Pound Slides As Boris Johnson Heads To Win UK Leadership Contest

June 21 2019 - 3:43AM

RTTF2

The pound weakened against its major counterparts in the

European session on Friday, as odds of Boris Johnson winning the

U.K. leadership race for the Conservative Party intensified, after

the former Foreign Secretary extended his commanding lead in the

contests to succeed May.

The contest has come down to two, either Johnson or Jeremy Hunt,

who will now face off in a vote among the U.K.'s Conservative Party

members, with the results set to be announced in the week of July

22.

Markets are putting a 85 percent chance of Johnson win in the

Conservative Party leadership contest.

Data from the Office for National Statistics showed that UK net

borrowing decreased in May, but was more than economists' had

expected.

The public sector net borrowing, or PSNB, excluding banks fell

to GBP 5.1 billion from GBP 6.8 billion in April. Economists had

forecast GBP 4.2 billion borrowing.

The currency traded mixed against its major counterparts in the

Asian session. While it held steady against the franc and the euro,

it fell against the yen. Against the greenback, it rose.

The pound dropped to a 3-day low of 0.8933 against the euro from

Thursday's closing value of 0.8889. The next possible support for

the pound is seen around the 0.92 level.

Flash survey data from IHS Markit showed that Germany's private

sector growth remained unchanged in June.

The flash composite purchasing managers' index, or PMI, showed a

reading of 52.6 in June, same as seen in May. Economists had

forecast a reading of 52.5.

The U.K. currency edged lower to 1.2652 against the greenback,

from a high of 1.2725 hit at 10:00 pm ET. On the downside, 1.24 is

probably seen as the next support level for the pound.

The pound declined to 1.2428 against the franc, its lowest since

January 10. If the pound falls further, 1.23 is likely seen as its

next possible support level.

The pound that closed Thursday's trading at 136.29 against the

yen fell to a 2-day low of 135.97. The pound is seen finding

support around the 133.00 level.

Data from the Ministry of Communications and Internal Affairs

showed that Japan consumer prices increased 0.7 percent on year in

May.

That was in line with expectations and down from 0.9 percent in

April.

Looking ahead, Canada retail sales for April, U.S. existing home

sales for May and Markit's services PMI for June will be out in the

New York session.

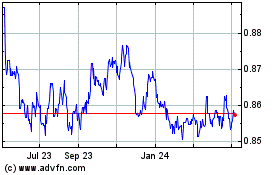

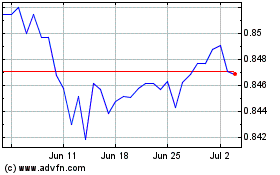

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024