Societe Generale: Third quarter 2022 earnings

RESULTS AT SEPTEMBER 30TH, 2022

Press releaseParis, November 4th,

2022

STRONG RESULTS IN Q3 22Good business

performance with revenues up +2.3% vs. Q3 21 driven by the

resilience of French Retail Banking, strong growth in International

Retail Banking and in Financial Services, and a robust performance

from Global Markets and Financing & Advisory

Good cost control, limited increase in

operating expenses (+1.5% vs. Q3 21 published, +2.0%

underlying)

Improvement in the underlying cost to income

ratio, excluding contribution to the Single Resolution Fund,

at 60.7%(1) (vs. 61.8%(1) in Q3 21)

Cost of risk contained at 31 basis

points, with around two-thirds consisting of prudent

provisioning on performing loans, the level of defaults remaining

low at ~10 basis points

Underlying Group net income of EUR 1.4

billion(1) (EUR 1.5 billion on a reported basis)

Underlying profitability (ROTE) of

10.5%(1) (11.2% on a reported basis)

EXCELLENT UNDERLYING PERFORMANCE IN 9M

22

Underlying Group net income of EUR 4.5

billion(1) (EUR 858 million on a reported basis), up +11.2% vs.

9M 21

Underlying cost to income ratio, excluding

contribution to the Single Resolution Fund, of 59.6%(1) at

end-September, now expected below 64% for 2022

Underlying profitability (ROTE) of

10.4%(1) (1.3% on a reported basis)

STRENGTHENED CAPITAL POSITION AND ROBUST

BALANCE SHEET

CET 1 ratio of 13.1%(2) at end-September

2022, up 13 basis points vs. end-June 2022(3) and

around

380 basis points above the regulatory

requirement

CONTINUED ORDERLY EXECUTION OF STRATEGIC

INITIATIVES Merger of retail banking networks in France:

all regulatory approvals obtained and legal merger date confirmed

at January 1st, 2023Successful finalisation of the partnership

between Boursorama and ING in France: onboarding of around

two-thirds of eligible customers to the partnership, i.e. 315,000

customers, and transfer of nearly EUR 8.5 billion of

outstandingsAcquisition of Leaseplan by ALD: approval

process on track, rights issue expected before the end of the year

and closing of the acquisition expected during the first quarter of

2023ESG ambition: acceleration of the decarbonisation of our

loan portfolios

Fréderic Oudéa, the Group’s Chief Executive

Officer, commented:

“In an increasingly complex geopolitical and

economic environment, Societe Generale posts, once again, excellent

results, with both a very solid commercial performance and

profitability. The third quarter is marked by increasing revenues,

continued control of operating expenses and a contained cost of

risk, while maintaining a prudent provisioning policy. We continue

to make good progress on the execution of our strategic

initiatives, with several major milestones achieved, notably on the

merger of the retail banking networks in France and the

finalisation of the partnership between Boursorama and ING.

Furthermore, on September 30th, the Board of Directors decided that

at the next General Meeting it would propose Slawomir Krupa as

Board member to be my successor as Chief Executive Officer of the

Group in May 2023. The coming months will enable us to continue to

implement the strategic initiatives underway, which would ensure

sustainable growth and profitability, while together ensuring an

effective and orderly transition.”

- GROUP CONSOLIDATED RESULTS

|

In EURm |

Q3 22 |

Q3 21 |

Change |

9M 22 |

9M 21 |

Change |

|

Net banking income |

6,828 |

6,672 |

+2.3% |

+3.7%* |

21,174 |

19,178 |

+10.4% |

+10.9%* |

|

Operating expenses |

(4,233) |

(4,170) |

+1.5% |

+4.3%* |

(14,020) |

(13,025) |

+7.6% |

+8.9%* |

|

Underlying operating expenses(1) |

(4,358) |

(4,272) |

+2.0% |

+4.8%* |

(13,273) |

(12,594) |

+5.4% |

+6.7%* |

|

Gross operating income |

2,595 |

2,502 |

+3.7% |

+2.8%* |

7,154 |

6,153 |

+16.3% |

+14.9%* |

|

Underlying gross operating income(1) |

2,470 |

2,400 |

+2.9% |

+1.9%* |

7,901 |

6,584 |

+20.0% |

+18.7%* |

|

Net cost of risk |

(456) |

(196) |

x 2.3 |

x 2.3* |

(1,234) |

(614) |

x 2.0 |

+52.2%* |

|

Operating income |

2,139 |

2,306 |

-7.2% |

-8.1%* |

5,920 |

5,539 |

+6.9% |

+9.3%* |

|

Underlying operating income(1) |

2,014 |

2,204 |

-8.6% |

-9.5%* |

6,667 |

5,970 |

+11.7% |

+14.1%* |

|

Net profits or losses from other assets |

4 |

175 |

-97.7% |

-97.7%* |

(3,286) |

186 |

n/s |

n/s |

|

Income tax |

(396) |

(699) |

-43.4% |

-43.4%* |

(1,076) |

(1,386) |

-22.4% |

-19.6%* |

|

Net income |

1,751 |

1,781 |

-1.7% |

-2.8%* |

1,566 |

4,343 |

-63.9% |

-63.9%* |

|

O.w. non-controlling interests |

253 |

180 |

+40.6% |

+37.3%* |

708 |

489 |

+44.8% |

+42.9%* |

|

Reported Group net income |

1,498 |

1,601 |

-6.4% |

-7.3%* |

858 |

3,854 |

-77.7% |

-77.7%* |

|

Underlying Group net income(1) |

1,410 |

1,391 |

+1.4% |

+0.3%* |

4,489 |

4,038 |

+11.2% |

+12.2%* |

|

ROE |

9.9% |

11.1% |

|

|

1.1% |

8.7% |

+0.0% |

+0.0%* |

|

ROTE |

11.2% |

12.7% |

|

|

1.3% |

10.0% |

+0.0% |

+0.0%* |

|

Underlying ROTE(1) |

10.5% |

10.9% |

|

|

10.4% |

10.4% |

+0.0% |

+0.0%* |

(1) Adjusted for exceptional items and

linearisation of IFRIC 21

Societe Generale’s Board of Directors, which met

on November 3rd, 2022 under the chairmanship of Lorenzo Bini

Smaghi, examined the Societe Generale Group’s results for Q3 and 9M

2022.

The various restatements enabling the transition

from underlying data to published data are presented in the

methodology notes (section 10.5).

Net banking incomeNet banking income

continued to enjoy good momentum despite a more uncertain economic

environment, with growth of +2.3% (+3.7%*) in Q3 22 vs. Q3

21.

French Retail Banking was resilient (+0.5% vs.

Q3 21). Net banking income showed a healthy momentum on service

fees and in private banking.

International Retail Banking & Financial

Services’ revenues rose +5.6% (+13.5%*) vs. Q3 21, driven by a very

good quarter for ALD and International Retail Banking. The latter

saw its activities grow +13.0%* vs. Q3 21. Financial Services’ net

banking income was substantially higher (+19.0%* vs. Q3 21) while

Insurance net banking income increased by +2.1%* vs. Q3 21.

Global Banking & Investor Solutions

continued to enjoy dynamic growth, with revenues up +6.4% (+3.9%*)

vs. Q3 21. Global Markets & Investor Services was higher

(+11.2%, 5.2%*) than in Q3 21 while Financing & Advisory

activities increased by +7.0% (+1.5%*) vs. Q3 21.

