BOUYGUES: Nine-month 2020 results

PRESS RELEASE – PARIS, 19/11/2020

Nine-month 2020 results

- GROUP

- Very good Q3 2020

- Current operating profit: €813 million, up 22% vs Q3

2019

- Current operating margin: 8%, up 1.5 pts vs Q3 2019

- Robust financial situation and high liquidity

- Outlook revised upwards for H2 2020

- CONSTRUCTION BUSINESSES

- Backlog at a very high level

- Return to normal levels of activity in most countries

- Significantly positive current operating profit in Q3 2020:

€570 million vs current operating loss of €437 million in

H1 2020

- TF1

- Very good performance of the broadcasting segment in Q3

2020

- BOUYGUES TELECOM

- Good commercial performance

- Sales from services and EBITDA after Leases both up 7%

year-on-year through the first nine months

- Free cash flow objective of around €250 million confirmed

for 2020

|

KEY FIGURES (€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Q3 2019 |

Q3 2020 |

Change |

|

Sales |

27,601 |

24,948 |

-10%a |

|

10,155 |

10,190 |

0% |

|

Current operating profit |

1,118 |

681 |

-€437m |

|

665 |

813 |

+€148m |

|

Current operating margin |

4.1% |

2.7% |

-1.4 pts |

|

6.5% |

8% |

+1.5 pts |

|

Operating profit |

1,168b |

636c |

-€532m |

|

673 |

812 |

+€139m |

|

Net profit attributable to the Group |

848 |

283 |

-€565m |

|

623 |

527 |

-€96m |

|

|

|

|

|

|

|

|

|

|

Net surplus cash (+)/ net debt (-) |

(4,643) |

(3,661) |

+€982m |

|

|

|

|

(a) Down 9% like-for-like and at constant exchange rates (b)

Including net non-current income of €50m (c) Including net

non-current charges of €45m

The Group’s results in the first nine

months of 2020 reflect a significant improvement in activity and

profitability in the third quarter, after a first half

substantially impacted by the crisis linked to the Covid-19

pandemic.

- Sales were €24.9 billion, down 10%

year-on-year for the first nine months. They improved considerably

in the third quarter (up 1%1 after being down year-on-year 8%1 in

first-quarter 2020 and down 21%1 in second-quarter 2020). This

performance was driven by a catch-up of activity in the

construction businesses and in advertiser spending at TF1, as well

as by sustained growth in sales from services at

Bouygues Telecom.

- Current operating profit in the first nine

months of 2020 was €681 million versus a current operating

loss of €132 million in first-half 2020, and the current

operating margin was 2.7% versus -0.9% in first-half 2020.

- Net profit attributable to the Group recovered

significantly to reach €283 million in the first nine months

of 2020, compared to a first-half net loss of €244 million.

This figure included a contribution of €51 million from

Alstom, versus €238 million in the first nine months of

2019.

Group profitability improved

substantially in third-quarter 2020 and was better than

expectedThe Group reported current operating profit of

€813 million, up €148 million (+22%) from third-quarter

2019. The current operating margin was 8%, up 1.5 points over the

period. This performance reflected:

- A catch-up of activity in the construction

businesses, mainly in France, as well as savings measures

and compensations linked to worksites shutdown in the second

quarter 2020;

- A return in advertiser spending at TF1,

combined with savings on programming costs;

- Robust growth in sales and EBITDA after Leases at

Bouygues Telecom.

The Group benefits from a high level of

liquidity and a particularly robust financial

structure

- Available cash reached €10.1 billion at

end-September 2020, with €2.4 billion in cash and

€7.7 billion in unused medium- and long-term credit

facilities, of which €7.1 billion contain no financial

covenants.

- Net debt was €3.7 billion at

end-September 2020, €982 million less than at end-September

2019. It does not yet include the sale of 11 million Alstom shares

for €450 million, the acquisition of EIT, expected to be

closed by early 2021, and the first installment of €90 million

for 5G frequencies2.

- Net gearing3 was 32% versus 41% at

end-September 2019.

OUTLOOK

In some countries where the Group operates, a

deteriorating public-health situation caused by Covid-19 has

resulted in the reintroduction of lockdown measures, making ongoing

adjustments necessary. To date, the business segments are

continuing their operational activities. The outlook given below

assumes that there will be no further deterioration due to the

health crisis.

The very good third-quarter 2020 results

confirm the Group’s return to significant profitability, allowing

the upgrade of the outlook for the second half of 2020.The

Group now expects the current operating margin in

second-half 2020 to be slightly higher than in second-half

2019. As a reminder, the Group was expecting significant

profitability in the second half of 2020, although without reaching

the particularly high levels of the second half of 2019.

Bouygues Telecom is raising its guidance

for sales from services and maintaining its annual free cash flow

objective, therefore confirming its decision to maintain a high

level of investment to strengthen the quality of its

networks.Its objectives for 2020 are:

- Growth in sales from services estimated

between 5% and 6% (versus around

4% previously), despite the sharp decline in

roaming revenues due to Covid-19;

- Gross capex of

€1.25 billion (including expenditures

necessary for the integration of EIT but excluding the acquisition

of 5G frequencies);

- Free cash flow of around

€250 million.

