Q3 2024 Revenue: Solid organic sales growth of +2.4% Sports

division grew at a sustained pace in the most important quarter of

the year. Activity remained sluggish in flooring, particularly in

EMEA and the CIS countries

Q3 2024 Revenue:

Solid organic sales growth of +2.4%

Sports division grew at a sustained pace in the most

important quarter of the year

Activity remained sluggish in flooring, particularly in

EMEA and the CIS countries

Third quarter 2024 results

-

Organic sales growth of +2.4% compared to Q3 2023, driven

by an excellent performance in Sports and a slight increase in

North America

-

Sales prices were broadly stable over the quarter

(-0.5%)

-

Sports returned to sustained growth (i.e. +8.3% organic

growth) after a slight dip in the second quarter

-

In EMEA, sales volumes remained stable, the prices for some

products were adjusted downwards in a still slow

market

-

In North America, sales rose moderately (+0.7%) on the back

of higher volumes than in 2023, offsetting some adjustments to

selling prices

-

In the CIS and APAC regions, sales declined organically,

while Latin America reported growth over the quarter

Paris, October

18th,

2024

The Supervisory Board of Tarkett (Euronext Paris: FR0004188670

TKTT), has reviewed the Group's consolidated sales for the third

quarter of 2024.

The Group uses alternative performance indicators (not defined by

IFRS) described in detail in the appendix to this document:

|

Revenue in millions of euros |

Q3 2024 |

Q3 2023 |

Change |

Of which Organic growth |

|

EMEA |

214.1 |

209.4 |

+2.2% |

-2.2% |

|

North America |

218.7 |

228.4 |

-4.2% |

+0.7% |

|

CIS, APAC & Latin America |

155.0 |

165.6 |

-6.4% |

-2.9% |

|

Sports |

414.2 |

380.8 |

+8.8% |

+8.3% |

|

Total Group |

1 002.0 |

984.3 |

+1.8% |

+2.4% |

1. Revenue of the third

quarter 2024

Group net sales came to €1,002

million, up +1.8% compared to the third quarter of 2023. Organic

growth reached +2.4%. Sales prices remained broadly stable over the

year, with a slight decline of -0.5% compared to the third quarter

of 2023.

The EMEA segment generated

sales of €214 million, up +2.2% compared to the third quarter of

2023, including a favourable exchange rate effect of +0.7% and a

scope effect of +3.8% (integration of activities in Ukraine

previously included in the CIS zone), representing organic growth

of -2.2%. New construction and renovation projects remain limited

by the macroeconomic environment. Germany, Southern Europe and the

Netherlands reported growth over the period, while business

remained weak in France and Sweden. The selective adjustment of

certain selling prices has limited the decline in volumes and even

improved sales in certain product categories for the residential

sector.

The North America segment

posted sales of €219 million, down -4.2% compared to the third

quarter of 2023, due to a negative currency effect linked to the

depreciation of the dollar by -1.8% and a scope effect of -3.1%

(disposal of Diamond W, a flooring distribution subsidiary in

California). However, North America recorded organic growth of

+0.7%. Business volumes in the Commercial segment held up well

during the quarter, driven mainly by vinyl rolls, carpet tiles and

LVT for the education, healthcare and office sectors. The

Residential and Hospitality segments reported growth after a

particularly low level of activity in 2023. Selling prices remained

stable in the third quarter.

Sales in the CIS, APAC and Latin America

segment came to €155 million, down -6.4% compared to the

third quarter of 2023, with an organic decline in sales by -2.9%

(excluding selling price effects in CIS countries), a positive

exchange rate effect (+1.3%) and a scope effect of -4.8%

(integration of Ukraine into the EMEA segment). In Russia, which

accounts for around 7% of the Group's total sales, the market

slowed sharply, with volumes down by -16% over the quarter and -12%

over the first nine months of the year, adversely affecting organic

growth in the region. APAC was down slightly, reflecting weaker

sales in China, partly offset by good momentum in Australia. In

Latin America, volumes improved over the quarter despite the

unfavourable economic environment.

