Cnova N.V. - Cnova intends to increase its capital to fund

accelerated growth

NOT FOR DISTRIBUTION DIRECTLY OR

INDIRECTLY IN THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA OR

JAPAN.

CNOVA N.V.

Cnova intends

to increase its capital

to fund

accelerated growth

Cnova (Cdiscount’s

holding company)

accelerates the

development of its successful

e-commerce platform and

targets global expansion of its

tech-enabled B2B solutions for

marketplaces powered by its subsidiary

Octopia.

- Cnova N.V.

is a leading European tech player

with its e-commerce

platform Cdiscount and

its global innovative

tech-enabled ecosystem of

marketplaces with Octopia

- Cnova already achieved €4.2bn of

GMV (Gross Merchandise Volume), €2.2bn of net sales and an EBITDA

of €133m (+62.5% growth and reaching 6.0% of net sales) in

2020

- Encouraged by a strong start of the

year with its growing marketplace, digital marketing, and

tech-enabled B2B services, Cnova expects an EBITDA of €160m this

year, a 20%+ increase versus 2020, and c.100% increase versus

2019

- Leveraging

further its unique

digital assets,

Cnova offers through

Octopia full B2B

marketplace

solutions,

unlocking global growth

potential

- By 2025, the company aims

to reach a total GMV above €12bn, fueled by Octopia and by

the continuously growing marketplace activity

- Cnova is targeting

a placement of c.€300

million of new shares to

fund its accelerated growth

and a potential secondary

offering in addition to

further increase

its free float by

year-end, subject to market

conditions

AMSTERDAM – June 1, 2021, 08:30 CET Cnova N.V.

(Euronext Paris: CNV; ISIN: NL0010949392) (“Cnova”) today announced

its plan to increase its capital to fund its accelerated growth

prospects.

Over the past years, on the back of

the sustained growth of the

e-commerce sales channel, Cnova achieved significant growth and

margin expansion, demonstrating the strength of its

positioning as the French champion and a European leader in

e-commerce.

- In 2020, Cnova achieved €4.2bn of

GMV, €2.2bn of net sales and an EBITDA of €133m (growing +62.5% and

reaching 6.0% of net sales), with strong growth and improving

profitability continuing into 2021 year-to-date.

-

Marketplace with its strong digital

marketing capabilities was at the heart of this profitable growth,

with its GMV increasing by 22%, and

representing 44% of total GMV. The number of

merchants grew at 15% to 13,000 and the assortment at 33% to 100m

products.

Cnova has a clear ambition to become a leading global

end-to-end player, retailer and provider of technology solutions

across the e-commerce marketplace ecosystem. Leveraging on

the strategic assets built over the last 10 years, including

marketplace capabilities, digital marketing expertise,

differentiated logistics and technological know-how, Cnova, is now

also providing through Octopia a full marketplace solution,

including tech platform, merchant and product base and fulfilment

capabilities, and presenting both e-retailers and merchants with a

winning proposition. Octopia will unlock significant growth

potential and enhance the group’s profitability.

As of March 31, 2021, Cnova’s

marketplace represented 46% of GMV, and Octopia achieved +86%

year-on-year growth in the first quarter, with 518 website

clients across Europe. In particular, Octopia signed in a leading

EMEA retailer client over that period and launched its first

marketplace in April 2021.

Cnova stands

ready to accelerate rapidly its

growth taking advantage of the strong

momentum in both its marketplace and tech-enabled B2B

services platform Octopia.

The company is targeting for 2021 an EBITDA of

€160m this year, a 20%+ increase versus 2020, and c.100% increase

versus 2019. By 2025, the company aims a total GMV above €12bn,

fueled by Octopia and by the continuously growing marketplace

activity.

To fund its

accelerated growth, Cnova is

considering a c.€300m private placement to be launched by the end

of the year, subject to market conditions. Proceeds will fund the

international deployment of the Group and strengthen its tech

leadership.

In addition, certain existing shareholders of

Cnova may decide to sell a portion of their shares to further

increase the free float. Groupe Casino intends to remain the

company’s majority shareholder.

“Leveraging our strong foundations as a leading

e-commerce platform, our clear ambition is to become the first

global marketplace ecosystem leader. The ramp up of Octopia is

accelerating and promising. The capital increase we are envisaging

will provide Cnova with the full capacity to achieve our mission

and develop a decentralized network of independent marketplaces

powered by Cnova’s know-how and existing unique assets”,

said Emmanuel Grenier, Cnova’s

CEO.

Cnova will host an analyst presentation on June

7, 2021 at 8:30 am CET.

***

About Cnova N.V.

Cnova N.V. is a leading European e-commerce

platform with €4.2bn of GMV, €2.2bn of net sales and EBITDA of

€133m (6.0% of net sales) in 2020.

It serves 10.5 million active customers via its

state-of-the-art website, Cdiscount. With its marketplace at the

core of its business model, it provides a winning proposition to

both consumers and merchants.

Its B2B tech-enabled platform Octopia offers

unique marketplace tech solutions to websites globally.

Cnova N.V. is part of Groupe Casino, a global

diversified retailer, and is listed on Euronext Paris (ticker:

CNV).

|

Cnova Investor Relations

contact:investor@cnovagroup.com |

Media

contacts:elody.rustarucci@cdiscount.comTel:

+33 6 18 33 17 86 leo.finkel@plead.frTel: +33 6 32 09 54

94 |

***

DISCLAIMER

Certain information included in this press

release is not historical data but are forward-looking statements.

These forward-looking statements are based on estimates, forecasts

and assumptions including, but not limited to, assumptions about

Cnova's current and future strategy and the economic environment in

which Cnova operates. They involve known and unknown risks,

uncertainties, and other factors, which may cause Cnova's actual

performance and results, or the results of its industry, to differ

materially from those expressed or implied in such forward-looking

statements. These forward-looking statements and information are

not guarantees of future performance.

These forward-looking statements speak only as

of the date of this press release and Cnova expressly disclaims any

obligation or undertaking to release any update or revision to the

forward-looking statements included in this press release to

reflect changes in assumptions, events, conditions, or

circumstances on which the forward-looking statements are based.

The forward-looking statements contained in this press release are

made for illustrative purposes only.

This press release includes only summary

information and does not purport to be complete. No warranty is

given as to the accuracy or completeness of the information or

opinions contained in this press release.

The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such restrictions. This press release does

not contain and does not constitute an offer to sell securities or

an invitation or inducement to invest in securities in France, the

Netherlands, the United States, or any other jurisdiction. The

securities referred to herein may not be sold in the United States

of America absent registration or an exemption from registration

under the U.S. Securities Act of 1933, as amended. The company does

not intend to register all or any portion of any offering of the

securities in the United States of America or to conduct a public

offering of the securities in the United States of America.

***

- CNOVA - ITF - English version

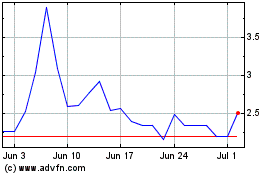

Cnova NV (EU:CNV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Apr 2023 to Apr 2024