Casino Group: 2021 Full Year Results

2021 FULL-YEAR RESULTS

AND FOURTH QUARTER 2021 NET SALES

Friday, 25 February 2022

2021 RESULTS

Repositioning of the

Group on buoyant formats in

all geographies

Both 2020 and 2021 were shaped by the

pandemic, which affected the Group's geographies and formats in

different ways depending on the period.Over one

year:

- Consolidated net sales

amounted to €30.5bn, down -0.8%1 year on year, including a

-5.4% decline for France Retail due to the impact of the health

crisis on the Paris region and tourist areas, a stable performance

for Cdiscount, and growth of +2.7% in Latin America.

- EBITDA came out at

€2,527m, including €1,281m2 for the French retail banners3

(-1.7% vs. 2020), €106m for Cdiscount (-18% vs. an exceptionally

high comparison basis in 2020), and €1,035m in Latam (excluding tax

credits), up +9% at constant exchange rates.

Over two years (i.e.

compared to the pre-Covid period), the Group benefited from

the positive effects of its transformation plans:

- In France, the retail

banners' EBITDA margin rose +83 bps

thanks to efficiency plans (stable EBITDA despite the

health-crisis-induced drop in sales).

- At

Cdiscount, deep transformation of the business model

towards a margin accretive mix (marketplace, digital

marketing and B2B) with EBITDA improving +54%.

- In Latam,

net sales rose +15% and EBITDA jumped

+29%4.

The Group is now well positioned in all

of its geographies:

- In

France, repositioning in formats adapted to new

consumer trends (premium, convenience and E-commerce)

- In Latin

America, following two major transactions (Assaí spin-off

and sale of 70 GPA hypermarkets to Assaí), the Group now has

well-adapted assets ready to accelerate growth in their respective

markets.

At end-2021, consolidated net debt stood

at €5.9bn (vs. €4.6bn at end-2020 and €5.7bn at

end-2019).

In France, the pace of the

disposal plan slowed due to the pandemic. Disposals worth

€400m have been secured since January 2021, with the bulk

of the proceeds to be collected in 2022.

In this context, reflecting the transitional

factors linked mainly to the Group’s repositioning in France, net

debt for the France Retail scope5 totalled €4.4bn at end-2021 vs.

€3.7bn one year earlier. The Group is now aiming to

complete the final €1.3bn of its €4.5bn disposal plan by the end of

2023.

In order to prioritise debt reduction, the Board

of Directors will recommend to the 2022 Annual General Meeting not

to pay a dividend in 2022 in respect of 2021.

In

France

France RetailThe

Group's key geographies, such as Paris and

south-east France, were particularly hard hit by the 2020-2021

health crisis (decline in customer traffic and tourist numbers,

restricted access to stores). The retail banners' net

sales3 totalled €14.1bn,

with same-store sales improving sequentially

quarter on quarter to -3.0% in Q4 (+1.3 pt vs Q3) and -1.6% on the

last four weeks6 (+1.4 pt vs Q4). Franprix-Convenience gross sales

under banner were up +2.5% in Q4 and +5.1% in

February6 driven by expansion with franchise.

|

|

Same store sales |

|

|

|

|

Gross sales under banner |

|

|

|

Q3 2021 |

Q4 2021 |

4weeks to 20

Feb6 |

|

|

Q3 2021 |

Q4 2021 |

4weeks to 20

Feb6 |

|

|

Monoprix |

-4.1% |

-2.8% |

-3.4% |

|

Franprix |

-2.5% |

-0.2% |

-1.0% |

|

|

Supermarkets |

-2.7% |

-3.3% |

-2.2% |

|

Convenience |

+5.0% |

+5.0% |

+10% |

|

|

Franprix |

-3.6% |

-2.0% |

-1.8% |

|

Franprix and Convenience |

+2.1% |

+2.5% |

+5.1% |

|

|

Convenience |

-1.3% |

-0.7% |

+5.9% |

|

|

|

|

|

|

|

Hypermarkets |

-8.5% |

-4.7% |

-1.5% |

|

|

|

|

|

|

|

FRANCE RETAIL |

-4.3% |

-3.0% |

-1.6% |

|

|

|

|

|

|

|

- In this

environment, the Group has undergone a deep

transformation and is now refocused on the

most buoyant formats (premium, convenience and

e-commerce), which now represent 76% of sales (+16

pts vs. 2018). Expansion picked up in high-growth

formats: (i) convenience

stores (more than 730 stores opened since

January 2021) and (ii) e-commerce up +15% (vs. +6%

for the market7), including +48% for home delivery (vs. 25% for the

market1).

- The Group pushed

ahead with its omnichannel innovation strategy:

- New

customer services: subscriptions (210,000 by end-2021,

representing a two-fold increase over one year), digitalised

customer journey, personalised deals and Tesla charging

stations;

- Rollout of

best-in-class artificial intelligence technology

solutions in stores and logistics activities (partnerships

with Google Cloud, Amazon Web Service, Belive.ai);

- Strengthening of

partnerships with major e-commerce players (Ocado, Amazon and

Gorillas).

- The cost

savings plans implemented during the period

reduced the cost base and

sustainably increased banner profitability. As a consequence, the

retail banners' EBITDA margin increased by

+83 bps over two years (+31 bps over one year) to

9.1%, with a trading

margin of 3.4%. The restructuring

generated non-recurring expenses, which temporarily weighed on cash

flow generation.

- Lastly, the Group

signed a strategic agreement with Intermarché: (i)

creation of the AUXO purchasing partnership, the

second largest player in the market with a 24% market

share, and (ii) creation of Infinity Advertising, a joint

venture that monetises data (17 million profiles).

- Amid the ongoing

normalisation of the health situation, the

completion of the transformation plans and the continued expansion

of convenience and e-commerce formats will enable the Group to

aim for a return to growth in 2022 in profitable and

cash-flow generating formats.

Cdiscount

- Cdiscount's

business model has been completely

transformed over the last two years, shifting from a model

based on direct sales to one based on the marketplace,

digital marketing and B2B, with a decrease in direct

sales. All Cdiscount indicators improved over two

years, after an exceptional year in 2020:

Marketplace GMV up +22% (stable over one year),

digital marketing up +75% (+32%

over one year), 3.5-times increase in B2B GMV

(+30% over one year), NPS up +8 pts (+6 pts over

one year), and CDAV subscribers up +20% (+9% over

one year). Octopia has already won 12 major contracts

(including Rakuten) and will now be offered to Ocado

customers.

- In 2022, Cdiscount

will pursue its strategic plan prioritising the

marketplace, digital marketing and accelerated expansion of

B2B services (Octopia, C-Logistics).

Disposal plan

-

Implementation of the disposal plan initiated in

2018, of which €3.2bn has been completed to date, slowed during the

health crisis. €400m in disposals were

secured in 2021 and early 2022, of which

€291m cashed-in to

date (€48m in 2021 and €243m in early 2022). Due to the

disposal slow-down in 2021 and transitory elements linked to the

Group transformation, France Retail net debt (excluding IFRS 5)

evolved from €3.7bn to €4.4bn (excluding GreenYellow).

- In view of the

current outlook and the options available, the Group is confident

to complete its €4.5bn

disposal plan in France by the end of 2023 at the

latest.