In 9M 22, the Group posted robust revenue growth

of +10.4% (+10.9%*) vs. 9M 21, with growth in all the

businesses.

Operating expensesIn Q3 22, operating

expenses totalled EUR 4,233 million on a reported basis and EUR

4,358 million on an underlying basis (restated for transformation

costs and the linearisation of IFRIC 21), an increase of +2.0% vs.

Q3 21.

In 9M 22, underlying operating expenses were up

+5.4% vs. 9M 21 at EUR 13,273 million (EUR 14,020 million on a

reported basis). This rise can be explained primarily by the higher

contribution to the Single Resolution Fund (EUR +208 million), the

increase in the variable elements of employee remuneration

including the Global Employee Share Ownership Plan (EUR +142

million) and currency effects (EUR +165 million). Excluding these

variable elements, the increase in other expenses was limited at

EUR 164 million vs. 9M 21 (+1.3%).

Overall, underlying gross operating

income increased by 2.9% in Q3 22 to EUR 2,470 million and the

underlying cost to income ratio, excluding the Single Resolution

Fund, decreased to 60.7%.

In 9M 22, underlying gross operating income was

substantially higher (+20.0% vs. 9M 21) at EUR 7,901 million.

Cost of risk

The cost of risk remained contained at 31

basis points in Q3 22, or EUR 456 million. It breaks down into

a provision on non-performing loans which remains limited at EUR

154 million (~10 basis points), and an additional provision on

performing loans of EUR 302 million (21 basis points).

In 9M 2022, the cost of risk amounted to 29

basis points.

Offshore exposure to Russia was reduced to EUR

2.3 billion of EAD (Exposure At Default) at September 30th, 2022.

Exposure at risk on this portfolio is estimated at less than EUR 1

billion. The total associated provisions were EUR 452 million at

end-September 2022.

Moreover, at end-September 2022, the Group’s

residual exposure in relation to Rosbank amounted to around EUR 0.1

billion, corresponding mainly to guarantees and letters of credit

that were recognised under intra-group exposure before the disposal

of Rosbank.

The Group’s provisions on performing loans

amounted to EUR 3,754 million at end-September, an increase of EUR

399 million in 2022.

The non-performing loans ratio amounted to

2.7%(2) at September 30th, 2022, down ~10 basis points vs. June

30th, 2022. The Group’s gross coverage ratio for doubtful

outstandings was stable at 50%(3) at September 30th, 2022.

The cost of risk is still expected to be

between 30 and 35 basis points in 2022.

Group net income

|

In EURm |

|

|

|

|

Q3 22 |

Q3 21 |

9M 22 |

9M 21 |

|

Reported Group net income |

|

|

1,498 |

1,601 |

858 |

3,854 |

|

Underlying Group net income(1) |

|

|

1,410 |

1,391 |

4,489 |

4,038 |

|

In EURm |

|

|

|

|

Q3 22 |

Q3 21 |

9M 22 |

9M 21 |

|

ROTE |

|

|

11.2% |

12.7% |

1.3% |

10.0% |

|

Underlying ROTE(1) |

|

|

10.5% |

10.9% |

10.4% |

10.4% |

(1) Adjusted for exceptional items and

linearisation of IFRIC 21

Earnings per share amounts to EUR 0.55 in 9M 22

(EUR 4.02 in 9M 21). Underlying earnings per share amounts to EUR

4.68 over the same period (EUR 4.06 in 9M 21).

- THE GROUP’S FINANCIAL STRUCTURE

Group shareholders’ equity totalled EUR

66.3 billion at September 30th, 2022 (EUR 65.1 billion at December

31st, 2021). Net asset value per share was EUR 69.4 and tangible

net asset value per share was EUR 61.5.

The consolidated balance sheet totalled EUR

1,594 billion at September 30th, 2022 (EUR 1,464 billion at

December 31st, 2021). The net amount of customer loan outstandings

at September 30th, 2022, including lease financing, was EUR 503

billion (EUR 488 billion at December 31st, 2021) – excluding assets

and securities purchased under resale agreements. At the same time,

customer deposits amounted to EUR 527 billion, vs. EUR 502 billion

at December 31st, 2021 (excluding assets and securities sold under

repurchase agreements).

At October 18th, 2022, the parent company had

issued EUR 41.1 billion of medium/long-term debt, having an average

maturity of 5.1 years and an average spread of 56 basis points (vs.

the 6-month midswap, excluding subordinated debt). The subsidiaries

had issued EUR 2.7 billion. In total, the Group had issued EUR 43.8

billion of medium/long-term debt.

The LCR (Liquidity Coverage Ratio) was well

above regulatory requirements at 143% at end-September 2022 (143%

on average in Q3), vs. 129% at end-December 2021. At the same time,

the NSFR (Net Stable Funding Ratio) was at a level of 112% at

end-September 2022.

The Group’s risk-weighted assets (RWA)

amounted to EUR 371.6 billion at September 30th, 2022 (vs.

EUR 363.4 billion at end-December 2021) according to CRR2/CRD5

rules. Risk-weighted assets in respect of credit risk represent

83.6% of the total, at EUR 310.7 billion, up 1.9% vs. December

31st, 2021.

At September 30th, 2022, the Group’s Common

Equity Tier 1 ratio stood at 13.1%, or around 380 basis points

above the regulatory requirement. The CET1 ratio at September 30th,

2022 includes an effect of +15 basis points for phasing of the IFRS

9 impact. Excluding this effect, the fully-loaded ratio amounts to

12.9%. The Tier 1 ratio stood at 15.6% at end-September 2022 (15.9%

at end-December 2021) and the total capital ratio amounted to 19.0%

(18.8% at end-December 2021).

The leverage ratio stood at 4.2% at

September 30th, 2022.

With a level of 32.4% of RWA and 8.6% of

leverage exposure at end-September 2022, the Group’s TLAC ratio is

above the Financial Stability Board’s requirements for 2022. At

September 30th, 2022, the Group was also above its 2022 MREL

requirements of 25.2% of RWA and 5.91% of leverage exposure.

The Group is rated by four rating agencies: (i)

Fitch Ratings - long-term rating “A-”, stable rating, senior

preferred debt rating “A”, short-term rating “F1” (ii) Moody’s -

long-term rating (senior preferred debt) “A1”, stable outlook,

short-term rating “P-1” (iii) R&I - long-term rating (senior

preferred debt) “A”, stable outlook; and (iv) S&P Global

Ratings - long-term rating (senior preferred debt) “A”, stable

outlook, short-term rating “A-1”.

- FRENCH RETAIL BANKING

|

In EURm |

Q3 22 |

Q3 21 |

Change |

9M 22 |

9M 21 |

Change |

|

Net banking income |

2,176 |

2,165 |

+0.5% |

6,620 |

6,268 |

+5.6% |

|

Net banking income excl. PEL/CEL |

2,123 |

2,152 |

-1.3% |

6,473 |

6,250 |

+3.6% |

|

Operating expenses |

(1,523) |

(1,502) |

+1.4% |

(4,756) |

(4,560) |

+4.3% |

|

Underlying operating expenses(1) |

(1,579) |

(1,545) |

+2.2% |

(4,700) |

(4,517) |

+4.0% |

|

Gross operating income |

653 |

663 |

-1.5% |

1,864 |

1,708 |

+9.1% |

|

Underlying gross operating income(1) |

597 |

620 |

-3.7% |

1,920 |

1,751 |

+9.7% |

|

Net cost of risk |

(196) |

(8) |

x 24.5 |

(264) |

(145) |

+82.1% |

|

Operating income |

457 |

655 |

-30.2% |

1,600 |

1,563 |

+2.4% |

|

Net profits or losses from other assets |

3 |

(2) |

n/s |

6 |

2 |

x 3.0 |

|

Reported Group net income |

343 |

470 |

-27.0% |

1,195 |

1,136 |

+5.2% |

|

Underlying Group net income(1) |

301 |

439 |

-31.3% |

1,237 |

1,167 |

+5.9% |

|

RONE |

10.7% |

15.8% |

|

12.9% |

12.6% |

|

|

Underlying RONE(1) |

9.4% |

14.8% |

|

13.4% |

12.9% |

|

(1) Including PEL/CEL provision and adjusted

for the linearisation of IFRIC 21 NB: including Private Banking

activities as per Q1 22 restatement (France and international),

includes other businesses transferred following the disposal of

Lyxor

Societe Generale and Crédit du Nord

networks

Average loan outstandings were 3.7% higher than

in Q3 21 at EUR 215 billion.

