This prospectus relates to the proposed resale from time to time by Lincoln Park Capital Fund, LLC as selling stockholder of up to 81,150 shares of our common stock, par value $0.001 per share, issuable upon the exercise of a warrant. The Lincoln Park Capital Fund, LLC purchased the warrant from us pursuant to a securities purchase agreement, dated August 3, 2022. We are not selling any of our common stock pursuant to this prospectus, and we will not receive any proceeds from the sale of our common stock offered by this prospectus by the selling stockholder.

The selling stockholder may offer and sell or otherwise dispose of the shares of our common stock described in this prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholder will bear all underwriting fees, commissions and discounts, if any, attributable to the sales of shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the shares. See “Plan of Distribution” for more information about how the selling stockholder may sell or dispose of their shares of our common stock.

Our common stock is listed on The Nasdaq Global Market under the trading symbol “ACRX.” On November 21, 2022, the last reported sale price of the common stock was $2.26 per share.

ABOUT THIS PROSPECTUS

Neither we nor the selling stockholder have authorized anyone to provide you with any information other than that contained in, or incorporated by reference into, this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of our common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information contained in or incorporated by reference in this prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

Unless the context indicates otherwise, as used in this prospectus, the terms “AcelRx,” “AcelRx Pharmaceuticals, Inc.,” “we,” “us” and “our” refer to AcelRx Pharmaceuticals, Inc., a Delaware corporation, and its subsidiaries.

|

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

AcelRx Pharmaceuticals, Inc.

Overview

We are a specialty pharmaceutical company focused on the development and commercialization of innovative therapies for use in medically supervised settings. DSUVIA® (known as DZUVEO® in Europe) is focused on the treatment of acute pain, and each utilize sufentanil, delivered via a non-invasive route of sublingual administration, exclusively for use in medically supervised settings. In November 2018, the U.S. Food and Drug Administration, or FDA, approved DSUVIA for use in adults in a certified medically supervised healthcare setting, such as hospitals, surgical centers, and emergency departments, for the management of acute pain severe enough to require an opioid analgesic and for which alternative treatments are inadequate. The commercial launch of DSUVIA in the United States occurred in the first quarter of 2019. In June 2018, the European Commission, or EC, granted marketing approval of DZUVEO for the management of acute moderate to severe pain in adults in medically monitored settings. We are further developing a distribution capability and commercial organization to continue to market and sell DSUVIA in the United States. In geographies where we decide not to commercialize products by ourselves, we may seek to out-license commercialization rights. We currently intend to commercialize and promote DSUVIA/DZUVEO outside the United States with one or more strategic partners, and, in July 2021, entered into a License and Commercialization Agreement with Laboratoire Aguettant, or Aguettant, for Aguettant to commercialize DZUVEO in the European Union, Norway, Iceland, Liechtenstein, Andorra, Vatican City, Monaco, Switzerland and the United Kingdom. In July 2021, we also entered into a separate License and Commercialization Agreement with Aguettant pursuant to which we obtained the exclusive right to develop and, subject to FDA approval, commercialize in the United States (i) an ephedrine pre-filled syringe containing 10 ml of a solution of 3 mg/ml ephedrine hydrochloride for injection, and (ii) a phenylephrine pre-filled syringe containing 10 ml of a solution of 50 mcg/ml phenylephrine hydrochloride for injection.

In January 2022, we acquired Lowell Therapeutics, Inc., or Lowell, a privately held company, and as a result we acquired Niyad™, a regional anticoagulant for the dialysis circuit during continuous renal replacement therapy for acute kidney injury patients in the hospital, that we plan to study under an investigational device exemption, or IDE, and which has received Breakthrough Device Designation status from the FDA. While not approved for commercial use in the United States, the active drug component of Niyad, nafamostat, has been approved in Japan and South Korea as a regional anticoagulant for the dialysis circuit, disseminated intravascular coagulation, and acute pancreatitis. Niyad is a lyophilized formulation of nafamostat, a broad-spectrum, synthetic serine protease inhibitor, with anticoagulant, anti-inflammatory, and potential anti-viral activities. The second intended indication for Niyad is as a regional anticoagulant for the dialysis circuit for chronic kidney disease patients undergoing intermittent hemodialysis in dialysis centers. In addition, we acquired LTX-608, a proprietary nafamostat formulation for direct IV infusion that it intends to develop for the treatment of acute respiratory distress syndrome and disseminated intravascular coagulation.