In Latin America

- In Latin America,

the Group's geographies were heavily affected by the pandemic and

the Group's banners had to adapt to the new situation. Thanks to

major transactions (Assaí spin-off, sale of GPA

Extra Hypermarkets to Assaí), the Group now has

well-adapted assets ready to accelerate growth in

their respective markets:

- Assaí, in the cash &

carry segment in Brazil:

+17%8 growth and 28 store

openings over the year (total of 212 stores). The banner

is aiming to open 50 stores by 2024, in addition to the conversion

of the 70 Extra Hypermarkets sold by GPA to

Assaí, to reach R$100bn in gross

sales by 2024;

- GPA, which

operates buoyant formats

(premium, convenience and e-commerce) in the most buoyant

regions (São Paulo);

- Grupo Éxito, leader in

Colombia and Uruguay:

+21%2 acceleration in sales

in Q4 (vs +7.5% over the year);

omni-channel activities represent 12% of sales in

Colombia (2.4-times increase vs. 2019).

|

2021 Key Figure |

|

|

|

|

Change at CER |

|

In €m |

|

2019 |

2020 |

2021 |

Change over 1 year |

Change over 2 years |

|

Net sales – Groupo/w France Retail o/w Retail

banners9 o/w Vindémia (sold in June 2020)o/w

Cdiscount Gross merchandise volume

o/w marketplace o/w direct saleso/w Latam |

|

34,64516,32215,4948281,9663,8991,2451,99116,358 |

31,91215,21914,8134062,0374,2041,5141,93414,656 |

30,54914,07114,07102,0314,2061,5181,84014,448 |

-0.8%10-5.4%2-5.4%2--0.3%+0.0%+0.2%-4.9%+2.7%2 |

+6.9%2-2.6%2-2.6%2-+3.3%+7.9%+22%-7.6%+15%2 |

|

EBITDA – Group11o/w France

Retail o/w Retail

banners Margin (%)o/w CdiscountMargin

(%)o/w Latam (excl. tax credits)Margin (%) |

|

2,6401,4671,2828.3%693.5%1,1046.8% |

2,7381,4471,3048.8%1296.4%1,0237.0% |

2,5271,3581,2819.1%1065.2%1,0357.2% |

-4.7%-6.1%-1.7%+31 bps-18%-114 bps+8.7%+19

bps |

+12%-7.4%-0.0%+83 bps+54%+171 bps+29%+42 bps |

|

Trading profit – Group3o/w France

Retail o/w Retail

banners Margin (%)o/w CdiscountMargin

(%)o/w Latam (excl. tax credits)Margin (%) |

|

1,3216895103.3%40.2%6283.8% |

1,4226214883.3%532.6%6104.2% |

1,1935354843.4%180.9%6124.2% |

-12%-14%-0.8%+14 bps-65%-168 bps+7.9%+8 bps |

+9.7%-22%-5.0%+15 bps+369%+71 bps+34%+40 bps |

Leader Price, which was sold on 30 November

2020, is presented as a discontinued operation in 2020 and

2021.

The 2020 financial statements have been restated

to reflect the retrospective application of the IFRIC IC decision

relating to the recognition of liabilities for certain

post-employment benefits.

The Board of Directors met on 24 February 2022

to approve the statutory and consolidated financial statements for

2021. The auditors have completed their audit procedures on the

financial statements and are in the process of issuing their

report.

2021 FULL-YEAR RESULTS

|

In €m |

2020 |

2021 |

Reported change |

|

Net sales |

31,912 |

30,549 |

+0.1% (organic basis) |

|

EBITDA |

2,738 |

2,527 |

-4.7% at constant exchange rates |

|

Trading profit |

1,422 |

1,193 |

-12% at constant exchange rates |

|

o/w tax credits in Brazil |

139 |

28 |

(-1.5% excluding tax credits and property development) |

|

o/w property development in France |

63 |

13 |

|

Underlying net profit, from continuing

operations, Group share |

266 |

94 |

|

|

Net profit (loss) from continuingoperations, Group share |

(374) |

(275) |

Mainly impairment in Latam relating to the sale of the Extra

hypermarkets, and non-recurring expenses related to the completion

of the transformation plans in France |

|

Net profit (loss) from discontinuedoperations, Group share |

(516) |

(254) |

Leader Price's operating losses up until the transfer of the

stores |

|

Consolidated net profit (loss),Group

share |

(890) |

(530) |

|

In 2021, the Group's consolidated net

sales amounted to €30.5bn, up +0.1% on an

organic basis12 and down -4.3% after taking into account the

effects of exchange rates and hyperinflation (-3.4%), changes in

scope (-1.2%) and fuel (+0.7%).On the France

Retail scope, net sales were down -5.4% on a

same-store basis. Including Cdiscount, same-store growth

in France came to -4.8%.E-commerce (Cdiscount)

gross merchandise volume (GMV) represented

€4.2bn13, up +8%

over two years and stable compared to an

exceptional 2020 due to the pandemic, with an increase in the

marketplace contribution (+6.7 pts vs. 2019) to 45.2%2.Sales in

Latin America were up by +6.4% on an organic

basis1, mainly driven by the very good performance in the

cash & carry segment (Assaí), which grew by

+17%2 on an organic basis.

Consolidated EBITDA came to

€2,527m, a change of -7.7% including currency

effects and -4.7% at constant exchange rates. France EBITDA

(including Cdiscount) amounted to €1,464m, including

€1,358m on the France Retail scope and €106m for Cdiscount.

EBITDA for the retail banners (France Retail

excluding GreenYellow, Vindémia and property development) was

stable over two years (-1.7% vs. 2020) at €1,281m, reflecting a

+83-bp increase in the

margin (+31 bps vs. 2020) due to the efficiency plans.

EBITDA came to €14m for property development and

to €63m14 for GreenYellow. France EBITDA

margin (including Cdiscount) came to 9.1%, stable

year-on-year.In Latin America, EBITDA

increased by +9% over one year and by +29% over two years,

excluding tax credits and currency effects. Including tax credits15

(€28m in 2021 and €139m in 2020), EBITDA came out at €1,063m

compared to €1,161m in 2020.

Consolidated trading profit

came to €1,193m (€1,166m excluding tax credits4),

a decrease of -16.1% including currency effects and -12.5% at

constant exchange rates (-5.2% excluding tax credits).In

France (including Cdiscount), trading profit stood at

€554m, including €535m on the France Retail scope

and €18m for Cdiscount. Trading profit for the retail

banners (France Retail excluding GreenYellow, Vindémia and

property development) was virtually stable (-0.8%) at €484m,

reflecting a +14-bp increase in the margin

to 3.4%. Trading profit came to €13m for property

development and €39m for GreenYellow,

including higher depreciation and amortisation expense in

connection with the asset holding model. The trading margin

in France (including Cdiscount) was

3.4%.In Latin America,

trading profit excluding tax credits and currency effects

was up by +8% over one year and by +34% over two years.

Including tax credits (€28m in 2021 and €139m in 2020), trading

profit was €640m compared to €748m in 2020. Trading profit was

driven by (i) the significant improvement in trading profit at

Assaí, in line with business growth, and (ii) an

excellent performance from Éxito, with renewed

growth and an upturn in property development; but impacted by

hypermarkets at GPA Brazil (inventory drawdowns

before disposals).

Underlying net financial expense and net

profit, Group share16

Underlying net financial

expense for the period came to -€813m (-€500m

excluding interest expense on lease liabilities) vs.

-€681m in 2020 (-€360m excluding interest expense on lease

liabilities). In France, net financial expense

excluding interest expense on lease liabilities was impacted by an

increase in financial expenses related to a one-off cost of €38m

(mostly non-cash) arising in connection with the refinancing of

Term Loan B in the first quarter of 2021.

E-commerce (Cdiscount) net financial expense was

virtually stable compared with 2020. In Latin

America, financial expenses were up due to a lower level

of tax credits in 2021 (impact of -€81m in net financial

expense).

Underlying net profit from continuing

operations, Group share totalled €94m

compared with €266m in 2020, reflecting lower trading profit (o/w a

-€111m decrease in tax credits in Latin America, a -€50m decrease

relating to property development in France and a -€48m currency

effect) and higher underlying financial expenses. Diluted

underlying earnings per share17 stood at

€0.54, vs. €2.15 in 2020.

Other operating income and

expenses amounted to -€656m (vs. -€799m in 2020) and

included -€264m non-cash costs. In France

(including Cdiscount), other operating income and expenses amounted

to -€356m (-€692m in 2020), of which -€207m in cash costs excluding

the disposal plan and GreenYellow (-€231m in 2020), -€48m for

GreenYellow (mainly non-cash) and -€101m in other costs (-€451m in

2020) due to lower asset impairment charges. In Latin

America, other operating income and expenses amounted to

-€300m (-€103m in 2020), mainly due to impairment charges and costs

incurred in connection with the sale of GPA hypermarkets to

Assaí.

