Airbus Faces Nearly $4 Billion in Fines to Settle Corruption Probes--3rd Update

January 28 2020 - 2:27PM

Dow Jones News

By Benjamin Katz

LONDON -- Airbus SE will pay a record EUR3.6 billion in a

settlement with fraud agencies in the U.S., U.K. and France over

probes into bribery and corruption, lifting a reputational and

legal cloud that has hung over the company for years.

The European plane maker said it had reached an agreement in

principle with prosecutors at a preliminary court ruling in the

U.K. on Tuesday, paving the way for a so-called deferred

prosecution agreement that allows the company to avoid formal

charges.

The agreements still require final approval by courts in each

jurisdiction, Airbus said, with hearings expected on Jan. 31. If

approved, Airbus will book the penalties as a provision in its 2019

financial accounts.

The settlement comes about four years after Airbus first

announced it was under investigation for using third-party

consultants to help secure lucrative orders for commercial

aircraft.

Airbus said at the time it had self-reported to investigators

after discovering irregularities in its submissions for

state-backed funding guarantees. It later came under the purview of

the U.S. Department of Justice for inaccuracies in disclosures

relating to military export equipment that included U.S.-made

components

The resulting investigations grew into a slow-boiling crisis for

Airbus, eventually triggering a nearly complete overhaul of its top

management and sales teams. Airbus has handed over millions of

documents to investigators, and created a new ethics and compliance

system designed to prevent future contraventions.

It also placed a blanket ban on the use of third-party agents

and halted ongoing contracts, a move which has led to a series of

legal disputes.

The deal follows a similar agreement reached with Rolls-Royce

Holding PLC in 2017 that required the engine maker to pay GBP671

million ($874 million) in penalties to U.K., U.S. and Brazilian

investigators. Based on the scope of the Airbus probe, any

settlement the company reaches could be several times bigger.

Airbus shares rose sharply on the news of the deal, though fell

back somewhat later in the day. Airbus was trading up 1% in

midafternoon trading.

The deal allows Airbus Chief Executive Guillaume Faury, who took

over the top job in April, to move past a major legacy overhang

from his predecessor, Tom Enders. Airbus' new management team can

now focus more fully on running the company at a time when its arch

rival, Boeing Co., is facing its own crisis surrounding the

grounding of its 737 MAX airliner.

The grounding has allowed Airbus to overtake Boeing as the

world's largest jet maker by deliveries, a crown it has chased for

years. Despite that victory, Airbus has been battling its own

production issues at its factories and among its suppliers. Those

issues have prevented it from increasing production rates of its

A320neo, the main competitor to the MAX, and winning over some

Boeing customers exploring dropping orders for the grounded

jet.

The probe consumed much of Mr. Enders' time at the end of his

tenure as Airbus CEO. He helped oversee an internal investigation

into the use of middlemen and changed out management layers in an

effort to secure a deal with international prosecutors.

Write to Benjamin Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

January 28, 2020 14:12 ET (19:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

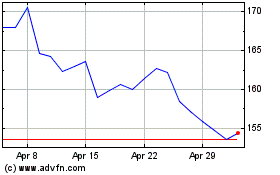

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024