Given

the ongoing uncertainty of the evolution of the Covid-19 pandemic,

TF1 has not set new guidance for 2020.

The Group will hold its Climate Markets

Day on 16 December 2020, during which it

will issue, for each of its business segments, a 2030 greenhouse

gas emissions reduction target compatible with the Paris Agreement

(limiting global warming to 1.5°C), together with action plans.

DETAILED ANALYSIS BY SECTOR OF ACTIVITY

CONSTRUCTION BUSINESSES

The backlog in the construction

businesses reached the very high level of

€33.5 billion at end-September 2020, up 3%4 year-on-year and

close to the record level of September 2018 (€33.8 billion),

providing good visibility on future activity.

In France, the backlog was

slightly down, by 1%5, to €13.9 billion, impacted by Covid-19

and municipal elections.

- The backlog at Bouygues Construction was stable at

€8.5 billion.

- The slight decrease of 1% in the backlog at Colas reflected

sustained growth in the Rail sector, which almost entirely offsets

an 8% decline in the Roads activities in mainland France. This

decrease is related to the slow restart in bids and contracts

despite government measures to support local authorities.

- The 3% decrease in the backlog at Bouygues Immobilier was

explained by lower reservations due to lower supply, affected by a

slower-than-expected resumption of the issuance of building

permits. Individual buyers have also been hit by tighter terms for

home loans. However, the decrease has been mitigated by the block

sale of 1,749 lots to CDC Habitat (341 lots in third-quarter

2020).

Internationally, the

construction businesses’ backlog was up 6%6 year-on-year to

€19.6 billion at end‑September 2020, boosted by an increase in

the backlogs of Bouygues Construction and Colas of 7% and 4%

respectively, versus end-September 2019. This good commercial

performance was driven by Civil Works (contract extensions in

Australia and the United Kingdom in particular), Energies &

Services, and Rail (including the first urban track contract in

Canada won by Colas). International business represented

62% of the combined backlog of Bouygues Construction and

Colas at end-September 2020, versus 61% a year earlier.

While they were hit hard by the Covid-19

pandemic in first-half 2020, the construction businesses

returned to profitability over the first nine months of

2020.

Sales were €18.9 billion

in the first nine months of 2020, down 12% year-on-year.

Activity rebounded strongly in the third quarter

compared to the first half of the year (down 1% in third-quarter

2020 compared to third-quarter 2019 versus down 19% in first-half

2020 compared to first-half 2019), boosted by both a catch-up in

activity during the summer in France and a return to normal levels

of activity in most countries.

The construction businesses reported

current operating profit of €133 million in

the first nine months of 2020, versus a current operating loss of

€437 million in first-half 2020. The operating margin of the

construction businesses turned positive at 0.7% versus -4% in the

first half. The improvement was due to strong activity in

third-quarter resulting in better fixed costs dilution, as well as

cost-saving measures taken by the business segments, and

compensations for worksites shutdown in second-quarter 2020.

Nine-month 2020 operating

profit of €72 million included non-current charges of

€61 million at Colas related to the reorganization of the

Roads activities in France and the continued dismantling of the

Dunkirk site, versus non-current charges of €10 million in the

first nine months of 2019.

TF1

TF1’s results in the first nine

months of the year included both the effects of the Covid-19

pandemic during the first half and the sharp upturn in the

broadcasting activity in third-quarter.

Sales in the first nine months of the year were

€1,361 million, down 16% year-on-year. Advertising revenue

rose 7.5% in third-quarter 2020 compared to third-quarter 2019,

with a 16‑minute7 year-on-year increase in TV viewing time and a

rebound in advertiser spending in several sectors.

Current operating profit in the first nine

months of 2020 was €126 million, down €58 million

year-on-year, versus a decrease of €95 million in first-half

2020 compared to first-half 2019. This improvement reflected higher

third-quarter sales and additional savings, notably on programming

costs (€138 million over the first nine months of 2020, of

which €31 million in third-quarter).

BOUYGUES TELECOM

Bouygues Telecom continued its

growth over the first nine months of 2020.

The company had 12 million mobile plan

customers excluding MtoM at end-September 2020, an increase of

455,000 new customers since the end of 2019, of which 181,000 were

in the third quarter alone.Bouygues Telecom had 1.4 million

FTTH customers at end-September 2020, with 378,000 new adds since

the end of 2019, of which 169,000 were in the third quarter. The

FTTH penetration rate continued to rise to 34% versus 22% a year

earlier. The company had a total of 4.1 million fixed

customers at end-September 2020.

