UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☑ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☐ Soliciting

Material Pursuant to §240.14a-12

180 Life Sciences Corp.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☑ |

|

No fee required |

| ☐ |

|

Fee paid previously with preliminary materials |

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

180 Life Sciences Corp.

3000 El Camino Real, Bldg. 4, Suite 200

Palo Alto, CA 94306

(650) 507-0669

November [●], 2022

To Our Stockholders:

You are cordially invited

to attend a special meeting (the “Special Meeting”) of stockholders of 180 Life Sciences Corp., a Delaware corporation

(the “Company” or “180 Life”) to be held (subject to postponement(s) or adjournment(s) thereof):

|

Date: |

|

Thursday, December 15, 2022 |

| Time: |

|

9:00 a.m. Pacific Time |

| Virtual Meeting Site: |

|

https://agm.issuerdirect.com/ATNF |

You will not be able to attend

the Special Meeting physically. The Special Meeting will be held via an audio teleconference and all stockholders are invited to attend

the meeting virtually. Stockholders may attend the Special Meeting via the Internet by logging in at https://agm.issuerdirect.com/ATNF

(please note this link is case sensitive), with your Control ID, and thereafter following the instructions to join the virtual meeting.

In addition to voting by submitting your proxy prior to the Special Meeting and/or voting online as discussed herein, you also will be

able to vote your shares electronically during the Special Meeting with your Request ID.

In connection with the Special

Meeting, you will be asked to consider and vote on certain stockholder proposals, which are more fully described in the accompanying proxy

statement. Whether or not you plan to attend the Special Meeting, we urge you to read the proxy statement (and any documents incorporated

into the proxy statement by reference) and consider such information carefully before voting. The attached Notice of Meeting and the Proxy

Statement describe the business to be considered and acted upon by the stockholders at the Special Meeting. Please review these materials

and vote your shares.

The Board of Directors

unanimously recommends that our stockholders vote “FOR” all of the proposals presented in the proxy statement.

Your vote is very important.

Even if you plan to attend the Special Meeting, if you are a holder of record of common stock please submit your proxy by mail, fax, Internet

or telephone as soon as possible to make sure that your shares are represented at the Special Meeting. If you hold your shares of common

stock in “street name” through a bank, broker, or other nominee, you must vote in accordance with the voting instructions

provided to you by such bank, broker, or other nominee, which include instructions for voting by Internet or telephone.

Our Board of Directors encourages

your participation in 180 Life Sciences Corp.’s electoral process and, to that end, solicits your proxy with respect to the matters

described in the Notice of Meeting and the Proxy Statement

We look forward to seeing you

on Thursday, December 15, 2022. Your vote and participation in our governance is very important to us.

Sincerely,

|

|

|

|

|

| Sir Marc Feldmann, Ph.D. |

|

|

|

Lawrence Steinman, M.D. |

| Executive Co-Chairman |

|

|

|

Executive Co-Chairman |

180 LIFE SCIENCES CORP.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

| Date: |

|

Thursday, December 15, 2022 |

| Time: |

|

9:00 a.m. Pacific Time |

| Virtual Meeting Site: |

|

https://agm.issuerdirect.com/ATNF |

Notice is hereby given that

a special meeting (the “Special Meeting”) of stockholders of 180 Life Sciences Corp. (the “Company”)

will be held via an audio teleconference at https://agm.issuerdirect.com/ATNF (please note this link is case sensitive), on Thursday,

December 15, 2022, at 9:00 a.m., Pacific Time.

At this meeting, you will be asked to:

| 1. | Approve an amendment to our Second Amended and Restated Certificate

of Incorporation, as amended, to effect a reverse stock split of our issued and outstanding shares of our common stock, par value $0.0001

per share, by a ratio of between one-for-four to one-for-twenty, inclusive, with the exact ratio to be set at a whole number to

be determined by our Board of Directors or a duly authorized committee thereof in its discretion, at any time after approval of the amendment

and prior to December 15, 2023; and |

| 2. | Approve the adjournment of the Special Meeting, if necessary,

to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve the above proposal. |

The close of business on November

7, 2022 has been established as the record date for determining the stockholders entitled to notice of and to vote at the Special Meeting

and at any adjournments thereof. At the close of business on the record date, there were (a) 40,331,011 shares of our common stock outstanding;

(b) no shares of our Series A Convertible Preferred Stock outstanding; (c) 1 share of our preferred Class C Special Voting Shares outstanding;

and (d) 1 share of our preferred Class K Special Voting Shares outstanding. The common stock votes one vote on all stockholder matters,

the Class C Special Voting Shares, vote 0 voting shares in aggregate; and the Class K Special Voting Shares vote 5,275 voting shares in

aggregate. As a result, we had an aggregate of 40,336,286 total voting shares as of the record date.

The presence in person or

by proxy of holders of a majority of the issued and outstanding shares of our voting stock entitled to vote at the Special Meeting constitutes

a quorum for the transaction of business at the Special Meeting. A list of the stockholders of record as of the record date will be available

for inspection by stockholders, for any purpose germane to the Special Meeting, at the Company’s offices during normal business

hours for a period of 10 days prior to the Special Meeting.

All stockholders are invited to attend the Special

Meeting in person.

Regardless of whether you

plan to attend the Special Meeting, we hope you will vote as soon as possible. If you are a holder of record of common stock or preferred

stock, you may vote in person at the Special Meeting or by mail, fax, Internet or telephone by following the instructions on the enclosed

proxy card or voting instruction card. Voting by written proxy or voting instruction card will ensure your representation at the Special

Meeting regardless of whether you attend in person. If you hold your shares of common stock or preferred stock in “street name”

through a bank, broker, or other nominee, you must vote in accordance with the voting instructions provided to you by such bank, broker,

or other nominee, which include instructions for voting by Internet or telephone.

If you have any questions

or require any assistance with voting your shares, please contact our proxy agent, Issuer Direct Corporation at (919) 481-4000, or 1-866-752-VOTE (8683).

By Order of the Board of Directors,

|

|

|

| Sir Marc Feldmann, Ph.D. |

|

Lawrence Steinman, M.D. |

| Executive Co-Chairman |

|

Executive Co-Chairman |

TABLE OF CONTENTS

Appendix A - Form of Certificate of Amendment of Second Amended

and Restated Certificate of Incorporation of 180 Life Sciences Corp.

180 LIFE SCIENCES CORP.

3000 El Camino Rd., Bldg. 4, Suite 200

Palo Alto, California 94306

PROXY STATEMENT

This proxy statement and an

accompanying proxy card are being furnished in connection with the solicitation by the Board of Directors (the “Board”)

of 180 Life Sciences Corp. (the “Company”) for use at a special meeting of stockholders (the “Special Meeting”)

to be held on Thursday, December 15, 2022, and at any adjournments, continuations or postponements thereof. The approximate date

this proxy statement and the accompanying proxy card are being first mailed to stockholders is on or about November 18, 2022. The Special

Meeting will be held via an audio teleconference at https://agm.issuerdirect.com/ATNF (please note this link is case sensitive), at 9:00 a.m.

Pacific Time.