Consolidated net profit (loss), Group

share

Net profit (loss) from

continuing operations, Group share came out at

-€275m (vs. -€374m in 2020), due to impairment in Latin America

relating to the sale of the Extra hypermarkets, and non-recurring

expenses related to the completion of the transformation plans in

France. It recorded an improvement of +€99m over one year,

reflecting a reduction in impairment charges. Net profit

(loss) from discontinued operations, Group share was

-€254m (vs. -€516m in 2020), reflecting operating losses recorded

by Leader Price up until the transfer of the

stores.Consolidated net profit (loss), Group share

amounted to -€530m vs. -€890m in 2020.

Financial position at 31 December

2021-Consolidated net debt excluding IFRS

5 stood at €5.9bn vs. €4.6bn at

31 December 2020. For the France Retail

scope excluding GreenYellow, net debt

increased to €4.4bn at the end of 2021 from €3.7bn at end-2020, due

mainly to the following transitory18 factors: (i) the temporary

effect of year-end activity (-€40m impact on working capital) and

strategic stockpiling (-€90m impact on working capital),

(ii) operating losses and working capital at Leader Price,

with the last Leader Price stores transferred to Aldi in September

2021 (-€0.4bn) and (iii) non-recurring expenses related to Group

transformation. For GreenYellow, the change from a

net cash position of €122m in 2020 to net debt of €34m in 2021

results from the increase in investments following the move to an

infrastructure model (asset holding) financed by its own resources.

In Latin America, Assaí's debt increased from

€664m to €864m due to the acquisition of 70 Extra hypermarkets.

At 31 December 2021, the Group's liquidity in

France (including Cdiscount) was €2.6bn, with

€562m in cash and cash equivalents and

€2.1bn confirmed undrawn lines of credit, available at any

time. The Group also has €339m in the unsecured

segregated account and €145m in the secured

segregated account

Financial information relating to

the covenants-At 31 December 2021, the

Group complied with the covenants contained in the revolving credit

facility. The ratio of secured gross debt to EBITDA (after

lease payments) was 2.7x19, within the

3.5x limit, representing headroom of €178m in EBITDA. The

ratio of EBITDA (after lease payments) to net finance costs

stood at 2.7x (above the required 2.5x), representing

headroom of €55m in EBITDA. The margin represents around €150m

excluding on-off financial expenses of €38m due to the refinancing

of Term Loan B in Q1 2021.

The Board of Directors will recommend to

the 2022 Annual General Meeting not to pay a dividend in 2022 in

respect of 2021.

HIGHLIGHTS-

Retail banners – France

EBITDA for the retail banners20 was virtually

stable (-1.7%) amid a -5.4% decline in same-store sales. EBITDA

margin increased by +31 bps over the year (from 8.8% to 9.1%), and

by +83 bps over two years thanks to efficiency plans. Trading

profit fell by -0.8%, with the trading margin increasing by +14

bps.

Refocus on buoyant formats

- Buoyant formats (supermarkets and

premium, convenience stores, Cdiscount) now account for 76% of net

sales (vs. a market average of 43%21), up +16 pts since 2018;

- The Group continued to

expand its convenience store network, with 730 stores

opened since January 2021 in urban (Franprix, Naturalia,

Monop'), semi-urban and rural (Spar, Vival, etc.) areas. These new

store openings are mainly based on a franchise development model

with low capital intensity, in all geographies with formats adapted

to each catchment area;

- Half of

hypermarkets are located in the Provence Alpes

Côte d'Azur, Auvergne-Rhône-Alpes and Bordeaux regions;

hypermarkets represent around 20% of net sales.

Food E-commerce

- Home

delivery net sales grew by +48% over the

year, ahead of the market (+25%22), with

strong leadership in the Ile-de-France

region23.

- In 2021, the Group

strengthened its partnerships with European and global e-commerce

leaders:

- Partnership with Ocado

- 2017: partnership signed

- 2020: start of operations at the

O'logistique automated warehouse in Fleury-Merogis

- 2022: Partnership

related to the development of Ocado's

services in France

- Amazon partnership

- 2018: Monoprix on Amazon Prime in

Paris (delivery in 2 hours)

- 2019: Amazon lockers in stores

- 2020: extension of Amazon Prime

(Lyon, Bordeaux, etc.)

- 2021: Monoprix

becomes Amazon’s sole partner for grocery home

delivery with the termination of its own

operations ; click & collect

from Casino stores (currently 85 stores out of a

target of 180), and lockers in more than 800

stores

- Partnership with Gorillas

- 2021: partnership signed

- 2022: Gorillas dark stores

supplied by Monoprix

- Including Drive,

total Food e-commerce grew by

+15% over the year (vs. +6% for the market3).

Digitalisation and customer

experience

- The Group had 639 stores

equipped with autonomous solutions at end-2021 (vs. 533 at

end-2020), facilitating evening and weekend openings. 63%

of payments in both Géant hypermarkets and Casino supermarkets are

now made by smartphone or automated check-out (vs. 61% and

48% respectively at end-2020). CasinoMax app users

accounted for 26% of sales in hypermarkets and supermarkets at

end-2021 (vs. 22% at end-2020).

- The banners' wide-ranging

innovations provide a unique customer experience through the

development of an affinity offer, along with commercial innovations

(commercial interface on WhatsApp, streamed live

shopping events, virtual reality product

presentations, presence on the metaverse).

Structural improvement in sales

momentum

- The purchasing alliance

with Intermarché (AUXO) launched in September 2021 enables

the Group to improve its purchasing terms. This partnership with

Intermarché will be extended to purchases of goods and services not

for resale from April 2022;

- The features pioneered by

the Group have been reinforced.

Non-food spaces have been reduced

in favour of food and specialised non-food spaces, including: Santé

au Quotidien (Monoprix), soft mobility (Monoprix, Franprix, Géant),

and non-food corners with specialists (textiles, jewellery, toys,

etc.);

- The Group had more than

210,000 Casino and Monoprix subscribers at 31 December

2021, a two-fold increase over one year.

Following the subscription programme launched in 2019 by the Casino

banners (Casino Max Extra), in 2021 Monoprix launched the

first truly omni-channel subscription in France

(Monopflix), offering identical discounts online and in stores.

Subscriptions strengthen customer loyalty and

allow the banners to offer very competitive prices

after the 10% discount. Customers with subscriptions in Géant and

Casino Supermarkets spend on average four times more than

unsubscribed customers.

Cdiscount: continuation of the long-term

strategy

Cdiscount continued to transform its

business model towards a more profitable business mix (increase in

marketplace, digital marketing and B2B; decrease in direct sales),

resulting in a favourable margin impact.

Cdiscount delivered a solid performance

in 2021, with GMV of €4.2bn, up

+8% over two years and stable compared to an

exceptional 2020.

The marketplace continues to grow,

reporting GMV of €1.5bn, up +22% over two

years (stable over one year). The marketplace

contribution to GMV grew by +6.7 pts over two

years (+1.3 pt over one year). Marketplace

revenues came in at €193m, up +29% over two

years (+5% over one year).

Digital marketing revenues

were up +75% over two years (up

+32% over one year), buoyed by the CARS (Cdiscount Ads Retail

Solution) digital marketing platform that enables vendors and

suppliers to promote their products and brands on a proprietary

self-service platform.

The banner has an increasing number of loyal and

active customers, with a base of 10 million active

customers, up +8% over two years. The Cdiscount à

Volonté loyalty programme now has more than 2.5 million

members (+20% over two years, +9% over one year), who have access

to 2.8 million items available for express delivery. Customer

satisfaction hit a record high, with NPS of 53 points, up +8.4

points over two years (+5.7 points over one year).

The development of B2B

activities picked up pace in 2021, with GMV of

€114m, up +30% year-on-year (3.5-times

higher over two years), including a rise of +26%

for the marketplace services and technology ecosystem

Octopia (3.3-times higher over two years), which

now has 12 major contracts (including Rakuten) in seven different

countries for its turnkey marketplace solutions. In addition,

C-logistics and C Chez Vous logistics solutions are now serving 20

customers.

Lastly, Octopia and Ocado signed an

agreement enabling Ocado customers to access the Octopia

marketplace.

