Philips' performance impacted by headwinds; order book strength and

improving component supplies expected to deliver growth and

profitability improvement from second half of 2022 onwards

July 25, 2022 Highlights

- Group sales amounted to EUR 4.2 billion, with a 7% comparable

sales decline mainly caused by continued supply shortages and

prolonged lockdowns in China, on the back of 9% comparable sales

growth in Q2 2021

- Order book remains strong; comparable order intake increased 1%

and includes a 5 percentage-points negative impact related to

China

- Income from operations amounted to EUR 11 million, compared to

EUR 85 million in Q2 2021

- Adjusted EBITA of EUR 216 million, or 5.2% of sales, compared

to EUR 532 million, or 12.6% of sales, in Q2 2021

- Operating cash flow was an outflow of EUR 306 million, mainly

due to temporarily higher inventories, compared to an inflow of EUR

332 million in Q2 2021

- In connection with the field action for specific CPAP, BiPAP

and mechanical ventilator devices, Philips Respironics has produced

3 million replacement devices and repair kits to date, and

published encouraging test results for the first-generation

DreamStation devices

- Comprehensive measures in place to improve supply chain

resilience and pricing; productivity program increased to EUR 500

million per year through 2025

- Company has revised full-year 2022 outlook to 1-3% comparable

sales growth and around 10% Adjusted EBITA margin, driven by 6-9%

comparable sales growth in the second half of 2022

- For the 2023-2025 period, Philips has provided a revised

performance improvement trajectory of 4-6% average annual

comparable sales growth, and an Adjusted EBITA margin of 14-15%, as

well as a free cash flow of around EUR 2 billion by 2025

Frans van Houten, CEO of Royal Philips:“Across

our businesses, we have stepped up our actions on productivity,

pricing, and strengthening supply chain resilience to mitigate the

ongoing headwinds and associated risks. The positive impact of

these actions, together with the strength of our order book and

improving component supplies, give me confidence that we will

resume growth from the third quarter onwards, resulting in 6-9%

comparable sales growth and improved profitability in the second

half of the year. For the full-year 2022, we expect to deliver 1-3%

comparable sales growth and around 10% Adjusted EBITA margin.

Our products remain in good demand, as evidenced by the further

growth of our already strong order book, confirming the relevance

of our strategy and portfolio of innovations to our customers. In

the second quarter, comparable order intake increased 1% and

includes a 5 percentage-points negative impact related to China. We

partnered with 19 more hospital groups to help them transform the

delivery of care and boost staff productivity. In our Personal

Health businesses, we delivered a second consecutive quarter of

double-digit comparable sales growth in North America.

Our performance in the second quarter was impacted by global,

industry-wide challenges including supply shortages, COVID lockdown

measures in China, inflationary pressures and the Russia-Ukraine

war, resulting in a comparable sales decline of 7%, with an

Adjusted EBITA margin of 5.2%. The impact of the COVID lockdowns

significantly affected our business in China, where comparable

sales and order intake declined almost 30% in the quarter.

Production in several of our factories, as well as those of our

suppliers in China, was suspended for two months, which exacerbated

the global supply chain and cost challenges. The China lockdowns

directly impacted the Adjusted EBITA margin of the Group by 120

basis points due to lower sales and a further 110 basis points

because of factory under-utilization. Global inflation and cost

headwinds had an additional impact of around 290 basis points on

Group profitability in the quarter.

Philips Respironics continues to make solid progress with the

repair and replacement program for the CPAP, BiPAP and mechanical

ventilator devices affected by the June 2021 field safety notice,

and published encouraging results related to the comprehensive test

and research program to assess the possible health risks. We know

how important the affected devices are to patients and are working

very hard to get a resolution to them as fast as we can.

Looking ahead to 2023 and beyond, while we continue to see risks

and a challenging macro-environment, we expect our supply chain

measures to take full effect, resulting in a significant

improvement in the conversion of our order book to revenue. Our

pricing and increased productivity measures will expand margins.

