Bombardier Nears End to Jet Venture -- WSJ

February 08 2020 - 3:02AM

Dow Jones News

By Jacquie McNish and Benjamin Katz

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 8, 2020).

Airbus SE is in advanced talks to acquire Bombardier Inc.'s

remaining stake in a commercial jet family that the Canadian

company once said would transform it into a major global aviation

player, people familiar with the matter said.

An agreement for the sale of Bombardier's 34% stake in the two

companies' joint A220 commercial jet program could be reached as

early as next week, ahead of both companies' earnings reports, the

people said.

The Quebec government, which holds a 16% stake in the venture,

is expected to hold its stake.

Financial terms of the planned sale couldn't be learned. While

talks are in final stages, they could still fall apart or the

contours of the potential deal could change.

The Montreal plane and train maker has been scrambling to reduce

roughly $9 billion of long-term debt, some of which comes due next

year. The company is seeking to pare its debts by selling the stake

in the Airbus partnership and one of its two other core divisions,

people familiar with the matter have said

Bombardier began talks several weeks ago to sell its

business-jet division to Textron Inc., The Wall Street Journal

reported Tuesday. Those discussions came after negotiations to sell

its train unit to France's Alstom SA slowed amid concerns about

rising costs and delivery delays at the division.

Much of Bombardier's debt was taken on to finance the company's

ambitious strategy to enter the commercial airline market. It

formally launched the CSeries in 2008 with the goal of developing

an aircraft that could compete with Boeing's 737 MAX and the Airbus

A320neo narrow-body commercial planes.

While the jet was lauded by airline customers, sales were

disappointing because of concerns about the sustainability of a

program that had severely weakened Bombardier's financial condition

after years of delays and soaring costs.

Airbus took a 50.01% stake in the CSeries program in July 2018.

It paid virtually no cash for the stake but committed to throwing

its global marketing heft behind the jet.

Bombardier, meanwhile, committed to covering the program's

losses over a set period.

Bombardier said last month that it had started a strategic

review of its stake in the Airbus partnership because of the rising

losses.

Under the terms of the proposed new stake sale, Airbus would

absorb the $350 million in losses that Bombardier was required to

cover this year, according to the people familiar with the

matter.

After the talks with Textron were reported by the Journal,

Bombardier came under political criticism in Quebec for putting up

for sale its business-jet division, which received a $1 billion

lifeline from the province in 2015.

Bombardier's jet business anchors a thriving aerospace sector in

Quebec, employing more than 40,000 workers.

Write to Jacquie McNish at Jacquie.McNish@wsj.com and Benjamin

Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

February 08, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

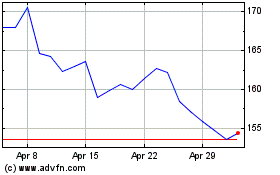

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024