|

|

Private Placement of Shares of Preferred Stock and Warrant

On August 3, 2022, we entered into a securities purchase agreement with Lincoln Park Capital Fund, LLC, or Lincoln Park, pursuant to which we issued in a private placement transaction an aggregate of 3,000 shares of Series A Preferred Stock, par value $0.001 per share, together with a warrant to purchase up to an aggregate of 81,150 shares of common stock at an exercise price of $4.066 per share (subject to adjustment as provided in the warrant), for an aggregate subscription amount equal to $300,000. On October 12, 2022, we redeemed all 3,000 shares of Series A Preferred Stock for an aggregate purchase price of $315,000.

The warrant is exercisable by means of cash and has term ending on February 3, 2028. However, if at the time of exercise there is no effective registration statement registering, or no current prospectus available for, the resale of the warrant shares by Lincoln Park, Lincoln Park may also exercise the warrant at their election, in whole or in part, at such time by means of a net exercise of the warrant on a cashless basis. The warrant provides for proportional adjustment of the number and kind of securities purchasable upon exercise of the warrant and the per share exercise price upon the occurrence of certain events such as stock splits, combinations, reverse stock splits and similar events. In addition, until August 3, 2023, if we issue or sell (or are deemed to have issued or sold) any common stock, convertible securities or options (each as defined in the warrant), but excluding shares of common stock deemed to have been issued or sold by us in an “exempt issuance” (as defined in the warrant) or to extend the term of such securities, for consideration per share, or the New Issuance Price, less than a price equal to the exercise price in effect immediately prior to such issue or sale or deemed issuance or sale (each of the foregoing, a “Dilutive Issuance”), then immediately after such Dilutive Issuance, the exercise price then in effect shall be reduced to an amount equal to the New Issuance Price.

Use of Proceeds

We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholder in this offering. The selling stockholder will receive all of the proceeds from the sale of shares of our common stock hereunder.

The Nasdaq Global Market Listing

Our common stock is listed on The Nasdaq Global Market under the symbol “ACRX.”

Company Information

We were originally incorporated as SuRx, Inc. in Delaware on July 13, 2005 and changed our name to AcelRx Pharmaceuticals, Inc. on January 6, 2006. Our principal executive offices are located at 25821 Industrial Boulevard, Suite 400, Hayward, California 94545, and our telephone number is (650) 216-3500. Our website address is www.acelrx.com. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus and should not be considered part of this prospectus.

|

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described under the heading “Risk Factors” contained in our most recent Annual Report on Form 10-K, as updated by our subsequent Quarterly Reports on Form 10-Q and other filings we make with the Securities and Exchange Commission, or the SEC, which are incorporated by reference into this prospectus in their entirety, together with other information in this prospectus and the documents incorporated by reference. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occur, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

| |

●

|

the accuracy of our estimates regarding the sufficiency of our cash resources, future revenues, expenses, capital requirements and needs for additional financing, and our ability to obtain additional financing and continue as a going concern;

|

| |

●

|

our ability to manage our operating costs and reduce our cash burn;

|

| |

●

|

the uncertainties and impact arising from the worldwide COVID-19 pandemic, including restrictions on the ability of our sales force to contact and communicate with target customers and resulting delays and challenges to our commercial sales of DSUVIA® (sufentanil sublingual tablet, 30 mcg);

|

| |

●

|

our success in commercializing DSUVIA in the United States, including the marketing, sales, and distribution of the product, whether alone or with contract sales organizations and other collaborators;