DEFINITIONS

Unless the context requires

otherwise, references in this proxy statement to the “Company,” “we,” “us,” “our,”

“180 Life”, “180LS” and “180 Life Sciences Corp.” refer specifically to 180 Life

Sciences Corp. and its consolidated subsidiaries. References to “KBL” refer to the Company prior to the November 6,

2020 Business Combination.

In addition, unless the context

otherwise requires and for the purposes of this Proxy Statement only:

| ● | “CAD” refers to Canadian dollars; |

| ● | “Exchange Act” refers to the Securities

Exchange Act of 1934, as amended; |

| ● | “£” or “GBP” refers

to British pounds sterling; |

| ● | “SEC” or the “Commission”

refers to the United States Securities and Exchange Commission; and |

| ● | “Securities Act” refers to the Securities

Act of 1933, as amended. |

SUMMARY

This summary highlights

selected information in this proxy statement and may not contain all of the information about the proposals being considered at the Special

Meeting that is important to you. You should carefully read this proxy statement in its entirety, and any other documents to which we

have referred you, for a more complete understanding of the matters being considered at the Special Meeting.

The Special Meeting

The Special Meeting of Stockholders

of 180 Life Sciences Corp. will be held at 9:00 a.m. Pacific Time on Thursday, December 15, 2022, via an audio teleconference at https://agm.issuerdirect.com/ATNF

(please note this link is case sensitive). At the Special Meeting, you will be asked to consider and vote upon:

| 1. | A proposal to approve an amendment to our Second Amended and

Restated Certificate of Incorporation, as amended, to effect a reverse stock split of our issued and outstanding shares of our common

stock, par value $0.0001 per share, by a ratio of between one-for-four to one-for-twenty, inclusive, with the exact ratio to be

set at a whole number to be determined by our Board of Directors or a duly authorized committee thereof in its discretion, at any time

after approval of the amendment and prior to December 15, 2023 (“Proposal 1”). |

| 2. | A proposal to adjourn the Special Meeting, if necessary,

to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve Proposal 1 (“Proposal 2”). |

We will also transact such

other business as may properly come before the Special Meeting or any adjournment or postponement thereof.

The close of business on November

7, 2022 has been established as the record date (“Record Date”) for determining the stockholders entitled to notice

of and to vote at the Special Meeting and at any adjournments thereof. Only stockholders at the close of business on the Record Date are

entitled to notice of, and to vote at, the Special Meeting and any adjournment or postponement thereof. At the close of business on the

record date, there were (a) 40,331,011 shares of our common stock outstanding; (b) no shares of our Series A Convertible Preferred Stock

outstanding; (c) 1 share of our preferred Class C Special Voting Shares outstanding; and (d) 1 share of our preferred Class K Special

Voting Shares outstanding. The common stock votes one vote on all stockholder matters, the Class C Special Voting Shares, vote 0 voting

shares in aggregate; and the Class K Special Voting Shares vote 5,275 voting shares in aggregate. As a result, we had an aggregate of

40,336,286 total voting shares as of the record date.

Voting Instructions

Stockholders may vote by completing

the enclosed proxy card and mailing it in the envelope provided, by using the toll-free telephone number provided on the proxy card, via

fax as set forth in the proxy card, over the Internet, or by following the instructions available on the meeting website during the meeting.

The telephone voting facility for stockholders of record will close at 11:59 p.m. Eastern Time on December 14, 2022. You may vote during

the meeting by following the instructions available on the meeting website during the meeting (which will require your Request ID).

If you hold shares through

an account with a bank or broker, the voting of the shares by the bank or broker when you do not provide voting instructions is governed

by the rules of the New York Stock Exchange (the “NYSE”). NYSE rules allow brokers, banks and other nominees to vote

shares on certain “routine” matters for which their customers do not provide voting instructions. Both Proposal 1 and

Proposal 2 are “routine” proposals. Therefore, if you do not instruct your broker, bank and other nominee how to vote,

your broker, bank and other nominee will have discretionary authority to vote your shares on those proposals. A broker non-vote occurs

when your bank or broker submits a proxy but does not vote on non-routine proposals, absent specific instructions from you.

Given that both Proposal 1 and Proposal 2 are routine proposals and your broker, bank or other nominee will have discretionary authority

to vote your shares on these proposals, we do not expect any broker non-votes at the Special Meeting.

Instructions for the Virtual Meeting

The Special Meeting will be

a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted via live audio webcast.

To participate in the virtual

meeting, visit https://agm.issuerdirect.com/ATNF (please note this link is case sensitive) and enter the control number

on your proxy card, or on the instructions that accompanied your proxy materials.

We recommend you check in/log

in to the Special Meeting 15 minutes before the meeting is scheduled to start so that any technical difficulties may be addressed before

the meeting begins.

You may vote during the meeting

by following the instructions available on the meeting website during the meeting. To the best of our knowledge, the virtual meeting platform

is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell

phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection

wherever they intend to participate in the meeting. Participants should also allow plenty of time to log in and ensure that they can hear

streaming audio prior to the start of the meeting.

Technicians will be available

to assist you if you experience technical difficulties accessing the virtual meeting website. If you encounter any difficulties accessing

the virtual meeting during the check-in or meeting time, please call 844-399-3386 for assistance.

Conduct at the Meeting

The Chairman of the meeting

has broad responsibility and legal authority to conduct the Special Meeting in an orderly and timely manner. This authority includes establishing

rules for stockholders who wish to address the meeting. Only stockholders or their valid proxy holders may address the meeting. The Chairman

may exercise broad discretion in recognizing stockholders who wish to speak and in determining the extent of discussion on each item of

business.

Inspector of Voting

It is anticipated that representatives

of Issuer Direct Corporation will tabulate the votes and act as inspector of election for the Special Meeting.

Confidential Voting

Independent inspectors will

count the votes. Your individual vote is kept confidential from us unless special circumstances exist. For example, a copy of your proxy

card will be sent to us if you write comments on the card, as necessary to meet applicable legal requirements, or to assert or defend

claims for or against the Company.

Voting Process

If you are a stockholder of

record, there are five ways to vote:

| ● | At the virtual Special Meeting. You

may vote during the meeting by following the instructions available on the meeting website during the meeting. |

| ● | Via the Internet. You may vote

by proxy via the Internet by following the instructions provided in the notice. |

| ● | By Telephone. If you request

printed copies of the proxy materials by mail, you may vote by proxy by calling the toll-free number found on the proxy card or

notice. |

| ● | By Fax. If you request printed

copies of the proxy materials by mail, you may vote by proxy by faxing your proxy to the number found on the proxy card or notice. |

| ● | By Mail. If you request printed

copies of the proxy materials by mail, you may vote by proxy by filling out the proxy card and returning it in the envelope provided. |

Providing and Revoking Proxies

The presence of a stockholder

at our Special Meeting will not automatically revoke that stockholder’s proxy. However, a stockholder may revoke a proxy at any

time prior to its exercise by:

| ● | submitting a written revocation prior to the Special Meeting

to the Corporate Secretary, 180 Life Sciences Corp., 3000 El Camino Real, Bldg. 4, Suite 200, Palo Alto, California 94306; |

| ● | submitting another signed and later dated proxy card and returning

it by mail in time to be received before our Special Meeting or by submitting a later dated proxy by the Internet or telephone prior

to the Special Meeting; or |

| ● | attending our Special Meeting and voting by following the

instructions available on the meeting website during the meeting. |

Other Matters Properly Brought Before the Special Meeting

Our Board knows of no other

matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the Special

Meeting, it is the intention of the persons named in the proxy to vote on those matters in accordance with their best judgment.