The roll-out of Bouygues Telecom’s FTTH network

is accelerating with 15.8 million FTTH premises marketed at

end-September 2020 versus 11.8 million at end-2019. The

company is benefiting from its partnerships with CityFast in Very

Dense Area and with Vauban Infrastructure Partners in Medium Dense

Area. In PIN (Public Initiative Networks) area, the company decided

to significantly increase its number of premises marketed. As a

result, Bouygues Telecom raises its target to 27 million

premises marketed by end-2022 versus 22 million previously

announced.

Sales in the first nine months of 2020 were

€4,675 million, up 6%, driven by 7% growth in sales from

services despite a €63-million8 fall in roaming over the period.

This reflects growth in both the mobile and fixed customer base and

a rise in ABPU. Mobile ABPU, restated for the impact of roaming,

rose €0.4 year-on-year to €20.3 per customer per month9, while

fixed ABPU rose €1.5 year-on-year to €28.1 per customer per

month. Other sales were up slightly by 1% in the first nine months

of 2020 versus the first nine months of 2019, following the

resumption of network roll-out and the sales of handsets after the

end of the first lockdown.Sales from services increased 5% in

third-quarter 2020 versus third-quarter 2019, sustained by strong

growth in sales from fixed services, up 10%, and higher sales from

mobile services, up 3%, despite the negative impact of roaming.

EBITDA after Leases was up €73 million

year-on-year at €1,123 million, a rise of 7%. It included

non-recurrent charges of €20 million due to brand

repositioning and related advertising campaigns in first-quarter

2020, plus €20 million of Covid-19-related costs in first-half

2020. Despite the fall in roaming, the EBITDA after Leases margin

was stable versus the first nine months of 2019 at 30.9%. Restated

for the impact of roaming, the EBITDA after Leases margin was

31.9%8.

Current operating profit in the first nine

months of 2020 was €444 million, up €39 million

year-on-year. Operating profit was down slightly by €5 million

year-on-year to €460 million due to lower non-current income

(€16 million in the first nine months of 2020 versus

€60 million a year earlier, mainly related to fewer disposals

of mobile sites).

Gross capex was €837 million in the first

nine months of 2020, up €103 million year-on-year, linked to

the strategy of enhancing network quality. Disposals over the same

period amounted to €222 million, much of which

(€185 million) was related to the sale of FTTH premises to

SDAIF in first-half 2020.

Bouygues Telecom participated in the 5G auction

in September 2020, acquiring a 70 MHz block of 3.5 GHz spectrum

which doubled its portfolio of frequencies for a reasonable price

of €602 million. As a result, Bouygues Telecom now has nearly

a quarter of the available spectrum in France.True to its pragmatic

approach, Bouygues Telecom will roll out its 5G network gradually

in line with benefits to customers which will materialize in two

main stages. In the first stage, the capacity will increase to

maintain good service quality in very dense areas where data

consumption is very intense (+40% a year8). In the second stage, 5G

will facilitate new services for BtoC and especially for BtoB

customers, thanks to its new features (low latency, better

bandwidth, ability to connect many objects, etc.).To roll-out its

5G network, Bouygues Telecom has decided simultaneously to install

new antennas, using the newly acquired 3.5 GHz frequency band,

and to gradually migrate existing 4G frequency bands to 5G.At the

same time, the company will continue to densify its network in

terms of both capacity and coverage, especially in very dense areas

which is necessary for both 5G and 4G. The goal is to have over

28,000 sites by 2023.Bouygues Telecom will open its 5G network for

users on 1 December 2020, with the objective of achieving national

coverage within a

year. Regarding

the acquisition of EIT, employee representative bodies have been

consulted and the French Competition Authority has been notified.

Bouygues Telecom is confident of closing the transaction by early

2021.

ALSTOM

Alstom’s contribution to

Bouygues' net profit in the first nine months of 2020 was

€51 million, versus a contribution of €238 million in the

first nine months of 2019. The contribution in the first nine

months of 2019 included a net capital gain of €172 million on

Bouygues' sale of 13% of Alstom’s share capital on

12 September 2019.

The €87 million net capital gain on Bouygues’

sale of 11 million Alstom shares, representing 4.8% of the

share capital, following settlement on 3 November of the forward

sale transaction with BNP Paribas, was not recorded in the

financial statements for the first nine months of 2020. The capital

gain will be recognized in fourth-quarter 2020.

In addition, on 17 November, Bouygues announced

the sale of a portion of its preferential subscription rights to

participate in the Alstom capital increase, which was announced on

16 November 2020.The proceeds will be fully reinvested by Bouygues

to fund the exercise of its remaining Alstom preferential

subscription rights, therefore limiting the dilutive effect. This

transaction confirms Bouygues’ support for Alstom’s strategy and

for the contemplated acquisition of Bombardier Transportation,

without committing additional capital.It will result in the

recognition of a net dilution profit of around €30 million that

will be booked to Bouygues’ fourth quarter 2020 results. As part of

this transaction, Bouygues has made the commitment to keep its

Alstom shares until 7 March 2021.

