ESG Rating 2023: Haffner Energy Awarded Silver Level for 2022 Performance

November 02 2023 - 1:00PM

Business Wire

Regulatory News:

Haffner Energy (ISIN code: FR0014007ND6 – Mnemonic: ALHAF),

has been awarded the Silver level in the 2023 ESG* assessment

campaign carried out by the independent body EthiFinance. This

overall assessment and the high scores obtained by the Company

reward its performance in 2022 and underline its progress since

2020. In addition to acknowledging the continuous progress made by

Haffner Energy and its advanced positioning in this area compared

with the average of the other companies assessed, this

extra-financial rating also reinforces the Company's determination

to pursue its commitment to ESG performance.

A proactive approach to the evaluation of Haffner Energy's

ESG practices by an independent third party

The Company Haffner Energy is aware that its extra-financial

performance contributes to the achievement of its mission to help

regenerate the planet through the production of green energies with

a neutral or negative carbon footprint (renewable hydrogen and gas,

sustainable aviation fuel). For this reason, the Company has

undergone an ESG assessment by the independent body EthiFinance, an

innovative European rating, research and advisory group serving

sustainable finance. EthiFinance's analysis assesses the progress

of Haffner Energy's performance over the last three years in four

areas: governance, environment, social and external

stakeholders.

Haffner Energy: excellent extra-financial performance

highlighted by EthiFinance

For 2022, Haffner Energy received an overall score of 67/100, up

significantly on 2021 (48*/100), broken down as follows: 61/100 for

governance, 71/100 for social issues, 57/100 for the environment

and 100/100 for external stakeholders.

Compared with the 644 international companies whose ESG

performance was analyzed over the same period, Haffner Energy is

well above the average, particularly at sector level (26th out of

164 companies assessed).

Score out of 100

Overall score

including Environment pillar

including Social pillar

including Governance

pillar

including external

stakeholders

HAFFNER ENERGY 2022

67

57

71

61

100

HAFFNER ENERGY 2021*

48

33

48

46

86

Benchmark of the 644 companies surveyed

including the industrial sector(164 companies surveyed)

48

50

36

58

56

including companies with a Net sales < 150 M€(375 companies

surveyed)

40

37

28

54

39

including French companies (252 companies surveyed)

58

57

56

64

63

* to iso referential, results for 2021 after restatement by

Ethifinance on the basis of their new rating methodology.

Haffner Energy stands out in particular for its scores, which

are higher than the averages of other companies in its sector

(EthiFinance studied a benchmark of 164 companies in the industry

over 2022) on the following items: composition (78/100 vs. 61/100

for the benchmark) and operation of governance bodies (88/100 vs.

74/100 for the benchmark), energy management and greenhouse gas

reduction (78/100 vs. 57/100 for the benchmark), consideration of

cybersecurity issues (100/100 vs. 67/100 for the benchmark).

An incentive to keep on progressing

Although above the sector average, and also very well positioned

in relation to comparable companies, Haffner Energy intends to

pursue its efforts to further improve its performance. Indeed, over

and above the virtuous nature of its core technology - the

thermolysis of biomass to produce renewable energies with a neutral

or negative carbon footprint - the company is committed to

operating its business in the most virtuous way possible.

Haffner Energy voluntarily underwent this assessment process in

order to identify areas for improvement. Since the assessment, the

company has already taken steps to further improve its practices in

a number of areas:

- Social policy: emphasis on equal opportunities and internal

promotion of employees (12% of employees changed jobs during the

2022-2023 financial year), greater diversity within teams (4% of

employees with disabilities, 13 different nationalities), and

stable gender distribution in a context of strong growth, with a

notable increase in the proportion of women in managerial

positions;

- Business ethics policy: all employees and key partners sign

charters aimed at preventing and combating corruption, respecting

human rights and labor legislation, and audits are carried out to

monitor their effective application;

- Biodiversity management: impact assessment of biomass

harvesting on soils, impact assessment of the company's own

facilities on biodiversity;

- Environmental policy: implementation of an Environmental

Management System with the eventual aim of ISO 14001

certification.

"This silver-level ESG score from EthiFinance is a great source

of pride for our company, as well as an incentive to make further

progress. Whatever the subject (waste treatment, reduction of

greenhouse gas emissions, or relations with suppliers and

customers) Haffner Energy intends to have a positive impact on its

stakeholders and on the ecosystems in which it operates: economic,

social, territorial and environmental", said Philippe Haffner, CEO

of Haffner Energy.

*ESG rating: "ESG" is an international acronym used by the

financial community to designate the Environmental, Social and

Governance criteria that make up the three pillars of

extra-financial analysis. These dimensions, and the different

criteria associated with each of them, help to determine a

company's societal contribution in each of these areas, and thus

broaden and enrich the analysis of companies' future financial

performance.

About EthiFinance

EthiFinance is an innovative European rating, research and

advisory group dedicated to sustainable finance. The group provides

solutions to investors, companies and organizations to meet the

challenges of financing as well as environmental and societal

transformations.

About Haffner Energy

A listed family company co-founded and co-directed by Marc and

Philippe Haffner, and a key player in the energy transition for 30

years, Haffner Energy designs and supplies innovative decarbonation

solutions for mobility, industry and local authorities. Its

HYNOCA®, SYNOCA® and SAFNOCA® solutions, based on biomass

thermolysis, a technology protected by 15 patent families, enable

customers to produce locally renewable hydrogen and gas, as well as

other green energies such as Sustainable Aviation Fuel, while

capturing carbon from the atmosphere through the co-production of

biochar. Thanks to this “carbon-negative” technology, decoupled

from the cost of fossil fuels and electricity, Haffner Energy

provides an immediate, agile and competitive response to the

strategic challenges of energy independence and decarbonization in

France and abroad.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231102470145/en/

Press contacts

CLAI - Communication corporate Thibault Lecauchois +33

(0)7 84 58 77 11 Valentine Serres +33(0)7 78 41 45 91

haffnerenergy@clai2.com

HAFFNER ENERGY Laure Bourdon +33 (0)7 87 96 35 15

laure.bourdon@haffner-energy.com

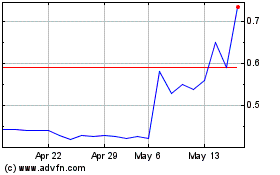

Haffner Energy (EU:ALHAF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Haffner Energy (EU:ALHAF)

Historical Stock Chart

From Dec 2023 to Dec 2024