Home loan outstandings rose +3.5% vs. Q3 21.

Outstanding loans to corporate and professional customers were 4%

higher than in Q3 21.

Average outstanding balance sheet deposits

including BMTN (negotiable medium-term notes) continued to rise

(+1.5% vs. Q3 21) to EUR 243 billion.

As a result, the average loan/deposit ratio

stood at 88% in Q3 22 vs. 87% in Q3 21.

Life insurance assets under management totalled

EUR 109 billion at end-September 2022, unchanged year-on-year (with

the unit-linked share accounting for 32%). Gross life insurance

inflow amounted to EUR 1.8 billion in Q3 22.

Personal protection insurance premiums were up

+8% vs. Q3 21 and property/casualty insurance premiums were up +4%

vs. Q3 21.

Boursorama

The bank consolidated its position as the

leading online bank in France, with more than 4.3 million clients

at end-September 2022 (+40% vs. Q3 21), thanks to the onboarding of

365,000 new clients in Q3 22 (x2.2 vs. Q3 21).

Average outstanding loans rose +21% vs. Q3 21 to

EUR 15 billion. Home loan outstandings were up +20% vs. Q3 21,

while consumer loan outstandings climbed +28% vs. Q3 21.

Average outstanding savings including deposits

and financial savings were 32% higher than in Q3 21 at EUR 46

billion, with deposits increasing by +37% vs. Q3 21. Brokerage

recorded more than 1.5 million transactions in Q3 22.

The exclusive offering reserved for ING

customers ended successfully on September 30th. The customer

acquisition rate was 63% or around 315,000 ING customers out of the

500,000 eligible customers. They consist mainly of affluent

customers. The outstandings collected total around EUR 8.5 billion

and consist mainly of life insurance outstandings.

Private Banking

Private Banking activities, which were

transferred to French Retail Banking at the beginning of 2022,

cover the activities in France and internationally. Assets under

management totalled EUR 146 billion at end-September. Net inflow

totalled EUR 1.3 billion in Q3 22. Net banking income amounted to

EUR 325 million in Q3 22 (+11.5% vs. Q3 21).

Net banking income

Q3 22: revenues totalled EUR 2,176

million, up +0.5% vs. Q3 21 including PEL/CEL, due to good

commercial activity. Net interest income and other revenues,

including PEL/CEL, was down -4.5% vs. Q3 21, impacted primarily by

the higher rate on regulated savings accounts and a time lag effect

in the rise in rates on new home loans due to the usury rate. Fees

increased by +6.5% vs. Q3 21, driven by the sharp rise in service

fees and the performance of financial fees.

9M 22: revenues totalled EUR 6,620

million, up +5.6% vs. 9M 21, including PEL/CEL. Net interest income

and other revenues, including PEL/CEL, was up +4.6% vs. 9M 21. Fees

were 6.8% higher than in 9M 21, benefiting from the strong growth

in service fees.

Operating expenses

Q3 22: operating expenses totalled EUR

1,523 million (+1.4% vs. Q3 21) and EUR 1,579 million on an

underlying basis (+2.2% vs. Q3 21). The cost to income ratio stood

at 70%, an increase of 0.6 points vs. Q3 21.

9M 22: operating expenses totalled EUR

4,756 million (+4.3% vs. 9M 21). The cost to income ratio stood at

72%, down 1 point vs. 9M 21.

Cost of risk

Q3 22: the commercial cost of risk

amounted to EUR 196 million or 32 basis points, including in

particular EUR 123 million on performing loans (20 basis points).

It was higher than in Q3 21 (1 basis point).

9M 22: the commercial cost of risk

amounted to EUR 264 million or 14 basis points, higher than in 9M

21 (8 basis points).

Contribution to Group net income

Q3 22: the contribution to Group net

income was EUR 343 million in Q3 22, down 27.0% vs. Q3 21

(EUR 470 million in Q3 21). RONE (after linearisation of the IFRIC

21 charge) stood at 9.4% in Q3 22 (10.9% excluding Boursorama).

9M 22: the contribution to Group net

income was EUR 1,195 million, up +5.2% vs. 9M 21. RONE (after

linearisation of the IFRIC 21 charge) stood at 13.4% in 9M 22.

- INTERNATIONAL RETAIL BANKING & FINANCIAL

SERVICES

|

In EURm |

Q3 22 |

Q3 21 |

Change |

9M 22 |

9M 21 |

Change |

|

Net banking income |

2,226 |

2,107 |

+5.6% |

+13.5%* |

6,753 |

5,958 |

+13.3% |

+17.9%* |

|

Operating expenses |

(1,006) |

(1,015) |

-0.9% |

+10.6%* |

(3,234) |

(3,115) |

+3.8% |

+9.5%* |

|

Underlying operating expenses(1) |

(1,037) |

(1,039) |

-0.2% |

+11.1%* |

(3,203) |

(3,091) |

+3.6% |

+9.3%* |

|

Gross operating income |

1,220 |

1,092 |

+11.7% |

+16.1%* |

3,519 |

2,843 |

+23.8% |

+26.8%* |

|

Underlying gross operating income(1) |

1,189 |

1,068 |

+11.3% |

+15.8%* |

3,550 |

2,867 |

+23.8% |

+26.8%* |

|

Net cost of risk |

(150) |

(145) |

+3.4% |

+7.3%* |

(572) |

(408) |

+40.2% |

-4.6%* |

|

Operating income |

1,070 |

947 |

+13.0% |

+17.4%* |

2,947 |

2,435 |

+21.0% |

+35.5%* |

|

Net profits or losses from other assets |

2 |

4 |

-50.0% |

-50.0%* |

12 |

10 |

+20.0% |

+19.3%* |

|

Reported Group net income |

624 |

584 |

+6.8% |

+13.2%* |

1,718 |

1,498 |

+14.7% |

+29.4%* |

|

Underlying Group net income(1) |

606 |

570 |

+6.3% |

+12.8%* |

1,736 |

1,512 |

+14.8% |

+29.4%* |

|

RONE |

23.8% |

22.6% |

|

|

21.4% |

19.7% |

|

|

|

Underlying RONE(1) |

23.1% |

22.1% |

|

|

21.7% |

19.9% |

|

|

(1) Adjusted for the linearisation of IFRIC 21

International Retail Banking’s

outstanding loans totalled EUR 86.7 billion, up +6.2%* vs. Q3 21.

Outstanding deposits were slightly higher (+0.8%*) than in Q3 21,

at EUR 80.9 billion.

