5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) (“5E,” “We,”

“Our,” or the “Company”) today announced its financial results for

the three months ended March 31, 2022.

Commenting on third quarter 2022

results, CEO, Mr Henri Tausch noted:

“Our team had a great start to the year as we

completed our public listing on the Nasdaq, progressed towards an

expected mechanical completion of the SSBF for CQ4 2022, continued

work focused on enhancing the Project’s scope, and signed a boron

advanced materials LOI. I could not be more proud of the 5E team

for their tremendous work and commitment as they focus on our

ultimate goal of enabling decarbonization with boron advanced

materials and lithium.

I am particularly pleased to provide a project

update in light of the current favorable market backdrop with

strong demand and tight supply, and with average boric acid prices

up more than 50% during CQ1 2022, as compared to average pricing in

2020 and 2021. I also believe that our enhanced project scope to

focus on boron and lithium could be an important step towards

creating a more durable and less seasonal business.

We remain focused on increasing 5E and boron

awareness and progressing towards initial production. We expect

initial production to serve as a foundation for future design,

engineering, and cost optimization for our proposed large-scale

boron and lithium complex.”

Third Quarter 2022 Financial

Highlights:

As of quarter-end, the Company maintained a cash

balance of $41.1 million and working capital of $38.1 million.

Project expenses decreased 3.6% year-over-year due to a reduction

in drilling activity and environmental permit expenses as the

Company transitions to construction to the SSBF. General and

administrative expenses increased by $29.1 million year-over-year,

primarily due to $25.1 million of stock-based compensation and

increased salaries as our employee head count increased as we

focused our efforts toward construction of the SSBF. The

stock-based compensation was driven by $23.8 million of shares

issued as payment for consulting fees under the Company’s Advisory

Agreement with Blue Horizon Advisors, LLC (“BHA”). Under the BHA

Advisory Agreement, BHA provided advisory services related to

assessing the Project, recruiting a U.S. based management team, and

advising in connection with the U.S. listing. Depreciation and

amortization increased as the Company began to place assets into

service.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

FOR THE THREE MONTHS ENDEDMARCH 31 |

|

FOR THE NINE MONTHS ENDEDMARCH 31 |

| |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| COST AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Project expenses |

|

$ |

1,972,536 |

|

|

$ |

2,045,719 |

|

|

$ |

9,782,791 |

|

|

$ |

3,424,419 |

|

|

General and administrative |

|

|

30,983,504 |

|

|

|

1,828,279 |

|

|

|

44,616,803 |

|

|

|

8,121,310 |

|

|

Depreciation and amortization expense |

|

|

36,063 |

|

|

|

6,081 |

|

|

|

76,249 |

|

|

|

15,344 |

|

| Total cost and expenses |

|

|

32,992,103 |

|

|

|

3,880,079 |

|

|

|

54,475,843 |

|

|

|

11,561,073 |

|

| LOSS FROM OPERATIONS |

|

|

(32,992,103 |

) |

|

|

(3,880,079 |

) |

|

|

(54,475,843 |

) |

|

|

(11,561,073 |

) |

| NON-OPERATING INCOME

(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

27,477 |

|

|

|

1,459 |

|

|

|

37,843 |

|

|

|

3,530 |

|

|

Interest income |

|

|

1,748 |

|

|

|

333 |

|

|

|

3,552 |

|

|

|

1,447 |

|

|

Interest expense |

|

|

(3,275 |

) |

|

|

(468 |

) |

|

|

(7,958 |

) |

|

|

(2,117 |

) |

|

Net foreign exchange gain (loss) |

|

|

(3,469 |

) |

|

|

(47,245 |

) |

|

|

965,180 |

|

|

|

(2,060,234 |

) |

| Total non-operating income

(expense) |

|

|

22,481 |

|

|

|

(45,921 |

) |

|

|

998,617 |

|

|

|

(2,057,374 |

) |

| NET LOSS |

|

|

(32,969,622 |

) |

|

|

(3,926,000 |

) |

|

|

(53,477,226 |

) |

|

|

(13,618,447 |

) |

| OTHER COMPREHENSIVE LOSS

(INCOME) |

|

|

|

|

|

| Reporting currency

translation |

|

|

338,592 |

|

|

|

(84,626 |

) |

|

|

1,168,480 |

|

|

|

(2,466,052 |

) |

| NET LOSS AND OTHER

COMPREHENSIVE LOSS |

|

$ |

(33,308,214 |

) |

|

$ |

(3,841,374 |

) |

|

$ |

(54,645,706 |

) |

|

$ |

(11,152,395 |

) |

| Net loss per common share –

basic and diluted |

|

$ |

(0.79 |

) |

|

$ |

(0.11 |

) |

|

$ |

(1.33 |

) |

|

$ |

(0.41 |

) |

| Weighted average common shares

outstanding — basic and diluted |

|

|

41,895,426 |

|

|

|

35,600,161 |

|

|

|

40,148,179 |

|

|

|

32,964,416 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securing Domestic Supply Chains and

