- Order intake of 14.9 million euros, bringing order book to

17.5 million euros

- Start of contract execution with sales of 0.3 million

euros

- EBITDA of (12.5) million euros, net income of (16.5)

million euros

- Cash available of 35.5 million euros

- Growth in backlog (65 million euros) and pipeline (252

million euros) in a more favorable regulatory environment

- Significant growth potential in Sustainable Aviation Fuels

(SAF)

- Strong sales growth expected by March 31, 2024; sales

target of 250 million euros postponed by one year to March 31st,

2027

Regulatory News:

HAFFNER ENERGY (Paris:ALHAF) (ISIN code:

FR0014007ND6 – Mnemonic: ALHAF), today announces the

publication of its annual results ending March 31st, 2023, approved

on June 27th, 2023 by the Company's Board of Directors.

Key figures ending March 31, 2023 (IFRS standards)

In thousands of euros

31.03.23 (12 months)

31.03.22 (12 months)

Order book

17,460

2,854

Net sales

Other income

303

26

384

1,013

EBITDA

(12,480)

(2,704)

Operating result

(16,484)

(4,726)

Net income

(16,461)

(4,807)

Shareholders' equity

36,887

54,253

Cash available

35,476

61,429

Philippe HAFFNER, Chairman and CEO of HAFFNER ENERGY,

commented: “During the 2022/2023 financial year, we have set

the milestones that will enable us to accelerate the deployment of

our strategy, by structuring our teams, developing our R&D and

achieving our first commercial successes. All HAFFNER ENERGY

employees are mobilized to transform our ever-growing prospects

into orders, to continue the technological development of our

solutions, and to industrialize the production of our Synoca® and

Hynoca® modules. The changing regulatory environment, our

technological roadmap and the recent acquisition of the industrial

company JACQUIER support these objectives. Our new organization

also reflects our ambitions in the United States of America, driven

by the opportunities offered by the IRA (Inflation Reduction Act).

Thanks to our unique technology, we are also firmly committed to

the development of sustainable aviation fuels, for which we provide

an agile and operational solution."

Order book of 17.5 million euros

The order book has grown significantly, with the signing of

three orders with CARBONLOOP, worth a total of 14.9 million euros:

a contract, signed on September 30th, 2022, for the supply,

installation and commissioning of 1 SYNOCA® unit to produce

renewable gas in the Yvelines region (78), and two contracts signed

on March 31st, 2023, for the production of a total of 450 tonnes of

hydrogen per year for heavy mobility applications at two French

sites. These new orders are in addition to the July 2020 contract

with R-Hynoca in Strasbourg, bringing the order book to 17.5

million euros on March 31st, 2023.

The first SYNOCA® contract with CARBONLOOP has begun to be

deployed, resulting in the recognition of €303k in sales on March

31st, 2023.

Operating result reflecting the rise of the

organization

To support the strong growth expected in its business, HAFFNER

ENERGY has pursued an active recruitment policy, with 48 new hires

during the year, taking the workforce to 72 by March 31st, 2023.

This structuring of the Company has led to an increase in external

expenses.

In addition, the financial statements to March 31st, 2023 show a

loss of €2.4m in down payments to XEBEC, a Canadian supplier of PSA

filters placed on September 29, 2022 under a Federally-protected

accommodation act against creditors (CCAA). XEBEC's PSA production

assets were acquired under a newly formed Canadian-entity, Ivys

Adsorption Inc. (IVYS) specializing in hydrogen purification,

carbon capture and renewable natural gas industries, on February

24th, 2023, led by US-based Ivys Energy Solutions specializing in

hydrogen refueling stations, Canadian-based Enbridge Emerging

Technology Inc., and a group of private owners. A new,

non-exclusive supply contract was signed on April 6th, 2023 between

HAFFNER ENERGY and IVYS for the supply of 8 PSA systems to the same

specifications, for a total amount which largely takes into account

the €2.4 million down payment made to XEBEC and from which HAFFNER

ENERGY will benefit as from the 2023/2024 financial year.

Lastly, HAFFNER ENERGY scrapped €585k of capitalized development

costs relating to technologies no longer part of the HYNOCA®

concept.

EBITDA thus came to €(12,480)k, compared with €(2,704)k the

previous year.

Operating result came to €(16,484)k, compared with €(4,726)k on

March 31st, 2022. It includes a provision of €3,506k for loss on

completion, to take into account both changes in the technology

sold and a highly inflationary supply price environment.

Net income amounted to €(16,461)k, compared with €(4,807)k on

March 31st, 2022.

On March 31st, 2023, available cash stood at €35,476k, compared

with €61,429k on March 31st, 2022, representing a consumption of

€25,953k over the year. In addition to EBITDA of €(12,480)k, this

takes into account downpayments on supplier orders of €8,855k, and

capitalized development costs of €5,322k.

