Philips 3Q Net Profit Rose as Sales Returned to Growth -- Update

October 19 2020 - 7:28AM

Dow Jones News

--Philips posted third-quarter profit ahead of expectations

--The connected care and personal-health divisions drove a

return to sales growth

--The Company is targeting accelerated sales growth and higher

profitability in the 2021-25 period

By Adria Calatayud

Koninklijke Philips NV said Monday that third-quarter net profit

rose and exceeded expectations, and that the company is targeting

accelerated sales growth and higher profitability in the 2021-25

period.

The Dutch medical-technology group said sales returned to growth

territory in the quarter despite challenging circumstances created

by the coronavirus pandemic. Higher sales were driven by

conversions of orders for patient monitors and ventilators and a

robust rebound of demand for the company's personal-health

portfolio, Philips said.

The company has felt a mixed impact from the pandemic, which

boosted its connected care division on the back of soaring orders

for patient monitors and ventilators, but hurt its

diagnosis-and-treatment division due to delays in elective

surgeries.

Philips made a net profit from continuing operations of 340

million euros ($398.4 million) for the quarter, compared with

EUR208 million for the same period a year before. Analysts expected

a net profit of EUR274 million, according to a consensus estimate

provided by the company.

This included a EUR57 million charge following the partial

cancellation of a ventilator contract with the U.S. Department of

Health and Human Services, which prompted Philips to cut its

outlook for 2020 in late August.

Quarterly sales increased to EUR4.98 billion from EUR4.70

billion a year before, Philips said. Comparable sales grew 10%, it

said. Analysts expected third-quarter sales to come in at EUR4.82

billion with comparable sales growth of 5.4%, according to a

company-provided consensus.

Adjusted earnings before interest, taxes and amortization margin

for the third quarter was 15.4%, the company said

Philips said it continues to see uncertainty and volatility

related to the impact of the coronavirus pandemic across the world,

but reiterated its guidance of modest comparable sales growth and

an unchanged adjusted Ebita margin for 2020.

"It is clear that the Covid-19 pandemic is far from over," Chief

Executive Frans van Houten said.

For the 2021-25 period, the company said it is targeting an

acceleration in the average annual comparable sales growth to

5%-6%, an adjusted Ebita margin improvement of 60-80 basis points

on average annually from 2021 and a free cash flow above EUR2

billion by 2025.

Philips--which will outline of its strategic plan at a capital

markets day next month--said it expects comparable sales growth to

be weaker next year, with a low single digit percentage rise, as

strong growth experienced this year in its connected care division

will be followed by a decline in 2021.

The current high demand for acute-care equipment won't be

sustained over the longer term, Mr. Van Houten said in a call with

journalists.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

October 19, 2020 07:13 ET (11:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

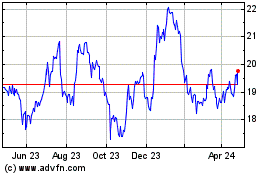

Koninklijke Philips NV (EU:PHIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

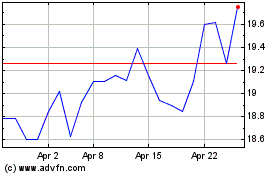

Koninklijke Philips NV (EU:PHIA)

Historical Stock Chart

From Apr 2023 to Apr 2024