Australian Dollar Retreats After RBA Rate Hike

July 04 2022 - 11:04PM

RTTF2

The Australian dollar pulled back from its early highs against

its major counterparts in the Asian session on Tuesday, after the

Reserve Bank of Australia raised its key interest rate by half

percentage points, in line with forecasts.

The policy board of the RBA, headed by Governor Philip Lowe,

decided to lift the cash rate target by 50 basis points to 1.35

percent from 0.85 percent.

The resilience of the economy and the higher inflation mean that

this extraordinary support is no longer needed, Lowe said in a

statement.

The bank expects to take further steps in the process of

normalizing monetary conditions in Australia over the months

ahead.

Lowe said the size and timing of future interest rate increases

will be guided by the incoming data and the Board's assessment of

the outlook for inflation and the labor market.

The aussie dropped to 0.6852 against the greenback and 0.8809

against the loonie, reversing from its early 4-day highs of 0.6895

and 0.8859, respectively. The aussie is likely to find support

around 0.67 against the greenback and 0.86 against the loonie.

After climbing to 5-day highs of 93.99 against the yen and

1.1079 against the kiwi in previous deals, the aussie retreated to

93.31 and 1.1036, respectively. The currency may face support

around 92.00 against the yen and 1.08 against the kiwi.

The aussie edged down to 1.5222 against the euro, from a 5-day

high of 1.5130 seen at 9:30 pm ET. On the downside, 1.55 is

possibly seen as its next support level.

Looking ahead, PMI reports from major European economies are due

in the European session.

The Bank of England publishes the Financial Stability Report at

5:30 am ET.

Canada building permits and U.S. factory orders for May will be

released in the New York session.

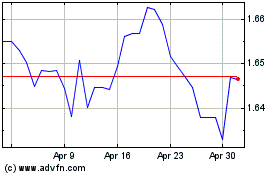

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

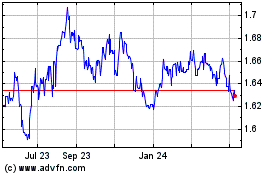

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024