Orange 4Q Revenue Falls; Proposes Dividends

February 18 2021 - 2:23AM

Dow Jones News

By Mauro Orru

Orange said Thursday that revenue for the fourth quarter fell,

and outlined proposals for dividends covering 2020 and 2021.

The French telecommunications company said quarterly revenue

fell to 10.92 billion euros ($13.15 billion) from EUR10.94 billion

on a comparable basis in the fourth quarter of 2019.

Earnings before interest, taxes, depreciation and amortization

after leases, or Ebitdaal, slipped to EUR3.18 billion in the

quarter from EUR3.26 billion on a comparable basis.

The company began using Ebitdaal as a financial indicator in

2019 to account for the adoption of the IFRS 16 accounting

standard.

For 2020, the company said net profit climbed to EUR4.82 billion

from EUR3 billion in 2019, while Ebitdaal fell to EUR12.68 billion

from EUR12.81 billion on a comparable basis.

Orange had guided for a decline in 2020 Ebitdaal of about 1%,

including all the effects related to the coronavirus pandemic.

For 2021, Orange expects stable but negative Ebitdaal and

confirmed its goal to generate between EUR3.5 billion and EUR4

billion in organic cash flow in 2023.

The company said it would ask shareholders in May to vote on a

dividend payout of EUR0.70 a share, plus EUR0.20 a share linked to

a EUR2.2 billion tax refund.

Orange also said it would propose a 2021 dividend of EUR0.70 a

share to the 2022 shareholders' meeting, with an interim dividend

of EUR0.30 a share to be paid in December.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

February 18, 2021 02:08 ET (07:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

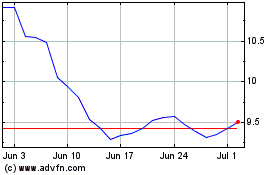

Orange (EU:ORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orange (EU:ORA)

Historical Stock Chart

From Apr 2023 to Apr 2024