GreenYellow: strong

activity momentum in 2021

The photovoltaic business continues to

grow. Capacity installed or under

construction climbed +31% year-on-year to

740 MW at

the end of 2021, while the advanced

pipeline24 was up sharply by

+44% to 816 MW. The pipeline

of additional opportunities25 represents 3.7 GW.

In the energy efficiency

business, GreenYellow had 985 GWh of projects deployed or

under construction at the end of 2021, up

+16% year-on-year, with the advanced

pipeline1 up +26%

to 317 GWh, and an additional opportunities

pipeline2 of 918 GWh.

GreenYellow delivered €80 million in

EBITDA26 in 2021, in line with

its objectives, a rise of +30%

year-on-year.

GreenYellow continued to expand its

geographic reach and entered into promising partnerships in

2021:

- Geographic expansion continued on

international markets, with GreenYellow's

positions strengthened in all its traditional geographies

(signature of the 200th PPA27 in South-East Asia) and new

markets captured such as Eastern Europe

(4 MW project for Solvay in Bulgaria).

- Strategic

partnerships:

- In November 2021, GreenYellow

signed a long-term strategic partnership with Schneider

Electric to provide turnkey energy efficiency programmes

to large international companies;

- In December 2021, GreenYellow

signed a strategic collaboration on energy and cloud with

Amazon Web Services. GreenYellow will supply

renewable electricity for Amazon's operations as part of a solar

power project in France.

At the beginning of 2022,

GreenYellow raised capital totalling €109m from an

institutional investor (convertible bonds with

warrants attached) and set-up an €87m syndicated

credit facility line to accelerate growth in 2022.

RelevanC: ongoing development of a

fast-growing business

2021 represented a year of transformation and

strategic expansion for RelevanC, shaped by the acquisition

of Inlead, a local digital marketing technology platform,

the launch of operations in Latin America (Brazil

and Colombia), and the creation of Infinity

Advertising, the joint subsidiary with Intermarché

offering retail media and targeted advertising services for food

banners (cumulative base of 17 million profiles).

RelevanC also signed partnerships with

technology leaders:

- Google Cloud and

Accenture: a commercial and technology partnership serving

international customers.

- Amazon

Web Service: planned partnership to improve the customer

experience through algorithms.

RelevanC continues to market its B2B

retail media platform to other retailers in France and

international markets in order to monetise their data and

advertising space. One of its clients is Everli, the first European

home delivery service through personal shoppers.

Latin America

The listing of Assaí shares on

the Novo Mercado and of its American Depositary Receipts (ADRs) on

the New York Stock Exchange took place on 1 March 2021, following

the spin-off from GPA in late 2020.

At the end of 2021, GPA and Assaí also announced

plans for GPA to sell 70 Extra hypermarkets to

Assaí with the intention of converting them into

the cash & carry format, and for GPA to transform

remaining Extra hypermarkets into Pão de Açúcar or

Mercado Extra supermarkets.

Assaí's highly profitable business model

steps up a gear

Assaí reported EBITDA growth of

+18%28 in 2021 to €489m, reflecting a +51-bp

margin improvement. The banner is now targeting R$100bn

(€17bn) in gross sales in 2024 (a rise of +30% p.a.),

driven by (i) the opening of around 50 stores between 2022

and 2024 on an organic basis and (ii) the

conversion of the 70 Extra hypermarkets (40

stores expected to open in the second half of 2022 and 30 in 2023).

The success of the 23 Extra Hiper stores already converted confirm

the potential for future conversions (three-fold increase in

sales). Assaí opened 28 stores in 2021, bringing

its total number of stores to

212.

GPA refocused on premium, convenience and

e-commerce

GPA Brazil continues to

optimise its store portfolio, accelerating its focus on

profitable premium and convenience formats, particularly in the São

Paulo region, and exiting the hypermarket format

(conversion of the hypermarkets not sold into Pão de Açúcar or

Mercado Extra supermarkets). However, the hypermarket closures or

conversions had a transitory impact on 2021 earnings. GPA also

continues to cement its leadership in food

e-commerce, where sales have increased by +363%29 vs.

2019, with a share of 8%2 in 2021 (vs. 2% in

2019).

Excellent performance from Grupo

Éxito

Grupo Éxito delivered an

excellent performance in 2021, with EBITDA up

+20%1 to €333m (9.0% EBITDA margin), and trading

profit up +33%1 to €211m. The Group confirmed its

leadership in Colombia and saw a sharp increase in sales towards

the end of the year, rising +21%30 in Q4 (+7.5% over the year to

€3.7bn). In Colombia2, sales

jumped +16% in Q4 (up +7% over the year to €2.8bn), driven by

innovation and omni-channel activities, which now account for 12%

of sales in the country (2.4-times more vs. 2019). Trading profit

in Colombia was up by +32% in Q4 and by +43% over the year, driven

by the business and by property development. In

Uruguay2, the Group delivered

faster +7% sales growth in Q4, with sales at €0.6bn for the year,

and excellent profitability (EBITDA at €59m with an EBITDA margin

of 10%).

A recognised CSR commitment

Casino Group is ranked as the no. 1

retailer and no. 8 global company for its CSR

policy and commitments in Moody's ESG ranking for

202131.

Recognised for its commitments in favour of the

climate and environmental

protection, the Group renewed its efforts to

reduce its carbon emissions, which fell by -12% in 2021

(-20% vs. 2015), in line with the commitment to reduce

greenhouse gas emissions by -38% by

203032. Initiatives include the

first low-carbon BREEAM Outstanding certified

warehouse opened by Monoprix in France, with 25% of electricity

generated by a solar power unit installed on the roof. The Group is

also taking action on deliveries, with a fleet of 480 low-carbon

emission trucks (CNG, bio-CNG33, rapeseed, electric power).

The Group continues to promote

responsible consumption, with sales of organic

products of €1.2 billion in

2021, corresponding to a +10-bp increase in the share of

sales. The nutritional quality of products also remains one of the

Group's priorities, with a Nutriscore now

displayed on 100% of Casino-brand products (60% rated A, B or C)

and more than 1,400 plant-based protein products in the Group's

banners.

The Group follows an inclusive HR policy

in favour of equal opportunity and diversity in employing

208,000 people, with women making up 41% of managers and over 8,700

employees with disabilities.

Disposal plan for non-strategic assets:

€3.2bn since July 2018

As of end-2021, sales of non-strategic

assets completed since July 2018 totalled €3.2bn. The

disposals carried out by the Group in 2021 are detailed below:

- On 27 July 2021,

the Group and BNPP signed a partnership and an agreement

for the sale of FLOA for €200m34 (€184m collected in early

2022). The planned sale provides for a new commercial partnership

between BNP Paribas and the Casino Supermarchés, Géant and

Cdiscount banners, as well as a strategic alliance between BNP

Paribas and Casino to develop the "FLOA Pay" split payment

solution. The Group also has an earn-out of 30% on the future value

created through to 2025. The disposal was finalised on

31st January 2022;

- On 6 December

2021, the Group completed the disposal of 3% of Mercialys

equity through a total return swap (TRS) for

€24m (received in 2021). On 21 February 2022, Casino Group

completed the additional definitive disposal of 6.5% of

Mercialys equity through a new TRS for

€59m (received in early 2022). The Group's stake

in Mercialys in terms of voting rights is reduced to 10.3%;

- In addition, the Group has secured

and recorded in advance a €118m earn-out in relation to the

Apollo and Fortress joint ventures (€24m received in

2021).

In view of the current outlook and the

options available, the Group is confident to complete its €4.5bn

disposal plan in France by the end of 2023 at the

latest.

Financial

structure

In 2021, the Group realized several transactions

aimed at improving its financial terms and conditions and extending

the maturity of its bonds and main syndicated credit facility.

The Group carried out several bond buybacks on

tranches of its 2023, 2024, 2025 and 2026 bonds, along with

refinancing operations including (i) issue of a new Term

Loan B for €1bn, maturing in August 2025, topped up by a

further €425m in November 2021, and (ii) issue of a

new €525 million unsecured bond maturing

in April 2027, enabling the Group to repay ahead of maturity its

previous €1.225bn Term Loan due in January 2024.

The Group also announced in July 2021 that it

had extended the maturity of its main syndicated credit

facility (RCF) from October 2023 to July

202635 for an amount of €1.8bn.

