Regulatory News:

Innate Pharma SA (Euronext Paris: IPH; Nasdaq: IPHA)

(“Innate” or the “Company”) today announced that it

has filed a prospectus supplement with the Securities and Exchange

Commission (“SEC”) relating to an At-The-Market (“ATM”) program.

Pursuant to this program, the Company may offer and sell to

eligible investors (as described below) a total gross amount of up

to $75 million of American Depositary Shares (“ADS”), each ADS

representing one ordinary share of Innate, from time to time in

sales deemed to be an “at the market offering” pursuant to the

terms of a sales agreement with SVB Securities LLC (“SVB

Securities”), acting as sales agent. The timing of any sales will

depend on a variety of factors. The ATM program is presently

intended to be effective unless terminated in accordance with the

sales agreement or the maximum amount of the program has been

reached.

The Company currently intends to use the net proceeds, if any,

of sales of ADSs issued under the program to fund the research and

development of our product candidates and for working capital and

general corporate purposes.

SVB Securities, as sales agent, will use commercially reasonable

efforts to arrange on the Company’s behalf for the sale of all ADSs

requested to be sold by the Company, consistent with SVB

Securities’ normal sales and trading practices. Sales prices may

vary based on market prices and other factors.

The ADSs and the underlying ordinary shares will be issued

through a capital increase without shareholders’ preferential

subscription rights under the provisions of Article L. 225-136 of

the French Commercial Code (Code de commerce), Article L. 411-2 1°

of the French monetary and financial code (Code monétaire et

financier) and pursuant to the 25th resolution adopted by the

Annual General Meeting of Shareholders held on May 19, 2020, within

the limit of a maximum number of 23,673,831 ordinary shares and

ADSs (being the maximum authorized by the shareholders in such

resolution), representing a maximum potential dilution of

approximately 26% based on the existing share capital of the

Company.

It should be noted that the 2022 Annual General Meeting of

Shareholders has been convened for May 20, 2022 (the “2022 Annual

General Meeting”). During the 2022 Annual General Meeting, new

resolutions allowing for capital increases will be put to the

shareholders’ vote. If they are approved, they will replace, inter

alia, the aforementioned 25th resolution adopted by the 2020 Annual

General Meeting of Shareholders held on May 19, 2020 (the “2020

Annual General Meeting”). Therefore, from then on, ADSs offered in

the ATM and the underlying ordinary shares would be issued either

(i) through a capital increase without shareholders’ preferential

subscription rights under the provisions of Article L. 225-136 of

the French Commercial Code (Code de commerce), Article L. 411-2 1°

of the French monetary and financial code (Code monétaire et

financier) and pursuant to the 20th resolution adopted by the 2022

Annual General Meeting, or (ii) through a capital increase without

shareholders’ preferential subscription rights and reserved to a

category of investors under the provisions of Article L. 225-138 of

the French Commercial Code (Code de commerce) and pursuant to the

22nd resolution adopted by the 2022 Annual General Meeting. In both

cases (i) and (ii) above, the maximum number of ordinary shares and

ADSs that can be issued is 23,922,825 ordinary shares (being the

maximum authorized by the shareholders in both such

resolutions).

Pursuant to the 25th resolution adopted by the 2020 Annual

General Meeting and, if and when applicable, the 20th resolution

that would adopted by the 2022 Annual General Meeting of

Shareholders, the ADSs offered in the ATM can only be offered to

“Qualified Institutional Buyers” as defined in Rule 144A under the

US 1933 Securities Act, as amended (the “Securities Act”) or to

“accredited investors” as defined in Regulation D under the

Securities Act. If after the 2022 Annual General Meeting, we were

to decide to rely instead on the aforementioned 22nd resolution

that would be adopted at such meeting, the ADSs offered in the ATM

could only be offered to the following categories of investors: (i)

industrial or commercial companies involved in the pharmaceutical /

biotechnological sector, or (ii) investment companies or investment

funds’ management companies or investment funds, governed by French

or foreign law, or (iii) any other legal person (including a trust)

or natural person that invest on a regular basis, in the

pharmaceutical / biotechnological sector, meeting, in each of the

cases (i) to (iii) above, the criteria for participating in an

offer made pursuant to Article L. 411-2 1° of the French monetary

and financial code (Code monétaire et financier) (i.e. also being

Qualified Institutional Buyers or Accredited Investors as described

above).

On an illustrative basis, assuming the issuance of the full

amount of $75 million of ADSs under the ATM program at an assumed

offering price of $3.10, the last reported sale price of the ADSs

on Nasdaq on April 21, 2022, a holder of 1.0% of the outstanding

Company’s share capital as of the date of this press release, would

hold 0.74% of the outstanding Company’s share capital after the

completion of the transaction (calculated on the basis of the

number of outstanding shares on the date of publication of this

press release).

