Q2 HIGHLIGHTS

- ACI total revenue up 27%

- Net income of $6 million, versus net loss of $15 million last

year

- ACI adjusted EBITDA up 80%

- Speedpay acquisition integration on track

- Reiterating 2019 and 2020 guidance

ACI Worldwide (NASDAQ: ACIW), a leading global provider of

real-time electronic payment and banking solutions, today announced

financial results for the quarter ended June 30, 2019.

“We are pleased with our results in Q2. ACI revenue increased

27%, or 6% excluding the Speedpay contribution. We continue to see

strong margin improvement in our On Demand segment which saw net

adjusted EBITDA margins of 18% compared to negative 5% last year,”

commented Phil Heasley, President and CEO, ACI Worldwide. “We are

also pleased with the integration and contribution of Speedpay and

we remain confident in our full year outlook.”

Q2 2019 FINANCIAL SUMMARY

In Q2 2019, total bookings were $301 million, up 52% from last

year. New bookings were $129 million, up slightly from Q2 last

year.

In Q2 2019, revenue was $298 million, up 27% from $235 million

in Q2 2018. Adjusting for the Speedpay contribution, Q2 revenue

grew 6% from last year. Recurring revenue increased 33% in the

quarter to $224 million, or 75% of total revenue, from $169

million, or 72% of total revenue last year. Net income in the

quarter was $6 million, versus a net loss of $15 million last year.

Adjusted EBITDA in Q2 was $55 million, up 80% from Q2 2018.

In Q2 2019, revenue from ACI’s On Demand segment was $173

million, up 52% from $114 million last year. Adjusting for the

Speedpay contribution, On Demand segment revenue grew 8% from last

year. On Demand segment net adjusted EBITDA margin improved to 18%

from negative 5% last year. On Demand segment net adjusted EBITDA

margins are adjusted for pass through interchange revenue of $78

million and $46 million, for Q2 2019 and Q2 2018, respectively.

ACI’s On Premise segment revenue was $125 million, up 3% from

$121 million last year. On Premise segment adjusted EBITDA margin

was 46% in Q2 2019 versus 45% in Q2 2018.

ACI ended Q2 2019 with a 12-month backlog of $1.1 billion and a

60-month backlog of $5.7 billion, up $328 million and $1.5 billion,

respectively. After adjusting for the Speedpay acquisition and

foreign currency fluctuations, our 12-month backlog increased $16

million and our 60-month backlog increased $29 million from Q1

2019.

Cash flows from operating activities in Q2 2019 were $14

million, versus $26 million in Q2 2018. Adjusted operating free

cash flow in Q2 2019 was $16 million, up from $13 million in Q2

2018. ACI ended Q2 2019 with $139 million in cash on hand and a

debt balance of $1.4 billion. The company has $176 million

remaining on its share repurchase authorization.

REITERATING GUIDANCE

We are reiterating our outlook for the full year 2019 and 2020.

We continue to expect 2019 total revenue to be between $1.315

billion and $1.345 billion and adjusted EBITDA to be in a range of

$360 million to $380 million, which excludes between $30 million

and $35 million in significant transaction related expenses. We

expect Q3 2019 revenue to be between $335 million and $345 million.

We continue to expect full-year 2019 new bookings growth to be in

the upper single digits to low double digits.

We continue to expect our 2020 adjusted EBITDA to be in a range

of $425 million to $445 million.

CONFERENCE CALL TO DISCUSS FINANCIAL RESULTS AND

OUTLOOK

Management will host a conference call at 8:30 am ET today to

discuss these results, the Speedpay acquisition, as well as 2019

and 2020 guidance. Interested persons may access a real-time audio

broadcast of the teleconference at

http://investor.aciworldwide.com/ or use the following numbers for

dial-in participation: US/Canada: (866) 914-7436, international: +1

(817) 385-9117. Please provide your name, the conference name ACI

Worldwide, Inc. and conference code 8549868. There will be a replay

of the call available for two weeks on (855) 859-2056 for US/Canada

callers and +1 (404) 537-3406 for international participants.