Lastly, Monoprix’s syndicated credit facility

which expired in July 2021 was also renewed. The new

€130 million syndicated facility matures in January 2026 and

has a yearly margin adjustment clause based on the achievement of

CSR targets.As a result of these two operations, the amount of the

Group’s undrawn lines of credit available at any time in the France

Retail segment stands at €2.2 billion, with an average

maturity of 4.6 years (vs. 2.2 years prior to the

operations).

At 31 December 2021, amounts held in a

segregated account to repay debt totalled €339m. Amount on the

secured segregated account totalled €145m.

Outlook for 2022 in

France-

-

In 2021, the Group completed its repositioning in

structurally buoyant formats with a good profitability

level

-

In 2022, as the health situation gradually gets back to

normal, the Group is confident to recover

growth momentum by capitalising on its

differentiating assets and innovative services

-

Convenience formats (Monop', Franprix, Naturalia,

Spar, Vival, etc.) with a target of more than 800 stores to be

opened, mainly under franchise

-

Confirmation of leadership in e-commerce,

particularly in home delivery, supported by its partners Ocado,

Amazon and Gorillas and the store network

-

Maintain high level of

profitability and improve cash

flow generation

-

Continuation of the €4.5bn disposal plan

in France. In view of the various options

available, the Group is confident that this plan will be

completed by the end of 2023

-

Fourth quarter 2021 net sales - In

the fourth quarter of 2021, the Group recorded net sales of

€8,335m, stable vs. 2020, including the effects of changes

in consolidation scope, exchange rates and fuel for -0.5%, +0.1%

and +1.2%, respectively. The calendar effect was -0.1%. The

Group’s same-store1 growth came to -0.4%

year-on-year and +7.7% over two years.

Consolidated net sales by segment

Q4 2021/Q4 2020 change NET SALES (in €m)

Q4 2021 Reported change Organic

change2 Same-store change1 Change1 over two years France

Retail 3,648 -2.4% -3.3% -3.0% -2.9%

Cdiscount 592 -7.9% -9.8% -9.7% -5.8%

GMV - - - -8.6% +0.5%

o/w marketplace - - - -14.6% +14.6%

o/w direct sales - - -

-3.6% -8.0% Latam Retail 4,096 +3.3% +3.1% +3.4%

+17.4% GROUP TOTAL 8,335 -0.1% -0.7% -0.4% +7.7%

For France Retail, same-store sales growth came to

-3.0% in Q4, an improvement of +1.3 pts on Q3

2021, in a market down by -3.7% in France3 during the quarter. Most

banners delivered a quarter-on-quarter improvement, including

Monoprix and Franprix in a market that declined by -5.6% in the Ile

de France region3 over the quarter. The total change in sales for

France Retail was -2.4%, of which +3.5% for the convenience

format, which saw a +5.0% increase in gross sales under banner,

driven by the expansion.

Change Consolidated

net sales in France by banner

Q3 2021 Q4 2021/Q4 2020

change Net sales by banner (in €m)

Same-store change1 Q4 2021 net sales Reported

change Organic change1 Same-store change1 Q4 vs. Q3 on

a same-store basis Monoprix -4.1% 1,191

-2.3% -1.8% -2.8% +1.3 pts Supermarkets

-2.7% 767 +5.6% -4.0% -3.3% -0.6 pts o/w Casino upermarkets4

-3.7% 732 +5.8% -4.0% -3.5% +0.2 pts Franprix

-3.6% 366 -3.3% -2.2% -2.0% +1.6 pts Gross

sales under banner - 432 -0.2% - - - Convenience

& Other5 -1.2% 425 -6.7% +2.9% -0.8% +0.4 pts

o/w Convenience6 -1.3% 327 +3.5% +3.7% -0.7% +0.6 pts

Gross sales under banner - 490 +5.0% - - -

Hypermarkets -8.5% 899 -6.3% -8.4% -4.7%

+3.8 pts o/w Géant2 -9.5% 848 -6.1% -8.3% -4.9% +4.6 pts

FRANCE RETAIL -4.3% 3,648 -2.4% -3.3% -3.0%

+1.3 pts

Market shares are now almost

stable in France, with a significant improvement on the trends seen

in recent periods, and a sales momentum over the last four weeks to

20 February with same store sales at -1.6% (+1.4 pt vs. Q4 2021).

Cdiscount reported a -7.9% decline in net sales

for the quarter, due to the high basis of comparison in Q4 2020

resulting from the November lockdown. Marketplace GMV

grew by +14.6% over two years. In Latin

America, sales rose by +3.4% on a same-store

basis (+17.4% over two years). Sales for the quarter in

Latin America were driven by an excellent performance from

Éxito (+15.5% on a same-store basis and +15.7% on an

organic basis).

APPENDICES – ADDITIONAL 2020 FINANCIAL INFORMATION RELATING TO THE

AUTUMN 2019 REFINANCING DOCUMENTATION See press release dated 21

November 2019 Financial information for the fourth quarter

ended 31 December 2021: In €m France Retail

+ E-commerce Latam Total

Net sales7 4,239 4,096

8,336 EBITDA1 532

313 845 (-) impact of leases8

(139) (83) (222) Adjusted Consolidated EBITDA including

leases1 393 230

623 Financial information

for the 12-month period ended 31 December 2021: In

€m France Retail + E-commerce

Latam Total Net sales1

16,101 14,448

30,549 EBITDA1 1,464

1,063 2,527 (-) impact of leases2

(622) (307) (930) (i) Adjusted consolidated EBITDA

including leases1 9 842

755 1,597 (ii) Gross

debt1 10 5,450 2,691

8,141 (iii) Gross cash and cash

equivalents1 11 569

1,714 2,283

At 31 December 2021, the Group's liquidity within the "France +

E-commerce" scope was €2.6bn, with €562m in cash and cash

equivalents and €2.1bn in confirmed, undrawn lines of credit.

Commercial paper amounted to €308m. Additional

information regarding covenants and segregated accounts:

Covenants tested as from 30 June 2021 pursuant to

the Revolving Credit Facility dated 18 November 2019, as

amended in July 2021 Type of covenant

(France and E-commerce excluding GreenYellow) At 31

December 2021 Secured gross debt/EBITDA after lease

payments ≤ 3.50x 2.70x EBITDA after lease

payments/Net finance costs ≥ 2.50x 2.69x The

secured gross debt/EBITDA after lease payments covenant stood at

2.70x, with EBITDA after lease payments of €780m and secured debt

of €2.1bn. The balance of the segregated account was €339m at 31

December 2021, the same level as at 30 September 2021.

The balance of the secured segregated account was €145m at 31

December 2021. No cash has been credited or debited from the bond

segregated account and its balance remained at €0.

APPENDICES – FULL-YEAR RESULTS

- Consolidated net sales by segment

Net sales In €m 2020

2021 Reported change

Change at CER France Retail

15,219 14,071

-7.5% - Latam Retail

14,656 14,448

-1.4% +6.0% E-commerce

(Cdiscount) 2,037 2,031

-0.3% - Group total 31,912 30,549

-4.3% -0.9%

- Consolidated EBITDA by segment

EBITDA In €m 2020

2021 Reported change

Change at CER France Retail 1,447

1,358 -6.1%

-5.9% Latam Retail 1,161 1,063

-8.5% -1.7% E-commerce

(Cdiscount) 129 106 -18.2%

-18.2% Group total 2,738 2,527 -7.7% -4.7%

- Consolidated trading profit by segment

Trading profit In €m 2020

2021 Reported change

Change at CER France Retail 621

535 -13.8%

-13.4% Latam Retail 748 640

-14.5% -8.1% E-commerce

(Cdiscount) 53 18 -65.0%

-65.0% Group total 1,422 1,193 -16.1% -12.5%

In €m 2020 Restated items 2020 underlying 2021 Restated

items 2021 underlying Trading

profit 1,422 0 1,422 1,193 0 1,193

o/w tax credits in Brazil 139 0 139 28 0

28 o/w property development in

France 63 0 63 13 0 13 Other operating income and expenses

(799) 799 0 (656) 656 0 Operating profit

622 799 1,422

537 656 1,193

Net finance costs (357) 0 (357) (422) 0 (422)

o/w tax credits in Brazil 104 0 104 23 0

23 Other financial income and expenses12 (391) 67 (324)

(391) (0) (391) Income taxes13 (80) (179) (259) 84 (147)

(62) Share of profit of equity-accounted investees 50 0 50

49 0 49 Net profit (loss) from continuing

operations (156) 688

532 (142) 509

367 o/w

attributable to non-controlling interests14 218 48 266 133 140 273

o/w Group share (374)

640 266 (275)

369 94 Underlying

net profit corresponds to net profit from continuing operations,

adjusted for (i) the impact of other operating income and expenses,

as defined in the "Significant accounting policies" section in the

notes to the consolidated financial statements, (ii) the impact of

non-recurring financial items, as well as (iii) income tax

expense/benefits related to these adjustments and (iv) the

application of IFRIC 23. Non-recurring financial items include fair

value adjustments to equity derivative instruments (such as total

return swaps and forward instruments related to GPA shares) and the

effects of discounting Brazilian tax liabilities.