Decarbonization

In June 2021, President Biden’s administration

announced a supply chain disruptions task force and Executive Order

14017 to address supply chain discontinuities with a focus to

secure domestic supply for advanced batteries and invest in

sustainable domestic and international production and processing of

critical materials. President Biden provided an update in February

2022 announcing major government initiatives to expand domestic,

sustainable critical materials supply in an effort to break

dependence on foreign sources. Major initiatives included updating

outdated mining laws and regulations, updating and prioritizing the

Federal list of critical minerals, and strengthening critical

mineral stockpiling. Executive Order 14051 delegates authority to

the Under Secretary of Defense for Acquisition and Sustainment of

strategic and critical materials. On March 31, 2022, the President

signed a determination permitting the use of Defense Production Act

(“DPA”) Title III authorities to strengthen the U.S. industrial

base for large-capacity batteries. The U.S. depends on unreliable

foreign sources for many of the strategic and critical materials

necessary for a clean energy transition, and the DPA Title III

authorities enables the Department of Defense to undertake actions,

including but not limited to feasibility studies and modernization

projects for mature mining, beneficiation, and value-added

processing projects to increase productivity, environmental

sustainability, and workforce safety.

The Defense Logistics Agency (“DLA”) is a combat

support agency within the United States Department of Defense, and

boron is classified as a mineral of interest by the DLA.

In addition to boron, we plan to focus on

lithium, which is a critical mineral, as part of our mineral

resource and continue to progress workstreams to establish lithium

as a co-product of future production within our Project. We believe

that we have an opportunity to benefit from government initiatives

to secure domestic supply chains and can be a key contributor in

progressing applications within clean energy, food security, and

national defense. In February, the Company’s Project was designated

as Critical Infrastructure by the Department of Homeland Security’s

Cybersecurity and Infrastructure Security Agency, thereby

supporting the Company’s goal of having an important role in

providing critical and strategic materials to the challenged global

supply chain.

Market Update

As a result of the COVID-19 pandemic and the

Ukraine and Russia conflict, there has been increased stress on an

already challenged global supply chain for boron and lithium. We

believe that this supply tightness could persist as only a limited

number of boron projects are currently known globally and demand

continues to increase, primarily as a result of increased demand

from the electric transportation, clean energy, food and domestic

security industries. This current imbalance is manifesting itself

with increased pricing across a variety of boron derivatives,

including boric acid prices at approximately $730 to $1,360 per

ton, depending on volume, according to third-party market research

as of April 2022. We believe that the boron market has historically

and largely followed a similar pricing structure as lithium,

whereby customers have executed long-standing volume-based supply

contracts. If these supply-demand trends continue, we believe

future boron contracts could reflect favorable pricing terms based

on factors such as supply constraints, value in use, and

inflation.

SSBF Update

During the quarter, we have made progress on

planning and procurement of long lead item equipment for our

proposed Small-Scale Boron Facility (“SSBF”), with major equipment

either already on-site or scheduled for delivery. Detailed

engineering, including our hazard analysis, instrument designs,

piping isometrics, and structural and foundation design, was

substantially completed during the quarter and the progress of

detailed engineering provided us the opportunity to engage in a

competitive bidding process for the SSBF construction contract. In

April 2022, we awarded the construction contract to a contractor

and broke ground on the SSBF. Assuming no unexpected delays in

construction or supply chain issues, we target completing

construction of the SSBF in the calendar fourth quarter of 2022 at

an engineered estimated production capacity of approximately 2,000

tons per year of boric acid. This facility is engineered to process

a pregnant leach solution (“PLS”) containing boron and lithium

extracted from colemanite. The extraction of the PLS is expected to

occur through our injection-recovery wells, and we have completed

one of our four wells during the quarter that will supply the SSBF.

