Australian, NZ Dollars Higher Amid Risk Appetite

January 09 2023 - 12:19AM

RTTF2

The Australian and NZ dollars climbed against their major

counterparts on Monday amid risk appetite, as data showing a

slowdown in U.S. wage growth and a contraction in U.S. service

sector activity in the month of December supported expectations

that the Federal Reserve will slow the pace of rate hikes.

Although non-farm payrolls beat expectations in December, wage

growth was lower than expected, helping ease Fed rate hike

concerns.

China reopened its international borders, stopping quarantine

requirements for travelers after almost three years.

Data from the Australian Bureau of Statistics showed that

Australia building approvals slumped a seasonally adjusted 9.0

percent on month in November - coming in at 13,898.

That missed expectations for a decline of 4.0 percent following

the 6.0 percent contraction in October.

The aussie climbed to more than a 4-month high of 0.6947 against

the greenback and near a 3-week high of 91.66 against the yen, off

its early lows of 0.6874 and 90.69, respectively. The aussie is

seen facing resistance around 0.72 against the greenback and 94.00

against the yen.

The aussie advanced to a 5-day high of 0.9302 against the loonie

and near a 6-week high of 1.5386 against the euro, after falling to

0.9237 and 1.5480, respectively in early deals. The next possible

resistance for the aussie is seen around 0.96 against the loonie

and 1.49 against the euro.

The kiwi rallied to near a 2-week high of 84.59 against the yen,

3-week high of 0.6409 against the greenback and near a 3-week high

of 1.6674 against the euro, from its early lows of 83.58, 0.6328

and 1.6799, respectively. The kiwi is likely to target resistance

around 87.00 against the yen, 0.66 against the greenback and 1.62

against the euro.

The kiwi rose to 1.0821 against the aussie at 9:40 pm ET and

held steady thereafter. On the upside, 1.10 is possibly seen as its

next resistance level.

Looking ahead, Eurozone jobless rate for November is due in the

European session.

Canada building permits and U.S. consumer credit for November

will be featured in the New York session.

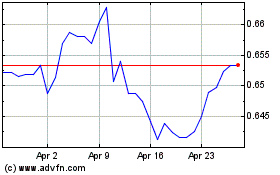

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024