Following this capital increase, Bouygues will

retain a stake of around 8% in Alstom.

FINANCIAL SITUATION

During the first nine months of 2020,

Bouygues’ goal has been to secure and

strengthen its cash position, and more broadly, its

financial resources.

It renewed its medium- and long-term credit

facilities as they expired, without financial covenants. It also

successfully completed a €1-billion bond issue in April, and in

July redeemed a bond issue in the same amount that had matured. At

30 September 2020, the average maturity of the Group’s bonds is 5.4

years and the average coupon on the bonds is 2.93%. The debt

maturity schedule is evenly spread.

The Group had €2.4 billion in cash at

end-September 2020. Unused medium- and long-term credit facilities

amounted to €7.7 billion, of which €7.1 billion contained

no financial covenants.Total available cash was €10.1 billion

at end-September 2020 versus €9.9 billion at end-September

2019.

Net debt at 30 September 2020 was

€3.7 billion, compared to €4.6 billion at the end of September

2019 and compared to €2.2 billion at the end of December 2019. In

the first nine months of 2020, the very concerted effort by the

business segments in dealing with the health crisis resulted in:- a

limited €106 million decline in the Group’s free cash flow, which

reached €541 million (compared to €647 million excluding Alstom's

dividends in the first nine months of 2019), in a context where,

over the same period, current operating profit declined by €437

million;- an approximate €1 billion reduction in the consumption of

WCR related to operating activities.

Net debt at 30 September 2020 does not

include Bouygues Telecom’s acquisition of EIT, the first

installment related to the 5G auction (€90 million) and the

proceeds of the partial sale of 11 million Alstom shares

(€450 million).

GOVERNANCE

The Group has decided to make the following

senior executive appointments at Bouygues

Immobilier and Bouygues Construction.

From 7 December 2020, Bernard Mounier, currently

Deputy CEO of Bouygues Construction with responsibility for

Bouygues Bâtiment France Europe, will join Bouygues Immobilier

alongside Pascal Minault, Chairman of Bouygues Immobilier, in order

to prepare to succeed him. Bouygues Immobilier’s Board of Directors

will meet at the appropriate time to appoint him as Chairman as of

1 March 2021.

On 1 April 2021, Pascal Minault will join

Bouygues Construction alongside Philippe Bonnave in order to

prepare to succeed him. Bouygues Construction’s Board of Directors

will then be asked to appoint Pascal Minault as CEO of Bouygues

Construction on 1 July 2021, then as Chairman and CEO at its

meeting in August. Philippe Bonnave will continue to serve as

Chairman of Bouygues Construction between 1 July and the Board

meeting in August.

These transition periods will enable Bernard

Mounier and Pascal Minault to prepare to assume their new

responsibilities in the best possible conditions.

FINANCIAL CALENDAR

- 16 December 2020: Climate Markets Day (2.30pm CET)

- 18 February 2021: Full-year 2020 results (7.30am

CET)

The financial statements have been subject to a

limited review by the statutory auditors and the corresponding

report has been issued.You can find the full financial statements

and notes to the financial statements on

www.bouygues.com/finance/results. The results presentation

conference call for analysts will start at 9am (CET) on 19 November

2020. Details on how to connect are available on

www.bouygues.com.The results presentation will be available before

the conference call starts on www.bouygues.com/finance/investors

presentations.

ABOUT BOUYGUES

Bouygues is a diversified services group

operating in over 90 countries with 130,500 employees all working

to make life better every day. Its business activities in

construction (Bouygues Construction, Bouygues

Immobilier, Colas) media (TF1) and

telecoms (Bouygues Telecom) are able to drive

growth since they all satisfy constantly changing and essential

needs.