Three additional injection-recovery wells were completed post

quarter-end. During the quarter, we had no lost time injuries for

any of our Company sites, and we will continue to prioritize the

safety and well-being of personnel.

Management expects that the successful

construction and operation of the SSBF will provide PLS and process

intelligence that will help us to more effectively detail engineer

our proposed large-scale complex.

Project Update

Over the past nine months, the Company has

worked with our external engineering partners on process design for

our proposed large-scale complex. Our SK-1300 initial assessment

report effective October 15, 2021 added further definition to our

large boron resource and established the existence of a lithium

mineral resource that we believe could provide us with potential

lithium carbonate production. Due to the current favorable market

backdrop and growing importance of critical materials, the Company

intends to focus primarily on further defining its boron and

lithium resources, and to work towards developing a large-scale

boron and lithium complex for the extraction of boric acid and

lithium carbonate. A focus on boron and lithium extraction and

related end markets is aligned with our mission to become a global

leader in enabling industries addressing decarbonization, and the

Company’s focus on high value in use materials.

The SSBF is expected to serve as a foundation

for future design, engineering, and cost optimization for our

large-scale complex. We believe that the successful completion of

the SSBF is an important path to obtaining critical information

that will help enable us to optimize the efficiency, output and

economic profile of our large-scale complex. As such, the Company

expects to incorporate value engineering and cost structure

optimization into the continued technical and economic analysis of

the proposed large-scale complex, and to provide project updates,

rather than completing a bankable feasibility study in 2022. The

Company has begun to progress plans for its proposed processing

plant, including defining infrastructure, material balance and

process flow diagrams, co-generation, integration of a sulfuric

acid plant, and development of a priced equipment list for process

equipment needed for full-scale operations. Notwithstanding the

proposed scope changes to the Project and large-scale complex

focused on boron and lithium, management continues to believe that

assuming successful construction and operation of the SSBF, and

obtaining the requisite funding for construction, we will be able

to achieve initial commercial production in 2025.

The Company is currently targeting a boric acid

production capacity of approximately 250,000 tons per year once the

large-scale complex commences initial operations. In addition,

based on currently expected engineering and process design, once in

full production the Project could potentially produce up to 500,000

tons per year of boric acid. The Company also intends to sell boron

advanced materials from the above estimated capacity figures.

However, further analysis is required with respect to the potential

for boron advanced materials, with the successful completion and

operation of the SSBF expected to provide key operational input for

this analysis. Additionally, early estimates by management

currently target a lithium carbonate production capacity of up to

several thousand tons per year upon completion of our proposed

large-scale complex, and we expect the successful completion and

operation of the SSBF to provide further information on this point,

which if successful, could allow us to become an important

participant in the U.S lithium carbonate market. Given currently

high lithium prices and electric vehicle growth forecasted by

third-party analysts, management believes that an ability to

produce a co-product of lithium carbonate could have a positive

impact on our business.

The proposed large-scale complex has been value

engineered to regenerate a significant portion of hydrochloric

acid, which management expects to increase efficiencies and reduce

our emphasis on sulphate of potash to produce feedstock

hydrochloric acid. While production of sulphate of potash remains

in our long-term plans, the Company believes we can implement the

Mannheim process to produce sulphate of potash during later phases

of the Project when capacity for boric acid production exceeds

250,000 tons per year. Our short to medium term plan focuses on the

production of boric acid, boron advanced materials, and lithium

carbonate where management currently sees favorable market pricing

and high value in use. Management believes that a focus on boron

and lithium could be an important step towards creating a more

durable, less seasonal business compared to a more traditional

commodity-driven fertilizer focused business.

The continued technical and economic analysis

described above with respect to our proposed large-scale complex

and overall business strategy, has been determined by management to

be a currently more cost and time efficient way to proceed. This

continued technical and economic analysis of the proposed

large-scale complex may lead to a separate technical study, an

update to our initial assessment from October 2021 or a more

comprehensive study. However, we cannot assure you of the form and

scope of this continued technical and economic analysis, and it is

possible that we will conclude that the completion of any such

further studies (including a bankable feasibility study) may not be

commercially reasonable, necessary or possible at all. Please also

see Item 1A. Risk Factors in our Form 10-Q filed with the SEC on

May 12, 2022.

Corporate Update

In early March 2022 we completed our redomicile

to the U.S. and listed on the Nasdaq Stock Market LLC (“Nasdaq”) on

March 15, 2022. We have established a Nasdaq compliant board and

expect to align our board composition with the ongoing needs of the

Company.