Proposals to be Voted Upon at the Special Meeting

Proposal 1

We are proposing to amend

Article IV of the Company’s Second Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”)

to effect a reverse stock split of our issued and outstanding shares of our common stock by a ratio of between one-for-four and one-for-twenty, inclusive,

with the exact ratio to be set at a whole number to be determined by our Board of Directors or a duly authorized committee thereof in

its discretion, at any time after approval of the amendment and prior to December 15, 2023. The text of the proposed articles of amendment

amending Article IV of the Certificate of Incorporation, subject to non-material technical, administrative or similar changes and modifications

in the reasonable discretion of the officers of the Company, is attached as Appendix A and is incorporated into

this proxy statement by reference.

Proposal 1 is not conditioned

on the approval of any other proposal. If Proposal 1 is approved, the Board intends to implement Proposal 1 (subject to the right

of the Board of Directors or a duly authorized committee thereof to approve the filing of the amendment to the Certificate of Incorporation

in their sole discretion) regardless of whether stockholders approve Proposal 2.

There are no specific plans,

arrangements, undertakings or agreements to issue shares at this time, except as described in Proposal 1 below.

The Board unanimously recommends

that you vote “FOR” Proposal 1.

Proposal 2

We are proposing to adjourn

the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting

to approve Proposal 1.

The Board unanimously recommends

that you vote “FOR” Proposal 2.

Vote Required

Approval of Proposal 1

requires the affirmative vote of the holders of a majority of the outstanding stock of the Company entitled to vote thereon. Approval

of Proposal 2 requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Special

Meeting and entitled to vote thereon. For each of Proposal 1 and Proposal 2, you may vote “FOR,” “AGAINST,”

or “ABSTAIN.”

Record Date

The close of business on November

7, 2022 has been established as the Record Date for determining the stockholders entitled to notice of and to vote at the Special Meeting

and at any adjournments thereof. At the close of business on the record date, there were (a) 40,331,011 shares of our common stock outstanding;

(b) no shares of our Series A Convertible Preferred Stock outstanding; (c) 1 share of our preferred Class C Special Voting Shares outstanding;

and (d) 1 share of our preferred Class K Special Voting Shares outstanding. The common stock votes one vote on all stockholder matters,

the Class C Special Voting Shares, vote 0 voting shares in aggregate; and the Class K Special Voting Shares vote 5,275 voting shares in

aggregate. As a result, we had an aggregate of 40,336,286 total voting shares as of the Record Date. The presence in person or by proxy

of holders of a majority of the issued and outstanding shares of our voting stock entitled to vote at the Special Meeting constitutes

a quorum for the transaction of business at the Special Meeting.

Results of Voting

We intend to announce the

final voting results at the Special Meeting and publish the final results in a Current Report on Form 8-K within four business days

of the Special Meeting, unless final results are unavailable in which case we will publish the preliminary results in such Current Report

on Form 8-K. If final results are not filed with our Current Report on Form 8-K to be filed within four business days of the

Special Meeting, the final results will be published in an amendment to our Current Report on Form 8-K within four business days

after the final voting results are known.

Multiple Stockholders Sharing the Same Address

In some cases, one copy of

this proxy statement and the accompanying notice of Special Meeting of Stockholders is being delivered to multiple stockholders sharing

an address, at the request of such stockholders. We will deliver promptly, upon written or oral request, a separate copy of this proxy

statement or the accompanying notice of Special Meeting of Stockholders to such a stockholder at a shared address to which a single copy

of the document was delivered. Stockholders sharing an address may also submit requests for delivery of a single copy of this proxy statement

or the accompanying notice of Special Meeting of stockholders, but in such event will still receive separate forms of proxy for each account.

To request separate or single delivery of these materials now or in the future, a stockholder may submit a written request to our Corporate

Secretary at our principal executive offices at 3000 El Camino Real, Bldg. 4, Suite 200, Palo Alto, California 94306, or a stockholder

may make a request by calling our Investor Relations at (650) 507-0669. To ensure that all shares are voted, please either vote each

account as discussed above under “Voting Process”, or sign and return by mail all proxy cards or voting instruction forms.

Solicitations

All solicitation expenses,

including costs of preparing, assembling and mailing proxy materials, will be borne by the Company. It is expected that solicitations

will be made primarily by mail, but our directors, officers and other employees also may solicit proxies by telephone and in person, without

additional compensation. Additionally, the Company has retained Issuer Direct Corporation as proxy agent and engaged Issuer Direct Corporation

to help assist in the solicitation of proxies. Issuer Direct Corporation may solicit proxies on the Board’s behalf. Arrangements

will be made with brokerage houses and other custodians, nominees, and fiduciaries for proxy materials to be sent to their principals,

and we will reimburse such persons for their reasonable expenses in so doing.

Adjournment of the Special Meeting

The chairman of the Special

Meeting or the holders of a majority of the shares present in person or represented by proxy at the Special Meeting and entitled to vote

have the power to adjourn the Special Meeting from time to time without notice other than announcement at the Special Meeting of the time

and place of the adjourned meeting.

FORWARD LOOKING STATEMENTS AND WEBSITE LINKS

Statements in this Proxy Statement

that are “forward-looking statements” are based on current expectations and assumptions that are subject to risks

and uncertainties. In some cases, forward-looking statements can be identified by terminology such as “may,” “should,”

“potential,” “continue,” “expects,” “anticipates,” “intends,”

“plans,” “believes,” “estimates,” and similar expressions. These statements involve

risks and uncertainties, and actual results may differ materially from any future results expressed or implied by the forward-looking statements,

including any failure to meet stated goals and commitments, and execute our strategies in the time frame expected or at all, as a result

of many factors, including the need for additional funding, the terms of such funding, changing government regulations, the outcome of

trials and our ability to market and commercialize future products. More information on risks, uncertainties, and other potential factors

that could affect our business and performance is included in our other filings with the SEC, including in the “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of our most

recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. These forward-looking statements

are based on our current estimates and assumptions and, as such, involve uncertainty and risk. Actual results could differ materially

from projected results.

We do not assume any obligation

to update information contained in this document, except as required by federal securities laws. Although this Proxy Statement may remain

available on our website or elsewhere, its continued availability does not indicate that we are reaffirming or confirming any of the information

contained herein. Neither our website nor its contents are a part of this Proxy Statement.

Website links included in

this Proxy Statement are for convenience only. The content in any website links included in this Proxy Statement is not incorporated herein

and does not constitute a part of this Proxy Statement.

PROPOSAL 1

AMENDMENT TO SECOND AMENDED AND RESTATED CERTIFICATE OF

INCORPORATION, AS AMENDED, TO EFFECT A REVERSE STOCK SPLIT

At the Special Meeting, stockholders

will be asked to approve an amendment to Article IV of the Company Certificate of Incorporation (the “Reverse Stock Split Amendment”)

to effect a reverse stock split of the Company’s issued and outstanding shares of common stock by a ratio of between one-for-four and one-for-twenty, inclusive

(the “Reverse Stock Split”), with the exact ratio to be set at a whole number to be determined by our Board of Directors

or a duly authorized committee thereof in its discretion, at any time after approval of the amendment and prior to December 15, 2023.

