs, depreciation and other miscellaneous expenses. The increase in other sales and marketing expenses was primarily the result of costs related to our national sales meeting, employee training and samples fulfillment resulting from our re-launch of RHOFADE in 2019. The decrease in stock-based compensation was primarily driven by forfeitures of equity awards as the result of turnover in our sales force.

General and Administrative Expenses

The following table summarizes our general and administrative expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

|

|

(In thousands)

|

|

Personnel expenses

|

|

$

|

2,454

|

|

$

|

1,798

|

|

$

|

656

|

|

Professional and legal fees

|

|

|

2,103

|

|

|

1,120

|

|

|

983

|

|

Facility and support services

|

|

|

704

|

|

|

637

|

|

|

67

|

|

Other general and administrative expenses

|

|

|

460

|

|

|

372

|

|

|

88

|

|

Stock-based compensation

|

|

|

2,472

|

|

|

2,333

|

|

|

139

|

|

Total general and administrative expenses

|

|

$

|

8,193

|

|

$

|

6,260

|

|

$

|

1,933

|

Personnel and stock-based compensation expenses increased due to increased headcount. Professional and legal fees included accounting, legal, medical affairs, costs incurred under the transition services agreement with Allergan, investor relations costs, as well as legal fees related to patents. The increase in professional and legal fees was primarily related to costs incurred under the transition services agreement with Allergan related to RHOFADE, which we acquired in November 2018, as well as medical affairs activities. Facility and support services included general office expenses and information technology costs, which have risen due to our increased headcount.

Amortization of Definite-Lived Intangible

During the three months ended March 31, 2019, we incurred $1.7 million of non-cash amortization expense related to the intangible asset for RHOFADE intellectual property we acquired in November 2018.

Other Income (Expense), net

The $0.9 million decrease in other income (expense), net was primarily due to interest expense incurred on our debt which we borrowed in October 2018.

Liquidity and Capital Resources

Since our inception, we have incurred net losses and negative cash flows from our operations. Prior to our acquisition of Confluence in August 2017, we did not generate any revenue. We have financed our operations over the last several years primarily through sales of our equity securities in public offerings and a private placement transaction. As described below, in October 2018 we also entered into a loan facility with an institutional lender.

As of March 31, 2019, we had cash, cash equivalents and marketable securities of $136.8 million. Cash in excess of immediate requirements is invested in accordance with our investment policy, primarily with a view towards liquidity and capital preservation.

We currently have no ongoing material financing commitments, such as lines of credit or guarantees, that are expected to affect our liquidity over the next five years, other than our debt financing obligation, sublease obligations, capital lease obligations and contingent obligations under acquisition and intellectual property licensing agreements, which are summarized below under “Contractual Obligations and Commitments

.”

October 2018 Public Offering

In October 2018, we closed a public offering in which we sold 9,941,750 shares of common stock at a price to the public of $10.75 per share, for aggregate gross proceeds of $106.9 million. We paid underwriting discounts and commissions of $6.4 million to the underwriters, and we incurred expenses of $0.3 million in connection with the offering. As a result, the net offering proceeds received by us, after deducting underwriting discounts, commissions and offering expenses, were $100.2 million.

Loan and Security Agreement with Oxford

In October 2018, we entered into a loan and security agreement, or the Loan and Security Agreement, with Oxford Finance LLC, or Oxford. The agreement provided for up to $65.0 million in term loans. Of the $65.0 million, we borrowed $30.0 million in October 2018, and did not draw the remaining $35.0 million that was available until March 31, 2019 under the agreement. The Loan and Security Agreement provides for interest only payments through the payment date immediately prior to November 1, 2021, followed by 24 consecutive equal monthly payments of principal and interest in arrears starting on November 1, 2021 and continuing through the maturity date of October 1, 2023. All unpaid principal and accrued and unpaid interest will be due and payable on the maturity date. The Loan and Security Agreement provides for an annual interest rate equal to the greater of (i) 8.35% and (ii) the 30-day U.S. LIBOR rate reported in The Wall Street Journal on the last business day of the month that immediately precedes the month in which the interest will accrue plus 6.25%. The Loan and Security Agreement also provides for a final payment equal to 5.75% of the original principal amount of the term loans drawn, which final payment is due on October 1, 2023 or upon the prepayment of the facility or the acceleration of amounts due under the facility as a result of an event of default.

