Pound Higher On Strong U.K. Services PMI

March 03 2023 - 4:55AM

RTTF2

The pound advanced against its most major counterparts in the

European session on Friday, as the nation's service sector returned

to growth in February, reducing concerns over a recession.

Data from S&P Global and the Chartered Institute of

Procurement & Supply showed that U.K. composite PMI rose to

53.1 in February from 48.5 in January.

U.K. services PMI climbed to 53.5 in February, slightly above

the flash reading of 53.3 and up from 48.7 in January. Economists

had forecast a score of 53.

Strong service sector data from Asia and Europe further

underpinned risk sentiment.

Comments from Atlanta Fed President Raphael Bostic that he

supported a "slow and steady" path of interest rate hikes eased

concerns about the rate outlook.

The pound climbed to 1.2017 against the greenback and 1.1273

against the franc, from an early low of 1.1938 and a 4-day low of

1.1224, respectively. The currency is seen facing resistance around

1.24 against the greenback and 1.22 against the franc.

The pound was up against the euro, at a 2-day high of 0.8840.

Next near term resistance for the currency is likely seen around

the 0.86 level.

In contrast, the pound was lower against the yen and was trading

at 163.12. Should the currency slides further, 161.00 is likely

seen as its next support level.

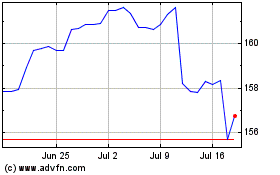

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

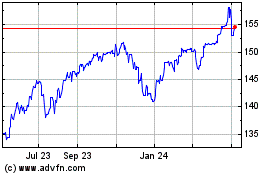

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024