Pound Appreciates On U.K. Reopening Optimism

July 07 2021 - 5:09AM

RTTF2

The pound climbed against its major counterparts in the European

session on Wednesday, as continued optimism over the lifting of

virus restrictions in the U.K. and a stabilization in U.S. bond

yields underpinned risk sentiment.

Prime Minister Boris Johnson on Monday announced plans to end

lockdown on July 19, which includes removal of mandates to wear

face masks and comply social distancing rules.

All restrictions on indoor or outdoor gatherings will end, while

limits on numbers at weddings and funerals will be removed.

Instructions to work from home will be scrapped. A final

decision will be announced on July 12.

European shares rose ahead of the Fed minutes due later in the

day.

U.S. Treasury yields stabilized after a fall on Tuesday in the

wake of a slowdown in U.S. service sector growth in June.

Weaker U.S. data tempered bets on a faster tightening of

monetary policy.

Data from Lloyds Bank subsidiary Halifax and IHS Markit showed

that UK house prices dropped for the first time in five months in

June as the government phases out stamp duty holiday.

House prices decreased 0.5 percent on a monthly basis in June,

reversing a 1.2 percent rise in May. The property prices averaged

GBP 260,358.

The pound rebounded from its early 5-day lows of 0.8583 against

the euro and 1.2721 against the franc and rose to 0.8544 and

1.2776, respectively. If the pound continues its uptrend, 0.84 and

1.30 are possibly seen as its next resistance levels against the

euro and the franc, respectively.

The pound edged up to 1.3842 against the greenback and 153.17

against the yen, off its prior low of 1.3777 and more than a 2-week

low of 152.33, respectively. The pound is seen finding resistance

around 1.40 against the greenback and 156.00 against the yen.

Looking ahead, the Fed minutes from the June 15-16 meeting are

set for release at 2:00 pm ET.

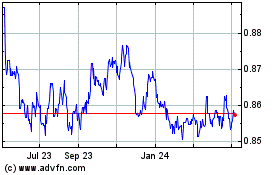

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

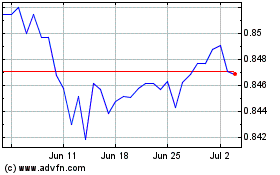

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024