For the Europe scope, outstanding loans were up

+5.9%* vs. end-September 2021 at EUR 62.7 billion, driven by a

positive momentum in the Czech Republic (+9.1%*) and in Romania

(+8.6%*). Outstanding deposits declined -1.7%* to EUR 54.3 billion.

The good momentum in Romania and Western Europe was offset by a

slowdown in the Czech Republic notably due to a shift towards

financial savings.

In Africa, Mediterranean Basin and French

Overseas Territories, outstanding loans confirmed their rebound,

with an increase of +7.0%*. Outstanding deposits continued to enjoy

a good momentum, up +6.2%*.

In the Insurance business, life insurance

outstandings totalled EUR 130 billion at end-September 2022.

The share of unit-linked products in outstandings was still high at

35%, stable vs. September 2021. Gross life insurance savings inflow

amounted to EUR 2,573 million in Q3 22 in a highly volatile market.

The share of unit-linked products remained high at 39% in Q3 22.

Protection insurance saw an increase of +2.8%* vs. Q3 21, with a

good momentum for property/casualty insurance premiums.

Financial Services also enjoyed a very

good momentum. Operational Vehicle Leasing and Fleet Management

posted growth of +5.2% vs. end-September 2021 and the number of

contracts totalled 1.8 million. Equipment Finance outstanding loans

were slightly higher (+0.5%) than at end-September 2021, at EUR

14.5 billion (excluding factoring).

Net banking incomeNet banking income

amounted to EUR 2,226 million in Q3 22, up +13.5%* vs. Q3 21.

Revenues amounted to EUR 6,753 million in 9M 22, up +17.9%* vs. 9M

21.

International Retail Banking’s net

banking income totalled EUR 1,260 million in Q3 22, up +13.0%*.

International Retail Banking’s net banking income totalled EUR

3,873 million in 9M 22, up +12.6%* vs. 9M 21.

Revenues in Europe climbed +14.5%* vs. Q3 21,

due primarily to substantial growth in net interest income (+16.2%*

vs. Q3 21), driven by the Czech Republic (+41.1%* vs. Q3 21) and

Romania (+20.1%* vs. Q3 21).

The Africa, Mediterranean Basin and French

Overseas Territories scope posted revenues up +10.5%* vs. Q3 21 at

EUR 485 million, driven by all the entities.

The Insurance business posted net banking

income up +2.1%* vs. Q3 21, at EUR 247 million. The Insurance

business’ net banking income was 5.1%* higher in 9M 22 than in 9M

21 at EUR 749 million.

Financial Services’ net banking income

was substantially higher (+19.0%*) than in Q3 21, at EUR 719

million. This performance is due primarily at ALD level to a good

commercial momentum, a strong used car sale result (EUR 3,149 per

vehicle in 9M 22), a depreciation adjustment and, to a lesser

extent, the transfer to hyperinflation accounting for activities in

Turkey. Financial Services’ net banking income totalled EUR 2,131

million in 9M 22, up +35.0%* vs. 9M 21.

Operating expensesOperating expenses

increased by +11.1%*(1) vs. Q3 21 to EUR 1,037 million(1),

resulting in a positive jaws effect. The cost to income ratio

(after linearisation of the IFRIC 21 charge) stood at 46.6%(1) in

Q3 22, lower than in Q3 21 (49.3%(1)). Operating expenses totalled

EUR 3,203 million(1) in 9M 22, up +9.3%*(1) vs. 9M 21.

In International Retail Banking,

operating expenses were up +6.2%*(1) vs. Q3 21.

In the Insurance business, operating

expenses rose +5.7%*(1) vs. Q3 21, with a cost to income ratio

(after linearisation of the IFRIC 21 charge) of 38.7%(1).

In Financial Services, operating expenses

increased by +26.9%*(1) vs. Q3 21. This rise is due in particular

to the recognition in Q3 22 of charges related to the preparation

of the acquisition of Leaseplan.

Cost of risk

In Q3 22, the cost of risk was higher at 47

basis points (EUR 150 million), vs. 43 basis points in Q3 21.

On 9M 22, the cost of risk amounted to 56 basis

points (EUR 572 million). It was 41 basis points in 9M 21.

Contribution to Group net income

The contribution to Group net income totalled

EUR 606 million(1) in Q3 22, up +12.8%*(1) vs. Q3 21. The

contribution to Group net income totalled EUR 1,736 million(1) in

9M 22 (+29.4%*(1) vs. 9M 21).

Underlying RONE stood at 23.1% in Q3 22 and

21.7% in 9M 22. Underlying RONE was 18.4% in International Retail

Banking and 28.0% in Financial Services and Insurance in Q3 22.

- GLOBAL BANKING & INVESTOR SOLUTIONS

|

In EURm |

Q3 22 |

Q3 21 |

Variation |

9M 22 |

9M 21 |

Variation |

|

Net banking income |

2,312 |

2,172 |

+6.4% |

+3.9%* |

7,630 |

6,671 |

+14.4% |

+12.4%* |

|

Operating expenses |

(1,428) |

(1,457) |

-2.0% |

-2.7%* |

(5,165) |

(4,848) |

+6.5% |

+6.4%* |

|

Underlying operating expenses(1) |

(1,613) |

(1,578) |

+2.2% |

+1.6%* |

(4,980) |

(4,727) |

+5.3% |

+5.2%* |

|

Gross operating income |

884 |

715 |

+23.6% |

+16.6%* |

2,465 |

1,823 |

+35.2% |

+27.4%* |

|

Underlying gross operating income(1) |

699 |

594 |

+17.6% |

+9.6%* |

2,650 |

1,944 |

+36.3% |

+28.9%* |

|

Net cost of risk |

(80) |

(44) |

+81.8% |

+58.6%* |

(343) |

(62) |

x 5.5 |

x 5.1* |

|

Operating income |

804 |

671 |

+19.8% |

+13.6%* |

2,122 |

1,761 |

+20.5% |

+13.7%* |

|

Reported Group net income |

629 |

544 |

+15.6% |

+10.1%* |

1,673 |

1,397 |

+19.8% |

+13.2%* |

|

Underlying Group net income(1) |

486 |

451 |

+7.8% |

+1.6%* |

1,816 |

1,490 |

+21.9% |

+15.6%* |

|

RONE |

16.7% |

15.0% |

+0.0% |

+0.0%* |

15.3% |

13.5% |

+0.0% |

+0.0%* |

|

Underlying RONE(1) |

12.9% |

12.5% |

+0.0% |

+0.0%* |

16.6% |

14.4% |

+0.0% |

+0.0%* |

(1) Adjusted for the linearisation of IFRIC

21NB: excluding Private Banking activities as per Q1 22 restatement

(France and International). Excludes businesses transferred

following the disposal of Lyxor

Net banking income

Global Banking & Investor Solutions

delivered a very solid performance in Q3, with revenues of EUR

2,312 million, up +6.4% vs. Q3 21.

Revenues increased substantially in 9M 22,

+14.4% vs. 9M 21 (EUR 7,630 million vs. EUR 6,671 million).

In Global Markets & Investor

Services, net banking income totalled EUR 1,505 million in Q3

22 (+11.2% vs. Q3 21). It amounted to EUR 5,212 million in 9M

22, +18.6% vs. 9M 21.

Global Markets turned in a strong performance in

Q3 22 (EUR 1,344 million), up +12.1% vs. Q3 21, benefiting from

dynamic commercial activity in a still volatile environment.

Revenues were higher in 9M 22 (+18.8%) than in 9M 21 at EUR 4,637

million.