- Change in net debt by entity

Net debt before IFRS 5 In €m

2019 2020 2021

France (4,069)

(3,751) (4,736) o/w

France Retail excl. GreenYellow (4,001) (3,661) (4,365)

o/w E-commerce (Cdiscount) (221)

(213) (337) o/w GreenYellow 153 122 (34) Latam

Retail (1,587) (882)

(1,122) o/w GPA Brazil (541) (373) (475)

o/w Assaí (1,460) (664) (864) o/w Grupo Éxito 626 333

361 o/w Segisor (185) (179) (144) Total

(5,657) (4,634)

(5,858)

- Change in net debt for France Retail excl. GreenYellow (excl.

IFRS 5)1516

Excluding GreenYellow, France Retail net debt

increased from €3.7bn to €4.4bn (see PDF version)

APPENDICES – NET SALES

Consolidated net sales by segment

Net sales (in €m) 2021 Reported

change Organic change17 Same-store change1 France

Retail 14,071 -7.5% -6.2% -5.4% Cdiscount

2,031 -0.3% -1.7% -1.6% Total France 16,101 -6.7%

-5.6% -4.8% Latam Retail 14,448 -1.4% +6.4% +2.7%

GROUP TOTAL 30,549 -4.3% +0.1% -0.8%

Cdiscount GMV 4,206 +0.0% n.a. n.a.

2021/2020

change in net sales in France by banner Net sales

by banner (in €m) 2021 net sales Reported

change Organic change1 Same-store change1

Monoprix 4,408 -2.8% -2.4% -3.7%

Supermarkets 2,996 -2.4% -7.8% -5.9% o/w Casino

Supermarkets18 2,835 -2.6% -8.2% -6.8% Franprix

1,438 -9.0% -8.2% -7.3% Convenience & Other19

1,788 -18.7% -2.7% -5.1% o/w Convenience20 1,395 -1.5% -1.8% -5.2%

Hypermarkets 3,442 -10.3% -11.1% -8.1% o/w Géant2

3,233 -10.7% -11.8% -8.9% FRANCE RETAIL 14,071

-7.5% -6.2% -5.4% Main data – Cdiscount21

Key figures (in €m) 2020 2021

Reported growth Reported growth over two

years Total GMV including tax

4,204 4,206

+0.0% +7.9% o/w direct sales

1,934 1,840 -4.9% -7.6% o/w marketplace 1,514 1,518 +0.2% +22% o/w

Octopia 87 109 +25.6% x3.3 Marketplace contribution (%) 43.9% 45.2%

+1.3 pts +6.7 pts Net sales 2,225

2,166 -2.6%

-1.3% Traffic (millions of visits) 1,154 1,082

-6.2% +6.0% Active customers (in millions) 10.3 10.0 -2.5% +8.0%

Cnova provided a

detailed report on its 2021 results on 17 February 2022. APPENDICES

– OTHER INFORMATION Exchange rate AVERAGE EXCHANGE

RATES 2020 2021 Currency

effect Brazil (EUR/BRL) 5.8936 6.3797 -7.6% Colombia

(EUR/COP) (x 1000) 4.2160 4.4265 -4.8% Uruguay (EUR/UYP) 47.9825

51.5217 -6.9% Argentina22 (EUR/ARS) 103.1176 116.7629 -11.7% Poland

(EUR/PLN) 4.4445 4.5655 -2.6% Gross sales

under banner in France TOTAL ESTIMATED GROSS

SALES UNDER BANNER (in €m, excluding fuel) Change

(incl. calendar effects) Q4 2021

Q4 2021 FY 2021 Monoprix 1,244

-2.0% -2.8% Franprix 432 -0.2% -7.1% Supermarkets 701 +0.4% -6.0%

Hypermarkets 807 -11.6% -13.2% Convenience & Other 588 -2.7%

-12.7% o/w Convenience 490 +5.0% +0.4%

TOTAL FRANCE 3,772 -3.7% -8.0% TOTAL GROSS

SALES UNDER BANNER (in €m, excluding fuel) Change (incl.

calendar effects) Q4 2021

Q4 2021 FY 2021 Total France

3,772 -3.7% -8.0% Cdiscount 1,007 -8.6% 0.0% TOTAL FRANCE

AND CDISCOUNT 4,779 -4.8% -6.6%

Store network at period-end

FRANCE 31 March 2021

30 June 2021 30 Sept. 2021

31 Dec. 2021 Géant Casino

hypermarkets 104 95

95 95

o/w French franchised affiliates 3 3 3 3

International affiliates 7 7 7 7 Casino

Supermarkets 417 422

425 429

o/w French franchised affiliates 68 64 63 61

International affiliates 25 22 25 26 Monoprix

(Monop’, Naturalia, etc.) 806 830

833 838

o/w franchised affiliates 195 201 203 206

Naturalia integrated

stores 189 203 200 198

Naturalia franchises 34 39 44 51 Franprix

(Franprix, Marché d’à côté, etc.) 877

890 906 942

o/w franchises 493 533 564 614

Convenience (Spar, Vival, Le Petit Casino, etc.)

5,311 5,502

5,563 5,728 Other

businesses 334 320

303 286 Total

France 7,849 8,059

8,125 8,318 INTERNATIONAL

31 March 2021 30 June 2021

30 Sept. 2021 31 Dec. 2021

ARGENTINA 25 25

25 25 Libertad hypermarkets 15 15

15 15 Mini Libertad and Petit Libertad mini-supermarkets 10 10 10

10 URUGUAY 93 92

93 94 Géant hypermarkets 2 2 2 2

Disco supermarkets 30 30 30 30 Devoto supermarkets 24 24 24 24

Devoto Express mini-supermarkets 35 34 35 36 Möte 2 2 2 2

BRAZIL 1,058

1,058 1,064

1,021 Extra hypermarkets 103 103 103 72 Pão de

Açúcar supermarkets 182 181 181 181 Extra supermarkets 147 147 146

146 Compre Bem 28 28 28 28 Assaí (cash & carry) 184 187 191 212

Mini Mercado Extra & Minuto Pão de Açúcar mini-supermarkets 237

236 239 240 Drugstores 103 102 102 68 + Service stations 74 74 74

74 COLOMBIA 1,974

2,006 2,035

2,063 Éxito hypermarkets 92 92 92 91 Éxito and

Carulla supermarkets 153 155 153 158 Super Inter supermarkets 61 61

61 61 Surtimax (discount) 1,548 1,577 1,607 1,632

o/w “Aliados” 1,476 1,505 1,536

1,560 B2B 34 34 34 36 Éxito Express and Carulla Express

mini-supermarkets 86 87 88 85 CAMEROON

2 3 4

4 Cash & carry 2 3 4 4 Total

International 3,152

3,184 3,221

3,207 Consolidated income

statement (in € millions)