A vote “FOR” Proposal 1 will constitute approval of the Reverse Stock Split Amendment and will grant the Board the

authority to determine whether to implement the Reverse Stock Split and to select the Reverse Stock Split ratio out of the range approved

by the Company’s stockholders at the Special Meeting. The Board expects to authorize the consummation of the Reverse Stock Split

only if and to the extent necessary to regain and maintain compliance with the Nasdaq listing requirements, as further discussed under

“Purpose” below. Upon the effectiveness of the Reverse Stock Split (the “Effective Date”), the issued

and outstanding shares of the Company’s common stock immediately prior to the Effective Date will be reclassified into a fewer number

of shares based on the Reverse Stock Split ratio selected by the Board.

The Reverse Stock Split, as

more fully described below, will not change the number of authorized shares of common stock or the par value of the Company’s common

stock.

The description in this Proxy

Statement of the proposed Reverse Stock Split Amendment is qualified in its entirety by reference to, and should be read in conjunction

with, the full text of the Form of Amendment to the Certificate of Incorporation attached to this Proxy Statement as Appendix A

which is subject to non-material technical, administrative or similar changes and modifications in the reasonable discretion of the officers

of the Company.

Purpose

The sole purpose for the Reverse

Stock Split is based on the Board’s belief that the Reverse Stock Split will likely be necessary to maintain the listing of our

common stock on the Nasdaq Capital Market. In the event that the Board, in its sole discretion determines to implement the Reverse Stock

Split for such purpose, the Board believes that the Reverse Stock Split could also improve the marketability and liquidity of the common

stock.

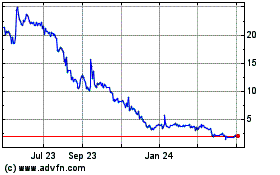

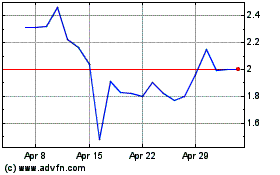

Maintain our listing on

the Nasdaq Capital Market. Our common stock is traded on the Nasdaq Capital Market. On September 30, 2022, the Company was notified

by Nasdaq (the “Nasdaq Letter”) that it no longer satisfied the minimum bid price requirement for continued listing,

of $1.00 per share, as set forth in Nasdaq Listing Rule 5550(a)(2). The Nasdaq Letter provided that the Company has 180 calendar days

from the date therein to regain compliance (i.e., until March 29, 2023)(the “Expiration Date”). If the Company fails

to regain compliance by the Expiration Date, the Company may be granted a second 180-day grace period, or until September 25,

2023 (the “Second Nasdaq Extension Period”), within which to comply with the Nasdaq minimum bid price requirement,

so long as the Company meets The Nasdaq Capital Market initial listing criteria (except for the bid price requirement) and notifies Nasdaq

in writing of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary.

During the compliance period, the common stock will continue to be listed and traded on the Nasdaq Capital Market. If the Company does

not regain compliance during the allotted compliance period, our common stock (and our publicly traded warrants) will be subject to delisting

by Nasdaq. As of the date of this Proxy Statement, our stock price has not had a minimum bid price of at least $1.00 for at least ten

(10) consecutive business days since the date of the Nasdaq Letter. In the event that our stock price satisfies the minimum bid price

requirement of at least $1.00 for at least ten (10) consecutive business days without requiring the Reverse Stock Split, the Board

may not implement the Reverse Stock Split.

The Board has considered the

potential harm to the Company and its stockholders should Nasdaq delist our common stock (and our publicly traded warrants) from the Nasdaq

Capital Market. Delisting our common stock (and our publicly traded warrants) could adversely affect the liquidity of our common stock

(and our publicly traded warrants) because alternatives, such as the OTCQB Market maintained by OTC Markets, Inc. and/or the pink sheets,

are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate

quotations in seeking to buy our common stock (and our publicly traded warrants) on an over-the-counter market. Many investors

likely would not buy or sell our common stock (and our publicly traded warrants) due to difficulty in accessing over-the-counter markets,

policies preventing them from trading in securities not listed on a national exchange or other reasons. The Board of Directors believes

that the Reverse Stock Split is a potentially effective means for us to maintain compliance with the rules of Nasdaq and to avoid, or

at least mitigate, the likely adverse consequences of our common stock (and our publicly traded warrants) being delisted from the Nasdaq

Capital Market by producing the immediate effect of increasing the bid price of our common stock.

Furthermore, the delisting

of our common stock from the Nasdaq Capital Market will result in the delisting of our publicly traded warrants from the Nasdaq Capital

Market.

Improve the marketability

and liquidity of the common stock. In the event the Board elects to implement the Reverse Stock Split in order to avoid the delisting

of our common stock from the Nasdaq Capital Market, we also believe that the increased market price of our common stock expected as a

result of implementing the Reverse Stock Split will improve the marketability and liquidity of our common stock and will encourage interest

and trading in our common stock. A reverse stock split could allow a broader range of institutions to invest in our common stock (namely,

funds that are prohibited from buying stocks whose price is below a certain threshold), potentially increasing the liquidity of our common

stock. A reverse stock split could help increase analyst and broker interest in our stock as their policies can discourage them from following

or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks,

many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks

or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and

practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally,

because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions

on higher-priced stocks, the current average price per share of our common stock can result in individual stockholders paying transaction

costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher.

It should be noted, however, that the liquidity of our common stock may in fact be adversely affected by the proposed Reverse Stock Split

given the reduced number of shares of common stock that would be outstanding after the Reverse Stock Split.

For the above reasons, we

believe that providing the Board with the ability to effect the Reverse Stock Split, in the event that it determines, in its sole discretion,

that implementing the Reverse Stock Split will help us regain and maintain compliance with the Nasdaq listing requirements and, as a result,

could also improve the marketability and liquidity of our common stock, is in the best interests of the Company and our stockholders.

However, regardless as to whether or not the Board believes that implementing the Reverse Stock Split could help us regain and maintain

compliance with the Nasdaq listing requirements, the Board reserves the right not to implement the Reverse Stock Split if it determines,

in its sole discretion, that it otherwise would not be in our and our stockholders’ best interests.

Accounting Matters

The par value of the shares

of our common stock is not changing as a result of the implementation of the Reverse Stock Split. Our stated capital, which consists of

the par value per share of our common stock multiplied by the aggregate number of shares of our common stock issued and outstanding, will

be reduced proportionately on the effective date of the Reverse Stock Split. Correspondingly, our additional paid-in capital, which consists

of the difference between our stated capital and the aggregate amount paid to us upon the issuance of all currently outstanding shares

of our common stock, will be increased by a number equal to the decrease in stated capital. Further, net loss per share, book value per

share and other per share amounts will be increased as a result of the Reverse Stock Split because there will be fewer shares of common

stock outstanding.

Risks of the Proposed Reverse Stock Split

We cannot assure you that

the proposed Reverse Stock Split will increase our stock price and have the desired effect of maintaining compliance with the rules of

the Nasdaq. The Board expects that the Reverse Stock Split of our common stock will increase the market price of our common stock

so that we are able to regain and maintain compliance with the Nasdaq minimum bid price listing standard. However, the effect of the Reverse

Stock Split upon the market price of our common stock cannot be predicted with any certainty, and the history of similar reverse stock

splits for companies in like circumstances is varied. Under applicable Nasdaq rules, to regain compliance with the $1.00 minimum closing

bid price requirement and maintain our listing on the Nasdaq Capital Market, the $1.00 closing bid price must be maintained for a minimum

of ten (10) consecutive business days. Accordingly, we cannot assure you that we will be able to maintain our Nasdaq listing after

the Reverse Stock Split is effected or that the market price per share after the Reverse Stock Split will exceed or remain in excess of

the $1.00 minimum bid price for a sustained period of time.