The Equity activity delivered a solid

performance in Q3 (EUR 806 million, +1.0% vs. Q3 21), driven by a

sustained high client demand in both flow activities and investment

solutions. Revenues were up +9.6% in 9M 22 vs. 9M 21 at EUR 2,649

million.

Fixed Income & Currency activities posted

substantially higher revenues (+34.2% vs. Q3 21) at EUR 538 million

in a volatile rate environment. Revenues increased to EUR 1,988

million in 9M 22 (+33.8% vs. 9M 21).

Securities Services saw its revenues increase

+3.9% vs. Q3 21, to EUR 161 million. Revenues were up +17.3% in 9M

22 vs. 9M 21 at EUR 575 million. Securities Services’ assets under

custody and assets under administration amounted to EUR 4,275

billion and EUR 598 billion respectively.

Financing & Advisory posted revenues

of EUR 807 million, up +7.0% vs. Q3 21. They amounted to EUR 2,418

million in 9M 22, significantly higher (+14.7%) than in 9M

21.

The Global Banking & Advisory business,

slightly lower (-1.4% vs. Q3 21), continued to capitalise on the

good market momentum in Asset Finance and activities related to

Natural Resources. These performances were also driven by the

strategy focused on Environmental, Social and Governance criteria.

The Asset-Backed Products platform also showed good resilience in

Q3. In contrast, Investment Banking was negatively impacted by

current market conditions and the decline in volumes.

Global Transaction and Payment Services

continued to experience very high growth, up +50.0% vs. Q3

21. It was a record quarter as a result of a very good performance

in all activities, particularly Cash Management and Correspondent

Banking.

Operating expenses

Operating expenses totalled EUR 1,428 million in

Q3 22, -2.0% lower than in Q3 21 on a reported basis, and slightly

higher (+2.2%) on an underlying basis. The increase on an

underlying basis can be explained primarily by the rise of EUR 64

million in linearised IFRIC 21 charges in Q3.

With a positive jaws effect, the underlying cost

to income ratio excluding the contribution to the Single Resolution

Fund improved to 63.0%.

Operating expenses were up +6.5% on a reported

basis and +5.3% on an underlying basis in 9M 22.

Cost of risk

The cost of risk amounted to 17 basis points (or

EUR 80 million) in Q3 22, with cost of risk amounting to EUR 43

million on the Russian offshore portfolio. It stood at 26 basis

points (or EUR 343 million) in 9M 22 given the provisioning on the

Russian offshore portfolio (EUR 303 million).

Contribution to Group net income

The contribution to Group net income was EUR 629

million on a reported basis (+15.6% vs. Q3 21) and EUR 486 million

on an underlying basis in Q3 22. It was EUR 1,673 million on a

reported basis and EUR 1,816 million on an underlying basis in 9M

22.

Global Banking & Investor Solutions posted

an underlying RONE of 12.9% in Q3 22 and 16.1% excluding the

contribution to the Single Resolution Fund (vs. 14.6% in Q3 21).

The underlying RONE was 16.6% in 9M 22 vs. 14.4% in 9M 21.

- CORPORATE CENTRE

|

In EURm |

Q3 22 |

Q3 21 |

9M 22 |

9M 21 |

|

Net banking income |

114 |

228 |

171 |

281 |

|

Operating expenses |

(276) |

(196) |

(865) |

(502) |

|

Underlying operating expenses(1) |

(129) |

(110) |

(390) |

(259) |

|

Gross operating income |

(162) |

32 |

(694) |

(221) |

|

Underlying gross operating income(1) |

(15) |

118 |

(219) |

22 |

|

Net cost of risk |

(30) |

1 |

(55) |

1 |

|

Net profits or losses from other assets |

(1) |

173 |

(3,304) |

174 |

|

Income tax |

152 |

(166) |

485 |

(6) |

|

Reported Group net income |

(98) |

3 |

(3,728) |

(177) |

|

Underlying Group net income(1) |

16 |

(69) |

(299) |

(132) |

(1) Adjusted for the linearisation of IFRIC

21

The Corporate Centre includes:

- the property management of the Group’s head office,

- the Group’s equity portfolio,

- the Treasury function for the Group,

- certain costs related to cross-functional projects as well as

certain costs incurred by the Group not re-invoiced to the

businesses.

The Corporate Centre’s net banking income

totalled EUR 114 million in Q3 22 vs. EUR +228 million in Q3

21, and EUR +171 million in 9M 22 vs. EUR +281 million in 9M

21.

Operating expenses totalled EUR 276

million in Q3 22 vs. EUR 196 million in Q3 21. They include the

Group’s transformation costs for a total amount of EUR 160 million

relating to the activities of French Retail Banking (EUR 100

million), Global Banking & Investor Solutions (EUR 24 million)

and the Corporate Centre (EUR 36 million). Underlying costs came to

EUR 129 million in Q3 22 compared to EUR 110 million in Q3 21.

In 9M 22, operating expenses totalled EUR 865

million vs. EUR 502 million in 9M 21. Transformation costs totalled

EUR 462 million (EUR 301 million for the activities of French

Retail Banking, EUR 63 million for Global Banking & Investor

Solutions and EUR 98 million for the Corporate Centre). Underlying

costs came to EUR 390 million in 9M 22 compared to EUR 259 million

in 9M 21.

Gross operating income totalled EUR -162

million in Q3 22 vs. EUR 32 million in Q3 21. Underlying gross

operating income came to EUR -15 million in Q3 22 vs. EUR 118

million in Q3 21. In 9M 22, gross operating income was EUR -694

million on a reported basis (vs. EUR -221 million in 9M 21) and EUR

-219 million on an underlying basis (vs. EUR 22 million in 9M

21).

The Corporate Centre’s contribution to Group

net income was EUR -98 million in Q3 22 vs. EUR 3 million in Q3

21. The Corporate Centre’s contribution to Group net income on an

underlying basis was EUR 16 million. In 9M 22, the contribution to

Group net income was EUR -3,728 million on a reported basis and EUR

-299 million on an underlying basis.

- 2022 AND 2023 FINANCIAL CALENDAR

|

2022 and 2023 Financial communication calendar |

|

February 8th,

2023 Fourth

quarter and FY 2022 results |

|

May 12th,

2023

First quarter 2023 resultsMay 23rd,

2023

2023 General MeetingAugust 3rd,

2023

Second quarter 2023 results |

|

|

|

The Alternative Performance Measures, notably the notions of net

banking income for the pillars, operating expenses, IFRIC 21

adjustment, cost of risk in basis points, ROE, ROTE, RONE, net

assets, tangible net assets, and the amounts serving as a basis for

the different restatements carried out (in particular the

transition from published data to underlying data) are presented in

the methodology notes, as are the principles for the presentation

of prudential ratios. This document contains

forward-looking statements relating to the targets and strategies

of the Societe Generale Group.These forward-looking statements are

based on a series of assumptions, both general and specific, in

particular the application of accounting principles and methods in

accordance with IFRS (International Financial Reporting Standards)