2021 2020 (restated)23

CONTINUING OPERATIONS Net

sales 30,549 31,912 Other revenue

504 598 Total revenue

31,053 32,510 Cost of goods sold

(23,436) (24,314) Gross

margin 7,617

8,195 Selling expenses

(5,122) (5,508) General and administrative

expenses (1,302) (1,266) Trading

profit 1,193

1,422 As a % of net sales

3.9% 4.5% Other

operating income 349 304 Other operating

expenses (1,005) (1,103) Operating

profit 537 622 As

a % of net sales 1.8% 2.0%

Income from cash and cash equivalents

27 16 Finance costs (449)

(373) Net finance costs

(422) (357) Other financial

income 116 210 Other financial expenses

(507) (601) Profit (loss) before

tax (276) (125)

As a % of net sales -0.9% -0.4%

Income tax benefit (expense)

84 (80) Share of profit of equity-accounted

investees 49 50 Net profit (loss)

from continuing operations (142)

(156) As a % of net sales

-0.5% -0.5% Attributable to owners of the parent

(275) (374) Attributable to non-controlling

interests 133 218 DISCONTINUED

OPERATIONS Net profit (loss)

from discontinued operations (255)

(508) Attributable to owners of the parent

(254) (516) Attributable to non-controlling

interests (1) 7 CONTINUING AND

DISCONTINUED OPERATIONS

Consolidated net profit (loss)

(397) (664) Attributable to

owners of the parent (530) (890)

Attributable to non-controlling interests

133 225 Earnings per share

(in €) 2021 2020

(restated)1 From continuing operations,

attributable to owners of the parent

(2.89) (3.79)

(2.89) (3.79) From continuing and

discontinued operations, attributable to owners of the

parent

(5.24) (8.58)

(5.24) (8.58) Consolidated

statement of comprehensive income (in €

millions) 2021 2020

(restated)24 Consolidated net profit

(loss) (397) (664)

Items that may be subsequently reclassified to profit or

loss (84) (1,367) Cash

flow hedges and cash flow hedge reserve(i) 38 (17)

Foreign currency translation adjustments(ii) (108)

(1,328) Debt instruments at fair value through other comprehensive

income (OCI) (1) 1 Share of items of

equity-accounted investees that may be subsequently reclassified to

profit or loss (3) (27) Income tax effects

(10) 5 Items that will never be

reclassified to profit or loss 2

(6) Equity instruments at fair value through other

comprehensive income - - Actuarial gains and

losses 2 (10) Share of items of equity-accounted

investees that will never be subsequently reclassified to profit or

loss - - Income tax effects - 4

Other comprehensive income (loss) for the year, net of

tax (82) (1,373)

Total comprehensive income (loss) for the year, net of

tax (479) (2,037)

Attributable to owners of the parent (529) (1,456)

Attributable to non-controlling interests 50 (581)

- The change in the cash flow hedge reserve was not material in

either 2021 or 2020.

- The €108 million negative net translation adjustment in 2021

arose primarily from the depreciation of the Colombian peso for

€124 million. The €1,328 million negative net translation

adjustment in 2020 mainly concerned the depreciation of the

Brazilian and Colombian currencies for €957 million and €235

million, respectively.

Consolidated statement of financial

position ASSETS 31 Dec.

2021 31 Dec. 2020 (restated) 25 1

Jan. 2020 (restated)1 (in € millions)

Goodwill 6,667 6,656 7,489 Intangible

assets 2,024 2,061 2,296 Property, plant

and equipment 4,641 4,279 5,113 Investment

property 411 428 493 Right-of-use assets

4,748 4,888 5,602 Investments in

equity-accounted investees 201 191 341

Other non-current assets 1,183 1,217 1,183

Deferred tax assets 1,191 1,019 768

Non-current assets 21,067

20,738 23,284 Inventories

3,214 3,209 3,775 Trade receivables

772 941 836 Other current assets

2,033 1,770 1,536 Current tax assets

196 167 111 Cash and cash equivalents

2,283 2,744 3,572 Assets held for sale

973 932 2,818 Current assets

9,470 9,763

12,647 TOTAL ASSETS

30,537 30,501

35,932

EQUITY AND LIABILITIES 31 Dec.

2021 31 Dec. 2020 (restated)1 1

Jan. 2020 (restated)1 (in € millions)

Share capital 166 166 166 Additional

paid-in capital, treasury shares, retained earnings and

consolidated net profit (loss) 2,589 3,143

4,650 Equity attributable to owners of the parent

2,755 3,309

4,816 Non-controlling interests

2,883 2,856

3,488 Total equity

5,638 6,165

8,304 Non-current provisions for employee benefits

273 289 293 Other non-current provisions

376 374 458 Non-current borrowings and

debt, gross 7,461 6,701 8,100 Non-current

lease liabilities 4,174 4,281 4,761

Non-current put options granted to owners of non-controlling

interests 61 45 61 Other non-current

liabilities 225 201 181 Deferred tax

liabilities 405 508 566 Total

non-current liabilities 12,975

12,398 14,422 Current provisions

for employee benefits 12 12 11 Other

current provisions 216 189 153 Trade

payables 6,097 6,190 6,580 Current

borrowings and debt, gross 1,369 1,355

1,549 Current lease liabilities 718 705 723

Current put options granted to owners of non-controlling interests

133 119 105 Current tax liabilities

8 98 48 Other current liabilities

3,197 3,059 2,839 Liabilities associated with

assets held for sale 175 210 1,197

Current liabilities 11,925

11,937 13,206 TOTAL

EQUITY AND LIABILITIES 30,537

30,501 35,932

Consolidated statement of cash

flows (in € millions)

2021 2020 (restated) Profit

(loss) before tax from continuing operations

(276) (125) Profit (loss) before tax from

discontinued operations (330) (462)

Consolidated profit (loss) before tax

(606) (587) Depreciation and

amortisation for the year 1,334 1,316

Provision and impairment expense 299 390

Losses (gains) arising from changes in fair value

(5) 78 Expenses (income) on share-based payment

plans 14 12 Other non-cash items

(47) (50) (Gains) losses on disposals of

non-current assets (128) (88) (Gains)

losses due to changes in percentage ownership of subsidiaries

resulting in acquisition/loss of control 20

58 Dividends received from equity-accounted investees

17 17 Net finance costs

422 357 Interest paid on leases, net

313 320 No-drawdown, non-recourse factoring and

associated transaction costs 88 60 Disposal

gains and losses and adjustments related to discontinued operations

114 258 Net cash from operating

activities before change in working capital, net finance costs and

income tax 1,835

2,142 Income tax paid

(184) (157) Change in operating working capital

(26) 26 Income tax paid and change in

operating working capital: discontinued operations

(97) 211 Net cash from operating

activities 1,529

2,222 of which continuing

operations 1,841

2,215 Cash outflows related to acquisitions of:

§ Property, plant and equipment,

intangible assets and investment property

(1,131) (927) § Non-current financial assets

(174) (942) Cash inflows related to

disposals of: § Property, plant and

equipment, intangible assets and investment property

156 423 § Non-current financial assets

163 461 Effect of changes in scope of

consolidation resulting in acquisition or loss of control

(15) 157 Effect of changes in scope of

consolidation related to equity-accounted investees

1 (63) Change in loans and advances granted

(30) (28) Net cash from (used in) investing

activities of discontinued operations (81)

453 Net cash used in investing activities

(1,111) (466) of which

continuing operations (1,030)

(920) Dividends paid:

§ to owners of the parent - -

§ to non-controlling interests (102)

(45) § to holders of deeply-subordinated perpetual bonds

(35) (36) Increase (decrease) in the

parent's share capital - - Transactions

between the Group and owners of non-controlling interests

15 (55) (Purchases) sales of treasury shares

- (1) Additions to loans and borrowings

4,203 2,066 Repayments of loans and

borrowings (3,514) (2,632) Repayments of

lease liabilities (623) (603) Interest

paid, net (752) (717) Other repayments

(30) (23) Net cash used in financing

activities of discontinued operations (10)

(73) Net cash used in financing activities

(848) (2,177) of which

continuing operations (838)

(2,044) Effect of changes in exchange rates on

cash and cash equivalents of continuing operations

(22) (494) Effect of changes in exchange rates on

cash and cash equivalents of discontinued operations

- - Change in cash and cash

equivalents (452)

