Car maker bet on boom in car sales that didn't happen and now

has to prepare for restructuring

By Sean McLain

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 23, 2020).

TOKYO -- Years ago, under Carlos Ghosn, Nissan Motor Co. bet on

a future where global car sales would boom, driven by a bulging

population in developing countries.

That future never came to pass, and now Nissan is gearing up for

a restructuring plan due by May that is expected to involve closing

plants, retrenching in major markets and cooperating more with its

biggest shareholder, Renault SA of France.

"We wanted to grow much faster than the market, and the market

didn't grow in line with our expectations," said Chief Operating

Officer Ashwani Gupta, who is in charge of the restructuring plan,

in an interview last week.

Even if times were normal, it would be hard enough to rescue

Nissan. In the final quarter of 2019, before the world knew of the

novel coronavirus, the car maker posted its first quarterly loss

since the global financial crisis in 2009. Its shares fell 27% in

2019 despite a global uptrend and have plunged with the rest of the

market this year.

The coronavirus is taking the bottom out of the car market.

Nissan's sales in China were down 80% in February from a year

earlier, and they fell 13% in the U.S. in the same month, before

car companies announced factory shutdowns. Those are its two

biggest markets, and Nissan hopes to jump-start its U.S. sales with

a new Rogue sport-utility vehicle and Frontier pickup.

"New product goes a long way, but because of this looming

downturn you may invest all this money and not get a good return on

it. The timing is terrible for them," said Christopher Richter, a

Tokyo-based analyst with CLSA. "It's going to be like crossing a

tightrope with a swamp full of alligators beneath you."

Global auto sales peaked at 95 million in 2017, according to

forecasting firm LMC Automotive. This year the number might be

around 86 million, LMC says, the lowest figure since 2013.

Nissan has the factory space to build seven million cars

annually -- Mr. Ghosn's old sales goal -- while it expects to sell

only around five million for the year ending March 31, an estimate

made before the pandemic spread widely in the U.S.

Mr. Gupta, the COO, sees Indonesia as a prime example of how

Nissan's bets went wrong. A decade ago, Nissan thought the

country's growing population and economic policies would lift the

total market size to two million cars annually from one

million.

"Where are we today? One point one," said Mr. Gupta.

The factory that built those cars in Purwakarta, Indonesia --

which Nissan spent around $300 million in 2014 to expand -- stopped

producing Datsun vehicles early this year after earlier shutting

down production of Nissans. It is unlikely to restart, according to

people briefed on the restructuring plan, although its final fate

is still under study. Many of the workers were laid off.

For Southeast Asia, Nissan will turn to alliance partner

Mitsubishi Motors Corp., in which it owns a one-third stake, and it

may use Mitsubishi's plant in Indonesia.

Much hinges on Nissan's relationship with Renault, which has

been in turmoil over the last 16 months since Mr. Ghosn, who led

both companies, was arrested in Tokyo. He is living in exile in

Lebanon after escaping Japan, where he faced trial on charges that

he denied.

Nissan Chief Executive Makoto Uchida and Mr. Gupta, both of whom

took over in December, are likely to stop production at Nissan's

plant in Barcelona and lean on Renault in Europe, according to

people familiar with the discussions.

One drawback of the alliance is slower speed, because key points

of Mr. Gupta's remake must be brought to an alliance operating

board headed by Renault Chairman Jean-Dominique Senard to ensure

they align with similar plans under way at Renault and

Mitsubishi

At a special Nissan shareholder meeting last month, investors

accused Mr. Uchida of taking too long, saying Nissan couldn't wait

until May for a plan. He apologized and asked for their

patience.

Mr. Gupta, a 49-year-old native of India who is fluent in

Japanese, worked at Renault and Mitsubishi before coming to Nissan.

He said his remedy was simple: more revenue through new models and

lower costs. "There's no rocket science," he said.

He grew animated describing how Nissan went nearly three years

without introducing a new car in Japan. "Come on. We have not

launched a single model in so many months in such a big market?" he

said. "Cut cost and this and that, it's a one-day job. If we really

want to sustain and grow, there is only dealer engagement and

motivation, fueled by new products."

The biggest priority is the U.S., which used to contribute the

lion's share of Nissan's profits. The company's previous chief

executive, Hiroto Saikawa, was ousted in part because of struggles

there.

Mr. Saikawa argued that Nissan inflated its sales with

profit-destroying discounts and, when that didn't work, by

unloading cars on rental agencies at thin profit margins. He

slashed the rental fleet sales and reined in incentives. Sales fell

but profits didn't recover.

Mr. Gupta doesn't disagree with Mr. Saikawa's diagnosis, but he

is tweaking the remedy. Spending on discounts and marketing is

creeping back up. Offers include 0% interest for three years on car

loans in the U.S., according to U.S. Nissan dealer websites. Mr.

Gupta said the company was getting smarter about discounts and

avoiding overproduction of old models that would need price cuts to

be unloaded.

U.S. Nissan dealer profit margins picked up in February despite

slower sales, according to Nissan.

"If the U.S. is great again, then Nissan is great again," Mr.

Gupta said.

Write to Sean McLain at sean.mclain@wsj.com

(END) Dow Jones Newswires

March 23, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

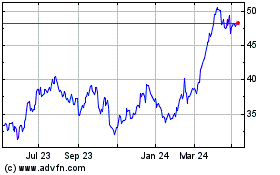

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

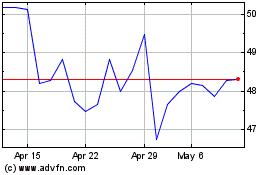

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024