|

| |

●

|

our ability to identify and secure potential partnerships with a third party having sufficient commercial resources to develop and potential grow the DSUVIA franchise;

|

| |

●

|

our ability to satisfactorily comply with FDA regulations concerning the advertising and promotion of DSUVIA;

|

| |

●

|

the size and growth potential of the markets for DSUVIA, and our other product candidates in the United States, and our ability to serve those markets;

|

| |

●

|

our ability to maintain regulatory approval of DSUVIA in the United States, including effective management of and compliance with the DSUVIA Risk Evaluation and Mitigation Strategies, or REMS, program;

|

| |

●

|

acceptance of DSUVIA by physicians, patients and the healthcare community, including the acceptance of pricing and placement of DSUVIA on payers’ formularies;

|

| |

●

|

our ability to realize the expected benefits and potential value created by the acquisition of Lowell Therapeutics Inc. for our stockholders, on a timely basis or at all;

|

| |

●

|

our ability to develop, file for and obtain regulatory approval for, and then successfully launch and commercialize products and product candidates that we have in-licensed or acquired;

|

| |

●

|

our ability to file for and secure a potential Emergency Use Authorization for our lead nafamostat product candidate, Niyad™;

|

| |

●

|

our ability to develop sales and marketing capabilities in a timely fashion, whether alone through recruiting qualified employees, by engaging a contract sales organization, or with potential future collaborators;

|

| |

●

|

successfully establishing and maintaining commercial manufacturing and supply chain relationships with third party service providers;

|

| |

●

|

our ability to manage effectively, and the impact of any costs associated with, potential governmental investigations, inquiries, regulatory actions or lawsuits that may be, or have been, brought against us;

|

| |

●

|

continued demonstration of an acceptable safety profile of DSUVIA;

|

| |

●

|

effectively competing with other medications for the treatment of moderate-to-severe acute pain in medically supervised settings, including IV-opioids and any subsequently approved products;

|

| |

●

|

our ability to manufacture and supply DZUVEO® to Laboratoire Aguettant, or Aguettant, in accordance with their forecasts and the License and Commercialization Agreement, or DZUVEO Agreement, with Aguettant, including compliance with any import/export controls or restrictions;

|

| |

●

|

the status of the DZUVEO Agreement or any other future potential collaborations, including potential milestones and revenue share payments under the DZUVEO Agreement;

|

| |

●

|

Aguettant’s ability to successfully launch and commercialize DZUVEO in the European Union, or EU;

|

| |

●

|

our, or Aguettant’s, ability to maintain regulatory approval of DZUVEO in the EU;

|

| |

●

|

our ability to obtain adequate government or third-party payer reimbursement;

|

| |

●

|

our ability to attract additional collaborators with development, regulatory and commercialization expertise;

|

| |

●

|

our ability to identify and secure potential commercial partners to develop and then commercialize our developmental product candidates;

|

| |

●

|

our ability to successfully retain our key commercial, scientific, engineering, medical or management personnel and hire new personnel as needed;

|

| |

●

|

regulatory developments in the United States and foreign countries;

|

| |

●

|

the performance of our third-party suppliers and manufacturers, including any supply chain impacts or work limitations;

|

| |

●

|

the success of competing therapies that are or become available;

|

| |

●

|

our liquidity and capital resources; and

|

| |

●

|

our ability to obtain and maintain intellectual property protection for our approved products and product candidates.

|

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss in greater detail, and incorporate by reference into this prospectus in its entirety, many of these risks under the headings “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, as updated by our subsequent filings under the Exchange Act, which are incorporated herein by reference, as may be updated or superseded by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

These risks are not exhaustive. Other sections of this prospectus may include additional factors that could harm our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for our management to predict all risk factors nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in, or implied by, any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus or to conform these statements to actual results or to changes in our expectations.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and achievements may be different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

USE OF PROCEEDS

All the shares of our common stock to be sold pursuant to this prospectus will be sold by the selling stockholder. We will not receive any of the proceeds from such sales.

