Vivendi Sells Further UMG Stake to Tencent-Led Consortium for $3.68 Billion -- 2nd Update

December 18 2020 - 4:54AM

Dow Jones News

--A Tencent-led consortium will purchase an additional 10% stake

in Vivendi's Universal Music Group

--The consortium acquired an initial 10% stake in UMG in

March

--Closing and payment should take place during first half of

2021

By Mauro Orru

Vivendi SE said Friday that it is selling an additional 10%

stake in its subsidiary Universal Music Group--the music giant

behind Ariana Grande and Billie Eilish--to a consortium led by

Tencent Holdings Ltd. for 3 billion euros ($3.68 billion).

The European media giant said the agreement is based on an

enterprise value of EUR30 billion for 100% of UMG's share

capital.

Closing and payment should take place during the first half of

2021, subject to regulatory approvals.

The news comes nearly a year after Vivendi announced the first

10% stake sale to the Tencent-led consortium--which includes

Tencent's streaming business, Tencent Music Entertainment

Group--for the same price.

Under the initial agreement, which closed in March this year,

the consortium had the option to buy an additional stake of up to

10% in UMG on the same valuation basis until Jan. 15.

A separate agreement was also signed in March enabling Tencent

Music Entertainment to acquire a minority stake in the capital of

the UMG subsidiary that owns UMG's Greater China operations.

The deal bolsters Tencent's exposure to some of the biggest

names in music. Universal's stable also includes classic acts such

as Queen and the Beatles.

Bob Dylan recently sold his entire publishing catalog--including

more than 600 copyrights spanning 60 years--to Universal. While

terms of the deal weren't disclosed, the catalog is likely worth

hundreds of millions of dollars.

Tencent Music Entertainment Group went public in the U.S. in

December 2018 in one of that year's highest-profile listings.

Details of Vivendi's negotiations with Tencent emerged in August

2019, a year after the Paris-listed company said it would embark on

a search for buyers to sell up to 50% of its music subsidiary in a

bid to cash in on the music-streaming revolution.

Following Friday's agreement, Vivendi said it will continue to

work with Tencent and Tencent Music Entertainment to "broaden

artist opportunities" and promote a "thriving music and

entertainment industry."

Universal is a bright spot for Vivendi, and has long been the

leading force of sales growth at the media conglomerate along with

the Canal+ Group business.

The stake divestment provides a sizeable cash return for

Vivendi, but Citi analysts said the company has been selling out

its most attractive growth assets, while the use of the

proceeds--which have been funneled into slower-growth areas--has

disappointed.

"The harsh truth is that there is less enthusiasm for that

capital to be recycled into areas like book/magazine publishing and

travel retail," Citi analysts said.

Vivendi said cash from the two stake sales could be employed to

cut financial debt, and to finance share buybacks and

acquisitions.

The company is planning additional minority interest sales in

UMG, which it plans to list in 2022 at the latest.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

December 18, 2020 04:39 ET (09:39 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

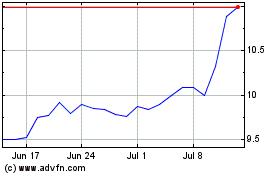

Vivendi (EU:VIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

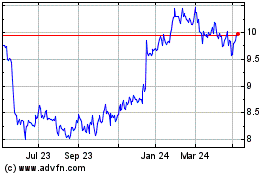

Vivendi (EU:VIV)

Historical Stock Chart

From Apr 2023 to Apr 2024