as adopted in the European Union, as well as the application of

existing prudential regulations. These forward-looking

statements have also been developed from scenarios based on a

number of economic assumptions in the context of a given

competitive and regulatory environment. The Group may be unable

to:- anticipate all the risks, uncertainties or other factors

likely to affect its business and to appraise their potential

consequences;- evaluate the extent to which the occurrence of

a risk or a combination of risks could cause actual results to

differ materially from those provided in this document and the

related presentation. Therefore, although Societe Generale

believes that these statements are based on reasonable assumptions,

these forward-looking statements are subject to numerous risks and

uncertainties, including matters not yet known to it or its

management or not currently considered material, and there can be

no assurance that anticipated events will occur or that the

objectives set out will actually be achieved. Important factors

that could cause actual results to differ materially from the

results anticipated in the forward-looking statements include,

among others, overall trends in general economic activity and in

Societe Generale’s markets in particular, regulatory and prudential

changes, and the success of Societe Generale’s strategic, operating

and financial initiatives. More detailed information on the

potential risks that could affect Societe Generale’s financial

results can be found in the section “Risk Factors” in our Universal

Registration Document filed with the French Autorité des Marchés

Financiers (which is available on

https://investors.societegenerale.com/en). Investors are

advised to take into account factors of uncertainty and risk likely

to impact the operations of the Group when considering the

information contained in such forward-looking statements. Other

than as required by applicable law, Societe Generale does not

undertake any obligation to update or revise any forward-looking

information or statements. Unless otherwise specified, the sources

for the business rankings and market positions are internal. |

- APPENDIX 1: FINANCIAL DATA

GROUP NET INCOME BY CORE BUSINESS

|

In EURm |

Q3 22 |

Q3 21 |

Variation |

9M 22 |

9M 21 |

Variation |

|

French Retail Banking |

343 |

470 |

-27.0% |

1,195 |

1,136 |

+5.2% |

|

International Retail Banking and Financial Services |

624 |

584 |

+6.8% |

1,718 |

1,498 |

+14.7% |

|

Global Banking and Investor Solutions |

629 |

544 |

+15.6% |

1,673 |

1,397 |

+19.8% |

|

Core Businesses |

1,596 |

1,598 |

-0.1% |

4,586 |

4,031 |

+13.8% |

|

Corporate Centre |

(98) |

3 |

n/s |

(3,728) |

(177) |

n/s |

|

Group |

1,498 |

1,601 |

-6.4% |

858 |

3,854 |

-77.7% |

CONSOLIDATED BALANCE SHEET

|

In EUR m |

30.09.2022 |

31.12.2021 |

|

Cash, due from central banks |

200,834 |

179,969 |

|

Financial assets at fair value through profit or loss |

396,846 |

342,714 |

|

Hedging derivatives |

30,998 |

13,239 |

|

Financial assets at fair value through other comprehensive

income |

41,337 |

43,450 |

|

Securities at amortised cost |

20,281 |

19,371 |

|

Due from banks at amortised cost |

77,736 |

55,972 |

|

Customer loans at amortised cost |

513,138 |

497,164 |

|

Revaluation differences on portfolios hedged against interest rate

risk |

(1,514) |

131 |

|

Investments of insurance companies |

158,923 |

178,898 |

|

Tax assets |

4,500 |

4,812 |

|

Other assets |

112,517 |

92,898 |

|

Non-current assets held for sale |

6 |

27 |

|

Deferred profit-sharing |

982 |

- |

|

Investments accounted for using the equity method |

115 |

95 |

|

Tangible and intangible fixed assets |

33,048 |

31,968 |

|

Goodwill |

3,794 |

3,741 |

|

Total |

1,593,541 |

1,464,449 |

|

In EUR m |

30.09.2022 |

31.12.2021 |

|

Due to central banks |

9,392 |

5,152 |

|

Financial liabilities at fair value through profit or loss |

367,483 |

307,563 |

|

Hedging derivatives |

44,641 |

10,425 |

|

Debt securities issued |

125,189 |

135,324 |

|

Due to banks |

149,785 |

139,177 |

|

Customer deposits |

534,732 |

509,133 |

|

Revaluation differences on portfolios hedged against interest rate

risk |

(8,984) |

2,832 |

|

Tax liabilities |

1,735 |

1,577 |

|

Other liabilities |

134,535 |

106,305 |

|

Non-current liabilities held for sale |

- |

1 |

|

Insurance contracts related liabilities |

140,452 |

155,288 |

|

Provisions |

4,907 |

4,850 |

|

Subordinated debts |

17,601 |

15,959 |

|

Total liabilities |

1,521,468 |

1,393,586 |

|

Shareholder's equity |

- |

- |

|

Shareholders' equity, Group share |

- |

- |

|

Issued common stocks and capital reserves |

21,497 |

21,913 |

|

Other equity instruments |

7,676 |

7,534 |

|

Retained earnings |

34,622 |

30,631 |

|

Net income |

858 |

5,641 |

|

Sub-total |

64,653 |

65,719 |

|

Unrealised or deferred capital gains and losses |

1,658 |

(652) |

|

Sub-total equity, Group share |

66,311 |

65,067 |

|

Non-controlling interests |

5,762 |

5,796 |

|

Total equity |

72,073 |

70,863 |

|

Total |

1,593,541 |

1,464,449 |

- APPENDIX 2: METHODOLOGY

1 –The financial information presented for

the third quarter and the first nine months of 2022 was examined by

the Board of Directors on November 3rd, 2022 and has been

prepared in accordance with IFRS as adopted in the European Union

and applicable at that date. This information has not been

audited.

2 - Net banking income

The pillars’ net banking income is defined on

page 41 of Societe Generale’s 2022 Universal Registration Document.

The terms “Revenues” or “Net Banking Income” are used

interchangeably. They provide a normalised measure of each pillar’s

net banking income taking into account the normative capital

mobilised for its activity.

3 - Operating expenses

Operating expenses correspond to the “Operating

Expenses” as presented in note 8.1 to the Group’s consolidated

financial statements as at December 31st, 2021 (pages 482 et seq.

of Societe Generale’s 2022 Universal Registration Document). The

term “costs” is also used to refer to Operating Expenses. The

Cost/Income Ratio is defined on page 41 of Societe Generale’s 2022

Universal Registration Document.

4 - IFRIC 21 adjustment

The IFRIC 21 adjustment corrects the result of

the charges recognised in the accounts in their entirety when they

are due (generating event) so as to recognise only the portion

relating to the current quarter, i.e. a quarter of the total. It

consists in smoothing the charge recognised accordingly over the

financial year in order to provide a more economic idea of the

costs actually attributable to the activity over the period

analysed.

The contributions to Single Resolution Fund

(« SRF ») are part of IFRIC21 adjusted charges, they

include contributions to national resolution funds within the

EU.

5 – Exceptional items – Transition from

accounting data to underlying data

It may be necessary for the Group to present

underlying indicators in order to facilitate the understanding of

its actual performance. The transition from published data to

underlying data is obtained by restating published data for

exceptional items and the IFRIC 21 adjustment.

Moreover, the Group restates the revenues and

earnings of the French Retail Banking pillar for PEL/CEL provision

allocations or write-backs. This adjustment makes it easier to

identify the revenues and earnings relating to the pillar’s

activity, by excluding the volatile component related to

commitments specific to regulated savings.