DESCRIPTION OF CAPITAL STOCK

Summary

Our authorized capital stock consists of 200,000,000 shares of common stock and 10,000,000 shares of preferred stock, $0.001 par value. As of October 31, 2022, we had 7,449,366 shares of common stock issued and outstanding and no shares of preferred stock issued and outstanding.

A description of the material terms and provisions of our amended and restated certificate of incorporation and amended and restated bylaws affecting the rights of holders of our capital stock is set forth below. The description is intended as a summary, and is qualified in its entirety by reference to our amended and restated certificate of incorporation and our amended and restated bylaws which are incorporated by reference into the registration statement of which this prospectus is a part.

Common Stock

Voting Rights. Each holder of common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors. In all matters other than the election of directors, the affirmative vote of the majority of shares present in person, by remote communication, or represented by proxy at a meeting of the stockholders and entitled to vote generally on the subject matter shall be the act of the stockholders. Directors shall be elected by a plurality of the votes of the shares present in person, by remote communication, or represented by proxy at a meeting of the stockholders and entitled to vote generally on the election of directors. Our stockholders do not have cumulative voting rights in the election of directors. Accordingly, the holders of a majority of the voting shares are able to elect all of the directors to be elected at any particular time.

Dividends. Subject to preferences that may be applicable to any then outstanding preferred stock, holders of our common stock are entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of funds legally available if our board of directors, in its discretion, determines to issue dividends and then only at the times and in the amounts that our board of directors may determine.

Liquidation. In the event of our liquidation, dissolution or winding up, holders of common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred stock.

Rights. Holders of common stock have no preemptive, conversion, subscription or other rights, and there are no redemption or sinking fund provisions applicable to shares of common stock.

Fully Paid and Nonassessable. All of outstanding shares of common stock are fully paid and nonassessable.

Preferred Stock

Our board of directors may, without further action by our stockholders, fix the rights, preferences, privileges and restrictions of up to an aggregate of 10,000,000 shares of preferred stock in one or more series and authorize their issuance. These rights, preferences and privileges could include dividend rights, conversion rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of our common stock. The issuance of our preferred stock could adversely affect the voting power of holders of our common stock, and the likelihood that such holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change of control or other corporate action.

Anti-Takeover Effects of Provisions of our Certificate of Incorporation and Bylaws and Delaware Law

Certificate of Incorporation and Bylaws. Our amended and restated certificate of incorporation and amended and restated bylaws include a number of provisions that may deter or impede hostile takeovers or changes of control or management. These provisions include:

| |

●

|

Issuance of Undesignated Preferred Stock. Under our certificate of incorporation, our board of directors has the authority, without further action by the stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights, designated from time to time by the board of directors. The existence of authorized but unissued shares of preferred stock enables our board of directors to make it more difficult or to discourage an attempt to obtain control of us by means of a merger, tender offer, proxy contest or otherwise.

|

| |

●

|

Classified Board. Our certificate of incorporation provides for a classified board of directors consisting of three classes of directors, with staggered three-year terms. Only one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. This provision may have the effect of delaying a change in control of the board.

|

| |

●

|

Board of Directors Vacancies. Our Certificate of Incorporation and Bylaws authorize only our board of directors to fill vacant directorships. In addition, the number of directors constituting our board of directors may be set only by resolution adopted by a majority vote of our entire board of directors. These provisions prevent a stockholder from increasing the size of our board of directors and gaining control of our board of directors by filling the resulting vacancies with its own nominees.

|

| |

●

|

Stockholder Action; Special Meetings of Stockholders. Our certificate of incorporation provides that our stockholders may not take action by written consent and may only take action at annual or special meetings of our stockholders. Stockholders will not be permitted to cumulate their votes for the election of directors. Our bylaws further provide that special meetings of our stockholders may be called only by a majority of our board of directors, the chairman of our board of directors, or our chief executive officer. These provisions may prevent stockholders from corporate actions as stockholders at times when they otherwise would like to do so.