Customer contract discussions advanced during

the quarter, and we signed a non-binding letter of intent with Rose

Mill Co. in May 2022 for boron advanced materials that focus on

industrial and military applications. We continue to advance

discussions with other customers for boron advanced materials.

Our team in California and Texas continues to

grow with several new hires across operations, administration, and

finance, including a former executive with over 19 years of

experience at Albemarle Corporation that spans across multiple

disciplines including process design, purchasing, M&A, and

general management. As of May 2022, the majority of our

administrative and operational personnel have transitioned to the

U.S. We anticipate a step-up in hiring as we work towards

mechanical completion and operation of the SSBF. We currently

estimate that our proposed large-scale complex could create up to

approximately 400 new jobs in an economically distressed California

Opportunity Zone.

More recently and in light of the recent

Presidential Executive Orders and U.S. government initiatives, we

increased our government affairs effort by engaging a specialized

management consulting firm to pursue federal, state, and local

funding opportunities.

Finally, we executed a research agreement with

Georgetown University that aims to enhance the performance of

permanent magnets through increased usage of boron. We believe the

potential benefits of this agreement include creating intellectual

property and commercialization pathways for the Company as it

pertains to the manufacturing of boron enhanced permanent

magnets.

About 5E Advanced Materials,

Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX:

5EA) is focused on becoming a vertically integrated global leader

and supplier of boron specialty and advanced materials whose

mission is to enable decarbonization. BORON+ products target

critical, high value applications within electric transportation,

clean energy, food and domestic security. We anticipate boron and

lithium products will target applications for electric

transportation, clean energy, food and domestic security. Our

business strategy will focus on our boron and lithium resource in

Southern California, which is designated as Critical Infrastructure

by the Department of Homeland Security’s Cybersecurity and

Infrastructure Security Agency, which we believe is one of the

largest known and environmentally permitted new conventional boron

deposits globally.

Forward Looking Statements

The information herein contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934, and

as described in securities legislation in Australia and other

jurisdictions. Forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “may,” “could,” and other similar

expressions, although not all forward-looking statements contain

these identifying words. All forward-looking statements reflect a

number of assumptions, which are subject to numerous risks and

uncertainties many of which are beyond the control of 5E, and which

may cause actual results to be materially different from those

described in the forward-looking statements. These risks and

uncertainties include, but are not limited to, our limited

operating history in the borates industry with no revenue from our

properties; our need for substantial additional financing to

execute our business plan and our ability to access capital and the

financial markets; our status as an exploration stage company with

no known mineral reserves and the inherent uncertainty in estimates

of mineral resources; risks and uncertainties relating to the

development of the Fort Cady project; risks related to the demand

for end use applications that require borates and related minerals

and compounds that we expect to produce; risks related to

compliance with environmental and regulatory requirements;

unanticipated costs or delays associated with our Small-Scale Boron

Facility; and the completion and outcome of future technical and

economic studies related to our project. For additional information

regarding these various risks and uncertainties, you should

carefully review the risk factors and other disclosures in our

amended Form 10 filed with the U.S. Securities and Exchange

Commission (SEC) on March 7, 2022, and our Form 10-Q filed with the

SEC on May 12, 2022 . Additional risks are also disclosed by 5E in

its filings with the Securities and Exchange Commission (SEC)

throughout the year, including its Form 10-K, Form 10-Qs and Form

8-Ks, as well as in its filings under the Australian Securities

Exchange. Any forward-looking statements are given only as of the

date hereof. Except as required by law, 5E expressly disclaims any

obligation to update or revise any such forward-looking statements.

Additionally, 5E undertakes no obligation to comment on third party

analyses or statements regarding 5E’s actual or expected financial

or operating results or its securities.

Authorized for release by:

Henri Tausch, Chief Executive Officer

For further information contact:

Chance Pipitone

Investor Relations – U.S.

info@5Eadvancedmaterials.com

Ph: +1 (346) 433-8912

Elvis Jurcevic

Investor Relations – Australia

ej@irxadvisors.com

Ph: + 61 408 268 271

Chris Sullivan

Media

chris@macmillancom.com

Ph: +1 (917) 902-0617

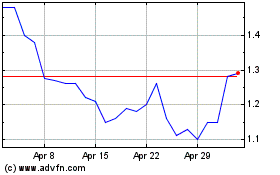

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Apr 2023 to Apr 2024