Based on these actions, the strong fundamentals of our businesses,

and taking our 2022 outlook into account, we now expect to deliver

comparable sales growth of 4-6% and an Adjusted EBITA margin of

14-15% by 2025, with further improvement thereafter.”

Business segment performanceThe Diagnosis &

Treatment businesses’ comparable sales decreased 4% on the back of

16% comparable sales growth in Q2 2021. High-single-digit growth in

Enterprise Diagnostic Informatics and mid-single-digit growth in

Image-Guided Therapy was more than offset by a decline in

Ultrasound and Diagnostic Imaging, due to specific electronic

component shortages. Comparable order intake increased 3% on the

back of 29% comparable order intake growth in Q2 2021, with growth

across all businesses, reflecting ongoing solid demand for Philips’

portfolio. The Adjusted EBITA margin was 6.2%, mainly due to the

decline in sales, cost inflation and an unfavorable mix impact,

partly offset by productivity measures.

The Connected Care businesses’ comparable sales decreased 13%,

mainly due to the consequences of the Respironics field action and

the impact of supply chain headwinds. Comparable order intake

showed a 2% decrease, while demand for Hospital Patient Monitoring

and Connected Care Informatics remains robust. The Adjusted EBITA

margin amounted to 1.1%, mainly due to the decline in sales and

cost inflation, partly offset by productivity measures.

The Personal Health businesses’ comparable sales decreased by 5%

on the back of 33% comparable sales growth in Q2 2021. Double-digit

growth in North America was more than offset by double-digit

declines in China and Russia. The Adjusted EBITA margin amounted to

12.4%, mainly due to the decline in sales and cost inflation.

Philips’ ongoing focus on innovation and customer partnerships

resulted in the following key developments in the quarter:

- Philips signed 19 new long-term strategic partnerships with

hospitals in Europe, Asia, and North America, including a 10-year

patient monitoring agreement with a large hospital in Germany.

Through Philips’ advanced enterprise monitoring offering, the

hospital will transition from stand-alone devices towards a

scalable enterprise-wide patient monitoring solution that keeps

care teams connected and informed for enhanced patient care

management.

- Philips received FDA clearance to market its new 7700 3.0T MR

system, featuring an enhanced gradient system for Philips’ highest

image quality to support a precision diagnosis. Philips also

received FDA clearance for its SmartSpeed MR acceleration software,

adding AI data collection algorithms to Philips’ existing

Compressed SENSE MR engine for higher image resolution with three

times faster scan times and virtually no loss in image

quality.

- Philips received clearance from the Chinese National Medical

Products Association (NMPA) to launch its helium-free operations MR

Ingenia Ambition, which is produced in China for the Chinese

market. Philips is joining forces with B-Soft, a Chinese healthcare

informatics company, to develop a healthcare informatics solution

tailored to the needs of Chinese hospitals. This highlights the

continued progress of Philips’ strategy in China to drive

market-relevant offerings through its local footprint as well as

partnerships with the local innovation ecosystem.

- Demonstrating the clinical benefits of Philips' minimally

invasive therapy options, the company announced positive results

from its Tack Optimized Balloon Angioplasty below-the-knee clinical

trial. The results show that the Tack endovascular system provides

a sustained treatment effect for patients with critical limb

ischemia, a severe stage of peripheral arterial disease.

- Building on Philips’ leadership in interventional cardiology

solutions, the company launched the latest version of its

EchoNavigator image-guidance tool, which seamlessly integrates live

ultrasound, interventional X-ray imaging and advanced 3D heart

models to help interventional teams treat structural heart disease

with greater ease and efficiency.

- Philips signed a long-term agreement with the Rijnstate

hospital in the Netherlands to deliver a wide range of advanced

ultrasound devices for 17 different departments at multiple

locations of the hospital. The agreement involves ultrasound

devices and services for cardiological, vascular or radiological

examinations, OB/GYN, as well as mobile devices for the emergency

department.

