Orange Plans to Launch Takeover Bid for Belgian Subsidiary

December 03 2020 - 2:01AM

Dow Jones News

By Pietro Lombardi

Orange said late Wednesday that it plans to launch a takeover

bid for its Belgian subsidiary Orange Belgium SA that would value

the business at roughly 1.3 billion euros ($1.58 billion).

The French telecommunications company, which according to

FactSet holds almost 53% in Orange Belgium, wants to launch a

conditional offer of EUR22 a share in cash for all the shares it

doesn't own already. This is a premium of almost 36% compared with

Orange Belgium's closing price on Wednesday.

"This project is part of the continued efforts of the Orange

Group to adapt the capital structure of its subsidiaries to their

needs," it said.

A delisting of Orange Belgium may be considered, depending on

the conditions. If Orange reaches a stake of at least 90% and

voting rights of 95% after the offer, it would then launch a

squeeze-out.

The launch of the offer, its timing and conditions will depend

on some factors, including market conditions and the developments

in financial markets, Orange said.

Should an offer be made, there would be no minimum thresholds

and a material adverse change clause would be included.

Orange Belgium said late Wednesday that it took note of the

news.

"The Board of Directors of Orange Belgium will meet as soon as

possible to take note and examine the content of the offer in

accordance with the legal provisions," it said.

Write to Pietro Lombardi at pietro.lombardi@wsj.com;

@pietrolombard10

(END) Dow Jones Newswires

December 03, 2020 01:46 ET (06:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

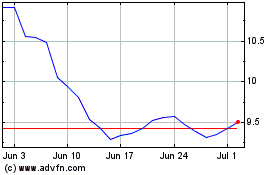

Orange (EU:ORA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orange (EU:ORA)

Historical Stock Chart

From Apr 2023 to Apr 2024