Indian Rupee Drops Against U.S. Dollar After RBI Rate Cut

April 03 2019 - 11:18PM

RTTF2

The Indian rupee declined against the U.S. dollar in the morning

session on Thursday, after the Reserve Bank of India reduced the

key interest rate and lowered the growth and inflation outlook.

The RBI slashed its repo rate by 25 basis points to 6 percent,

in line with economists' expectations.

The reverse repo rate was lowered to 5.75 percent and the

marginal standing facility rate was cut to 6.25 percent.

The Monetary Policy Committee decided to maintain the neutral

monetary policy stance, the RBI said.

"These decisions are in consonance with the objective of

achieving the medium-term target for consumer price index (CPI)

inflation of 4 per cent within a band of +/- 2 per cent, while

supporting growth," the bank said.

The rupee declined to 69.03 against the greenback from

yesterday's closing value of 68.64. Next key support for the rupee

is seen around the 71.00 region.

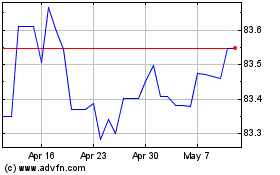

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

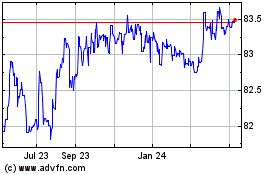

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024