- Building on the successful strengthening of the company’s

innovative power toothbrushes portfolio, ranging from entry-level

to premium propositions, as well as targeted advertising and

promotion campaigns, Philips Oral Healthcare recorded continued

strong double-digit comparable sales growth and market share gains

in North America in the quarter.

Philips Respironics field action related to specific

CPAP, BiPAP and mechanical ventilatorsPhilips Respironics

continued to make solid progress with the repair and replacement

program for the CPAP, BiPAP and mechanical ventilator devices

affected by the June 2021 field safety notice, as well as the

comprehensive test and research program to assess the possible

health risks. To date, 3 million replacement devices and repair

kits have been produced. Philips Respironics aims to further

increase capacity and complete around 90% of the production and

shipments to customers in 2022. The test results to date for the

first-generation DreamStation devices, which represent the majority

of the registered affected devices, are very encouraging. They show

a very low prevalence of visible foam degradation, and new and used

first-generation DreamStation devices passed volatile organic

compound and respirable particulate emission testing.

Following the FDA’s inspection of certain of Philips

Respironics’ facilities in the US in 2021 and the subsequent

inspectional observations, the US Department of Justice, acting on

behalf of the FDA, recently began discussions with Philips

regarding the terms of a proposed consent decree to resolve the

identified issues.

Capital allocationIn the second quarter,

Philips issued EUR 750 million fixed-rate notes due 2027, EUR 650

million Green Innovation Notes due 2029 and EUR 600 million

Sustainability Innovation Notes due 2033 under its Euro Medium Term

Note program, and entered into a series of transactions to extend

and optimize the company’s debt maturity profile. See here for more

information on Philips' current debt structure.

Following the issuance of 14,174,568 new shares related to the

share dividend, and the cancellation of 8,758,455 shares that were

acquired as part of the EUR 1.5 billion share repurchase program

for capital reduction purposes, Philips’ current issued share

capital amounts to 889,315,082 common shares. As communicated

earlier, Philips intends to have 19,571,218 shares delivered

through the early settlement of forward contracts (entered into as

part of the same share repurchase program) and to cancel those as

well, which would result in 869,743,864 issued common shares at

year-end 2022 (2021: 883,898,969). Click here to view the release

online

For further information, please contact:

Ben Zwirs Philips Global Press Office Tel.: +31 6

1521 3446 E-mail: ben.zwirs@philips.com Derya

Guzel Philips Investor Relations Tel.: +31 20 59 77055

E-mail: derya.guzel@philips.com About Royal

Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health

technology company focused on improving people's health and

well-being, and enabling better outcomes across the health

continuum – from healthy living and prevention, to diagnosis,

treatment and home care. Philips leverages advanced technology and

deep clinical and consumer insights to deliver integrated

solutions. Headquartered in the Netherlands, the company is a

leader in diagnostic imaging, image-guided therapy, patient

monitoring and health informatics, as well as in consumer health

and home care. Philips generated 2021 sales of EUR 17.2 billion and

employs approximately 79,000 employees with sales and services in

more than 100 countries. News about Philips can be found at

www.philips.com/newscenter.

Forward-looking statements and other important

information Forward-looking statements This document and

the related oral presentation, including responses to questions

following the presentation, contain certain forward-looking

statements with respect to the financial condition, results of

operations and business of Philips and certain of the plans and

objectives of Philips with respect to these items. Examples of

forward-looking statements include statements made about our

strategy, estimates of sales growth, future Adjusted EBITA*),

future restructuring and acquisition- related charges and other

costs, future developments in Philips’ organic business and the

completion of acquisitions and divestments. Forward-looking

statements can be identified generally as those containing words

such as “anticipates”, “assumes”, “believes”, “estimates”,

“expects”, “should”, “will”, “will likely result”, “forecast”,

“outlook”, “projects”, “may” or similar expressions. By their

nature, these statements involve risk and uncertainty because they

relate to future events and circumstances and there are many

factors that could cause actual results and developments to differ

materially from those expressed or implied by these statements.

