Pound Weakens After BoE Decision

March 17 2022 - 6:09AM

RTTF2

The pound fell against its major counterparts in the European

session on Thursday, after the Bank of England raised its key rate

by 25 basis points, as expected.

Policymakers led by Governor Andrew Bailey decided to increase

the key interest to 0.75 percent from 0.50 percent.

The Monetary Policy Committee voted by a majority of 8-1 to hike

the Bank Rate by 0.25 percentage points. One member preferred to

maintain the rate at 0.5 percent.

"The Committee judges that some further modest tightening in

monetary policy may be appropriate in the coming months, but there

are risks on both sides of that judgement depending on how

medium-term prospects for inflation evolve," the bank said.

The BoE expects inflation to rise further in coming months, to

around 8 percent in the second quarter of 2022, and perhaps even

higher later this year.

The bank said the effects of Russia's invasion of Ukraine would

likely accentuate both the peak in inflation and the adverse impact

on activity by intensifying the squeeze on household incomes.

The currency showed mixed trading against its key counterparts

in the Asian session. While it rose against the yen and the franc,

it held steady against the euro and the greenback.

The pound retreated to 1.3096 against the greenback, from a

10-day high of 1.3211 seen at 7:45 am ET. The pair had finished

Wednesday's deals at 1.3147. The currency is likely to find support

around the 1.28 level.

The pound weakened to 155.46 against the yen, after touching

156.70 at 7:45 am ET, which was its highest level since February

23. The pair was valued at 156.07 when it ended trading on

Wednesday. If the pound slides further, 153.00 is possibly seen as

its next support level.

Data from the Cabinet Office showed that Japan core machine

orders climbed 5.1 percent on year in January - coming in at 899.6

billion yen.

That was shy of expectations for an increase of 8.1 percent but

was unchanged from December's annual reading.

The pound edged down to 1.2306 against the franc, dropping from

nearly a 3-week high of 1.2415 set at 7:45 am ET. At Wednesday's

close, the pair was worth 1.2354. The pound is seen finding support

around the 1.21 level.

Data from the Federal Customs Administration showed that

Switzerland's exports grew for a second straight month and at a

faster pace in February, while imports declined.

Exports grew by a real 8.1 percent month-on-month in February,

following a 2.0 percent rise in January.

The pound touched a 2-day low of 0.8444 against the euro, down

from a 3-day high of 0.8367 hit at 7:45 am ET. The pound had ended

yesterday's trading session at 0.8389 against the euro. On the

downside, 0.86 is possibly seen as its next support level.

Final data from Eurostat showed that Eurozone inflation rose

more than initially estimated in February.

Inflation advanced to a fresh record high 5.9 percent in

February from 5.1 percent in January. The rate was revised up from

5.8 percent.

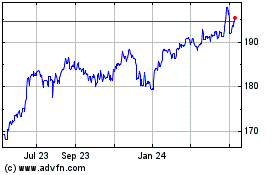

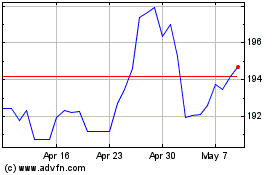

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024