- Strong growth in pipeline* confirming sales guidance of

€250m by March 31, 2027, and breakeven EBITDA target as of March

31, 2026

- First semester results marked by the impact of ongoing

discussions of the execution of the Carbonloop contracts, and the

termination of the R-Hynoca contract, signed on December

13

- Savings and cash preservation plan to cope with a temporary

drop in activity

- Setting up a new-generation industrial demonstrator on a

Haffner Energy owned site in Marolles (Marne).

- Expanded commercial offering, with renewable gas (syngas)

and sustainable aviation fuel (SAF) solutions, for a broader and

more immediate market than renewable hydrogen.

Regulatory News:

Haffner Energy (Paris:ALHAF) publishes its half-year

results for the period ending September 30, 2023, as approved on

December 13, 2023, by the Company's Board of Directors.

Key figures ending September 30, 2023 (IFRS / K€)

In thousands of euros (K€)

09.30.22 (6 months)

09.30.23 (6 months)

Net sales

(343)

EBITDA

(4,204)

(5,477)

Operating result

(5,241)

(3,531)

Net income

(5,274)

(3,333)

In thousands of euros (K€)

03.31.23

09.30.23

Shareolders' equity

36,887

33,321

Cash available

35,477

21,007

Delays in the deployment of the hydrogen ecosystem are more

than offset by the renewable gas segment

Hydrogen dedicated to regional ecosystems continues to face the

"chicken and egg problem", hampering the financing and

implementation of renewable hydrogen production units. Beyond this

dilemma, recent inflation is driving up costs, requiring business

plans to be revised and slowing hydrogen deployment. This situation

is impacting the development of the HYNOCA® decentralized hydrogen

production solution for capacities of up to 3 tonnes per day.

However, this effect should be more than offset, both in terms of

sales and EBITDA, thanks to Haffner Energy's new offer which

targets the replacement of fossil natural gas within large industry

by fully renewable gas.

Ongoing discussions with Carbonloop on contract

execution

Haffner Energy and Carbonloop signed, for the year ending March

31, 2023, a contract for the production of renewable gas (September

30, 2022) with a capacity of 500 kw and two contracts for the

supply of renewable hydrogen (March 31, 2023) with a capacity of

720 kg of hydrogen per day. The renewable gas production contract

was intended to serve in particular as a demonstration, testing and

training platform for Carbonloop. In the 1st half of 2023/2024,

this contract continued to be executed while one of the two

renewable hydrogen contracts started his own.

In September 2023, Haffner Energy and Carbonloop entered into

discussions regarding the continuation of these contracts, which

are still ongoing.

Due to the uncertainty about the outcome of these

discussions, no revenue was retained at the end of the year.

Haffner Energy considers that the order book for these three

contracts, totalling €14.9 million by September 30, 2023, and

affected by a loss at termination of €1.5 million by September 30,

2023, is at risk.

Termination of the R-Hynoca contracts on December 13, 2023,

and installation of a new-generation industrial demonstrator on a

Haffner Energy owned site in Marolles

On December 13, 2023, R-Hynoca and Haffner Energy mutually

agreed to terminate the turnkey contract that was to have produced

720 kg of renewable hydrogen per day in Strasbourg by 2024. This

termination was accompanied, as contractually agreed, by the

repayment of the balance of K€ 461 of phase 1, booked in sales in

previous years, and the cancellation of phase 2 in the amount of K€

2,854 with a deficit of K€ 4,084.

In the context of this termination, Haffner Energy will set up a

new-generation demonstrator at its Marolles site, 3 km from its

head office. The purposes of this new demonstrator will be to

qualify the biomasses of the Company's customers, to train its own

staff and those of its customers, and to improve its feedback.

Commissioning is scheduled for the end of the first quarter 2024,

and its operation will be doubled in the first half of 2024 by that

of the Strasbourg module. Most of the investment for the new

demonstrator has already been made, and its installation at the

Marolles site will begin in January 2024. The module set up in

Strasbourg will be, for his part, shut down by June 30, 2024 at the

latest, and dismantled from July 1, 2024.