About ACI Worldwide

ACI Worldwide, the Universal Payments (UP) company, powers

electronic payments for more than 5,100 organizations around the

world. More than 1,000 of the largest financial institutions and

intermediaries, as well as thousands of global merchants, rely on

ACI to execute $14 trillion each day in payments and securities. In

addition, myriad organizations utilize our electronic bill

presentment and payment services. Through our comprehensive suite

of software solutions delivered on customers’ premises or through

ACI’s private cloud, we provide real-time, immediate payments

capabilities and enable the industry’s most complete omni-channel

payments experience. To learn more about ACI, please visit

www.aciworldwide.com. You can also find us on Twitter

@ACI_Worldwide.

© Copyright ACI Worldwide, Inc. 2019.

ACI, ACI Worldwide, the ACI logo, ACI Universal Payments, UP,

the UP logo and all ACI product/solution names are trademarks or

registered trademarks of ACI Worldwide, Inc., or one of its

subsidiaries, in the United States, other countries or both. Other

parties' trademarks referenced are the property of their respective

owners.

To supplement our financial results presented on a GAAP basis,

we use the non-GAAP measures indicated in the tables, which exclude

significant transaction-related expenses, as well as other

significant non-cash expenses such as depreciation, amortization

and stock-based compensation, that we believe are helpful in

understanding our past financial performance and our future

results. The presentation of these non-GAAP financial measures

should be considered in addition to our GAAP results and are not

intended to be considered in isolation or as a substitute for the

financial information prepared and presented in accordance with

GAAP. Management generally compensates for limitations in the use

of non-GAAP financial measures by relying on comparable GAAP

financial measures and providing investors with a reconciliation of

non-GAAP financial measures only in addition to and in conjunction

with results presented in accordance with GAAP. We believe that

these non-GAAP financial measures reflect an additional way to view

aspects of our operations that, when viewed with our GAAP results,

provide a more complete understanding of factors and trends

affecting our business. Certain non-GAAP measures include:

- Adjusted EBITDA: net income plus income tax expense (benefit),

net interest income (expense), net other income (expense),

depreciation, amortization and stock-based compensation, as well as

significant transaction-related expenses. Adjusted EBITDA should be

considered in addition to, rather than as a substitute for, net

income.

- Net Adjusted EBITDA Margin: Adjusted EBITDA divided by revenue

net of pass through interchange revenue. Net Adjusted EBITDA Margin

should be considered in addition to, rather than as a substitute

for, net income.

ACI is also presenting adjusted operating free cash flow, which

is defined as net cash provided by operating activities and net

after-tax payments associated with significant transaction-related

expenses, less capital expenditures. Adjusted operating free cash

flow is considered a non-GAAP financial measure as defined by SEC

Regulation G. We utilize this non-GAAP financial measure, and

believe it is useful to investors, as an indicator of cash flow

available for debt repayment and other investing activities, such

as capital investments and acquisitions. We utilize adjusted

operating free cash flow as a further indicator of operating

performance and for planning investment activities. Adjusted

operating free cash flow should be considered in addition to,

rather than as a substitute for, net cash provided by operating

activities. A limitation of adjusted operating free cash flow is

that it does not represent the total increase or decrease in the

cash balance for the period. This measure also does not exclude

mandatory debt service obligations and, therefore, does not

represent the residual cash flow available for discretionary

expenditures. We believe that adjusted operating free cash flow is

useful to investors to provide disclosures of our operating results

on the same basis as that used by our management.

ACI backlog includes estimates for SaaS and PaaS, license,

maintenance, and services revenue specified in executed contracts

but excluded from contracted revenue that will be recognized in

future periods, as well as revenue from assumed contract renewals

to the extent that we believe recognition of the related revenue

will occur within the corresponding backlog period. We have

historically included assumed renewals in backlog estimates based

upon automatic renewal provisions in the executed contract and our

historic experience with customer renewal rates.

Backlog is considered a non-GAAP financial measure as defined by

SEC Regulation G. Our 60-month backlog estimates are derived using

the following key assumptions:

- License arrangements are assumed to renew at the end of their

committed term or under the renewal option stated in the contract

at a rate consistent with historical experience. If the license

arrangement includes extended payment terms, the renewal estimate

is adjusted for the effects of a significant financing

component.

- Maintenance fees are assumed to exist for the duration of the

license term for those contracts in which the committed maintenance

term is less than the committed license term.

- SaaS and PaaS arrangements are assumed to renew at the end of

their committed term at a rate consistent with our historical

experiences.

