Additional Proxy Soliciting Materials (definitive) (defa14a)

July 08 2019 - 3:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant

T

Filed by a Party other than the Registrant

£

Check the appropriate box:

|

|

|

|

|

|

£

|

Preliminary Proxy Statement

|

|

£

|

Confidential, for Use of the Commission (as permitted by Rule 14a-6(e)(2))

|

|

£

|

Definitive Proxy Statement

|

|

T

|

Definitive Additional Materials

|

|

£

|

Soliciting Material Pursuant to Rule 14a-12

|

ACACIA RESEARCH CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

T

|

No fee required.

|

|

£

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

£

|

Fee paid previously with preliminary materials:

|

|

£

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

July 8, 2019

Dear Stockholders,

As you are aware, the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Acacia Research Corporation (“Acacia” or the “Company”) will be held on Monday, July 15, 2019, at 2 p.m., local time, at the offices of Schulte Roth & Zabel LLP at 919 Third Avenue, New York, New York 10022. This communication is intended to supplement the definitive proxy statement relating to the Annual Meeting, which was filed with the Securities and Exchange Commission on June 14, 2019 (the “Proxy Statement”). In particular, this letter provides supplemental information regarding “Proposal No. 8 - Advisory Vote on the Compensation of Our Named Executive Officers”, which provides an opportunity for our stockholders, through what is commonly referred to as a “say-on-pay” vote, to endorse or not endorse Acacia’s executive compensation program.

At the 2018 Annual Meeting of Stockholders (the “2018 Annual Meeting”), we actively solicited against the Company’s say-on-pay proposal (the “2018 Say-On-Pay Proposal” or “2018 Say-On-Pay Vote”). We had researched and then brought to the attention of Acacia stockholders and the proxy advisory firms the misaligned and self-serving compensation arrangements that benefited the now “Legacy Board” and “Legacy Management Team” at the expense of Acacia stockholders. The 2018 Say-On-Pay Proposal was not approved, receiving only 19% support. The current Board of Directors, which is comprised of all new individuals, none of which served on the Board at the time of the 2018 Say-On-Pay Vote, strongly believes the results of the 2018 Say-On-Pay Vote were a result of the prior actions of the Legacy Board and Legacy Management team. Shortly after the 2018 Annual Meeting, all remaining members of the Legacy Board resigned and have now been replaced by highly qualified and capable new directors with a cross section of industry aligned talent.

As part of the 2018 campaign, we met with or spoke to a substantial majority of Acacia stockholders and developed a keen understanding of stockholders’ views on the Company’s strategy, its financial underperformance, degraded corporate governance infrastructure and its misaligned compensation practices, including the self-serving compensation arrangements discussed above. The reconstituted Board has continued to speak with a majority of Acacia's stockholders to understand their views on the Company’s strategy, its governance and executive compensation program. The current Board of Directors believes these actions are directly responsive to stockholders concerns and in the best interests of Acacia and its stockholders. As mentioned in the Proxy Statement, the Board has adopted a Policy Statement on Corporate Communications to Investors and Media that facilities better communications with the stockholders and stakeholders of the Company.

This entirely new Board of Directors at Acacia has taken concrete steps to follow through on the elimination of wasteful, self-serving, and conflicted compensation arrangements and to align policies and compensation arrangements with stockholders. We believe that Acacia historically had not properly disclosed the various conflicts that existed within its key committees, including those of its compensation committee. The new Acacia Board has established independent key committees chaired by highly qualified directors.

For example:

|

|

|

|

•

|

The Legacy Board and Management created AIP Operation LLC (“AIP”), an LLC structure that allowed the

|

Legacy Board and Management to collect additional compensation that was not aligned with the interests of stockholders. This structure was a key point of the activist campaign, and as promised, the new Board of Directors has taken steps to eliminate the self-dealing AIP structure. Not only have all previous participants in the AIP compensation structure resigned or been terminated, any previously issued and outstanding AIP profits interest units will have no value if AIP is eventually dissolved with no assets to distribute. We have also eliminated AIP’s substantial annual audit fees.

|

|

|

|

•

|

The Legacy Board and Management received Board fees as directors of companies in which Acacia had invested, but instead of reinvesting that money into Acacia, they kept the money for themselves. This practice has been eliminated.

|

|

|

|

|

•

|

We believe that the Legacy Board did not properly disclose the extensive interlocks and conflicts of interest between the members of the Compensation Committee and the other members of the Board. The new Compensation Committee, chaired by Luis Rinaldini, is completely independent and actively engaged in setting compensation for all senior management and directors of Acacia which appropriately reflects their contribution to value creation and strongly aligns with stockholders.

|

All previous named executive officers who held positions at the time of the 2018 Annual Meeting have been terminated. Any payments made as a result of these terminations were contractual. The current Board is currently seeking to recover equity incentive bonus payments that we have deemed to be unearned.

We also hired Marc W. Booth, our only named executive officer, as Chief Intellectual Property Officer. Mr. Booth received a base salary of $250,000 (prorated for the portion of the year after which he was appointed), a discretionary bonus of $250,000 and a year-end holiday bonus of $4,808 in fiscal year 2018. We believe that these amounts are appropriate and align Mr. Booth’s interests with our stockholders.

We have also had follow-up discussions with Institutional Shareholder Services, Inc. (ISS) and clarified the differences between our current executive compensation program and the legacy compensation program of our Previous Leadership. Under the new leadership, we intend to continue our discussions with stockholders regarding say-on-pay and are committed to providing an effective compensation program that is in line with the interests of our stockholders.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” APPROVAL OF PROPOSAL NO. 8.

Additional Information

This letter should be read in conjunction with the Proxy Statement, which we encourage you to read carefully and in its entirety before making a voting decision. To the extent that information in this letter differs from or updates information contained in the Proxy Statement, the information contained herein supersedes the information contained in the Proxy Statement.

We look forward to seeing you at the Annual Meeting.

Very truly yours,

Clifford Press

Director

Alfred Tobia

Director

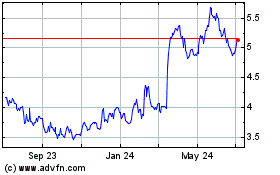

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

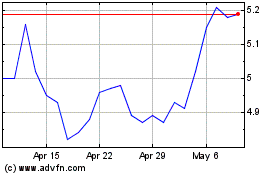

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024