Business in the Sports segment

has been very dynamic in the third quarter despite a high basis for

comparison. Sales came to €414 million, up +8.8%, including +8.3%

organic growth compared with the third quarter of 2023. Growth was

also driven by the positive scope effect of +1.7% (acquisition in

July 2024 of Classic Turf & Tracks, specialised in the

construction of tennis courts and athletics tracks) and exchange

rate effect is negative due to the depreciation of the dollar

against the euro (-1.3%). The level of activity was particularly

good for artificial turf and running tracks in North America, and

artificial turf and hybrid fields installations in Europe were also

very buoyant.

2. Outlook for the end of 2024 and

short-term objectives

In an uncertain geopolitical and macroeconomic

context, Tarkett managed to maintain a stable level of activity

over the first nine months (-0.4% organic growth) and improved its

performance in the most important quarter of the year (+2.4%

organic growth in Q3).

The flooring market is showing no signs of

recovery, despite the reduction of interest rates. Some European

countries are still experiencing a major slowdown. The Group has

introduced measures to simplify its organisation and adapt its

production footprint to reduce fixed costs and maintain performance

in the region.

In North America, leading indicators do not

point to a rapid recovery in the Residential segment (15% of Group

sales in North America). The Commercial segments are performing

better, but there is no clear change in trend at this stage.

Nevertheless, the Group has improved its positioning and turned

around its performance in this region, which offers growth

opportunities.

In the CIS, the Russian market slowed sharply in

the first nine months of the year (down 12% in volume), and the

Group does not expect the situation to improve in the near

future.

Sports remains the most buoyant segment, driven

by a market that continues to grow, although at a slower pace than

in previous years. The Group intends to continue to strengthen its

leadership position and is ready to consider additional external

growth opportunities to extend its geographical coverage and add

complementary products to its existing portfolio.

For 2024, Tarkett’s objective is to achieve a

solid improvement in financial performance (measured by the

Adjusted EBITDA indicator) and to deliver significantly positive

free cash flow to reduce debt and continue to improve debt

leverage.

This press release may contain

forward-looking statements. These statements do not constitute

forecasts regarding results or any other performance indicator, but

rather trends or targets. These statements are by their nature

subject to risks and uncertainties as described in the Company’s

Registration Document available on its website

(https://www.tarkett-group.com/en/category/urd/).

They do not reflect the future performance of the Company, which

may differ significantly. The Company does not undertake to provide

updates to these statements.

Financial calendar

- 20 February

2025: Financial results for Q4 and FY2024 – Press release after

close of trading

- 24 April 2025:

Financial results for Q1 2025 – Press release after close of

trading

Investor Relations and Individual Shareholders

Contact

investors@tarkett.com

Contacts Media

Brunswick - tarkett@brunswickgroup.com - Tel.: +33 (0) 1 53 96 83

83

Hugues Boëton – Tel. : +33 (0)6 79 99 27 15 – Benoit Grange –

Tel. : +33 (0)6 14 45 09 26

About Tarkett

With a history of more than 140 years, Tarkett is a worldwide

leader in innovative and sustainable flooring and sports surface

solutions, generating turnover of € 3.4 billion in 2023. The Group

has close to 12,000 employees, 23 R&D centers, 8 recycling

centers and 34 production sites. Tarkett creates and manufactures

solutions for hospitals, schools, housing, hotels, offices, stores

and sports fields, serving customers in over 100 countries. To

build “The Way to Better Floors,” the Group is committed to

circular economy and sustainability, in line with its Tarkett

Human‐Conscious Design® approach. Tarkett is listed on the Euronext

regulated market (compartment B, ISIN: FR0004188670, ticker: TKTT)

www.tarkett‐group.com

Appendices

1/ Definition of alternative performance indicators (not

defined by IFRS)

- Organic growth measures the change

in net sales compared with the same period of the previous year,

excluding the effect of exchange rates and changes in the scope of

consolidation. The currency effect is obtained by applying the

previous year's exchange rates to the current year's sales and

calculating the difference with the current year's sales. It also

includes the effect of price adjustments in CIS countries designed

to offset changes in local currencies against the euro.