Technological improvements and partnerships with strategic

shareholders

As part of the R-Hynoca contract in Strasbourg, HAFFNER ENERGY

continued to improve and test its industrial demonstrator, while

developing a new version to be installed in the second half of

2023. In particular, the tests carried out have notably validated

the technology's endurance for the production of a Hypergas® rich

in hydrogen at over 50%, as well as assessing the compliance of

co-produced biochar with the requirements of existing

certifications such as EBC (The European Biochar Certificate), Puro

Earth or Verra. These tests are continuing, with the installation

of equipment enabling the production of mobility-quality hydrogen.

The new industrial series module developed during the year benefits

from feedback from the version currently in service, with an

optimized architecture and increased capacities.

With its partner VICAT and other European partners, HAFFNER

ENERGY also worked during the year to respond, on April 18th, 2023,

to a European call for proposals under the Horizon Europe program.

The aim is to develop a high-capacity demonstrator to produce

hydrogen for industry from sustainable biomass residues and sewage

sludge. The result of this call for proposals is expected early in

the 4th quarter of 2023.

Contacts with EREN Industries also continued during the year.

The aim of the two partners is to set up a 70% EREN/30% HAFFNER

ENERGY joint venture and, in particular, to develop an initial

hydrogen supply project for industrial applications.

Finally, on June 28th, 2022, HAFFNER ENERGY placed an order with

its partner HRS for a hydrogen refueling station. This first

project brings the partnership between HAFFNER ENERGY and HRS,

signed in January 2022, into its operational phase, thus initiating

the commercial deployment of joint infrastructures.

Strong growth in backlog(1) to €65 million and pipeline(2) to

€252 million

HAFFNER ENERGY's sales activity remains buoyant, driven by a

team of 12 employees, up from 2 on March 31, 2022, and now headed

by Warren Brower, recently arrived from the United States.

The backlog(1) of 33 million euros presented at the time of the

IPO now stands at 65 million euros. In addition to

CARBONLOOP/KOUROS and R-Hynoca, it still actively includes CORBAT

and ROUSSEL. New additions to the backlog:

- ALKMAAR, for which a project company, in

partnership with two developers, has been set up in the Netherlands

to produce distributed hydrogen for mobility; - SARA, (Société

Anonyme de la Raffinerie des Antilles), with whom a long-term

strategic partnership agreement was signed on March 31, 2023, which

should rapidly translate into a firm order for the first HYNOCA

plant in the West Indies, France; - ENERALYS, a developer of

white-label renewable hydrogen production projects, with whom a

project company has been set up for production in the Centre-Val de

Loire region, France.

The pipeline(2) of prospects, which amounted to €183 million at

the time of the IPO, now stands at €252 million. It comprises 19

projects for 17 different customers, located 68% in Europe and 32%

in North America.

Conversion to firm orders facilitated by a more favorable

legislative and regulatory context

The conversion of these commercial prospects into firm orders

could benefit from a more favorable legislative and regulatory

context. In France, since May 2023, the "Hydrogen Territorial

Ecosystems" call for proposals led by ADEME now includes the

production of hydrogen from biomass among the technologies eligible

for public funding. HAFFNER ENERGY is actively working alongside

its customers to respond to this call for proposals, which is due

to close on September 29, 2023.

In addition, the upcoming institutional calendar is dense

(revision of the national hydrogen strategy to be published at the

beginning of July, green industry bill before the summer,

multi-year energy programming and energy-climate bill in the fall,

agricultural orientation bill at the end of the year...) and

HAFFNER ENERGY is pursuing its commitment to public authorities and

stakeholders so that the production of hydrogen and its derivatives

by thermolysis of biomass can find a concrete translation in the

legislative texts to come.

In Europe, inter-institutional discussions concerning

legislation applicable to renewable and low-carbon hydrogen are

continuing (RED3 and gas package), and agreements have been reached

on structuring texts for HAFFNER ENERGY (AFIR, Fuel EU Maritime,

RefuelEU Aviation). In particular, these texts set decarbonization

targets for heavy transport (road/maritime/aviation), offering

HAFFNER ENERGY significant market prospects.

Europe has also recently communicated a proposal for a directive

on the certification of negative emissions. There is a high

probability that the inclusion of biochar, a co-product of HAFFNER

ENERGY's sustainable biomass thermolysis process, will be among the

technologies recognized by Europe for actively removing CO2 from

the atmosphere.

Finally, in the United States of America, the latest

announcements from the Biden administration are also particularly

favorable to HAFFNER ENERGY. The National Hydrogen Strategy,

published at the beginning of June, puts forward major objectives

for the production of clean hydrogen (10 million tons by 2030) and

"Sustainable Aviation Fuels or SAF" (3 billion gallons by 2030). As

the US strategy is technology-neutral and based on life-cycle

assessment of carbon footprints, the production of hydrogen from

biomass has a prominent place among the technologies

identified.

