180 Degree Capital Corp. Commits to Invest in the Combination of B. Riley Principal Merger Corp. and Alta Equipment Holdings,...

January 23 2020 - 9:00AM

180 Degree Capital Corp. (NASDAQ:TURN) (“180” and the “Company”),

today announced that it has committed to invest $4 million in B.

Riley Principal Merger Corp. (“BRPM”), a blank check corporation,

in conjunction with BRPM’s merger with Alta Equipment Holdings,

Inc. (“Alta”), a provider of premium materials handling equipment,

construction equipment, cranes, warehouse solutions, power

generation equipment, and contractors’ rental equipment. Alta

operates a branch network of locations in the US Midwest and

Northeast that offers its customers a one-stop-shop for most of

their equipment needs by providing sales, parts, service, and

rental functions under one roof. The merger has been approved by

the Board of Directors of each company. The transaction, including

180’s investment, is currently expected to close in the first

quarter of 2020, subject to regulatory and shareholder approvals.

“We are excited to participate in the public

listing of Alta through its merger with BRPM,” said Kevin M.

Rendino, Chief Executive Officer of 180 Degree Capital Corp. “We

are impressed by Alta’s management team, the company’s expansion

from distribution of industrial forklifts to other industrial and

construction equipment, and the overall growth of the business to

date. We look forward to the completion of the merger and to

becoming a shareholder of Alta should shareholders of BRPM approve

the transaction.”

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 and its holdings

can be found on its website at www.180degreecapital.com.

Press Contact:Daniel B. Wolfe180 Degree Capital

Corp.973-746-4500

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 is not responsible for the contents of third party

websites.

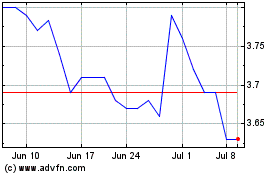

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Mar 2024 to Apr 2024

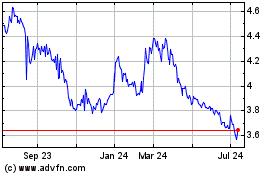

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Apr 2023 to Apr 2024