During the term of the ATM program, the Company will include in

the publication of its financial results information about its use

of the program during the preceding quarter and will also provide

an update after each capital increase on a dedicated location on

its corporate website in order to inform investors about the main

features of each issue that may be completed under the ATM program

from time to time. In addition, in case of a particularly

significant capital increase, the Company will publish an ad hoc

press release.

A shelf registration statement on Form F-3 (including a

prospectus) relating to Innate’s ADSs was filed with the SEC and

became effective upon filing on January 31, 2021. Before purchasing

ADSs in the offering, prospective investors should read the

prospectus supplement and the accompanying prospectus, together

with the documents incorporated by reference therein. Prospective

investors may obtain these documents for free by visiting EDGAR on

the SEC’s website at www.sec.gov. Alternatively, a copy of

the prospectus supplement (and accompanying prospectus) relating to

the offering may be obtained from SVB Securities LLC, Attention:

Syndicate Department, 53 State Street, 40th Floor, Boston, MA

02109, by telephone at (800) 808-7525, ext. 6105, or by email at

syndicate@svbsecurities.com. Unless total issuances of ordinary

shares under the ATM program over a rolling twelve months period

were to represent (together, as the case may be, with other

issuances of ordinary shares effected on the basis of Article 1,

paragraph 5.a) of Regulation (EU) 2017/1129 of June 14,2017) 20% or

more of the then outstanding share capital of the Company, no

prospectus will be subject to the approbation of the Autorité des

Marchés Financiers (“AMF”).

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction. In particular, no public offering of the

ADSs will be made in Europe.

About Innate Pharma:

Innate Pharma S.A. is a global, clinical-stage oncology-focused

biotech company dedicated to improving treatment and clinical

outcomes for patients through therapeutic antibodies that harness

the immune system to fight cancer.

Innate Pharma’s broad pipeline of antibodies includes several

potentially first-in-class clinical and preclinical candidates in

cancers with high unmet medical need.

Innate is a pioneer in the understanding of natural killer cell

biology and has expanded its expertise in the tumor

microenvironment and tumor-antigens, as well as antibody

engineering. This innovative approach has resulted in a diversified

proprietary portfolio and major alliances with leaders in the

biopharmaceutical industry including Bristol-Myers Squibb, Novo

Nordisk A/S, Sanofi, and a multi-products collaboration with

AstraZeneca.

Headquartered in Marseille, France, with a US office in

Rockville, MD, Innate Pharma is listed on Euronext Paris and Nasdaq

in the US.

Information about Innate Pharma shares:

ISIN code

FR0010331421

Ticker code

Euronext: IPH Nasdaq: IPHA

LEI

9695002Y8420ZB8HJE29

Disclaimer on forward-looking information and risk

factors:

This press release contains certain forward-looking statements,

including those within the meaning of the Private Securities

Litigation Reform Act of 1995. The use of certain words, including

“believe,” “potential,” “expect” and “will” and similar

expressions, is intended to identify forward-looking statements.

Although the company believes its expectations are based on

reasonable assumptions, these forward-looking statements are

subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those anticipated. These

risks and uncertainties include, among other things, the

uncertainties inherent in research and development, including

related to safety, progression of and results from its ongoing and

planned clinical trials and preclinical studies, review and

approvals by regulatory authorities of its product candidates, the

Company’s commercialization efforts, the Company’s continued

ability to raise capital to fund its development and the overall

impact of the COVID-19 outbreak on the global healthcare system as

well as the Company’s business, financial condition and results of

operations. For an additional discussion of risks and uncertainties

which could cause the company’s actual results, financial

condition, performance or achievements to differ from those

contained in the forward-looking statements, please refer to the

Risk Factors (“Facteurs de Risque”) section of the Universal

Registration Document filed with the French Financial Markets

Authority (“AMF”), which is available on the AMF website

http://www.amf-france.org or on Innate Pharma’s website, and public

filings and reports filed with the U.S. Securities and Exchange

Commission (“SEC”), including the Company’s Annual Report on Form

20-F for the year ended December 31, 2021, and subsequent filings

and reports filed with the AMF or SEC, or otherwise made public, by

the Company.

This press release and the information contained herein do not

constitute an offer to sell or a solicitation of an offer to buy or

subscribe to shares in Innate Pharma in any country.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220503006340/en/

Investors and Media

Innate Pharma Henry Wheeler +33 (0)4 84 90 32 88

Henry.wheeler@innate-pharma.fr

ATCG Press Marie Puvieux (France) +33 981 87 46 72

innate-pharma@atcg-partners.com

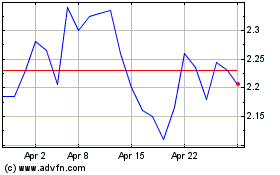

Innate Pharma (EU:IPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

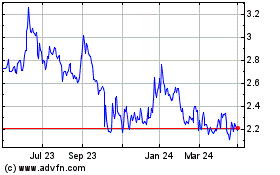

Innate Pharma (EU:IPH)

Historical Stock Chart

From Apr 2023 to Apr 2024