|

| |

●

|

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at our annual meeting of stockholders. Our bylaws also specify certain requirements as to the form and content of a stockholder’s notice. These provisions may make it more difficult for our stockholders to bring matters before our annual meeting of stockholders or to nominate directors at our annual meeting of stockholders.

|

These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies and to discourage certain types of transactions that may involve an actual or threatened acquisition of us. These provisions are designed to reduce our vulnerability to an unsolicited acquisition proposal. The provisions also are intended to discourage certain tactics that may be used in proxy fights. However, these provisions could have the effect of discouraging others from making tender offers for our shares and, as a consequence, they may also reduce fluctuations in the market price of our shares that could result from actual or rumored takeover attempts.

Section 203 of the Delaware General Corporation Law

We are subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers. This section prevents some Delaware corporations from engaging, under some circumstances, in a business combination, which includes a merger or sale of at least 10% of the corporation’s assets with any interested stockholder, meaning a stockholder who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of the corporation’s outstanding voting stock, unless:

| |

●

|

the transaction is approved by the board of directors prior to the time that the interested stockholder became an interested stockholder;

|

| |

●

|

upon consummation of the transaction which resulted in the stockholder’s becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

|

| |

●

|

at or subsequent to such time that the stockholder became an interested stockholder the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders by at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder.

|

In general, Section 203 defines “business combination" to include the following:

| |

●

|

any merger or consolidation involving the corporation and the interested stockholder;

|

| |

●

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

| |

●

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

| |

●

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

|

| |

●

|

the receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation.

A Delaware corporation may “opt out” of these provisions with an express provision in its original certificate of incorporation or an express provision in its certificate of incorporation or bylaws resulting from a stockholders’ amendment approved by at least a majority of the outstanding voting shares. We have not “opted out” of these provisions and do not plan to do so. The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us.

Listing on The Nasdaq Global Market

Our common stock is listed on The Nasdaq Global Market under the symbol “ACRX.”

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare, Inc.: 1-800-736-3001. The transfer agent's address is 250 Royall Street, Canton, Massachusetts 02021.

SELLING STOCKHOLDER

We have prepared this prospectus to allow the selling stockholder to offer and sell from time to time up to 81,150 shares of our common stock issuable upon the exercise of a warrant.

The following table sets forth (i) the name of the selling stockholder; (ii) the number of shares beneficially owned by the selling stockholder; (iii) the number of shares that may be offered under this prospectus; and (iv) the number of shares of common stock beneficially owned by the selling stockholder assuming all of the shares covered hereby are sold. We do not know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale or other disposition of any shares. The selling stockholder has not during the three years prior to the date of this prospectus had, any position, office or other material relationships with us or any of our affiliates.

The information set forth in the table below is based upon information obtained from the selling stockholder. Beneficial ownership of the selling stockholder is determined in accordance with Rule 13d-3(d) under the Exchange Act. The percentage of shares beneficially owned prior to, and after, the offering is based on 7,449,366 shares of our common stock outstanding as of October 31, 2022, and assumes the issuance of 81,150 shares to the selling stockholder.

As used in this prospectus, the term “selling stockholder” includes the selling stockholder listed in the table below, together with any additional selling stockholders listed in a prospectus supplement, and their donees, pledgees, assignees, transferees, distributees and successors-in-interest that receive shares in any non-sale transfer after the date of this prospectus.

