Airbus Books $14 Billion Deal With Air Arabia -- Update

November 18 2019 - 2:29PM

Dow Jones News

By Benjamin Katz

DUBAI -- Airbus SE booked a $14 billion order for its

single-aisle A320neo, underscoring the disadvantage American plane

maker Boeing Co. is facing for orders amid an eight-month grounding

of the 737 MAX.

The deal from Air Arabia, for 120 A320neos, follows similar

narrow-body wins -- including a 100-jet deal from Spirit Airlines

and a 300-jet order from India's Indigo -- for Airbus in recent

months.

The Air Arabia order was announced at the biennial international

air show here. The deal's dollar value is based on list prices and

doesn't include normal discounts.

Boeing, for its part, booked an order for 10 MAX jets from

Turkey's SunExpress. That number, though small, is important for

the manufacturer at a time when the aircraft still requires

regulatory certification to resume flights.

MAX sales have stalled since the grounding, with the notable

exception of a surprise, preliminary deal with British Airways

owner International Consolidated Airlines Group SA made at the

Paris Air Show in June. That deal, for 200 aircraft, has yet to be

completed, but was seen as a vote of confidence for Boeing.

Complicating its ability to capitalize on its rival's troubles,

Toulouse, France-based Airbus has been suffering production issues

that forced it to lower its delivery guidance for the year last

month, making Airbus suppliers wary of attempts to further scale up

output to meet demand.

"There are customers expressing their frustration" with the MAX

delays, said Airbus Chief Executive Guillaume Faury. Airbus

production slots for the A320neo are full until 2024, he said,

which is when the first of the new Air Arabia models will be

delivered.

"I don't want to comment on what's happening on the other side

of the Atlantic, but basically it contributes to the lack of

capacity," said Mr. Faury. "We are under pressure because of this

lack of capacity."

In a further blow to Boeing, the chairman of its biggest

customer for the MAX in the Middle East -- low-cost carrier

Flydubai -- told reporters he could switch to the Airbus A320.

Sheikh Ahmed bin Saeed Al Maktoum, who is also CEO of long-haul

giant Emirates Airline, stopped short of saying he was leaning that

way. He said he was on good terms with Boeing. Boeing declined to

comment on Sheikh Ahmed's comments.

Boeing reiterated yesterday that it hopes to receive

certification for the MAX in December with operations able to

restart in January. The manufacturer has racked up hundreds of

undelivered aircraft as it works to get signoff for its fixes from

the Federal Aviation Administration after two fatal crashes.

Airbus also secured a $16 billion order for its A350 wide-body

jets from Emirates, a significant commitment for one of its biggest

jets but less than an earlier promise by the Mideast carrier to buy

$21 billion worth of Airbus planes.

Emirates said at the air show Monday it will take 50 A350s

instead of its initial plan for 40 A350s and 30 A330neos. Airbus

has struggled to drum up a significant backlog for the A330neo, a

rival to Boeing Co.'s 787 Dreamliner.

In a separate setback to Boeing, Abu Dhabi's Etihad Airways said

earlier on Monday that it was planning to take 20 fewer of its

aircraft than Boeing had counted on. Etihad has undertaken a

strategy overhaul and fleet review after suffering losses in the

last three years amid oil price volatility, bad investments and

increased competition.

(END) Dow Jones Newswires

November 18, 2019 14:14 ET (19:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

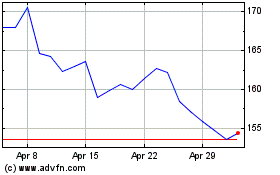

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024