INVESTORS AND ANALYSTS

CONTACT:investors@bouygues.com • Tel.: +33 (0)1 44 20 10

79

PRESS CONTACT:presse@bouygues.com • Tel.: +33

(0)1 44 20 12 01

BOUYGUES SA • 32 avenue Hoche • 75378 Paris

CEDEX 08 • www.bouygues.com

NINE-MONTH 2020 BUSINESS ACTIVITY

|

BACKLOGAT THE CONSTRUCTION

BUSINESSES(€ million) |

End-September |

|

|

2019 |

2020 |

Change |

| Bouygues

Construction |

21,160 |

22,063 |

+4% |

| Bouygues

Immobilier |

2,245 |

2,192 |

-2% |

|

Colas |

9,084 |

9,274 |

+2% |

|

Total |

32,489 |

33,529 |

+3% |

|

BOUYGUES CONSTRUCTIONORDER

INTAKE(€ million) |

9-month |

|

|

2019 |

2020 |

Change |

| France |

3,550 |

3,185 |

-10% |

|

International |

4,512 |

5,756 |

+28% |

|

Total |

8,062 |

8,941 |

+11% |

|

BOUYGUES

IMMOBILIERRESERVATIONS(€ million) |

9-month |

|

|

2019 |

2020 |

Change |

| Residential

property |

1,408 |

1,177 |

-16% |

|

Commercial property |

44 |

121 |

Nm |

|

Total |

1,452 |

1,298 |

-11% |

|

COLASBACKLOG(€ million) |

End-September |

|

|

2019 |

2020 |

Change |

| Mainland France |

3,292 |

3,260 |

-1% |

|

International and French overseas territories |

5,792 |

6,014 |

+4% |

|

Total |

9,084 |

9,274 |

+2% |

|

TF1AUDIENCE SHAREa |

End-September |

|

|

2019 |

2020 |

Change |

|

Total |

32.1% |

31.8% |

-0.3 pts |

(a) Source: Médiamétrie – women under 50 who are purchasing

decision-makers

|

BOUYGUES TELECOMCUSTOMER BASE

(‘000) |

|

|

End-Dec 2019 |

End-Sept 2020 |

Change |

| Mobile customer base

excl. MtoM |

11,958 |

12,336 |

+378 |

|

Mobile plan base excl. MtoM |

11,543 |

11,999 |

+455 |

|

Total mobile customers |

17,800 |

18,450 |

+650 |

|

Total fixed customers |

3,916 |

4,053 |

+137 |

9-MONTH 2020 FINANCIAL

PERFORMANCE

|

|

|

|

|

CONDENSED CONSOLIDATED INCOME STATEMENT

(€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Sales |

27,601 |

24,948 |

-10%a |

| Current operating

profit |

1,118 |

681 |

-€437m |

|

Other operating income and expenses |

50b |

(45)c |

-€95m |

|

Operating profit |

1,168 |

636 |

-€532m |

| Cost of net debt |

(162) |

(132) |

+€30m |

| Interest expense on lease obligations |

(42) |

(40) |

+€2m |

| Other financial income and expenses |

19 |

(19) |

-€38m |

| Income

tax |

(325) |

(203) |

+€122m |

| Share of net profits of joint ventures and

associates |

286 |

109 |

-€177m |

| o/w Alstom |

238 |

51 |

-€187m |

| Net

profit from continuing operations |

944 |

351 |

-€593m |

| Net profit

attributable to non-controlling interests |

(96) |

(68) |

+€28m |

| Net

profit attributable to the Group |

848 |

283 |

-€565m |

(a) Down 9% like-for-like and at constant exchange rates (b)

Including non-current charges of €10m at Bouygues Construction

related to restructuring costs and non-current income of €60m at

Bouygues Telecom mainly related to the disposal of mobile

sites

(c) Including non-current charges of €61m at

Colas related to the reorganization of the roads activities in

France and the continued dismantling of the Dunkirk site and

non-current income of €16m at Bouygues Telecom mainly related to

the disposal of mobile sites

|

|

|

|

|

CALCULATION OF EBITDA AFTER LEASESa

(€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Current operating profit |

1,118 |

681 |

-€437m |

| Interest expense on lease

obligations |

(42) |

(40) |

+€2m |

| Net depreciation and amortization

expense on property, plant and equipment and intangible assets |

1,278 |

1,342 |

+€64m |

| Charges to provisions and impairment

losses, net of reversals due to utilization |

171 |

119 |

-€52m |

|

Reversals of unutilized provisions and impairment losses and

other |

(173) |

(194) |

-€21m |

|

EBITDA after Leasesa |

2,352 |

1,908 |

-€444m |

(a) See glossary for definitions

|

|

|

|

|

|

|

|

SALES BY SECTOR OF ACTIVITY (€ million) |

9-month 2019 |

9-month 2020 |

Change |

Forex effect |

Scope effect |

lfl & |

|

constant fxc |

|

Construction businessesa |

21,583 |

18,928 |

-12% |

+0.1% |

+0.4% |

-12% |

| o/w Bouygues Construction |

9,899 |

8,611 |

-13% |

-0.4% |

0.0% |

-13% |

| o/w Bouygues Immobilier |

1,610 |

1,323 |

-18% |

+0.1% |

0.0% |

-18% |

| o/w

Colas |

10,182 |

9,085 |

-11% |

+0.5% |

+0.8% |

-9% |

| TF1 |

1,615 |

1,361 |

-16% |

0.0% |

-0.1% |

-16% |

|

Bouygues Telecom |

4,426 |

4,675 |

+6% |

0.0% |

-0.2% |

+6% |

| Bouygues SA and

other |

145 |

137 |

Nm |

- |

- |

Nm |

|

Intra-Group eliminationsb |

(276) |

(244) |

Nm |

- |

- |

Nm |

| Group sales |

27,601 |

24,948 |

-10% |

0.0% |

+0.3% |

-9% |

| o/w France |

16,043 |

14,306 |

-11% |

0.0% |

+0.7% |

-10% |

| o/w

international |

11,558 |

10,642 |

-8% |

+0.1% |

-0.2% |

-8% |

(a) Total of the sales contributions (after eliminations within

the construction businesses)(b) Including intra-Group eliminations

of the construction businesses(c) Like-for-like and at constant

exchange rates

|

|

|

|

|

CONTRIBUTION TO GROUP EBITDA AFTER LEASES BY SECTOR OF

ACTIVITY (€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Construction businesses |

