Airbus Raises 2021 Cash Flow, Earnings Targets; Adjusts Production Ramp-Up Plans -- 2nd Update

October 28 2021 - 6:33AM

Dow Jones News

By Olivia Bugault

Airbus SE on Thursday raised its free cash flow and earnings

guidance for the year despite lower sales in the third quarter, and

confirmed plans to ramp-up production with some adjustments.

The European plane maker said Thursday that it now expects

adjusted earnings before interest and taxes at around 4.5 billion

euros ($5.22 billion) for the year, and is targeting free cash flow

before mergers and acquisitions and customer financing at roughly

EUR2.5 billion.

Airbus previously raised its outlook in July, when it guided for

adjusted EBIT of EUR4 billion and free cash flow of EUR2

billion.

The company on Thursday maintained its target of 600 commercial

jet deliveries for the year. Over the first nine months of 2021,

Airbus delivered 424 aircraft.

The guidance upgrade is good news as Airbus is now expecting

earnings to be 12.5% higher this year for the same number of

deliveries, implying increased profitability, Citi said.

The updated outlook comes as Airbus swung to a net profit of

EUR404 million in the third quarter, from a net loss of EUR767

million in the same period a year earlier. Revenue fell 6% to

EUR10.52 billion on the back of lower plane deliveries. Airbus

delivered 127 commercial aircraft in the quarter, 18 fewer than

during the same period last year.

Airbus's more closely watched adjusted earnings before interest

and taxes fell 19% on-year to EUR666 million, but was 7% above

market expectations, Citi said.

The company also updated its production ramp-up plans after it

said in May that for its A320 family of narrow-body jets it was

targeting a monthly production rate of 45 in the fourth quarter of

2021 and 64 by the second quarter of 2023. Airbus is now working to

step up production to 65 a month by the summer of 2023 for its A320

family, it said.

Demand supports Airbus's planned output ramp-up, Chief Executive

Guillaume Faury said during a call with journalists. Mr. Faury

added that the company is still studying a potential increase in

the production of A320 family jets to up to 75 a month by 2025.

Regarding the production rate of its widebody jets, Airbus said

that "the recent commercial successes of the A330 program enable a

monthly rate increase from around 2 to almost 3 aircraft at the end

of 2022." The company stuck to its plan to increase the output of

its A350 wide-body jets to 6 a month from 5, though it should now

happen in early 2023 and not by the autumn of 2022 as previously

said.

During the call, Mr. Faury also said the company is dealing with

delays from a small number of suppliers, issues that affect

deliveries but not the output ramp-up.

Air traffic is recovering in Europe and world-wide thanks to

short-haul and leisure flights, but long-haul travel is still

lagging behind as some countries are slower to reopen borders.

Airbus still expects air traffic to return to 2019 levels between

2023 and 2025, Mr. Faury said.

At 1001 GMT, Airbus shares were up 1.2% at EUR111.30.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

October 28, 2021 06:18 ET (10:18 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

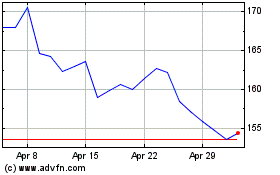

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024