Societe Generale: Capital reduction by cancellation of treasury shares

February 01 2022 - 2:45AM

Societe Generale: Capital reduction by cancellation of treasury

shares

PRESS

RELEASE:

CAPITAL REDUCTION BY CANCELLATION

OF TREASURY

SHARES

Regulated information

Paris, 1st February 2022

Meeting on January 13, 2022, the Board of

Directors, with the authorization of the Extraordinary General

Meeting of May 19, 2020, decided to decrease, on February 1, 2022,

the share capital of Societe Generale by cancellation of 16,247,062

ordinary shares repurchased from November 4 to December 17, 2021

included and representing circa 1.9% of share capital (before

capital decrease).

This capital reduction by shares cancellation is

part of the Group's shareholder return policy.

The share capital of Societe Generale will

amount to 1,046,405,540 euros, divided into 837,124,432 ordinary

shares, each with an unchanged nominal value of 1.25 euros.

Information regarding total amount of voting

rights and shares will be updated and available in the following

section “Monthly reports on total amount of voting rights and

shares”:

https://investors.societegenerale.com/en/financial-and-non-financial-information/regulated-information

Press contacts:

Societe Generale

Societe Generale is one of the leading European financial

services groups. Based on a diversified and integrated banking

model, the Group combines financial strength and proven expertise

in innovation with a strategy of sustainable growth. Committed to

the positive transformations of the world’s societies and

economies, Societe Generale and its teams seek to build, day after

day, together with its clients, a better and sustainable future

through responsible and innovative financial solutions.

Active in the real economy for over 150 years, with a solid

position in Europe and connected to the rest of the world, Societe

Generale has over 133,000 members of staff in 61 countries and

supports on a daily basis 30 million individual clients, businesses

and institutional investors around the world by offering a wide

range of advisory services and tailored financial solutions. The

Group is built on three complementary core businesses:

- French Retail

Banking which encompasses the Societe Generale, Credit du

Nord and Boursorama brands. Each offers a full range of financial

services with omnichannel products at the cutting edge of digital

innovation;

-

International Retail Banking, Insurance and Financial

Services to Corporates, with networks in Africa, Russia,

Central and Eastern Europe and specialised businesses that are

leaders in their markets;

- Global Banking and Investor

Solutions, which offers recognised expertise, key

international locations and integrated solutions.

Societe Generale is included in the principal socially

responsible investment indices: DJSI (Europe), FTSE4Good (Global

and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity

and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX

Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index

(World and Europe).

In case of doubt regarding the authenticity of this press

release, please go to the end of Societe Generale’s newsroom page

where official Press Releases sent by Societe Generale can be

certified using blockchain technology. A link will allow you to

check the document’s legitimacy directly on the web page.

For more information, you can follow us on Twitter

@societegenerale or visit our website www.societegenerale.com.

- Societe Generale_ Capital reduction by cancellation of treasury

shares

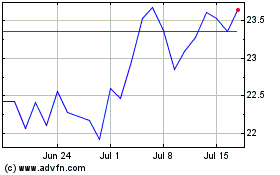

Societe Generale (EU:GLE)

Historical Stock Chart

From Mar 2024 to Apr 2024

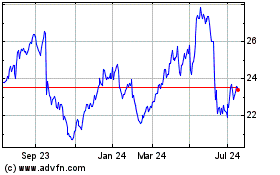

Societe Generale (EU:GLE)

Historical Stock Chart

From Apr 2023 to Apr 2024