(856) Net cash and cash equivalents at

beginning of period 2,675

3,530

- of which net cash and cash equivalents of continuing

operations

2,675 3,471

- of which net cash and cash equivalents of discontinued

operations

(1) 59 Net cash and cash equivalents at end of

period 2,223

2,675

- of which net cash and cash equivalents of continuing

operations

2,224 2,675

- of which net cash and cash equivalents of discontinued

operations

(1) (1) Analyst and

investor contacts - Lionel

Benchimol +33 (0)1 53 65 64 17 -

lbenchimol@groupe-casino.fr or +33 (0)1 53 65 24 17 -

IR_Casino@groupe-casino.fr Press

contacts - Casino Group –

Communications Department Stéphanie

Abadie +33 (0)6 26 27 37 05 – sabadie@groupe-casino.fr or

+33 (0)1 53 65 24 78 – directiondelacommunication@groupe-casino.fr

- Agence IMAGE 7

Karine Allouis +33 (0)1 53 70 74 84 –

kallouis@image7.fr Franck Pasquier +33 (0)6

73 62 57 99 – fpasquier@image7.fr

Disclaimer This

press release was prepared solely for information purposes, and

should not be construed as a solicitation or an offer to buy or

sell securities or related financial instruments. Likewise, it does

not provide and should not be treated as providing investment

advice. It has no connection with the specific investment

objectives, financial situation or needs of any receiver. No

representation or warranty, either express or implied, is provided

in relation to the accuracy, completeness or reliability of the

information contained herein. Recipients should not consider it as

a substitute for the exercise of their own judgement. All the

opinions expressed herein are subject to change without

notice. 1 Same-store change

excluding fuel and calendar effects 2 Excluding fuel and

calendar effects 3 Source: IRI - Total PGC FI 4Excluding Codim

stores in Corsica: 8 supermarkets and 4 hypermarkets 5 Other:

mainly Geimex 6 Net sales on a same-store basis include the

same-store performance of franchised stores 7 Unaudited data, scope

as defined in refinancing documentation with mainly Segisor

accounted for within the France Retail + E-commerce scope 8

Interest paid on lease liabilities and repayment of lease

liabilities as defined in the documentation 9 EBITDA after lease

payments (i.e., repayments of principal and interest on lease

liabilities) 10 Loans and other borrowings 11 At 31 December 2021

12 Other financial income and expenses have been restated,

primarily for the impact of discounting tax liabilities, as well as

for changes in the fair value adjustments to equity derivative

instruments 13 Income taxes have been adjusted for the tax effects

corresponding to the above restated items and the tax effects of

the restatements 14 Non-controlling interests have been adjusted

for the amounts relating to the above restated items 15 France

Retail free cash flow before dividends to the owners of the parent

and holders of TSSDI deeply-subordinated bonds, excluding financial

expenses, and including lease payments 16 Including -€30m in other

net financial investments, -€33m in non-cash financial expenses,

-€0.4bn relating to Leader Price, +€118m in earn-outs secured or

received from the Apollo and Fortress joint ventures, and +€24m in

proceeds from the disposal of Mercialys 17 Excluding fuel

and calendar effects 18 Excluding Codim stores in Corsica: 8

supermarkets and 4 hypermarkets 19 Other: mainly Geimex 20 Net

sales on a same-store basis include the same-store performance of

franchised stores 21 Data published by the subsidiary 22

Pursuant to the application of IAS 29, the exchange rate used to

convert the Argentina figures corresponds to the rate at the

reporting date 23 Previously published comparative information has

been restated 24 Previously published comparative information has

been restated 25 Previously published comparative information has

been restated

1 Same-store growth2 See press release dated 28

January 20223 France Retail excluding GreenYellow, real estate

development and Vindémia (sold on 30 June 2020)4 At

constant exchange rates, excluding tax credits5 Net debt excluding

the impact of IFRS 5, and excluding GreenYellow6 4 weeks to 20

February 20227 Source: NielsenIQ, P13 MAT8 Data published by the

subsidiary9 France Retail excluding property development,

GreenYellow and Vindémia (sold in June 2020)10 Same-store

change excluding fuel and calendar effects11 Of which €28m in tax

credits restated by the subsidiaries in the calculation of adjusted

EBITDA in 2021 (€139m in 2020, none in 2019)

12 Excluding fuel and calendar effects 13 Data

published by the subsidiary14 Contribution to consolidated EBITDA.

Data published by the subsidiary: EBITDA at €80m in 2021 (€62m in

2020)15 Tax credits restated by subsidiaries in the calculation of

adjusted EBITDA16 See definition on page 1617 Underlying diluted

EPS includes the dilutive effect of TSSDI deeply-subordinated bond

distributions 18 See page 1719 Secured debt of €2.1bn and

EBITDA excluding GreenYellow of €780m20 France Retail

excluding GreenYellow, Vindémia and real estate development21

Kantar market shares (P12 MAT), e-commerce included in hypermarkets

and supermarkets segments on a pro rata basis22 Source: NielsenIQ,

P13 MAT23 Source: NielsenIQ Q4 202124 Projects at the "awarded" and

"advanced pipeline" stages within GreenYellow's portfolio of

projects in development25The pipeline of projects in the "pipeline"

and "early stage" within GreenYellow's portfolio of projects in

development26 Data published by the subsidiary. Contribution to

consolidated EBITDA: €63m (€57m in 2020)27 Power Purchasing

Agreement28 Change at constant exchange rates, excluding tax

credits29 Data published by the subsidiary30 Change in local

currency; data published by the subsidiary31 Score of 74/10032

Scopes 1 and 2 compared to 2015, Group target33 Technology that

emits three times fewer greenhouse gases than diesel34 Including

€150m relating to the sale of shares and an earn-out of €50m linked

to the sale of technology assets from the "FLOA Pay" split payment

solution and to commercial agreements between Cdiscount, Casino

banners and FLOA35 Maturity July 2026 (May 2025 if the Term Loan B,

maturing in August 2025, is not repaid or refinanced as at that

date)36 Same-store change excluding fuel and calendar

effects 37 Excluding fuel and calendar effects38 Source: IRI -

Total PGC FI39Excluding Codim stores in Corsica: 8 supermarkets and

4 hypermarkets40 Other: mainly Geimex41 Net sales on a same-store

basis include the same-store performance of franchised stores42

Unaudited data, scope as defined in refinancing documentation with

mainly Segisor accounted for within the France Retail + E-commerce

scope43 Interest paid on lease liabilities and repayment of lease

liabilities as defined in the documentation44 EBITDA after lease

payments (i.e., repayments of principal and interest on lease

liabilities)45 Loans and other borrowings 46 At 31 December 202147

Other financial income and expenses have been restated, primarily

for the impact of discounting tax liabilities, as well as for

changes in the fair value adjustments to equity derivative

instruments48 Income taxes have been adjusted for the tax effects

corresponding to the above restated items and the tax effects of

the restatements49 Non-controlling interests have been adjusted for

the amounts relating to the above restated items50 France Retail

free cash flow before dividends to the owners of the parent and

holders of TSSDI deeply-subordinated bonds, excluding financial

expenses, and including lease payments 51 Including -€30m in other

net financial investments, -€33m in non-cash financial expenses,

-€0.4bn relating to Leader Price, +€118m in earn-outs secured or

received from the Apollo and Fortress joint ventures, and +€24m in

proceeds from the disposal of Mercialys

52 Excluding fuel and calendar effects53 Excluding

Codim stores in Corsica: 8 supermarkets and 4 hypermarkets54 Other:

mainly Geimex55 Net sales on a same-store basis include the

same-store performance of franchised stores56 Data published by the

subsidiary57 Pursuant to the application of IAS 29, the exchange

rate used to convert the Argentina figures corresponds to the rate

at the reporting date58 Previously published comparative

information has been restated59 Previously published comparative

information has been restated60 Previously published comparative

information has been restated

- 20220225 - PR - 2021 Full Year Results

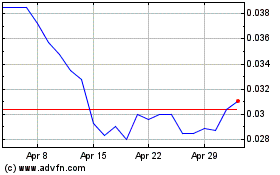

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Casino Guichard Perrachon (EU:CO)

Historical Stock Chart

From Apr 2023 to Apr 2024