It is possible that the per

share price of our common stock after the Reverse Stock Split will not rise in proportion to the reduction in the number of shares of

our common stock outstanding resulting from the Reverse Stock Split, and the market price per post-Reverse Stock Split share may not exceed

or remain in excess of the $1.00 minimum bid price for a sustained period of time, and the Reverse Stock Split may not result in a per

share price that would attract brokers and investors who do not trade in lower priced stocks. Even if we effect the Reverse Stock Split,

the market price of our common stock may decrease due to factors unrelated to the stock split. In any case, the market price of our common

stock may also be based on other factors which may be unrelated to the number of shares outstanding, including our future performance.

If the Reverse Stock Split is consummated and the trading price of the common stock declines, the percentage decline as an absolute number

and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Even

if the market price per post-Reverse Stock Split share of our common stock remains in excess of $1.00 per share, we may be delisted due

to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum stockholders’ equity,

the minimum number of shares that must be in the public float, the minimum market value of the public float and the minimum number of

round lot holders.

The proposed Reverse Stock

Split may decrease the liquidity of our common stock. The liquidity of our common stock may be harmed by the proposed Reverse Stock

Split given the reduced number of shares of common stock that would be outstanding after the Reverse Stock Split, particularly if the

stock price does not increase as a result of the Reverse Stock Split. In addition, investors might consider the increased proportion of

unissued authorized shares of common stock to issued shares to have an anti-takeover effect under certain circumstances, because the proportion

allows for dilutive issuances which could prevent certain stockholders from changing the composition of the Board or render tender offers

for a combination with another entity more difficult to successfully complete. The Board does not intend for the Reverse Stock Split to

have any anti-takeover effects.

Principal Effects of the Reverse Stock Split

Common stock. If

this proposal is approved by the stockholders at the Special Meeting and the Board determines to effect the Reverse Stock Split and thus

amend the Certificate of Incorporation, the Company will file a certificate of amendment to the Certificate of Incorporation with the

Secretary of State of the State of Delaware. Except for adjustments that may result from the treatment of fractional shares as described

below, each issued share of common stock immediately prior to the Effective Date will automatically be changed, as of the Effective Date,

into a fraction of a share of common stock based on the exchange ratio within the approved range determined by the Board. In addition,

proportional adjustments will be made to the maximum number of shares of common stock issuable under, and other terms of, our stock plans,

as well as to the number of shares of common stock issuable under, and the exercise price of, our outstanding options and warrants.

Except for adjustments that

may result from the treatment of fractional shares of common stock as described below, because the Reverse Stock Split would apply to

all issued shares of our common stock, the proposed Reverse Stock Split would not alter the relative rights and preferences of our existing

stockholders nor affect any stockholder’s proportionate equity interest in the Company. For example, a holder of two percent (2%)

of the voting power of the outstanding shares of our common stock immediately prior to the effectiveness of the Reverse Stock Split will

generally continue to hold two percent (2%) of the voting power of the outstanding shares of our common stock immediately after the Reverse

Stock Split. Moreover, the number of stockholders of record will not be affected by the Reverse Stock Split. The amendment to the Certificate

of Incorporation itself would not change the number of authorized shares of our common stock or the par value thereof. The Reverse Stock

Split will have the effect of creating additional unreserved shares of our authorized common stock. Although at present we have no current

arrangements or understandings providing for the issuance of the additional shares of common stock that would be made available for issuance

upon effectiveness of the Reverse Stock Split, other than those shares needed to satisfy the conversion and/or exercise of the Company’s

outstanding convertible notes, warrants and options, these additional shares of common stock may be used by us for various purposes in

the future without further stockholder approval, including, among other things:

| ● | raising capital to fund our operations and to continue as

a going concern; |

| ● | establishing strategic relationships with other companies; |

| ● | providing equity incentives to our employees, officers or

directors; and |

| ● | expanding our business or product lines through the acquisition

of other businesses or products. |

While the Reverse Stock Split

will make additional shares of common stock available for the Company to use in connection with the foregoing, the primary purpose of

the Reverse Stock Split is to increase our stock price in order to regain and maintain compliance with the Nasdaq minimum bid price listing

standard, which compliance will be the sole factor in determining the ratio of the Reverse Stock Split.

The following table sets forth

the approximate number of issued and outstanding shares of common stock, net income (loss) per share for the nine months ended September

30, 2022, and the approximate exercise prices of our outstanding warrants and options, each in the event of a 1:4 to 1:20 Reverse Stock

Split:

| | |

Pre-Reverse Stock Split | | |

After a 1:4 Reverse Stock Split | | |

After a 1:8 Reverse Stock Split | | |

After a 1:10 Reverse Stock Split | | |

After a 1:15 Reverse Stock Split | | |

After a 1:20 Reverse Stock Split | |

| Common Stock authorized (1) | |

| 100,000,000 | | |

| 100,000,000 | | |

| 100,000,000 | | |

| 100,000,000 | | |

| 100,000,000 | | |

| 100,000,000 | |

| Common Stock outstanding | |

| 40,331,011 | | |

| 10,082,753 | | |

| 5,041,377 | | |

| 4,033,102 | | |

| 2,688,735 | | |

| 2,016,551 | |

| Number of shares of Common Stock reserved for issuance upon exercise of outstanding pre-funded warrants (2) | |

| 1,085,000 | | |

| 271,250 | | |

| 135,625 | | |

| 108,500 | | |

| 72,334 | | |

| 54,250 | |

| Number of shares of Common Stock reserved for issuance upon exercise of outstanding warrants (3) | |

| 17,285,984 | | |

| 4,321,496 | | |

| 2,160,748 | | |

| 1,728,599 | | |

| 1,152,399 | | |

| 864,300 | |

| Number of shares of Common Stock reserved for issuance upon exercise of outstanding options (4) | |

| 3,259,121 | | |

| 814,781 | | |

| 407,391 | | |

| 325,913 | | |

| 217,275 | | |

| 162,957 | |

| Number of shares of Common Stock reserved for issuance under outstanding equity incentive plans | |

| 2,312,740 | | |

| 578,185 | | |

| 289,093 | | |

| 231,274 | | |

| 154,183 | | |

| 115,637 | |

| Number of shares of Common Stock authorized but unissued and unreserved | |

| 35,726,144 | | |

| 83,931,535 | | |

| 91,965,766 | | |

| 93,572,612 | | |

| 95,715,074 | | |

| 96,786,305 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) applicable to Common Stock per share for the quarter ended September 30, 2022 | |

| [__] | | |

| [__] | | |

| [__] | | |

| [__] | | |

| [__] | | |

| [__] | |

| Exercise Price of Outstanding Pre-Funded Warrants (2) | |

$ | 0.0001 | | |

$ | 0.0004 | | |

$ | 0.0008 | | |

$ | 0.0010 | | |

$ | 0.0015 | | |

$ | 0.0020 | |

| Weighted Average Exercise Price of Outstanding Warrants (3) | |

$ | 6.13 | | |

$ | 24.52 | | |

$ | 49.04 | | |

$ | 61.30 | | |

$ | 91.95 | | |

$ | 122.60 | |

| Weighted Average Exercise Price of Outstanding Options (4) | |

$ | 4.23 | | |

$ | 16.92 | | |

$ | 33.84 | | |

$ | 42.30 | | |

$ | 63.45 | | |

$ | 84.60 | |

| Voting Rights of the Class K Special Voting Share | |

| 5,275 | | |

| 1,319 | | |

| 660 | | |

| 528 | | |

| 352 | | |

| 264 | |

These estimates do not reflect the potential effects of rounding up

of fractional shares that may result from the Reverse Stock Split.

