Australian Dollar Rises On RBA's Surprise Rate Hike

May 01 2023 - 11:07PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Tuesday, after Australia's

central bank unexpectedly raised its benchmark interest rate by a

quarter-point.

The monetary board of the Reserve Bank of Australia decided to

hike the cash rate target by 25 basis points to 3.85 percent.

Markets widely expected the apex bank to leave the rate unchanged

today.

The board also lifted the rate paid on Exchange Settlement

balances by 25 basis points to 3.75 percent.

"Given the importance of returning inflation to target within a

reasonable timeframe, the Board judged that a further increase in

interest rates was warranted today," Governor Philip Lowe said.

In the Asian trading today, the Australian dollar rose to nearly

a 2-1/2-month high of 92.39 against the yen and a 1-week high of

1.0832 against the NZ dollar, from early lows of 90.36 and 1.0725,

respectively. If the aussie extends its uptrend, it is likely to

find resistance around 94.00 against the yen and 1.09 against the

kiwi.

Against the euro, the U.S. dollar and the Canadian dollar, the

aussie advanced to near 2-week highs of 1.6377, 0.6709 and 0.9078

from early lows of 1.6583, 0.6620 and 0.8969, respectively. The

aussie may test resistance around 1.61 against the euro, 0.69

against the greenback and 0.91 against the loonie.

The other antipodean currency of Australia, the New Zealand

dollar, also strengthened after the unexpected rate hike from

RBA.

The NZ dollar rose to near a 5-month high of 85.35 against the

yen and near a 2-week high of 1.7728 against the euro, from early

lows of 84.69 and 1.7801, respectively. If the kiwi extends its

uptrend, it is likely to find resistance around 88.00 against the

yen and 1.74 against the euro.

Against the U.S. dollar, the kiwi edged up to 0.6197 from an

early low of 0.6163. The kiwi may test resistance around the 0.64

area.

Looking ahead, Swiss consumer confidence for the second quarter,

manufacturing PMI reports from European countries for April and

Eurozone flash CPI for April are due in the European session.

In the New York session, U.S. factory orders for March is slated

for release.

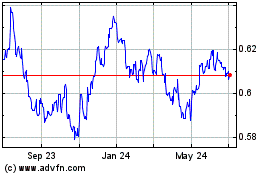

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

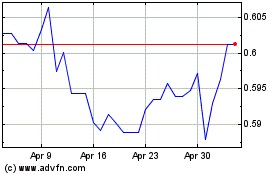

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024