- Foreign currency exchange rates are assumed to remain constant

over the 60-month backlog period for those contracts stated in

currencies other than the U.S. dollar.

- Our pricing policies and practices are assumed to remain

constant over the 60-month backlog period.

Estimates of future financial results are inherently unreliable.

Our backlog estimates require substantial judgment and are based on

a number of assumptions as described above. These assumptions may

turn out to be inaccurate or wrong, including, but not limited to,

reasons outside of management’s control. For example, our customers

may attempt to renegotiate or terminate their contracts for a

number of reasons, including mergers, changes in their financial

condition, or general changes in economic conditions in the

customer’s industry or geographic location, or we may experience

delays in the development or delivery of products or services

specified in customer contracts which may cause the actual renewal

rates and amounts to differ from historical experiences. Changes in

foreign currency exchange rates may also impact the amount of

revenue actually recognized in future periods. Accordingly, there

can be no assurance that contracts included in backlog estimates

will actually generate the specified revenue or that the actual

revenue will be generated within the corresponding 60-month

period.

Backlog estimates should be considered in addition to, rather

than as a substitute for, reported revenue and contracted but not

recognized revenue (including deferred revenue).

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements based on

current expectations that involve a number of risks and

uncertainties. Generally, forward-looking statements do not relate

strictly to historical or current facts and may include words or

phrases such as “believes,” “will,” “expects,” “anticipates,”

“intends,” and words and phrases of similar impact. The

forward-looking statements are made pursuant to safe harbor

provisions of the Private Securities Litigation Reform Act of

1995.

Forward-looking statements in this press release include, but

are not limited to, statements regarding: (i) expectations

regarding Speedpay integration and contribution; (ii) confidence in

our full year outlook; (iii) expectations regarding revenue,

adjusted EBITDA, and new bookings growth in 2019; (iv) expectations

regarding revenue in Q3 2019; and (v) expectations regarding our

2020 adjusted EBITDA target.

All of the foregoing forward-looking statements are expressly

qualified by the risk factors discussed in our filings with the

Securities and Exchange Commission. Such factors include, but are

not limited to, increased competition, the success of our Universal

Payments strategy, demand for our products, restrictions and other

financial covenants in our debt agreements, consolidations and

failures in the financial services industry, customer reluctance to

switch to a new vendor, the accuracy of management’s backlog

estimates, the maturity of certain products, failure to obtain

renewals of customer contracts or to obtain such renewals on

favorable terms, delay or cancellation of customer projects or

inaccurate project completion estimates, volatility and disruption

of the capital and credit markets and adverse changes in the global

economy, our existing levels of debt, impairment of our goodwill or

intangible assets, litigation, future acquisitions, strategic

partnerships and investments, integration of and achieving benefits

from the Speedpay acquisition, the complexity of our products and

services and the risk that they may contain hidden defects or be

subjected to security breaches or viruses, compliance of our

products with applicable legislation, governmental regulations and

industry standards, our ability to protect customer information

from security breaches or attacks, our compliance with privacy

regulations, our ability to adequately defend our intellectual

property, exposure to credit or operating risks arising from

certain payment funding methods, the cyclical nature of our revenue

and earnings and the accuracy of forecasts due to the concentration

of revenue-generating activity during the final weeks of each

quarter, business interruptions or failure of our information

technology and communication systems, our offshore software

development activities, risks from operating internationally,

including fluctuations in currency exchange rates, exposure to

unknown tax liabilities, volatility in our stock price, and

potential claims associated with our sale and transition of our CFS

assets and liabilities. For a detailed discussion of these risk

factors, parties that are relying on the forward-looking statements

should review our filings with the Securities and Exchange

Commission, including our most recently filed Annual Report on Form

10-K and our Quarterly Reports on Form 10-Q.