| (1) | There will be no change to the 100,000,000 authorized shares

of common stock of the Company as a result of the Reverse Stock Split. |

| (2) | The exercise price of the pre-funded warrants has already

been paid to the Company in full and such warrants are exercisable until they are exercised in full and have no expiration date. |

| (3) | Includes warrants to purchase (a) 2,564,000 shares of common

stock with an exercise price of $5.00 per share and an expiration date of February 23, 2026; (b) 63,658 shares of common stock with an

exercise price of $5.28 per share and an expiration date of May 2, 2025; (c) 25,000 shares of common stock with an exercise price of

$7.07 per share and an expiration date of August 2, 2024; (d) 2,500,000 shares of common stock with an exercise price of $7.50 per share

and an expiration date of August 23, 2026; (e) 6,001,250 shares of common stock with an exercise price of $11.50 per share and an expiration

date of November 6, 2025; and (f) 6,132,076 shares of common stock with an exercise price of $1.06 per share and an expiration date of

January 20, 2028. |

| (4) | Includes options to purchase (a) 50,000 shares of common

stock with an exercise price of $2.49 per share and an expiration date of December 3, 2030; (b) 1,580,000 shares of common stock with

an exercise price of $4.43 per share and an expiration date of February 26, 2031; (c) 436,000 shares of common stock with an exercise

price of $7.56 per share and an expiration date of August 3, 2031; (d) 675,000 shares of common stock with an exercise price of $3.95

per share and an expiration date of December 8, 2031; and (e) 518,121 shares of common stock with an exercise price of $1.36 per share

and an expiration date of August 19, 2032. |

Employee Plans, Options,

Restricted Stock Awards and Convertible or Exchangeable Securities. Pursuant to the terms of the 2022 Omnibus Incentive Plan and 2020

Omnibus Incentive Plan (collectively, the “Plans”), the Board or a committee thereof, as applicable, will adjust the

number of shares of common stock available for future grant under the Plans, the number of shares of common stock underlying outstanding

awards, the exercise price per share of outstanding stock options, and other terms of outstanding awards issued pursuant to the Plans,

as well as certain issuance limits set forth in the Plans, to equitably reflect the effects of the Reverse Stock Split. Based upon the

Reverse Stock Split ratio determined by the Board, proportionate adjustments are also generally required to be made to the per share exercise

price and the number of shares of common stock issuable upon the exercise or conversion of outstanding options, and any convertible or

exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of common stock. This would result in

approximately the same aggregate price being required to be paid under such options, and convertible or exchangeable securities upon exercise,

and approximately the same value of shares of common stock being delivered upon such exercise, exchange or conversion, immediately following

the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares of common stock subject to

restricted stock awards will be similarly adjusted, subject to our treatment of fractional shares of common stock. The number of shares

of common stock reserved for issuance pursuant to these securities and our Plans will be adjusted proportionately based upon the Reverse

Stock Split ratio determined by the Board of Directors, subject to our treatment of fractional shares of common stock. See also the table

above.

Warrants. As a result

of the Reverse Stock Split, the number of shares of common stock issuable upon exercise of each outstanding warrant to purchase shares

of common stock of the Company, including, but not limited to, our publicly traded warrants, will decrease in proportion to the final

reverse stock ratio approved by the Board in connection with the Reverse Stock Split and the exercise price of each outstanding warrant

to purchase shares of common stock will increase in proportion to the final reverse stock ratio approved by the Board in connection with

the Reverse Stock Split, such that the aggregate exercise price payable upon exercise of each outstanding warrant to purchase shares of

common stock of the Company will remain the same both before and after the Reverse Stock Split. See also the table above.

Listing. Our shares

of common stock currently trade on the Nasdaq Capital Market. The Reverse Stock Split will not directly affect the listing of our common

stock on the Nasdaq Capital Market, although we believe that the Reverse Stock Split could potentially increase our stock price, facilitating

compliance with Nasdaq’s minimum bid price listing requirement. Following the Reverse Stock Split, our common stock will continue

to be listed on the Nasdaq Capital Market under the symbol “ATNF,” although our common stock is expected to have a

new CUSIP number, a number used to identify our common stock. The Reverse Stock Split will have no effect on our publicly traded warrants,

which will continue to trade on the Nasdaq Capital Market under the symbol “ATNFW”, except for proportional adjustments

to the number of shares of common stock issuable upon exercise thereof and to the exercise price thereof, and expected adjustments to

the trading price thereof mirroring the Reverse Stock Split ratio which will affect our common stock.

“Public Company”

Status. Our common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the “public

company” periodic reporting and other requirements of the Exchange Act. The proposed Reverse Stock Split will not affect our

status as a public company or this registration under the Exchange Act. The Reverse Stock Split is not intended as, and will not have

the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act.

Odd Lot Transactions.

It is likely that some of our stockholders will own “odd-lots” of less than 100 shares of common stock following

the Reverse Stock Split. A purchase or sale of less than 100 shares of common stock (an “odd lot” transaction) may

result in incrementally higher trading costs through certain brokers, particularly “full service” brokers, and generally

may be more difficult than a “round lot” sale. Therefore, those stockholders who own less than 100 shares of common stock

following the Reverse Stock Split may be required to pay somewhat higher transaction costs and may experience some difficulties or delays

should they then determine to sell their shares of common stock.

Authorized but Unissued

Shares; Potential Anti-Takeover Effects. Our Certificate of Incorporation presently authorizes 100,000,000 shares of common stock

and 5,000,000 shares of blank check preferred stock, a total of one (1) of which authorized shares of preferred stock is designated as

the “Class C Special Voting Share” (the “Class C Special Voting Share”); one (1) of which authorized shares

of preferred stock is designated as the “Class K Special Voting Share” (the “Class K Special Voting Share,”

and together with the Class C Voting Share, the “Special Voting Shares”); and one million (1,000,000) of which authorized

shares of preferred stock are designated as “Series A Convertible Preferred Stock” (the “Series A Shares”).

The Reverse Stock Split would not change the number of authorized shares of the common stock or blank check preferred stock as designated.

Therefore, because the number of issued and outstanding shares of common stock would decrease, the number of shares of common stock remaining

available for issuance by us in the future would increase. See also the table above.

Such additional shares would

be available for issuance from time to time for corporate purposes such as issuances of common stock in connection with capital-raising

transactions and acquisitions of companies or other assets, as well as for issuance upon conversion or exercise of securities such as

convertible preferred stock, convertible debt, warrants or options convertible into or exercisable for common stock. We believe that the

availability of the additional shares of common stock will provide us with the flexibility to meet business needs as they arise, to take

advantage of favorable opportunities and to respond effectively in a changing corporate environment. For example, we may elect to issue

shares of common stock to raise equity capital, to make acquisitions through the use of stock, to establish strategic relationships with

other companies, to adopt additional employee benefit plans or reserve additional shares of common stock for issuance under such plans,

where the Board determines it advisable to do so, without the necessity of soliciting further stockholder approval, subject to applicable

stockholder vote requirements under Delaware law and Nasdaq rules. If we issue additional shares of common stock for any of these purposes,

the aggregate ownership interest of our current stockholders, and the interest of each such existing stockholder, would be diluted, possibly

substantially.