We have the option to prepay the outstanding balance of the term loans in full, subject to a prepayment fee of (i) 3% of the original principal amount of the aggregate term loans drawn for any prepayment prior to the first anniversary of the applicable funding date, (ii) 2% of the original principal amount of the aggregate term loans drawn for any prepayment between the first and second anniversaries of the applicable funding date or (iii) 1% of the original principal amount of the aggregate term loans drawn for any prepayment after the second anniversary of the applicable funding date but before October 1, 2023. We also have the option to prepay the term loans in part, once in a three-month period, of an amount of $2.0 million or greater, subject to the same prepayment fees and other specified limitations.

Cash Flows

The following table summarizes our cash flows for each of the periods presented:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

2019

|

|

2018

|

|

|

|

(In thousands)

|

|

Net cash used in operating activities

|

|

$

|

(31,318)

|

|

$

|

(21,872)

|

|

Net cash provided by investing activities

|

|

|

8,616

|

|

|

56,193

|

|

Net cash provided by (used in) financing activities

|

|

|

(120)

|

|

|

358

|

|

Net increase (decrease) in cash and cash equivalents

|

|

$

|

(22,822)

|

|

$

|

34,679

|

Operating Activities

During the three months ended March 31, 2019, operating activities used $31.3 million of cash primarily resulting from our net loss of $37.6 million, partially offset by non-cash adjustments of $7.1 million. Net cash provided by changes in our operating assets and liabilities during the three months ended March 31, 2019 consisted of an $8.3 million increase in accounts payable and accrued expenses and a $1.9 million decrease in prepaid expenses and other current assets, which were offset by an $11.0 million increase in accounts receivable. The increase in accounts payable and accrued expenses was primarily driven by expenses incurred, but not yet paid, as of March 31, 2019, as well as the timing of vendor invoicing and payments. Expenses incurred, but not yet paid, as of March 31, 2019 primarily included sales and marketing expenses related to the re-launch of RHOFADE, as well as expenses related to our Phase 3 clinical trials for A-101 45% Topical Solution, our Phase 2 clinical trials for ATI-501 and ATI-502 and pre-clinical development activities for ATI-450. The decrease in prepaid expenses and other current assets was due to research and development activities primarily related to pre-clinical development activities for ATI-450 which concluded during the three months ended March 31, 2019 and sales and marketing expenses related to our national sales meeting which was held during the three months ended March 31, 2019. The increase in accounts receivable was primarily the result of sales of RHOFADE. Non-cash expenses of $7.1 million were composed of stock-based compensation expense and depreciation and amortization expense.

During the three months ended March 31, 2018, operating activities used $21.9 million of cash primarily resulting from our net loss of $30.2 million, partially offset by changes in our operating assets and liabilities of $2.1 million, and non-cash adjustments of $6.2 million. Net cash provided by changes in our operating assets and liabilities during the three months ended March 31, 2018 consisted of a $1.0 million decrease in prepaid expenses and other current assets and a $1.1 million increase in accounts payable and accrued expenses. The decrease in prepaid expenses and other current assets was primarily due to a $2.0 million PDUFA fee paid to the FDA in conjunction with the filing of the NDA for ESKATA, for which we received a refund during the three months ended March 31, 2018, partially offset by deposits made for clinical supplies and development activities that were incurred during the second quarter of 2018. The increase in accounts payable and accrued expenses was primarily due to expenses incurred, but not yet paid, in connection with our Phase 2 clinical trials for A-101 45% Topical Solution, ATI-501 and ATI-502, as well as the timing of vendor invoicing and payments. Non-cash expenses of $6.2 million were primarily composed of stock-based compensation expense.

Investing Activities

During the three months ended March 31, 2019, investing activities provided $8.6 million of cash, consisting of proceeds from sales and maturities of marketable securities of $82.0 million, partially offset by purchases of marketable securities of $73.1 million, and purchases of equipment of $0.3 million.

During the three months ended March 31, 2018, investing activities provided $56.2 million of cash, consisting of proceeds from sales and maturities of marketable securities of $92.1 million, partially offset by purchases of marketable securities of $35.6 million, and purchases of equipment of $0.3 million.

Financing Activities

During the three months ended March 31, 2019, financing activities used $0.1 million of cash related to finance lease payments.

During the three months ended March 31, 2018, financing activities provided $0.4 million of cash primarily from the exercise of employee stock options.

Funding Requirements

We plan to focus in the near term on the commercialization of our marketed products, as well as the clinical development of our drug candidates. We anticipate we will incur net losses for the next several years as we continue to commercialize our marketed products, continue the clinical development of A-101 45% Topical Solution for the treatment of common warts and continue research and development of ATI-501 and ATI-502 for the treatment of AA and other dermatological conditions, as well as the identification, research and development of other compounds. We plan to continue to invest in discovery efforts to explore additional drug candidates, build commercial capabilities and expand our corporate infrastructure. We may not be able to complete the development and initiate commercialization of these programs if, among other things, our clinical trials are not successful or if the FDA does not approve our drug candidates currently in clinical trials when we expect, or at all.