The reconciliation enabling the transition from

published accounting data to underlying data is set out in the

table below:

|

in EUR m |

|

Q3 22 |

Q3 21 |

|

9M 22 |

9M 21 |

|

Exceptional operating expenses (-) |

|

(125) |

(102) |

|

747 |

431 |

|

IFRIC linearisation |

|

(285) |

(199) |

|

285 |

199 |

|

Transformation costs(1) |

|

160 |

97 |

|

462 |

232 |

|

Of which

related to French Retail Banking |

|

100 |

46 |

|

301 |

106 |

|

Of which

related to Global Banking & Investor Solutions |

|

24 |

23 |

|

63 |

66 |

|

Of which

related to Corporate Centre |

|

36 |

28 |

|

98 |

60 |

|

Exceptional Net profit or losses from other assets

(+/-) |

|

0 |

(185) |

|

3,303 |

(185) |

|

Net losses from the disposal of Russian activities(1) |

|

0 |

|

|

3,300 |

|

|

Lyxor disposal(1) |

|

0 |

|

|

3 |

|

| Total

exceptional items (pre-tax) |

|

(125) |

(287) |

|

4,050 |

246 |

|

|

|

|

|

|

|

|

| Reported

Net income - Group Share |

|

1,498 |

1,601 |

|

858 |

3,854 |

| Total

exceptional items - Group share (post-tax) |

|

(88) |

(211) |

|

3,631 |

184 |

|

Underlying Net income - Group Share |

|

1,410 |

1,391 |

|

4,489 |

4,038 |

(1) Allocated to Corporate Centre

-

6 - Cost of risk in basis points, coverage

ratio for doubtful outstandings

The cost of risk is defined on pages 43 and 663

of Societe Generale’s 2022 Universal Registration Document. This

indicator makes it possible to assess the level of risk of each of

the pillars as a percentage of balance sheet loan commitments,

including operating leases.

|

In EURm |

|

Q3 22 |

Q3 21 |

9M 22 |

9M 21 |

|

French Retail Banking |

Net Cost

Of Risk |

196 |

8 |

264 |

145 |

| Gross

loan Outstandings |

246,467 |

234,980 |

244,941 |

234,525 |

|

Cost of Risk in bp |

32 |

1 |

14 |

8 |

|

International Retail Banking and Financial Services |

Net Cost

Of Risk |

150 |

145 |

572 |

408 |

| Gross

loan Outstandings |

127,594 |

134,725 |

136,405 |

132,088 |

|

Cost of Risk in bp |

47 |

43 |

56 |

41 |

|

Global Banking and Investor Solutions |

Net Cost

Of Risk |

80 |

44 |

343 |

62 |

| Gross

loan Outstandings |

190,678 |

149,761 |

179,454 |

144,456 |

|

Cost of Risk in bp |

17 |

12 |

26 |

7 |

|

Corporate Centre |

Net Cost

Of Risk |

30 |

(1) |

55 |

(1) |

| Gross

loan Outstandings |

15,924 |

14,244 |

15,093 |

13,589 |

|

Cost of Risk in bp |

75 |

(1) |

49 |

(1) |

|

Societe Generale Group |

Net Cost

Of Risk |

456 |

196 |

1,234 |

614 |

| Gross

loan Outstandings |

580,663 |

533,711 |

575,893 |

524,659 |

|

Cost of Risk in bp |

31 |

15 |

29 |

16 |

The gross coverage ratio for doubtful

outstandings is calculated as the ratio of provisions

recognised in respect of the credit risk to gross outstandings

identified as in default within the meaning of the regulations,

without taking account of any guarantees provided. This coverage

ratio measures the maximum residual risk associated with

outstandings in default (“doubtful”).

7 - ROE, ROTE, RONE

The notions of ROE (Return on Equity) and ROTE

(Return on Tangible Equity), as well as their calculation

methodology, are specified on page 43 and 44 of Societe Generale’s

2022 Universal Registration Document. This measure makes it

possible to assess Societe Generale’s return on equity and return

on tangible equity.

RONE (Return on Normative Equity) determines the

return on average normative equity allocated to the Group’s

businesses, according to the principles presented on page 44 of

Societe Generale’s 2022 Universal Registration Document.

Group net income used for the ratio numerator is

book Group net income adjusted for “interest net of tax payable on

deeply subordinated notes and undated subordinated notes, interest

paid to holders of deeply subordinated notes and undated

subordinated notes, issue premium amortisations” and “unrealised

gains/losses booked under shareholders’ equity, excluding

conversion reserves”. For ROTE, income is also restated for

goodwill impairment.

Details of the corrections made to book equity

in order to calculate ROE and ROTE for the period are given in the

table below: ROTE calculation: calculation methodology

|

End of period (in EURm) |

Q3 22 |

Q3 21 |

9M 22 |

9M 21 |

|

Shareholders' equity Group share |

66,311 |

63,638 |

66,311 |

63,638 |

|

Deeply subordinated notes |

(9,350) |

(7,820) |

(9,350) |

(7,820) |

|

Undated subordinated notes |

- |

- |

- |

- |

| Interest

of deeeply & undated subodinated notes, issue premium

amortisations(1) |

(80) |

(34) |

(80) |

(34) |

|

OCI excluding conversion reserves |

1,259 |

(613) |

1,259 |

(613) |

|

Distribution provision(2) |

(1,916) |

(1,726) |

(1,916) |

(1,726) |

|

Distribution N-1 to be paid |

(334) |

- |

(334) |

- |

|

ROE equity end-of-period |

55,891 |

53,445 |

55,891 |

53,445 |

|

Average ROE equity(3) |

55,264 |

52,947 |

54,922 |

52,219 |

|

Average Goodwill |

(3,667) |

(3,927) |

(3,646) |

(3,927) |

|

Average Intangible Assets |

(2,730) |

(2,599) |

(2,735) |

(2,549) |

|

Average ROTE equity(3) |

48,867 |

46,421 |

48,541 |

45,743 |

|

|

|

|

|

|

|

Group net Income |

1,498 |

1,601 |

858 |

3,854 |

|

Interest on deeply subordinated notes and undated subordinated

notes |

(126) |

(130) |

(404) |

(439) |

|

Cancellation of goodwill impairment |

1 |

- |

3 |

- |

|

Ajusted Group net Income |

1,373 |

1,471 |

457 |

3,415 |

|

Average ROTE equity(3) |

48,867 |

46,421 |

48,541 |

45,743 |

|

ROTE |

11.2% |

12.7% |

1.3% |

10.0% |

|

|

|

|

|

|

|

Underlying Group net income |

1,410 |

1,391 |

4,489 |

4,038 |

|

Interest on deeply subordinated notes and undated subordinated

notes |

(126) |

(130) |

(404) |

(439) |

|

Cancellation of goodwill impairment |

1 |

- |

3 |

- |

|

Ajusted Underlying Group net Income |

1,285 |

1,261 |

4,088 |

3,599 |

|

Average ROTE equity (underlying)(3) |

48,779 |

46,210 |

52,172 |

45,927 |

|

Underlying ROTE |

10.5% |

10.9% |

10.4% |

10.4% |

(1) Interest payable to holders of deeply

subordinated notes & undated subordinated notes, issue premium

amortisations(2) The distribution to be paid is calculated based on

a pay-out ratio of 50% of the underlying Group net income, after

deduction of deeply subordinated notes and on undated subordinated

notes(3) Amounts restated compared with the financial statements

published in 2021 (See Note 1.7 of the financial statements)