The additional shares of our

common stock that would become available for issuance upon an effective Reverse Stock Split could also be used by us to oppose a hostile

takeover attempt or delay or prevent a change of control or changes in or removal of our management, including any transaction that may

be favored by a majority of our stockholders or in which our stockholders might otherwise receive a premium for their shares of common

stock over then-current market prices or benefit in some other manner. Although the increased proportion of authorized but unissued shares

of common stock to issued shares of common stock could, under certain circumstances, have an anti-takeover effect, the Reverse Stock Split

is not being proposed in order to respond to a hostile takeover attempt or to an attempt to obtain control of the Company.

The Reverse Stock Split will

also have no effect on our designated preferred stock, except for automatic adjustments to the voting and conversion rights associated

therewith in proportion to the Board approved Reverse Stock Split ratio, in order for such voting and conversion rights to remain proportional

to the common stock of the Company following the Reverse Stock Split. For example, the Reverse Stock Split will have the effect of reducing

the voting rights of the Company’s Class K Special Voting Shares in proportion to the final ratio of the Reverse Stock Split approved

by the Board which will result in the Class K Special Voting Shares continuing to have the same proportional total voting rights

before and after the Reverse Stock Split (see also the table above).

Fractional Shares

We will not issue fractional

certificates for post-Reverse Stock Split shares of common stock in connection with the Reverse Stock Split. To the extent any holders

of pre-Reverse Stock Split shares of common stock are entitled to fractional shares of common stock as a result of the Reverse

Stock Split, the Company will issue an additional share to all holders of fractional shares of common stock.

Determination of the Reverse Stock Split Ratio

The

Board believes that stockholder approval of an amendment that gives the board the discretion to implement a reverse stock split at a ratio

of between one-for-four and one-for-twenty, inclusive, for the potential Reverse Stock Split is advisable and in the best interests of

our Company and stockholders because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented.

We believe that the proposed Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse

Stock Split. The Reverse Stock Split ratio to be selected by our Board will be not more than one-for-twenty, nor less than one-for-four.

The Company will publicly announce the chosen ratio at least five business days prior to the effectiveness of the Reverse Stock Split

and the Reverse Stock Split will be implemented by the one-year anniversary of the date on which the Special Meeting is held, if at all.

The

selection of the specific Reverse Stock Split ratio will be based on several factors, including, among other things:

| ● | our

ability to maintain the listing of our common stock on The Nasdaq Capital Market; |

| ● | the

per share price of our common stock immediately prior to the Reverse Stock Split; |

| ● | the

expected stability of the per share price of our common stock following the Reverse Stock Split; |

| ● | the

likelihood that the Reverse Stock Split will result in increased marketability and liquidity of our common stock; |

| ● | prevailing

market conditions; |

| ● | general

economic conditions in our industry; and |

| ● | our

market capitalization before and after the Reverse Stock Split |

We

believe that granting our Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take these

factors into consideration and to react to changing market conditions.

Potential Consequences if the Reverse Stock Split Proposal is

Not Approved

If

the Reverse Stock Split is not approved by our stockholders, our Board will not have the authority to effect the Reverse Stock Split to,

among other things, facilitate the continued listing of our common stock on The Nasdaq Capital Market by increasing the per share trading

price of our Common Stock to help ensure a share price high enough to satisfy the $1.00 per share minimum bid price requirement. Any inability

of our Board to effect the Reverse Stock Split could expose us to delisting from The Nasdaq Capital Market.

Effective Date and Time of the Reverse Stock Split

If

the Reverse Stock Split is approved by our stockholders, the Reverse Stock Split would become effective, if at all, when the amendment

to our Certificate of Incorporation to affect the Reverse Stock Split is accepted and recorded by the office of the Secretary of State

of the State of Delaware, or such later effective date and time as set forth in the amendment (the Effective Date). However, notwithstanding

approval of the Reverse Stock Split by our stockholders, the Board will have the sole authority to elect whether or not and when (prior

to December 15, 2023, the one-year anniversary of the Special Meeting) to amend our Certificate of Incorporation to effect the Reverse

Stock Split.

No Dissenters’ Rights

Under Delaware law, our stockholders

would not be entitled to dissenters’ rights or rights of appraisal in connection with the implementation of the Reverse Stock Split,

and we will not independently provide our stockholders with any such rights.

Certain United States Federal Income Tax Consequences

The following is a summary

of certain U.S. federal income tax consequences of the Reverse Stock Split that are applicable to United States holders (as defined below).

It does not address any state, local or non-U.S. income or other tax consequences, or any U.S. federal estate, gift, or other non-income tax

consequences. The discussion is based on the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”),

Treasury Regulations promulgated under the Internal Revenue Code, published rulings and procedures of the Internal Revenue Service, and

court decisions, all as of the date hereof. These authorities are subject to change or differing interpretation, possibly on a retroactive

basis. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the U.S. federal

income tax consequences of the Reverse Stock Split.

This discussion does not address

all U.S. federal income tax consequences relevant to United States holders of common stock. In addition, it does not address consequences

relevant to United States holders that are subject to special U.S. tax rules, including, without limitation, stockholders that are:

| ● | persons who do not hold their common stock as a “capital

asset” within the meaning of Section 1221 of the Internal Revenue Code; |

| ● | brokers or dealers in securities; |

| ● | banks or other financial institutions; |

| ● | “real estate investment trusts”; |

| ● | “regulated investment companies”; |

| ● | tax-exempt organizations; |

| ● | governments, agencies or instrumentalities thereof, or entities

they control; |

| ● | partnerships, grantor trusts or other entities that are treated

as pass-through entities for U.S. federal income tax purposes, and their owners; |

| ● | persons who are subject to the alternative minimum tax provisions

of the Internal Revenue Code; |

| ● | persons who hold their shares as part of a hedge, wash sale,

synthetic security, conversion transaction, or other integrated transaction; |

| ● | persons that have a functional currency other than the U.S.

dollar; |

| ● | traders in securities who elect to apply a mark-to-market

method of accounting; |

| ● | persons who hold shares of common stock that may constitute

“qualified small business stock” under Section 1202 of the Internal Revenue Code or “Section 1244 stock” for

purposes of Section 1244 of the Internal Revenue Code; |

| ● | persons who acquired their shares of stock in a transaction

subject to the gain rollover provisions of Section 1045 of the Internal Revenue Code; |

| ● | persons subject to special tax accounting rules as a result

of any item of gross income with respect to common stock being taken into account in an “applicable financial statement”

(as defined in the Internal Revenue Code); |

| ● | persons deemed to sell common stock under the constructive

sale provisions of the Internal Revenue Code; |

| ● | persons who acquired their shares of common stock pursuant

to the exercise of options or otherwise as compensation or through a tax-qualified retirement plan or through the exercise of a warrant

or conversion rights under convertible instruments; and |

| ● | certain expatriates or former citizens or long-term residents

of the United States. |

Stockholders subject to any

of the special U.S. tax rules that are described in this paragraph are urged to consult their own tax advisors regarding the consequences

to them of the Reverse Stock Split.

If an entity that is treated

as a partnership for U.S. federal income tax purposes holds common stock, the U.S. federal income tax treatment of a partner in the partnership

will generally depend upon the status of the partner, the activities of the partnership and certain determinations made at the partner

level. If you are a partnership or a partner of a partnership holding common stock or any other person not addressed by this discussion,

you should consult your tax advisors regarding the tax consequences of the Reverse Stock Split.

