Current Report Filing (8-k)

July 23 2020 - 8:51AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2020

ACELRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35068

|

|

41-2193603

|

|

(State of incorporation)

|

|

(Commission File No.)

|

|

(IRS Employer Identification No.)

|

351 Galveston Drive

Redwood City, CA 94063

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

ACRX

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On July 17, 2020, AcelRx Pharmaceuticals, Inc. (the “Company”) entered into a distribution agreement (the “Distribution Agreement”) with Zimmer Biomet Dental (“ZB Dental”), pursuant to which ZB Dental obtained the exclusive right to promote, market, sell, and arrange to distribute DSUVIA® (sufentanil sublingual tablet 30 mcg) in the United States to clinicians, dentists, surgeons and other licensed health care practitioners that perform dental (including specialty dental), oral-maxillofacial, cranio-maxillofacial or oral surgery procedures (“Professionals”) and their respective institutions and facilities that are permitted to use DSUVIA.

ZB Dental’s distribution rights are non-exclusive for crossover ambulatory surgery centers and certain government customers, and do not extend to ambulatory care centers outside the class of trade or into hospitals. ZB Dental will conduct any distribution activities in a manner consistent with DSUVIA’s FDA-approved indication and REMS program, and within the parameters established in the Distribution Agreement. ZB Dental has the right to sublicense its distribution rights to its qualified marketing partners but may not otherwise sublicense its distribution rights to any third party without the Company’s prior written consent.

Pursuant to the Distribution Agreement, ZB Dental will purchase DSUVIA from the Company at an agreed price (“Purchase Price”) through December 31, 2023, subject to adjustment. The Company has the right to adjust the Purchase Price beginning in 2024, subject to certain limitations.

Beginning in 2022, the parties will establish annual minimums for purchase orders to be submitted by ZB Dental. If the parties cannot reach agreement on such annual minimums, then ZB Dental’s distribution rights will automatically become non-exclusive and either party will have the right to terminate the Distribution Agreement upon 180 days’ prior written notice. Once annual minimums are established, ZB Dental’s distribution rights will become non-exclusive at the Company’s option in the event that ZB Dental fails to meet such annual minimums; provided, however, that ZB Dental will, under certain circumstances, have the right to retain exclusivity by paying the Company a specified exclusivity fee to cure the shortfall.

The Distribution Agreement has an initial term that ends on December 31, 2022, which term will automatically renew for consecutive two year terms until the agreement is terminated pursuant to its terms.

The Distribution Agreement also provides ZB Dental with a right of first negotiation and a right of first refusal to distribute DZUVEO to Professionals in the European Union (“EU Rights”), subject to certain limitations.

The foregoing description of the Distribution Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Distribution Agreement, which will be filed with the Company’s Quarterly Report on Form 10-Q for the quarter ending September 30, 2020.

DSUVIA is expected to be available for order by certified dental and oral surgeons exclusively through ZB Dental in the United States, pending satisfaction of applicable licensing requirements.

On July 23, 2020, the Company issued a press release announcing the execution of the Distribution Agreement, a copy of which is filed as Exhibit 99.1 hereto and incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition

On July 23, 2020, the Company updated the Corporate Presentation on its website at www.acelrx.com in the Presentations subsection of the Investors tab. The updates included, among other things, that the Company expects to report total revenues of $2.9 million, of which approximately $2.6 million relates to the recognition of revenue related to the Company’s Zalviso® agreement with Grünenthal that was previously deferred, and operating expense (SG&A and R&D) of $8.5 million (including $1.2 million of non-cash stock-based compensation) for the second quarter of 2020, and had $43.7 million in cash, cash equivalents and short-term investments as of June 30, 2020 (the “Earnings Estimate”). A copy of the Earnings Estimate is filed as Exhibit 99.2 hereto and incorporated herein by reference.

The Company has not yet completed its financial close process for the quarter ended June 30, 2020 and these estimates for total revenues and cash, cash equivalents and short-term investments are based on preliminary estimates of the Company’s financial results that it expects to report for the applicable periods. These estimates are subject to change upon completion of the Company’s financial closing procedures. The Company’s independent registered public accounting firm, OUM & Co. LLP, has not audited, reviewed, or compiled these estimates and, accordingly, does not express an opinion on, or provided any other form of assurance with respect to, these preliminary estimates. These estimates are not a comprehensive statement of the Company’s financial results for the quarter ended June 30, 2020 and its actual results may differ materially from these estimates as a result of the completion of the Company’s financial closing procedures, final adjustments and other developments arising between now and the time that our financial results for this period are finalized.

Item 8.01 Other Events

Securities Purchase Agreement

On July 22, 2020, the Company entered into a securities purchase agreement (the “Purchase Agreement”) with funds affiliated with two leading life sciences investors—Armistice Capital and Rock Springs Capital (the “Purchasers”), relating to the issuance and sale (the “Offering”) of 9,433,962 shares of its common stock, par value $0.001 per share (“Common Stock”).

The offering price for the securities is $1.06 per share. The aggregate gross proceeds to the Company from this offering are expected to be approximately $10 million. No underwriter or placement agent participated in the offering.

The offering is being made pursuant to an effective registration statement on Form S-3 (Registration Statement No. 333-239156), as previously filed with the Securities and Exchange Commission (the “SEC”), and a related prospectus.

The Purchase Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company and the Purchasers. The representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of the Purchase Agreement and as of a specific date, were solely for the benefit of the parties to the Purchase Agreement, and may be subject to limitations agreed upon by the contracting parties.

The Purchase Agreement is filed as Exhibit 10.1 and the description of the terms of the Purchase Agreement is qualified in its entirety by reference to such exhibit. A copy of the opinion of Cooley LLP relating to the legality of the issuance and sale of the shares of Common Stock is attached as Exhibit 5.1 hereto.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: July 23, 2020

|

ACELRX PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Raffi Asadorian

|

|

|

|

|

Raffi Asadorian

|

|

|

|

|

Chief Financial Officer

|

|

3

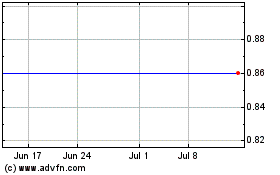

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

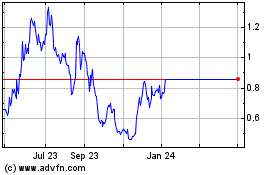

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Apr 2023 to Apr 2024