980 |

546 |

-€434m |

| o/w Bouygues

Construction |

395 |

79 |

-€316m |

| o/w Bouygues

Immobilier |

32 |

(5) |

-€37m |

|

o/w Colas |

553 |

472 |

-€81m |

|

TF1 |

328 |

253 |

-€75m |

| Bouygues

Telecom |

1,050 |

1,123 |

+€73m |

|

Bouygues SA and other |

(6) |

(14) |

-€8m |

|

Group EBITDA after Leases |

2,352 |

1,908 |

-€444m |

|

|

|

|

|

CONTRIBUTION TO GROUP CURRENT OPERATING PROFIT/(LOSS) BY

SECTOR OF ACTIVITY (€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Construction businesses |

545 |

133 |

-€412m |

| o/w Bouygues

Construction |

280 |

19 |

-€261m |

| o/w Bouygues

Immobilier |

42 |

(10) |

-€52m |

|

o/w Colas |

223 |

124 |

-€99m |

|

TF1 |

184 |

126 |

-€58m |

| Bouygues

Telecom |

405 |

444 |

+€39m |

|

Bouygues SA and other |

(16) |

(22) |

-€6m |

|

Group current operating profit |

1,118 |

681 |

-€437m |

|

|

|

|

|

CONTRIBUTION TO GROUP OPERATING PROFIT/(LOSS) BY SECTOR OF

ACTIVITY (€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Construction businesses |

535 |

72 |

-€463m |

| o/w Bouygues

Construction |

270 |

19 |

-€251m |

| o/w Bouygues

Immobilier |

42 |

(10) |

-€52m |

|

o/w Colas |

223 |

63 |

-€160m |

|

TF1 |

184 |

126 |

-€58m |

| Bouygues

Telecom |

465 |

460 |

-€5m |

|

Bouygues SA and other |

(16) |

(22) |

-€6m |

|

Group operating profit |

1,168a |

636b |

-€532m |

(a) Including non-current charges of €10m at Bouygues

Construction related to restructuring costs and non-current income

of €60m at Bouygues Telecom mainly related to the capital gain

on the sale of mobile sites

(b) Including non-current charges of €61m at

Colas related to the reorganization of the roads activities in

France and the continued dismantling of the Dunkirk site and

non-current income of €16m at Bouygues Telecom mainly related to

the disposal of mobile sites

|

CONTRIBUTION TO NET PROFIT/(LOSS) ATTRIBUTABLE TO THE GROUP

BY SECTOR OF ACTIVITY

(€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Construction businesses |

381 |

6 |

-€375m |

| o/w Bouygues

Construction |

226 |

5 |

-€221m |

| o/w Bouygues

Immobilier |

20 |

(18) |

-€38m |

|

o/w Colas |

135 |

19 |

-€116m |

|

TF1 |

52 |

34 |

-€18m |

|

Bouygues Telecom |

251 |

253 |

+€2m |

|

Alstom |

238 |

51 |

-€187m |

|

Bouygues SA and other |

(74) |

(61) |

+€13m |

|

Net profit attributable to the Group |

848 |

283 |

-€565m |

|

NET SURPLUS CASH (+)/NET DEBT (-) BY BUSINESS SEGMENT

(€ million) |

End-Dec 2019 |

End-Sept 2020 |

Change |

| Bouygues

Construction |

3,113 |

2,297 |

-€816m |

| Bouygues

Immobilier |

(279) |

(434) |

-€155m |

| Colas |

(367) |

(838) |

-€471m |

| TF1 |

(127) |

(71) |

+€56m |

| Bouygues

Telecom |

(1,454) |

(1,659) |

-€205m |

|

Bouygues SA and other |

(3,108) |

(2,956) |

+€152m |

|

Net surplus cash (+)/Net debt (-) |

(2,222) |

(3,661) |

-€1,439m |

|

Current and non-current lease obligations |

(1,686) |

(1,592) |

+€94m |

(a) See glossary for definitions

|

CONTRIBUTION TO NET CAPITAL EXPENDITURE BY SECTOR OF

ACTIVITY (€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Construction businesses |

