Pound Falls On BoE Disappointment

November 05 2021 - 2:09AM

RTTF2

The pound dropped against its major counterparts in the European

session on Friday in the wake of the latest monetary policy

decision from the Bank of England to keep rate on hold,

disappointing some investors who had expected a hike to contain

inflation.

The BoE kept the bank rate unchanged at 0.10 percent and the QE

program at GBP 875 billion.

Dave Ramsden and Michael Saunders called for an increase in the

bank rate by 15 basis points to 0.25 percent.

Policymakers noted that there was considerable uncertainty about

the near-term outlook for the labor market, as over a million jobs

were expected to have been furloughed immediately before the

Coronavirus Job Retention Scheme closed at the end of

September.

The decision shocked investors as surging energy and food prices

have led to a spike in inflation, exceeding the BoE's target.

Governor Andrew Bailey said that inflation was being driven by

global "supply shocks" instead of demand pressure in the

economy.

The pound weakened to 1.3438 against the dollar, its lowest

level since October 1. The pound is likely to challenge support

around the 1.31 level.

The pound touched near a 9-month low of 1.2278 against the

franc, from yesterday's close of 1.2303. On the downside, 1.20 is

likely seen as the next support for the pound.

The pound was down against the euro, at a 5-week low of 0.8590.

Next key support for the pound is seen around the 0.88 level.

The pound hit more than a 3-week low of 152.85 against the yen,

from Thursday's close of 153.51. The pound is poised to challenge

support around the 150.00 mark.

Looking ahead, U.S. and Canadian jobs data for October, U.S.

consumer credit for September and Canada Ivey PMI for October will

be published in the New York session.

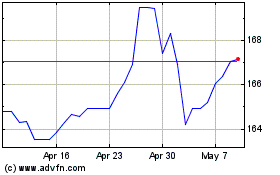

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024