The new HAFFNER ENERGY organization, announced in a press

release dated May 25, 2023, is designed to accelerate international

development, particularly in the United States of America.

Significant development potential in sustainable aviation

fuels (SAF)

In addition to renewable hydrogen production, the technology

developed by HAFFNER ENERGY is particularly well suited to making

an agile, operational and competitive contribution to the

production of sustainable aviation fuels (SAF) for the necessary

decarbonization of aviation.

HAFFNER ENERGY has an optimal renewable Syngas to feed a

Fischer-Tropsch process, a mature and well-known technology for

producing Sustainable Aviation Fuels (SAF) with three comparative

advantages over gasification technologies: diversity of the biomass

used, competitiveness, and carbon neutrality in full life-cycle

analysis.

Strong sales growth expected for March 31, 2024, and sales

target of 250 million euros postponed by one year to March 31,

2027

HAFFNER ENERGY is continuing to build up its order book, and is

expected to accelerate its order intake, enabling a very strong

increase in sales to March 31, 2024. The extent of this growth will

depend in particular on external factors, notably on the time

required to obtain the necessary administrative approvals (building

permits, operating permits, etc).

HAFFNER ENERGY initiates a first phase of its industrialization

with the acquisition, announced on June 13th, 2023, of JACQUIER, a

family business specializing in industrial boilermaking and general

mechanics located in the Marne region of France, and a partner

since 2017 for the manufacture of strategic equipment.

The biomass thermolysis developed by HAFFNER ENERGY represents a

high-performance and agile technological alternative for producing

hydrogen and renewable gas, while relieving growing electricity

needs and contributing to the energy transition and decarbonization

of uses. It also enables thermochemical production of sustainable

aviation fuels (SAF). Against this very buoyant international

backdrop, but due to offset in order intake since the IPO in

February 2022, HAFFNER ENERGY is shifting its sales target of 250

million euros, initially announced for March 31st, 2026, to March

31st, 2027.

Upcoming events

Individual shareholder webinar: July 5th, 2023 at 6:00 pm by

videoconference (Registration details on

https://www.haffner-energy.com/webinaires/)

Annual General Meeting: September 13th, 2023

More detailed financial information on the annual accounts

ending March 31st, 2023 is available at www.haffner-energy.com.

About Haffner Energy

A listed family company co-founded and co-directed by Marc and

Philippe Haffner, Haffner Energy has been a player in the energy

transition for 30 years, designing and supplying innovative

decarbonization solutions for mobility, industry and local

authorities. Its HYNOCA® and SYNOCA® technologies, based on the

thermolysis of biomass and protected by 15 patent families, enable

customers to produce locally renewable hydrogen and gas, as well as

other green energies such as Sustainable Aviation Fuel and

methanol, while capturing carbon from the atmosphere through the

co-production of biochar. Thanks to this "carbon-negative"

technology, decoupled from the cost of fossil fuels and

electricity, Haffner Energy provides an immediate, agile and

competitive response to the strategic challenges of energy

independence and decarbonization in France and abroad.

Glossary:

(1) The backlog designates a project when at least one of

the following situations occurs:

- a deposit, linked to a contract comprising

a precise number of modules to be ordered or a defined has been

paid by the customer; or - a purchase contract or purchase order

has been signed between Haffner Energy and a customer; or - a

letter of intent or specification has been signed between Haffner

Energy and a customer; or - a project company, created specifically

for a given project involving the Company's equipment, has been set

up and the sponsors have made a financial commitment; or - Haffner

Energy is awarded a contract through a competitive bidding

process.

(2) Pipeline designates a commercial opportunity when at

least one of the following situations occurs:

- a preliminary feasibility study for the

installation of equipment is or has been carried out; or - a

preliminary project budget or business plan, or a complete

commercial offer including specifications, has been sent to the

customer, and Haffner Energy is awaiting the customer's response;

or - a letter of intent has been sent to Haffner Energy by the

customer; or - Haffner Energy has received an invitation to

participate and is part of a tender process.

(3) EBITDA corresponds to operating income before

depreciation, amortization and impairments net of reversals and

before operating provisions net of reversals.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230627505145/en/

Press NEWCAP – Financial Communication Nicolas

Merigeau 01 44 71 94 98 haffner@newcap.eu

HAFFNER ENERGY Laure Bourdon 07 87 96 35 15

laure.bourdon@haffner-energy.com

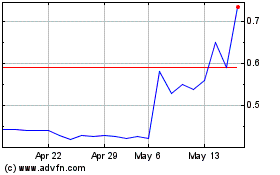

Haffner Energy (EU:ALHAF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Haffner Energy (EU:ALHAF)

Historical Stock Chart

From Dec 2023 to Dec 2024