| |

|

Beneficial Ownership

Prior to This Offering

|

|

|

Beneficial Ownership

After This Offering

|

|

|

Name of Selling Stockholder

|

|

Shares

|

|

|

% of Total

Voting Power

Before This

Offering

|

|

|

Number of

Shares Being

Offered

|

|

|

Shares

|

|

|

% of Total

Voting Power

After This

Offering

|

|

|

Lincoln Park Capital Fund, LLC(1)

|

|

|

81,150 |

|

|

|

1.1 |

% |

|

|

81,150 |

|

|

|

— |

|

|

|

— |

|

|

(1)

|

Represents 81,150 shares of common stock underlying warrants held by the selling stockholder. Lincoln Park Capital, LLC (“LPC”) is the Managing Member of Lincoln Park Capital Fund, LLC (“Lincoln Park”). Rockledge Capital Corporation (“RCC”) and Alex Noah Investors, LLC (“Alex Noah”) are the managing Members of LPC. Josh Scheinfeld is the president and sole shareholder of RCC as well as a principal of LPC. Mr. Cope is the president and sole shareholder of Alex Noah, as well as a principal of LPC. As a result of the foregoing, Mr. Scheinfeld and Mr. Cope have shared voting and shared investment power over shares of common stock of the Company held directly by Lincoln Park. The address of Lincoln Park is 440 N. Wells Street, Suite 410, Chicago, Illinois 60654.

|

PLAN OF DISTRIBUTION

The selling stockholder and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of the shares of common stock covered hereby on The Nasdaq Global Market or any other stock exchange, market or trading facility on which the common stock is traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder may use any one or more of the following methods when selling the common stock:

| |

●

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| |

●

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

| |

●

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

| |

●

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

| |

●

|

privately negotiated transactions;

|

| |

●

|

settlement of short sales;

|

| |

●

|

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

|

| |

●

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

| |

●

|

a combination of any such methods of sale; or

|

| |

●

|

any other method permitted pursuant to applicable law.

|

A selling stockholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act of 1933, as amended, or the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by a selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from a selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities or interests therein, a selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. A selling stockholder may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. A selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

A selling stockholder and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

We are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify any selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the common stock may be resold by the selling stockholder without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the shares of common stock have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Cooley LLP, Palo Alto, California, will pass upon the validity of the shares of our common stock offered by this prospectus.

EXPERTS

WithumSmith+Brown, PC, independent registered public accounting firm, has audited our consolidated financial statements and related schedule included in our Annual Report on Form 10-K for the year ended December 31, 2021, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Such financial statements are incorporated by reference in reliance on WithumSmith+Brown, PC’s report, given on their authority as experts in accounting and auditing.

OUM & Co. LLP, independent registered public accounting firm, has audited our consolidated financial statements and related schedule included in our Annual Report on Form 10-K for the year ended December 31, 2021, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration statement. Such financial statements are incorporated by reference in reliance on OUM & Co. LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Our website address is http://www.acelrx.com. Information contained on or accessible through our website is not a part of this prospectus and is not incorporated by reference herein, and the inclusion of our website address in this prospectus is an inactive textual reference only.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8‑K and exhibits filed on such form that are related to such items unless such Form 8‑K expressly provides to the contrary):

| |

●

|

our Current Reports on Form 8‑K, which were filed with the SEC on January 12, 2022; February 14, 2022, March 1, 2022, March 31, 2022, May 9, 2022, June 2, 2022, July 15, 2022, July 25, 2022, July 26, 2022, July 28, 2022, August 4, 2022, August 12, 2022, September 23, 2022 and October 25, 2022; and

|

| |

|

|

All filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8‑K and exhibits filed on such form that are related to such items unless such Form 8‑K expressly provides to the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective amendment that indicates the termination of the offering of the securities made by this prospectus and will become a part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference to the extent that statements in the later filed document modify or replace such earlier statements.

You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

AcelRx Pharmaceuticals, Inc.

25821 Industrial Boulevard, Suite 400

Hayward, California 94545

Attn: Investor Relations

(650) 216-3500

15

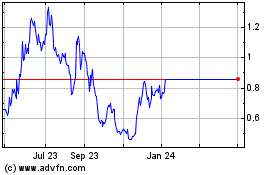

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Aug 2024 to Sep 2024

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Sep 2023 to Sep 2024