ACI WORLDWIDE, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited and

in thousands, except share and per share amounts)

June 30,2019 December 31,2018 ASSETS

Current assets Cash and cash equivalents

$

139,396

$

148,502

Receivables, net of allowances

286,393

348,182

Settlement assets

613,290

32,256

Prepaid expenses

30,645

23,277

Other current assets

52,259

14,260

Total current assets

1,121,983

566,477

Noncurrent assets Accrued receivables, net

177,513

189,010

Property and equipment, net

70,805

72,729

Operating lease right-of-use assets

62,316

—

Software, net

246,314

137,228

Goodwill

1,279,472

909,691

Intangible assets, net

374,908

168,127

Deferred income taxes, net

63,569

27,048

Other noncurrent assets

53,440

52,145

TOTAL ASSETS

$

3,450,320

$

2,122,455

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities Accounts payable

$

46,975

$

39,602

Settlement liabilities

589,742

31,605

Employee compensation

38,976

38,115

Current portion of long-term debt

34,089

20,767

Deferred revenue

79,311

104,843

Other current liabilities

81,156

61,688

Total current liabilities

870,249

296,620

Noncurrent liabilities Deferred revenue

59,122

51,292

Long-term debt

1,352,096

650,989

Deferred income taxes, net

23,243

31,715

Operating lease liabilities

50,550

—

Other noncurrent liabilities

42,483

43,608

Total liabilities

2,397,743

1,074,224

Commitments and contingencies

Stockholders’ equity Preferred

stock

—

—

Common stock

702

702

Additional paid-in capital

650,797

632,235

Retained earnings

843,530

863,768

Treasury stock

(349,426

)

(355,857

)

Accumulated other comprehensive loss

(93,026

)

(92,617

)

Total stockholders’ equity

1,052,577

1,048,231

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

$

3,450,320

$

2,122,455

ACI WORLDWIDE, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited and in thousands, except per share amounts)

Three Months EndedJune 30, Six Months EndedJune

30,

2019

2018

2019

2018

Revenues Software as a service and platform as a service

$

172,499

$

113,600

$

281,056

$

217,880

License

52,541

45,555

73,619

73,601

Maintenance

51,922

55,048

107,033

111,707

Services

20,656

20,792

41,765

41,117

Total revenues

297,618

234,995

503,473

444,305

Operating expenses Cost of revenue (1)

155,240

116,261

270,181

223,597

Research and development

39,235

37,862

75,429

74,653

Selling and marketing

32,962

33,160

62,392

65,053

General and administrative

49,319

28,837

80,836

57,486

Depreciation and amortization

26,744

21,033

48,610

42,378

Total operating expenses

303,500

237,153

537,448

463,167

Operating loss

(5,882

)

(2,158

)

(33,975

)

(18,862

)

Other income (expense) Interest expense

(15,323

)

(9,717

)

(26,937

)

(19,082

)

Interest income

2,997

2,742

6,030

5,486

Other, net

1,402

(1,677

)

(510

)

(1,732

)

Total other income (expense)

(10,924

)

(8,652

)

(21,417

)

(15,328

)

Loss before income taxes

(16,806

)

(10,810

)

(55,392

)

(34,190

)

Income tax expense (benefit)

(22,531

)

3,764

(35,154

)

(188

)

Net income (loss)

$

5,725

$

(14,574

)

$

(20,238

)

$

(34,002

)

Income (loss) per common share Basic

$

0.05

$

(0.13

)

$

(0.17

)

$

(0.29

)

Diluted

$

0.05

$

(0.13

)

$

(0.17

)

$

(0.29

)

Weighted average common shares outstanding Basic

116,586

115,548

116,287

115,595

Diluted

118,786

115,548

116,287

115,595

(1) The cost of revenue excludes charges for depreciation but

includes amortization of purchased and developed software for

resale.

ACI WORLDWIDE, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited and in thousands)

Three Months EndedJune 30, Six Months EndedJune

30,

2019

2018

2019

2018

Cash flows from operating activities: Net income (loss)

$

5,725

$

(14,574

)

$

(20,238

)

$

(34,002

)

Adjustments to reconcile net income (loss) to net cash flows from

operating activities: Depreciation

5,930

5,949

11,831

11,875

Amortization

23,848

18,402

42,799

37,469

Amortization of operating lease right-of-use assets

3,646

—

7,029

—

Amortization of deferred debt issuance costs

930

746

1,683

1,445

Deferred income taxes

(23,917

)

1,783

(41,331

)

(3,044

)

Stock-based compensation expense

14,372

7,705

20,957

14,067

Other

959

415

1,533

(248

)

Changes in operating assets and liabilities, net of impact of

acquisitions Receivables

(5,953

)

(1,052

)

88,596

67,689

Accounts payable

11,591

(1,047

)