These factors include but are not limited to: Philips’ ability to

gain leadership in health informatics in response to developments

in the health technology industry; Philips’ ability to transform

its business model to health technology solutions and services;

macroeconomic and geopolitical changes; integration of acquisitions

and their delivery on business plans and value creation

expectations; securing and maintaining Philips’ intellectual

property rights, and unauthorized use of third-party intellectual

property rights; Philips' ability to meet expectations with respect

to ESG-related matters; failure of products and services to meet

quality or security standards, adversely affecting patient safety

and customer operations; breaches of cybersecurity; Philips'

ability to execute and deliver on programs on business

transformation and IT system changes and continuity; the

effectiveness of our supply chain; attracting and retaining

personnel; COVID and other pandemics; challenges to drive

operational excellence and speed in bringing innovations to market;

compliance with regulations and standards including quality,

product safety and (cyber) security; compliance with business

conduct rules and regulations; treasury and financing risks; tax

risks; reliability of internal controls, financial reporting and

management process. For a discussion of factors that could cause

future results to differ from such forward-looking statements, see

also the Risk management chapter included in the Annual Report

2021. Reference is also made to Risk management in the Philips

semi-annual report 2022. Third-party market share

data Statements regarding market share, contained in this

document, including those regarding Philips’ competitive position,

are based on outside sources such as specialized research

institutes, industry and dealer panels in combination with

management estimates. Where information is not yet available to

Philips, market share statements may also be based on estimates and

projections prepared by management and/or based on outside sources

of information. Management's estimates of rankings are based on

order intake or sales, depending on the business. Market

Abuse Regulation This press release contains inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation. This press release was distributed at 07:00 am

CET on July 25, 2022. Use of non-IFRS information

In presenting and discussing the Philips Group’s financial

position, operating results and cash flows, management uses certain

non-IFRS financial measures. These non-IFRS financial measures

should not be viewed in isolation as alternatives to the equivalent

IFRS measure and should be used in conjunction with the most

directly comparable IFRS measures. Non-IFRS financial measures do

not have standardized meaning under IFRS and therefore may not be

comparable to similar measures presented by other issuers. A

reconciliation of these non-IFRS measures to the most directly

comparable IFRS measures is contained in this document. Further

information on non-IFRS measures can be found in the Annual Report

2021. Use of fair value information In presenting

the Philips Group’s financial position, fair values are used for

the measurement of various items in accordance with the applicable

accounting standards. These fair values are based on market prices,

where available, and are obtained from sources that are deemed to

be reliable. Readers are cautioned that these values are subject to

changes over time and are only valid at the balance sheet date.

When quoted prices or observable market data are not readily

available, fair values are estimated using appropriate valuation

models and unobservable inputs. Such fair value estimates require

management to make significant assumptions with respect to future

developments, which are inherently uncertain and may therefore

deviate from actual developments. Critical assumptions used are

disclosed in the Annual Report 2021 In certain cases independent

valuations are obtained to support management’s determination of

fair values. Presentation All amounts are in

millions of euros unless otherwise stated. Due to rounding, amounts

may not add up precisely to the totals provided. All reported data

is unaudited. Financial reporting is in accordance with the

accounting policies as stated in the Annual Report 2021 except for

the adoption of new standards and amendments to standards which are

also expected to be reflected in the company's consolidated

financial statements for the year ending December 31, 2022.

Prior-period amounts have been reclassified to conform to the

current-period presentation; this includes immaterial

organizational changes. *) Non-IFRS financial measure. Refer to the

Reconciliation of non-IFRS information

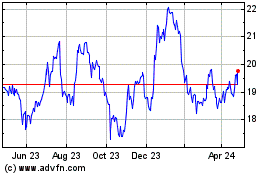

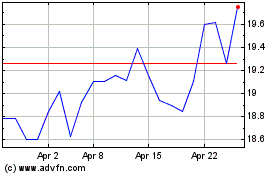

Koninklijke Philips NV (EU:PHIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Koninklijke Philips NV (EU:PHIA)

Historical Stock Chart

From Apr 2023 to Apr 2024