304 |

177 |

-€127m |

| o/w Bouygues

Construction |

149 |

67 |

-€82m |

| o/w Bouygues

Immobilier |

7 |

3 |

-€4m |

|

o/w Colas |

148 |

107 |

-€41m |

|

TF1 |

161 |

169 |

+€8m |

|

Bouygues Telecom |

638 |

615 |

-€23m |

|

Bouygues SA and other |

2 |

2 |

€0m |

|

Group net capital expenditure |

1,105 |

963 |

-€142m |

|

|

|

|

|

CONTRIBUTION TO GROUP FREE CASH

FLOWa BY SECTOR OF ACTIVITY

(€ million) |

9-month 2019 |

9-month 2020 |

Change |

|

Construction businesses |

400 |

172 |

-€228m |

| o/w Bouygues

Construction |

147 |

(24) |

-€171m |

| o/w Bouygues

Immobilier |

(20) |

(18) |

+€2m |

|

o/w Colas |

273 |

214 |

-€59m |

|

TF1 |

117 |

47 |

-€70m |

|

Bouygues Telecom |

205 |

377 |

+€172m |

|

Bouygues SA and other |

266b |

(55) |

-€321m |

| Group free

cash flowa |

988 |

541 |

-€447m |

|

Excluding €341m dividend from Alstom |

647 |

541 |

-€106m |

(a) See glossary for definitions(b) Including €341m dividend

from Alstom

THIRD-QUARTER 2020 FINANCIAL

PERFORMANCE

|

KEY FIGURES (€ million) |

|

Q3 2020 |

Change vs Q3 2019 |

|

Group sales |

|

10,190 |

0% |

| Group current

operating profit |

|

813 |

+€148m |

|

o/w Construction businesses |

|

570 |

+€97m |

|

o/w Bouygues Construction |

|

114 |

+€13m |

|

o/w Bouygues Immobilier |

|

28 |

+€15m |

|

o/w Colas |

|

428 |

+€69m |

| o/w TF1 |

|

58 |

+€37m |

|

o/w Bouygues Telecom |

|

191 |

+€16m |

|

Current operating margin |

|

8% |

+1.5 pts |

|

Group operating profit |

|

812 |

+€139m |

|

Net profit attributable to the Group |

|

527 |

-€96m |

AS A REMINDER: ESTIMATED IMPACT OF COVID-19 IN

FIRST-HALF 2020

|

ESTIMATED IMPACT OF COVID-19 IN FIRST-HALF 2020

(€ million) |

Sales |

Current operating profit |

|

Construction businesses |

-2,460 |

-530 |

| o/w Bouygues

Construction |

-1,250 |

-290 |

| o/w Bouygues

Immobilier |

-400 |

-50 |

|

o/w Colas |

-810 |

-190 |

|

TF1 |

-250 |

-100 |

|

Bouygues Telecom |

-70 |

-20 |

The estimated impact by business segment shown

above is based on first-half 2019 reported figures or the 2020

forecast.

Due to the resumption of the Group’s

activities, it is no longer possible in the third quarter to

quantify separately the impact of Covid-19 on the Group’s

year-on-year performance.

GLOSSARY

4G consumption: data consumed

on 4G cellular networks, excluding Wi-Fi.

4G users: customers who have

used the 4G network during the last three months (Arcep

definition).

ABPU (Average Billing Per

User):- In the mobile segment, it is equal to the total of

mobile sales billed to customers (BtoC and BtoB) divided by the

average number of customers over the period. It excludes MtoM SIM

cards and free SIM cards.- In the fixed segment, it is equal to the

total of fixed sales billed to customers (excluding BtoB) divided

by the average number of customers over the period.

BtoB (business to business):

when one business makes a commercial transaction with another.

Backlog (Bouygues Construction,

Colas): the amount of work still to be done on projects

for which a firm order has been taken, i.e. the contract has been

signed and has taken effect (after notice to proceed has been

issued and suspensory clauses have been lifted).

Backlog (Bouygues Immobilier):

sales outstanding from notarized sales plus total sales from signed

reservations that have still to be notarized.Under IFRS 11,

Bouygues Immobilier’s backlog does not include sales from

reservations taken via companies accounted for by the equity method

(co-promotion companies where there is joint control).

Construction businesses:

Bouygues Construction, Bouygues Immobilier and Colas.

EBITDA after Leases: current

operating profit after taking account of the interest expense

on lease obligations, before (i) net depreciation and amortization

expense on property, plant and equipment and intangible assets,

(ii) net charges to provisions and impairment losses, and (iii)

effects of acquisitions of control or losses of control. Those

effects relate to the impact of remeasuring previously-held

interests or retained interests.

EBITDA margin after Leases (Bouygues

Telecom): EBITDA after Leases as a proportion of sales

from services.

Free cash flow: net cash flow

(determined after (i) cost of net debt, (ii) interest expense on

lease obligations and (iii) income taxes paid), minus net

capital expenditure and repayments of lease obligations. It is

calculated before changes in working capital requirements (WCR)

related to operating activities and excluding 5G frequencies.

Free cash flow after WCR: net

cash flow (determined after (i) cost of net debt, (ii) interest

expense on lease obligations and (iii) income taxes paid),

minus net capital expenditure and repayments of lease obligations,

and after changes in working capital requirements (WCR) related to

operating activities.It is calculated after changes in working

capital requirements (WCR) related to operating activities and

excluding 5G frequencies.

Fixed churn: the total number of cancellations

in a given month, divided by the total number of subscribers at the

end of the previous month.

