Australian Dollar Declines On Global Growth Concerns

December 16 2022 - 12:20AM

RTTF2

The Australian dollar fell against its major counterparts in the

European session on Friday, as investors fear that tighter monetary

policy across the globe could lead to a recession.

Concerns over continued monetary tightening by the U.S. Federal

Reserve and other major central banks triggered fears of a slowdown

in global growth.

The U.S. Federal Reserve, the Bank of England and the European

Central Bank - all signalled that they will continue to tighten

policy going forward.

Comments from Fed Chair Powell dashed hopes for a pivot in

monetary policy despite the risk of an economic downturn.

Oil prices fell as hawkish signals from Fed and other central

banks darkened the economic outlook.

The aussie dropped to 0.6686 against the greenback and 0.9131

against the loonie, from its early highs of 0.6736 and 0.9177,

respectively. The next likely support for the aussie lies around

0.63 against the greenback and 0.885 against the loonie.

The AUD/NZD pair touched 1.0528, its lowest level in a year. The

currency may challenge support around the 1.035 level.

The EUR/AUD pair was higher, at more than a 10-month high of

1.5918. The aussie is seen finding support around the 1.62

level.

The AUD/JPY pair touched a 9-day low of 91.60. On the downside,

86.5 is likely seen as the next support level for the aussie.

Looking ahead, Eurozone CPI for November and trade data for

October are due in the European session.

Canada new housing price index for November and wholesale sales

for October will be out in the New York session.

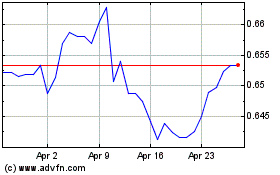

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024