The termination of the turnkey contract is accompanied by the

termination of R-Hynoca shareholders' agreement and license

agreement between R-Hynoca and Haffner Energy, and the withdrawal

of Haffner Energy from the capital of R-Hynoca, in which it held a

15% stake. The commissions on sales under the above-mentioned

agreement until 2039, are replaced by a lump-sum settlement by

Haffner Energy to R-Hynoca of a lump sum of 3 million euros, spread

over the period from signature to December 31, 2026. The

cancellation of these commissions, whose cumulative amount should

have been around 9M€ by 2027 based on the forecast sales growth

trajectory, will significantly improve Haffner Energy's EBITDA as

from the financial years ending March 31, 2025. This transaction

will be recorded in the accounts for the second half of

2023/2024.

This reorientation is positive for the Company, which from an

operational standpoint, will now be able to benefit from full

control of a demonstrator on its own site, facilitating long

endurance tests while reducing logistics costs.

Half-year results 2023/2024

Net sales of K€(343) include a K€118 contribution from Jacquier,

Haffner Energy's industrial subcontractor acquired in mid-June

2023, as well as K€(461) in cancelled sales on the R-Hynoca

contract.

Due to the implementation of an organization designed to support

future growth and the increase in headcount over the period (88

people vs. 48 at 09/30/22), personnel expenses rose by 47% to K€

2,996 by 09/30/2023 (vs. K€ 2 035 by 09/30/2022). Other external

expenses rose from K€ 1,405 to K€ 1,869, reflecting the increase in

subcontracting.

At the end of the 1st half of 2023/2024, EBITDA thus stood at K€

(5,477) versus K€ (4,204) the previous year.

At K€ (3,531), operating result for the 1st half of 2023/2024

includes the reversal of the K€ 4,084 loss on completion of the

R-Hynoca contract and a K€ 1,532 provision for depreciation of the

module installed in Strasbourg.

The net loss amounts to K€ (3,333), compared with K€ (5,274) by

September 30, 2022.

By September 30, 2023, cash available stood at K€ 21,007,

compared with K€ 35,477 by March 31, 2023, the consumption of K€

14,470 over the period being mainly due to negative operating cash

flow of €K (5 ,821), the build-up of inventories (K€ 5,765) and

ongoing R&D investments (development costs of K€ 3,245).

Expanding the addressable market with a new offer for

high-capacity renewable gas production and sustainable aviation

fuel

Haffner Energy's disruptive biomass thermolysis technology and

solutions have the potential to address accelerating

decarbonization needs, creating new development opportunities to

complement renewable hydrogen. During the first half of the year,

the Company worked hard to develop new high capacity offer is based

on its technology by increasing its capacity to capture the

renewable gas market intended to replace fossil natural gas, and

fossil jet-fuel with sustainable aviation fuel (SAF).

These new offers, in addition to renewable hydrogen solutions

have thus redefined the commercial priorities to reach immediately

addressable markets. These are detailed in the press releases

published on October 3, 2023, and November 29, 2023. In Europe, the

priority is given to SYNOCA® renewable gas offer, due to the

economic urgency of many manufacturers to replace natural gas and

to the context of energy independence and the pressure to

decarbonize industry. In the United States, the focus is mainly on

SAF through the SAFNOCA® offer and renewable hydrogen through the

HYNOCA® offer due to increased market interest, easier access to

biomass, and more incentive-based regulations for

decarbonization.

Strong increase in pipeline to €488m at 11/29/23 (compared

with €300m at 03/31/23)

As previously mentioned, the renewable hydrogen market is

developing slower than anticipated, particularly at the time of the

Company's IPO in February 2022 (prior to the conflict in Ukraine).

This situation is delaying the conversion of the hydrogen pipeline

into firm contracts. At the same time, Haffner Energy continues to

receive new requests for proposals for the deployment of its

HYNOCA® technology in Europe and seen growth in the United States,

where 12 hydrogen projects are currently under discussion. At

11/29/2023, Hynoca®'s hydrogen projects pipeline stood at €276

million, compared with €256 million at 03/31/2023.

In the renewable gas market, Haffner Energy's new competitive

high-capacity offer to address the immediate market for the

replacement of fossil natural gas in European industry has met with

very strong interest from manufacturers since its commercial launch

on 10/03/2023, and the Company is now facing extremely rapid growth

in demands. As a result, the SYNOCA® projects pipeline has grown

considerably, reaching €212 million at 11/29/2023, compared with

€43 million at 03/31/2023.