RONE calculation: Average capital allocated

to Core Businesses (in EURm)

|

In EURm |

Q3 22 |

Q3 21 |

Change |

9M 22 |

9M 21 |

Change |

|

French Retail Banking |

12,876 |

11,867 |

+8.5% |

12,331 |

12,065 |

+2.2% |

|

International Retail Banking and Financial Services |

10,505 |

10,340 |

+1.6% |

10,681 |

10,154 |

+5.2% |

|

Global Banking and Investor Solutions |

15,072 |

14,486 |

+4.0% |

14,619 |

13,824 |

+5.8% |

|

Core Businesses |

38,453 |

36,693 |

+4.8% |

37,631 |

36,042 |

+4.4% |

|

Corporate Center |

16,811 |

16,254 |

+3.4% |

17,291 |

16,177 |

+6.9% |

|

Group |

55,264 |

52,947 |

+4.4% |

54,922 |

52,219 |

+5.2% |

NB: Amounts restated in Q1 22 to take into

account the transfer of Private Banking activities (French and

international) to the French Retail Banking. Includes activities

transferred after the disposal of Lyxor

8 - Net assets and tangible net

assets

Net assets and tangible net assets are defined

in the methodology, page 46 of the Group’s 2022 Universal

Registration Document. The items used to calculate them are

presented below:

|

End of period (in EURm) |

9M 22 |

H1 22 |

2021 |

|

Shareholders' equity Group share |

66,311 |

64,583 |

65,067 |

|

Deeply subordinated notes |

(9,350) |

(8,683) |

(8,003) |

|

Undated subordinated notes |

|

|

|

|

Interest of deeeply & undated subodinated notes, issue premium

amortisations(1) |

(80) |

(8) |

20 |

|

Bookvalue of own shares in trading portfolio |

(125) |

(222) |

37 |

|

Net Asset Value |

56,756 |

55,669 |

57,121 |

|

Goodwill |

(3,667) |

(3,667) |

(3,624) |

|

Intangible Assets |

(2,788) |

(2,672) |

(2,733) |

|

Net Tangible Asset Value |

50,301 |

49,330 |

50,764 |

|

|

|

|

|

|

Number of shares used to calculate NAPS(2) |

817,789 |

831,045 |

831,162 |

|

Net Asset Value per Share |

69.4 |

67.0 |

68.7 |

|

Net Tangible Asset Value per Share |

61.5 |

59.4 |

61.1 |

(1) Interest payable to holders of deeply

subordinated notes & undated subordinated notes, issue premium

amortisations(2) The number of shares considered is the number of

ordinary shares outstanding as at end of period, excluding treasury

shares and buybacks, but including the trading shares held by the

Group.In accordance with IAS 33, historical data per share prior to

the date of detachment of a preferential subscription right are

restated by the adjustment coefficient for the transaction.

9 - Calculation of Earnings Per Share

(EPS)

The EPS published by Societe Generale is

calculated according to the rules defined by the IAS 33 standard

(see page 45 of Societe Generale’s 2022 Universal Registration

Document). The corrections made to Group net income in order to

calculate EPS correspond to the restatements carried out for the

calculation of ROE and ROTE. As specified on page 45 of Societe

Generale’s 2022 Universal Registration Document, the Group also

publishes EPS adjusted for the impact of non-economic and

exceptional items presented in methodology note No. 5.The

calculation of Earnings Per Share is described in the following

table:

|

Average number of shares (thousands) |

9M 22 |

H1 22 |

2021 |

|

Existing shares |

844,376 |

842,540 |

853,371 |

|

Deductions |

|

|

|

|

Shares allocated to cover stock option plans and free shares

awarded to staff |

6,050 |

6,041 |

3,861 |

|

Other own shares and treasury shares |

10,566 |

5,416 |

3,249 |

|

Number of shares used to calculate EPS(1) |

827,760 |

831,084 |

846,261 |

|

Group net Income |

858 |

(640) |

5,641 |

|

Interest on deeply subordinated notes and undated subordinated

notes |

(404) |

(278) |

(590) |

|

Adjusted Group net income (in EURm) |

454 |

(918) |

5,051 |

|

EPS (in EUR) |

0.55 |

(1.10) |

5.97 |

|

Underlying EPS(2) (in EUR) |

4.68 |

2.87 |

5.52 |

(1) The number of shares considered is the

average number of ordinary shares outstanding during the period,

excluding treasury shares and buybacks, but including the trading

shares held by the Group.(2) Calculated on the basis of underlying

Group net income (excluding linearisation of IFRIC 21).

10 - The Societe Generale Group’s Common

Equity Tier 1 capital is calculated in accordance with

applicable CRR2/CRD5 rules. The fully loaded solvency ratios are

presented pro forma for current earnings, net of dividends, for the

current financial year, unless specified otherwise. When there is

reference to phased-in ratios, these do not include the earnings

for the current financial year, unless specified otherwise. The

leverage ratio is also calculated according to applicable CRR2/CRD5

rules including the phased-in following the same rationale as

solvency ratios.

NB (1) The sum of values contained in the tables

and analyses may differ slightly from the total reported due to

rounding rules.

(2) All the information on the results for the

period (notably: press release, downloadable data, presentation

slides and supplement) is available on Societe Generale’s website

www.societegenerale.com in the “Investor” section.

Societe

Generale

Societe Generale is one of the leading European

financial services groups. Based on a diversified and integrated

banking model, the Group combines financial strength and proven

expertise in innovation with a strategy of sustainable growth.

Committed to the positive transformations of the world’s societies

and economies, Societe Generale and its teams seek to build, day

after day, together with its clients, a better and sustainable

future through responsible and innovative financial solutions.

Active in the real economy for over 150 years, with a solid

position in Europe and connected to the rest of the world, Societe

Generale has over 117,000 members of staff in 66 countries and

supports on a daily basis 25 million individual clients, businesses

and institutional investors around the world by offering a wide

range of advisory services and tailored financial solutions. The

Group is built on three complementary core businesses:

- French Retail Banking which encompasses the Societe

Generale, Credit du Nord and Boursorama brands. Each offers a full

range of financial services with omnichannel products at the

cutting edge of digital innovation;

- International Retail Banking, Insurance and Financial

Services, with networks in Africa, Central and Eastern Europe

and specialised businesses that are leaders in their markets;

- Global Banking and Investor Solutions, which offers

recognised expertise, key international locations and integrated

solutions.

Societe Generale is included in the principal

socially responsible investment indices: DJSI (Europe), FTSE4Good

(Global and Europe), Bloomberg Gender-Equality Index, Refinitiv

Diversity and Inclusion Index, Euronext Vigeo (Europe and

Eurozone), STOXX Global ESG Leaders indexes, and the MSCI Low

Carbon Leaders Index (World and Europe). In case of doubt regarding

the authenticity of this press release, please go to the end of

Societe Generale’s newsroom page where official Press Releases sent

by Societe Generale can be certified using blockchain technology. A

link will allow you to check the document’s legitimacy directly on

the web page. Key figures as of 30 June 2022. For more information,

you can follow us on Twitter @societegenerale or visit our website

www.societegenerale.com.

([1]) Underlying data (see methodology

note No. 5 for the transition from accounting data to underlying

data)

(2) Phased-in ratio (fully-loaded ratio of

12.9%) (3) Excluding IFRS 9 phasing effectThe footnote *

corresponds to data adjusted for changes in Group Structure and at

constant exchange rates

([2]) NPL ratio calculated according to

the EBA methodology published on July 16th, 2019

([3])Ratio between S3 provisions and the

gross book value of non-performing loans before offsetting of

guarantees and collateral

- Societe-Generale_PR_Q3-2022

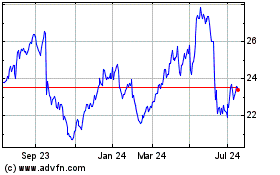

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

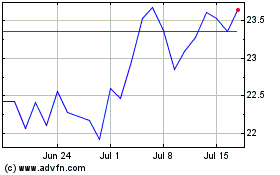

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024