1,294

(3,658

)

Accrued employee compensation

7,435

8,938

(1,163

)

(5,805

)

Current income taxes

(4,593

)

(3,674

)

(5,634

)

(7,243

)

Deferred revenue

(13,854

)

(1,184

)

(17,981

)

10,142

Other current and noncurrent assets and liabilities

(11,681

)

3,568

(32,510

)

(17,576

)

Net cash flows from operating activities

14,438

25,975

56,865

71,111

Cash flows from investing activities: Purchases of property and

equipment

(4,665

)

(5,171

)

(9,915

)

(11,108

)

Purchases of software and distribution rights

(6,722

)

(10,124

)

(11,300

)

(16,776

)

Acquisition of businesses, net of cash acquired

(758,546

)

—

(758,546

)

—

Other

—

(1,467

)

—

(1,467

)

Net cash flows from investing activities

(769,933

)

(16,762

)

(779,761

)

(29,351

)

Cash flows from financing activities: Proceeds from issuance of

common stock

922

811

1,753

1,564

Proceeds from exercises of stock options

959

5,788

5,816

14,906

Repurchase of restricted share awards and restricted share units

for tax withholdings

(185

)

(1,674

)

(2,809

)

(2,588

)

Repurchases of common stock

—

(23,414

)

(631

)

(54,527

)

Proceeds from revolving credit facility

250,000

37,000

250,000

85,000

Repayment of revolving credit facility

(15,000

)

(34,000

)

(15,000

)

(84,000

)

Proceeds from term portion of credit agreement

500,000

—

500,000

—

Repayment of term portion of credit agreement

(3,487

)

(5,188

)

(9,424

)

(10,375

)

Payments for debt issuance costs

(12,830

)

—

(12,830

)

—

Payments on other debt

(363

)

(1,198

)

(2,220

)

(1,550

)

Net cash flows from financing activities

720,016

(21,875

)

714,655

(51,570

)

Effect of exchange rate fluctuations on cash

(1,298

)

(2,586

)

(865

)

(867

)

Net decrease in cash and cash equivalents

(36,777

)

(15,248

)

(9,106

)

(10,677

)

Cash and cash equivalents, beginning of period

176,173

74,281

148,502

69,710

Cash and cash equivalents, end of period

$

139,396

$

59,033

$

139,396

$

59,033

Adjusted EBITDA

(millions) Quarter Ended June 30,

2019

2018

Net Income (Loss)

$

5.7

$

(14.6)

Plus: Income tax (benefit) expense

(22.5)

3.8

Net interest expense

12.3

7.0

Net other (income) expense

(1.4)

1.7

Depreciation expense

5.9

5.9

Amortization expense

23.9

18.4

Non-cash compensation expense

14.4

7.7

Adjusted EBITDA before significant transaction-related

expenses

$

38.3

$

29.9

Significant transaction-related expenses

16.6

0.6

Adjusted EBITDA

$

54.9

$

30.5

Segment Information

(millions) Quarter Ended June 30,

2019

2018

Revenue ACI On Premise

$

125.1

$

121.4

ACI On Demand

172.5

113.6

Total

$

297.6

$

235.0

Segment Adjusted EBITDA ACI On Premise

$

57.1

$

54.8

ACI On Demand

17.3

(3.4)

Reconciliation of Adjusted

Operating Free Cash Flow (millions) Quarter Ended June

30,

2019

2018

Net cash flows from operating activities

$

14.4

$

26.0

Net after-tax payments associated with significant

transaction-related expenses

12.5

2.2

Less: capital expenditures

(11.4)

(15.3)

Adjusted Operating Free Cash Flow

$

15.5

$

12.9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190808005201/en/

John Kraft, Vice President, Investor Relations & Strategic

Analysis ACI Worldwide 239-403-4627 john.kraft@aciworldwide.com

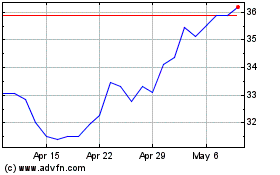

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Mar 2024 to Apr 2024

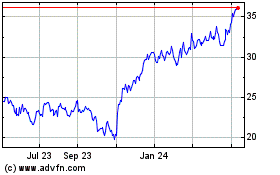

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Apr 2023 to Apr 2024