Finally, with regards to sustainable aviation fuel, Haffner

Energy has received numerous expressions of interest from the

industry's leading players for SAFNOCA®, its integrated solution

paving the way for the mass production of competitive sustainable

aviation fuel. Several initial MOUs (partnership agreements) are

currently under discussion for signature in the near future in

Europe and the United States, with the aim of mass-producing SAF

from 2026 onwards.

In total, Haffner Energy's pipeline* stood at €488 million by

11/29/23, compared with €300 million by 03/31/23. In view of the

numerous requests for bids received for SYNOCA® renewable gas

production equipment, this pipeline should continue to develop

favorably over the next few months.

Perspectives

In response to a temporary drop in business, following ongoing

discussions with Carbonloop and the termination of the R-Hynoca

contract, Haffner Energy has decided to implement a short-term

savings plan. The plan combines tighter cost control and a

reduction in the number of external service providers, as well as

non-replacement departures and targeted short-time working measures

affecting around 20% of the workforce. The Company is also

implementing cash preservation measures, in particular by seeking

out additional sources of financing.

As mentioned in the notes to the financial statements, the

Company's action plan safeguards the future of the Company, whose

strong pipeline growth enables to confirm its ambitions and

financial outlook of €250 million in sales by March 31, 2027. The

competitiveness of the gas produced from the SYNOCA® solution

enables Haffner Energy to anticipate the right level of gross

margin for a breakeven EBITDA target as early as the financial year

ending 03/31/2026.

Philippe Haffner, Chairman and Chief Executive Officer of

Haffner Energy said: "We are entering a new dynamic, thanks to

the evolution of our offer with a range of greater power solutions,

which allows us to address new markets with strong development

prospects in the very short term with renewable gas, and in the

medium term with sustainable aviation fuel. These new markets

complement the renewable hydrogen market. We put in place human,

technical and financial resources to ensure sustainable

growth.”

More detailed financial information on the half-year financial

statements by 30 September 2023 is available on the

www.haffner-energy.com website.

At the date of this press release, the audit procedures have

been completed and the statutory auditors' report is in the process

of being issued.

About Haffner Energy

Haffner Energy, a listed family company co-founded and

co-directed by Marc and Philippe Haffner, has been a key player in

the transition towards sustainable energy for 30 years. It designs

and supplies innovative decarbonization solutions for mobility,

industry and local authorities. Its HYNOCA®, SYNOCA® and SAFNOCA®

solutions, based on biomass thermolysis, a technology protected by

15 patent families, enable its customers to produce locally

renewable hydrogen and gas, as well as other green energies such as

Sustainable Aviation Fuel, while capturing carbon from the

atmosphere through the co-production of biochar.

Haffner Energy is listed on Euronext Growth (ISIN code:

FR0014007ND6 – Ticker: ALHAF).

Lexicon:

*Haffner Energy previously reported on an order book,

backlog and pipeline. The Company abandons the notion of a

backlog. As of 31/03/2023, the backlog was €65 million, including

€17.5 million in order backlog, and the pipeline amounted to €252

million. In the new definition, the backlog is unchanged at €17.5

million and the backlog excluding the backlog (65-17.5=€47.5

million) is included in the pipeline, which therefore amounts to

€300 million (€252 + €47.5 million).

The pipeline now includes the following criteria: preliminary

feasibility study completed / budget offer or preliminary business

plan / letter of intent sent or signed / participation in tender /

deposit paid by the client / creation of a company with a specific

project including equipment from the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231214235325/en/

HAFFNER ENERGY Investor Relations

investisseurs@haffner-energy.com

CLAI Valentine Serres +33 (0)7 78 41 45 91 Thibault

Lecauchois +33 (0)7 84 58 77 11 haffnerenergy@clai2.com

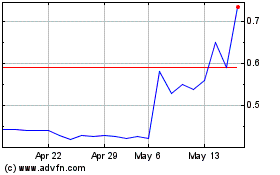

Haffner Energy (EU:ALHAF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Haffner Energy (EU:ALHAF)

Historical Stock Chart

From Feb 2024 to Feb 2025