Consequences to United States holders of the Reverse Stock Split

— Generally.

A United States holder, as

used herein, is a stockholder that is, for United States federal income tax purposes: (a) a citizen or individual resident of the

United States, (b) a corporation or any other entity taxable as a corporation created or organized in or under the laws of the United

States, any state thereof, or the District of Columbia, (c) an estate whose income is subject to United States federal income tax

regardless of its source, or (d) a trust, if either (i) a United States court can exercise primary supervision over the trust’s

administration and one or more United States persons (within the meaning of Section 7701(a)(30) of the Internal Revenue Code) are

authorized to control all substantial decisions of the trust or (ii) the trust was in existence on August 20, 1996 and has a

valid election in effect under applicable Treasury Regulations to be treated as a United States person for U.S. federal income tax purposes.

The Reverse Stock Split should

constitute a “recapitalization” for U.S. federal income tax purposes. Accordingly, except for adjustments that may

result from the treatment of fractional shares of common stock as described below, no gain or loss should be recognized by a United States

holder upon such United States holder’s exchange of pre-Reverse Stock Split shares of common stock for post-Reverse Stock

Split shares of common stock pursuant to the Reverse Stock Split. The aggregate adjusted basis of the post-Reverse Stock Split shares

of common stock received should equal the aggregate adjusted basis of the pre-Reverse Stock Split shares of common stock exchanged

for such new shares (increased by any income or gain recognized on receipt of a whole share in lieu of a fractional share). Except in

the case of any portion of a share of common stock treated as a distribution or as to which a United States holder recognizes capital

gain as a result of the treatment of fractional shares, discussed below, the United States holder’s holding period for the post-Reverse

Stock Split shares of common stock should include the period during which the United States holder held the pre-Reverse Stock

Split shares of common stock surrendered. The Treasury Regulations provide detailed rules for allocating the tax basis and holding period

of the pre-Reverse Stock Split shares of common stock surrendered to the post-Reverse Stock Split shares of common stock received

pursuant to the Reverse Stock Split. United States holders of shares of common stock acquired on different dates and at different prices

should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

The treatment of fractional

shares of common stock being rounded up to the next whole share is uncertain, and a United States holder that receives a whole share of

common stock in lieu of a fractional share of common stock may recognize income, which may be characterized as either capital gain or

as a dividend, in an amount not to exceed the excess of the fair market value of such whole share over the fair market value of the fractional

share to which the United States holder was otherwise entitled. The holding period for the portion of a share of common stock treated

as a distribution or as to which a United States holder recognizes gain might not include the holding period of pre-Reverse Stock

Split shares of common stock surrendered. United States holders should consult their tax advisors regarding the U.S. federal income tax

and other tax consequences of fractional shares being rounded to the next whole share.

Exchange of Stock Certificates

As of the Effective Date,

each certificate representing shares of our common stock outstanding before the Reverse Stock Split will be deemed, for all corporate

purposes, to evidence ownership of the reduced number of shares of our common stock resulting from the Reverse Stock Split. All shares

underlying options, warrants and other securities exchangeable or exercisable for or convertible into common stock also automatically

will be adjusted on the Effective Date.

Our transfer agent, Continental

Stock Transfer & Trust Company, will act as the exchange agent for purposes of exchanging stock certificates subsequent to the Reverse

Stock Split. Shortly after the Effective Date, stockholders of record will receive written instructions requesting them to complete and

return a letter of transmittal and surrender their old stock certificates for new stock certificates reflecting the adjusted number of

shares as a result of the Reverse Stock Split. Certificates representing shares of common stock issued in connection with the Reverse

Stock Split will continue to bear the same restrictive legends, if any, that were borne by the surrendered certificates representing the

shares of common stock outstanding prior to the Reverse Stock Split. No new certificates will be issued until such stockholder has surrendered

any outstanding certificates, together with the properly completed and executed letter of transmittal, to the exchange agent. Until surrendered,

each certificate representing shares of common stock outstanding before the Reverse Stock Split would continue to be valid and would represent

the adjusted number of shares of common stock, based on the ratio of the Reverse Stock Split.

Any stockholder whose stock

certificates are lost, destroyed or stolen will be entitled to a new certificate or certificates representing post-Reverse Stock Split

shares of common stock upon compliance with the requirements that we and our transfer agent customarily apply in connection with lost,

destroyed or stolen certificates. Instructions as to lost, destroyed or stolen certificates will be included in the letter of instructions

from the exchange agent.

Upon the Reverse Stock Split,

we intend to treat stockholders holding our common stock in “street name,” through a bank, broker or other nominee,

in the same manner as registered stockholders whose shares of common stock are registered in their names. Banks, brokers and other nominees

will be instructed to effect the Reverse Stock Split for their beneficial holders holding our common stock in “street name.”

However, such banks, brokers and other nominees may have different procedures than registered stockholders for processing the Reverse

Stock Split. If you hold your shares in “street name” with a bank, broker or other nominee, and if you have any questions

in this regard, we encourage you to contact your bank, broker or nominee.

YOU SHOULD NOT DESTROY

YOUR STOCK CERTIFICATES AND YOU SHOULD NOT SEND THEM NOW. YOU SHOULD SEND YOUR STOCK CERTIFICATES ONLY AFTER YOU HAVE RECEIVED INSTRUCTIONS

FROM THE EXCHANGE AGENT AND IN ACCORDANCE WITH THOSE INSTRUCTIONS.

If any certificates for shares

of common stock are to be issued in a name other than that in which the certificates for shares of common stock surrendered are registered,

the stockholder requesting the reissuance will be required to pay to us any transfer taxes or establish to our satisfaction that such

taxes have been paid or are not payable and, in addition, (a) the transfer must comply with all applicable federal and state securities

laws, and (b) the surrendered certificate must be properly endorsed and otherwise be in proper form for transfer.

Book-Entry Shares

The Company’s registered

stockholders may hold some or all of their shares electronically in book-entry form with our transfer agent. These stockholders do not

have stock certificates evidencing their ownership of common stock. They are, however, provided with a statement reflecting the number

of shares of common stock registered in their accounts. If you hold registered shares of common stock in book-entry form, you do not need

to take any action to receive your post-Reverse Stock Split shares of common stock in registered book-entry form.

Interests of Directors and Executive Officers

Our directors and executive

officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal except to the extent of their

ownership of shares of our common stock and equity awards granted to them under our equity incentive plans.

Vote Required

Proposal 1 requires the affirmative vote of the

holders of a majority of the outstanding stock of the Company entitled to vote thereon. Abstentions and broker non-votes, if any, will

have the same effect as a vote against Proposal 1.

Board Recommendation

The Board recommends that

you vote “FOR” Proposal 1 to amend the Company’s Certificate of Incorporation to effect a reverse stock split

of the Company’s issued and outstanding common stock by a ratio of between one-for-four and one-for-twenty, inclusive.

PROPOSAL 2

ADJOURNMENT OF THE SPECIAL MEETING TO SOLICIT ADDITIONAL PROXIES

Overview

We are asking you to approve

a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to solicit additional proxies if there are insufficient

votes to adopt the Reverse Stock Split at the time of the Special Meeting (the “Adjournment Proposal”). We intend to

move to adjourn the Special Meeting to enable our Board to solicit additional proxies for approval of the Reverse Stock Split if, at the