ING Marked by Over EUR1 Billion Regulatory Costs in 2019 -- Update

February 06 2020 - 11:05AM

Dow Jones News

By Sabela Ojea

--ING reported a 31% loss in net profit for the fourth quarter

of 2019.

--ING faced regulatory costs that surpassed 1 billion euros

($1.10 billion) in 2019 compared with EUR947 million in the

previous year.

--ING was fined EUR775 million in 2018 by the Dutch Public

Prosecution Service, over failures to stop money-laundering

activities.

ING Groep N.V. (ING) on Thursday reported a significant fall in

net profit for the fourth quarter of 2019 and said there needs to

be changes so that banks and authorities can collaborate after

facing regulatory costs of over 1 billion euros ($1.10 billion) for

the whole year.

The Dutch bank said it suffered a 31% loss in net profit for the

three months ended Dec. 31, reflecting higher risks, higher

expenses and a higher effective tax rate.

The lender said it had EUR303 million regulatory costs over the

period compared with EUR266 million for the same period a year

earlier.

However, these total cashout costs reached EUR1.02 billion for

the whole year compared with EUR947 million in 2018, despite facing

a EUR775 million fine by the Dutch Public Prosecution Service in

2018 over failures to crack down on money-laundering

activities.

ING said "its biggest growth factor from an economic

perspective" were these costs, which the bank mostly attributed to

an increase in contributions to bank taxes, contributions to

depositary taxes, as well as contributions to single resolutions.

More than 10% of its total cost-base was linked to these three

components, the bank said.

"In addition to a higher contribution for the deposit guarantee

schemes, the increase was mainly caused by a higher bank tax in the

Netherlands and a new bank tax in Romania," ING said.

The Dutch lender said it has seen incidents through the period,

including an alleged "external fraud" case that it says it has to

look into. It said the fraud is related to the documentation of its

security and that this was the first time it had to look into

something like this in five or six years, but didn't provide any

further details.

"The quarter was marked by a high amount of provisions for

existing and new defaulted files, including a suspected external

fraud case," it said.

"The next step is how to become more effective as a system, how

banks and authorities can collaborate more," ING said, noting the

need for changes so that authorities and banks can share

information. "There's a lot of work to do there," Chief Executive

Ralph Hamers said.

ING made a net profit of EUR880 million ($969.7 million) for the

fourth quarter compared with EUR1.27 billion for the same period a

year earlier. This compares with consensus forecasts of EUR1.14

billion, taken from FactSet and based on five analysts'

forecasts.

Underlying net profit also decreased to EUR880 million from

EUR1.24 billion in the year-earlier period. Citi group said Monday

that ING was expected to report an underlying net attributable

profit of EUR1.14 billion, which the U.S. bank attributed to a

slightly better net-interest income, offsetting marginally worse

costs and provisions.

The lender's underlying pretax profit--one of the bank's

preferred metrics, which strips out exceptional and other one-off

items--was EUR1.34 billion compared with EUR1.69 billion for the

fourth quarter of 2018. Underlying pretax profit was expected to be

EUR1.62 billion, according to FactSet and based on three analysts'

estimates.

However, the company was able to increase its net-interest

income to EUR3.60 billion, while total underlying income fell to

EUR4.44 billion from EUR4.50 billion.

ING's common equity Tier 1 ratio--a key measure of balance-sheet

strength--was 14.6%. Citi also said Monday that its CET1 ratio

should come in at 14.8%.

The board has declared a final dividend of 69 European cents a

share, up from 68 cents for the prior year.

ING also said its net core lending reached EUR2.0 billion in the

fourth quarter of 2019 compared to EUR3.2 billion for the same

period in 2018. Its total retail customer base also decreased to

38.8 million from the previous 38.4 million.

"Looking back at 2019, we see a year of solid commercial

performance despite the challenging rate environment, geopolitical

uncertainties and an increasingly complex and demanding regulatory

environment. The fourth quarter of 2019 proved challenging," Chief

Executive Ralph Hamers said.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

February 06, 2020 10:50 ET (15:50 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

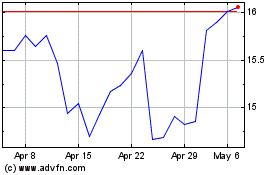

ING Groep NV (EU:INGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (EU:INGA)

Historical Stock Chart

From Apr 2023 to Apr 2024