- The effect of changes in Group

structure comprises:

- current-year sales generated by

entities not included in the scope of consolidation over the same

period in the previous year, up to their anniversary date of

consolidation,

- the reduction in sales relating to

divested businesses, not included in the scope of consolidation for

the current year but included in sales for the same period in the

previous year, until the anniversary date of the divestment.

|

Revenue in millions of euros |

2024 Revenue |

2023 Revenue |

Change |

Of which volume |

Of which selling price |

Of which selling price in CIS |

Of which exchange rate effect |

Of which scope effect |

|

Total Group Q1 |

668.1 |

698.5 |

-4.3% |

-2.3%

|

-0.3%

|

+0.5% |

-2.2% |

+0.0% |

|

Of which organic growth |

-2.7% |

|

|

|

|

Of which selling price increase |

|

+0.2% |

|

|

|

|

|

Total Group Q2 |

890.5 |

909.8 |

-2.1% |

-1.7%

|

-0.2%

|

+0.4% |

-0.7% |

+0.0% |

|

Of which organic growth |

-1.8% |

|

|

|

|

Of which selling price increase |

|

+0.2% |

|

|

|

|

|

Total Group S1 |

1 558.7 |

1 608.3 |

-3.1% |

-2.1%

|

-0.2%

|

+0.4% |

-1.3% |

+0.0% |

|

Of which organic growth |

-2.2% |

|

|

|

|

Of which selling price increase |

|

+0.2% |

|

|

|

|

|

Total Group Q3 |

1 002.0 |

984.3 |

+1.8% |

+2.9%

|

-0.5%

|

+0.3% |

-0.8% |

-0.1% |

|

Of which organic growth |

+2.4% |

|

|

|

|

Of which selling price increase |

|

-0.2% |

|

|

|

|

|

Total Group 9M |

2 560.7 |

2 592.6 |

-1.2% |

-0.1% |

-0.3%

|

+0.4% |

-1.1% |

+0.0% |

|

Of which organic growth |

-0.4% |

|

|

|

|

Of which selling price increase |

|

+0.1% |

|

|

|

Revenue in millions of euros |

9M 2024 |

9M 2023 |

Change |

Of which organic growth |

Organic change incl. CIS price changes (1) |

|

EMEA |

653,4 |

652,5 |

+0,1% |

-3,2% |

-3,2% |

|

North America |

665,0 |

686,4 |

-3,1% |

-1,2% |

-1,2% |

|

CIS, APAC & Latin America |

398,8 |

443,5 |

-10,1% |

-3,4% |

-1,1% |

|

Sports |

843,5 |

810,1 |

+4,1% |

+4,1% |

+4,1% |

|

Total Group |

2 560,7 |

2 592,6 |

-1,2% |

-0,4% |

-0,1% |

2/ Bridge in millions of euros 2023-2024

|

Q3 2023 |

984.3 |

|

+/- EMEA |

-4.7 |

|

+/- North America |

+1.5 |

|

+/- CIS, APAC & Latin America |

-4.9 |

|

+/- Sports |

+31.5 |

|

Q3 2024 at constant scope and exchange rates |

1 007.7 |

|

+/- Scope effect |

-0.4 |

|

+/- Currencies |

-9.5 |

|

+/- « Lag effect » in CIS |

+4.3 |

|

Q3 2024 |

1 002.0 |

|

9M 2023 |

2 592.6 |

|

+/- EMEA |

-21.1 |

|

+/- North America |

-8.5 |

|

+/- CIS, APAC & Latin America |

-14.9 |

|

+/- Sports |

+32.8 |

|

9M 2023 Like-for-Like |

2 580.8 |

|

+/- Scope effect |

-0.5 |

|

+/- Currencies |

-11.1 |

|

+/- « Lag effect » in CIS |

-8.6 |

|

9M 2024 |

2 560.7 |

***

- Press Release - Tarkett - Q3 2024 results

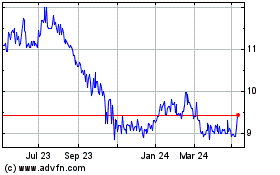

Tarkett (EU:TKTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

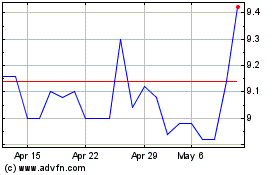

Tarkett (EU:TKTT)

Historical Stock Chart

From Nov 2023 to Nov 2024