FTTH (Fiber to the Home):

optical fiber from the central office (where the operator’s

transmission equipment is installed) all the way to homes or

business premises (Arcep definition).

FTTH penetration rate: the FTTH

share of the total fixed subscriber base (the number of FTTH

customers divided by the total number of fixed customers)

FTTH premises secured: the

horizontal deployed, being deployed or ordered up to the

concentration point.

FTTH premises marketed: the

connectable sockets, i.e. the horizontal and vertical deployed and

connected via the concentration point.

Growth in sales like-for-like and at

constant exchange rates:- at constant exchange rates:

change after translating foreign-currency sales for the current

period at theexchange rates for the comparative period;- on a

like-for-like basis: change in sales for the periods compared,

adjusted as follows:

- for acquisitions, by deducting from the current period those

sales of the acquired entity that have no equivalent during the

comparative period;

- for divestments, by deducting from the comparative period those

sales of the divested entity that have no equivalent during the

current period.

Mobile churn: the total number

of cancellations in a given month, divided by the total number of

subscribers at the end of the previous month.

MtoM: machine to machine

communication. This refers to direct communication between machines

or smart devices or between smart devices and people via an

information system using mobile communications networks, generally

without human intervention.

Net surplus cash/(net debt):

the aggregate of cash and cash equivalents, overdrafts and

short-term bank borrowings, non-current and current debt, and

financial instruments. Net surplus cash/(net debt) does not include

non-current and current lease obligations. A positive figure

represents net surplus cash and a negative figure represents net

debt. The main components of change in net debt are presented in

Note 7 to the consolidated financial statements at 30 September

2020, available at bouygues.com.

Order intake (Bouygues Construction,

Colas): a project is included under order intake when the

contract has been signed and has taken effect (the notice to

proceed has been issued and all suspensory clauses have been

lifted) and the financing has been arranged. The amount recorded

corresponds to the sales the project will generate.

PIN: Public-Initiative

Network.

Reservations by value (Bouygues

Immobilier): the € amount of the value of properties

reserved over a givenperiod.- Residential properties: the sum of

the value of unit and block reservation contracts signed by

customers andapproved by Bouygues Immobilier, minus registered

cancellations.- Commercial properties: these are registered as

reservations on notarized sale.For co-promotion companies:

- if Bouygues Immobilier has exclusive control over the

co-promotion company (full consolidation), 100% of amounts are

included in reservations;

- if joint control is exercised (the company is accounted for by

the equity method), commercial activity is recorded according to

the amount of the equity interest in the co-promotion company.

Sales from services (Bouygues Telecom)

comprise: - Sales billed to customers, which

include:- In Mobile:

- For BtoC customers: sales from outgoing call charges (voice,

texts and data), connection fees, and value-added services.

- For BtoB customers: sales from outgoing call charges (voice,

texts and data), connection fees, and value-added services, plus

sales from business services.

- Machine-To-Machine (MtoM) sales.

- Visitor roaming sales.

- Sales generated with Mobile Virtual Network Operators

(MVNOs).

- In Fixed:

- For BtoC customers: sales from outgoing call charges, fixed

broadband services, TV services (including Video on Demand and

catch-up TV), and connection fees and equipment hire.

- For BtoB customers: sales from outgoing call charges, fixed

broadband services, TV services (including Video on Demand and

catch-up TV), and connection fees and equipment hire, plus sales

from business services.

- Sales from bulk sales to other fixed line operators.

- Sales from incoming Voice and Texts.- Spreading of handset

subsidies over the projected life of the customer account, required

to comply withIFRS 15.- Capitalization of connection fee sales,

which is then spread over the projected life of the customer

account.

Other sales (Bouygues Telecom): difference

between Bouygues Telecom’s total sales and sales from services.It

comprises:- Sales from handsets, accessories and other- Roaming

sales- Non-telecom services (construction of sites or installation

of FTTH lines)- Co-financing of advertising

Very-high-speed: subscriptions

with peak downstream speeds higher or equal to 30 Mbit/s. Includes

FTTH, FTTLA, 4G box and VDSL2 subscriptions (Arcep definition).

1 Like-for-like and at constant exchange rates

2 Including the cost of releasing the frequencies

3 Net debt / shareholders’ equity

4 Up 3% at constant exchange rates and excluding principal

disposals and acquisitions

5 Down 1% at constant exchange rates and excluding principal

disposals and acquisitions

6 Up 6% at constant exchange rates and excluding principal

disposals and acquisitions

7 Among individuals aged 4+ (to 3 hours and 18 minutes)

8 Company estimates

9 €19.5 without restatement

- PR_financial results_9M_2020_VDEF

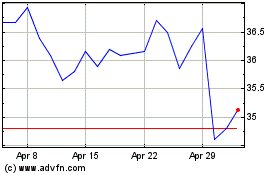

Bouygues (EU:EN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bouygues (EU:EN)

Historical Stock Chart

From Apr 2023 to Apr 2024