Our primary uses of capital are, and we expect will continue to be, compensation and related expenses, clinical costs, external research and development services, laboratory and related supplies, sales, marketing and advertising costs, legal and other regulatory expenses, and administrative and overhead costs. In addition, in 2019 we plan to invest in a new research facility for our drug discovery operations. Our future funding requirements will be heavily determined by the resources needed to support the commercialization of our marketed products, as well as the development of our drug candidates.

As a publicly traded company, we have incurred and will continue to incur significant legal, accounting and other expenses that we were not required to incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as rules adopted by the SEC and the Nasdaq Stock Market LLC, requires public companies to implement specified corporate governance practices that were not applicable to us prior to our IPO. We expect ongoing compliance with these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly, in particular after we cease to be an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or JOBS Act.

We believe our existing cash, cash equivalents and marketable securities are sufficient to fund our operating and capital expenditure requirements for a period greater than 12 months from the date of issuance of our consolidated financial statements that appear in Item 1 of this Quarterly Report on Form 10-Q based on our current operating assumptions including the commercialization of our marketed products, conducting Phase 3 clinical trials for A-101 45% Topical Solution for the treatment of common warts, the continued development of ATI-501 and ATI-502 as potential treatments for AA and other dermatological indications, and the development of ATI-450 as a potential treatment for rheumatoid arthritis and other dermatological conditions. These assumptions may prove to be wrong, and we could utilize our available capital resources sooner than we expect. We expect that we will require additional capital to commercialize A-101 45% Topical Solution for the treatment of common warts, if approved, to complete the clinical development of ATI-501 and ATI-502, to develop our preclinical compounds, to support our discovery efforts, and to pursue in-licenses or acquisitions of other drug candidates. We also expect to incur significant expenses related to the commercialization of our marketed products, including product manufacturing, sales, marketing, advertising and distribution costs. Additional funds may not be available on a timely basis, on commercially acceptable terms, or at all, and such funds, if raised, may not be sufficient to enable us to continue to implement our long-term business strategy. If we are unable to raise sufficient additional capital, we may need to substantially curtail our planned operations and the pursuit of our growth strategy.

We may raise additional capital through the sale of equity or convertible debt securities. In such an event, your ownership will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of a holder of our common stock.

Because of the numerous risks and uncertainties associated with research, development and commercialization of pharmaceutical drugs, we are unable to estimate the exact amount of our working capital requirements. Our future funding requirements will depend on many factors, including:

|

|

·

|

|

the number and development requirements of the drug candidates that we may pursue;

|

|

|

·

|

|

the scope, progress, results and costs of preclinical development, laboratory testing and conducting pre-clinical and clinical trials for our drug candidates;

|

|

|

·

|

|

the costs, timing and outcome of regulatory review of our drug candidates;

|

|

|

·

|

|

the cost of commercializing our marketed products and the costs and timing of future commercialization activities, including drug manufacturing, marketing, sales and distribution, for any of our drug candidates for which we receive marketing approval;

|

|

|

·

|

|

the revenue received from commercial sales of our marketed products and any of our drug candidates for which we receive marketing approval;

|

|

|

·

|

|

the progress of obtaining marketing approval for ESKATA in select countries in the European Union and Norway;

|

|

|

·

|

|

our ability to establish collaborations to commercialize our marketed products outside the United States;

|

|

|

·

|

|

the costs and timing of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims;

|

|

|

·

|

|

the extent to which we in-license or acquire additional drug candidates and technologies; and

|

|

|

·

|

|

the timing, receipt and amount of sales of, or milestone payments related to or royalties on, our current or future products or drug candidates, if any, as a result of licenses to, or partnership or collaborations with, third parties

.

|

Contractual Obligations and Commitments

We occupy space for our headquarters in Wayne, Pennsylvania under a sublease agreement which has a term through October 2023. We lease office space in Malvern, Pennsylvania under an operating lease agreement which has a term through November 2019. We occupy office and laboratory space in St. Louis, Missouri under an operating lease agreement which has a term through May 2019.

We lease laboratory equipment used in our laboratory space in St. Louis, Missouri under two capital lease financing arrangements which have terms through October 2020 and December 2020, respectively.

We lease a fleet of automobiles for our sales force and other field-based employees under the terms of a master lease agreement. The lease term for each automobile begins on the date we take delivery and continues for a period of four years.

In October 2018, we borrowed $30.0 million under the Loan and Security Agreement with Oxford. Amounts borrowed under the Loan and Security Agreement are subject to interest only through October 2021, after which we will be required to make principal and interest payments through the maturity date of October 2023.

