Orange Separates Out EUR350 Million Venture-Capital Arm

January 11 2021 - 7:59AM

Dow Jones News

By Adam Clark

French telecommunications company Orange said Monday that it

would separate out its venture-capital arm and give it an increased

allocation of 350 million euros ($427.7 million).

Orange Ventures will become a separate legal entity and make its

investment decisions autonomously, the company said. It will also

take over management of Orange Digital Ventures, the company's

portfolio of early-stage strategic investments launched in

2015.

"Our wish is to constitute an organization which combines the

best of both worlds: Orange's business expertise as well as the

agility of decision-making and the quality of the financial

monitoring of the best investment funds," said Jerome Berger,

president and managing partner of Orange Ventures.

Orange's highest-profile investments include British digital

bank Monzo and European savings marketplace Raisin. It invests

world-wide with investments of up to EUR20 million in each funding

round.

The separation follows a similar move by Spain's Banco Santander

SA, which said in September last year that it would launch an

autonomously managed venture-capital fund with a doubled allocation

of $400 million.

Write to Adam Clark at adam.clark@wsj.com

(END) Dow Jones Newswires

January 11, 2021 07:44 ET (12:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

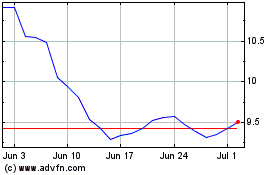

Orange (EU:ORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orange (EU:ORA)

Historical Stock Chart

From Apr 2023 to Apr 2024