Under various agreements, we may be required to make milestone payments and pay royalties and other amounts to third parties.

Under the assignment agreement with the Estate of Mickey Miller pursuant to which we acquired intellectual property, we have agreed to pay royalties on sales of ESKATA or other related products at rates ranging in low single-

digit percentages of net sales, as defined in the agreement. Under the related finder’s services agreement with KPT Consulting, LLC, we have agreed to make a remaining payment of $3.0 million upon the achievement of a specified commercial milestone. In addition, we have agreed to pay royalties on sales of ESKATA or other related products at a low single-digit percentage of net sales, as defined in the agreement.

Under a license agreement with Rigel, we have agreed to make aggregate payments of up to $80.0 million upon the achievement of specified pre-commercialization milestones, such as clinical trials and regulatory approvals. Further, we have agreed to pay up to an additional $10.0 million to Rigel upon the achievement of a second set of development milestones. With respect to any products we commercialize under the agreement, we will pay Rigel quarterly tiered royalties on our annual net sales of each product developed using the licensed JAK inhibitors at a high single digit percentage of annual net sales, subject to specified reductions.

Under a stock purchase agreement with the selling stockholders of Vixen

, w

e are obligated to make aggregate payments of up to $18.0 million upon the achievement of specified pre-commercialization milestones for three products covered by the Vixen patent rights in the United States, the European Union and Japan, and aggregate payments of up to $22.5 million upon the achievement of specified commercial milestones for products covered by the Vixen patent rights.

We are also obligated to make an annual payment of $0.1 million through March 2022, which amounts are creditable against any specified future payments that may be paid under the agreement.

With respect to any covered products that we commercialize under the

agreement

, we are obligated to pay a low single-digit percentage of annual net sales, subject to specified reductions, limitations and other adjustments, until the date that all of the patent rights for that product have expired, as determined on a country-by-country and product-by-product basis or, in specified circumstances, ten years from the first commercial sale of such product. If we sublicense any of the patent rights and know-how acquired pursuant to the

agreement

, we will be obligated to pay a portion of any consideration we receive from such sublicenses in specified circumstances.

Under a license agreement with The Trustees of Columbia University in the City of New York, or Columbia, we are obligated to pay an annual license fee of $10,000, subject to specified adjustments for patent expenses incurred by Columbia and creditable against any royalties that may be paid under the license agreement. We are also obligated to pay up to an aggregate of $11.6 million upon the achievement of specified commercial milestones, including specified levels of net sales of products covered by Columbia patent rights and/or know-how, and royalties at a sub-single-digit percentage of annual net sales of products covered by Columbia patent rights and/or know-how, subject to specified adjustments. If we sublicense any of Columbia’s patent rights and know-how acquired pursuant to the agreement, we will be obligated to pay Columbia a portion of any consideration we receive from such sublicenses in specified circumstances.

Under a merger agreement with Confluence,

w

e are obligated to make remaining aggregate payments of up to $75.0 million upon the achievement of specified regulatory and commercialization milestones. With respect to any covered products we commercialize, we are obligated to pay a low single-digit percentage of annual net sales, subject to specified reductions, limitations and other adjustments, until the date that all of the patent rights for that product have expired, as determined on a country-by-country and product-by-product basis or, in specified circumstances, ten years from the first commercial sale of such product. If we sublicense any of the patent rights and know-how acquired pursuant to the agreement, we will be obligated to pay a portion of any consideration we receive from such sublicenses in specified circumstances.

Under the Asset Purchase Agreement with Allergan pursuant to which we acquired intellectual property, we have agreed to pay Allergan royalties on net sales of RHOFADE ranging from a mid-single digit percentage to a mid-teen percentage of net sales, subject to specified reductions, limitations and other adjustments, on a country-by-country basis until the date that the patent rights related to a particular product, such as RHOFADE, have expired or, if later, November 30, 2028. In addition, we have agreed to assume the obligation to pay specified royalties and milestone payments under agreements with Aspect Pharmaceuticals, LLC and Vicept Therapeutics, Inc. We have also agreed to pay Allergan a one-time payment of $5.0 million upon the achievement of a specified development milestone related to the potential development of an additional dermatology product.

We enter into contracts in the normal course of business with CROs for clinical trials, preclinical research studies and testing, manufacturing and other services and products for operating purposes. These contracts generally provide for termination upon notice, and therefore we believe that our non-cancelable obligations under these agreements are not material.

Off-Balance Sheet Arrangements

We did not have during the periods presented, and we do not currently have, any off-balance sheet arrangements, as defined in the rules and regulations of the SEC.