Airbus Pulls Far Ahead of Boeing in New Jet Orders, Deliveries

October 29 2019 - 1:41PM

Dow Jones News

By Benjamin Katz

As Boeing Co. struggles to get its 737 MAX back in the air,

rival Airbus SE is racing ahead in the jet-making duopoly's annual

race for orders and deliveries.

Airbus on Tuesday booked one of its biggest jet orders ever --

for 300 aircraft valued at a list price of at least $33 billion --

doubling its order book for the year. The deal, with India's IndiGo

Airlines, was for the Airbus A320neo single-aisle jetliner family,

the chief rival to the MAX.

The order lifts the Toulouse, France-based company's gross

orders for the year to 603, far outstripping Boeing's 170.

The IndiGo order is one of the biggest in Airbus history, though

it falls short of its record of 430 aircraft two years ago from the

unrelated U.S. airline owner Indigo Partners. In addition, Airbus

last week announced a memorandum of understanding for 100 of the

A320neo jets with Florida-based discounter, Spirit Airlines. The

order's list-price value doesn't include typical discounts for

large buyers of jets.

The Indian carrier was an early customer of the A320neo, and

Boeing wasn't seen as being competitive for the order, cushioning

the blow. Still, the deal represents a major boost for Airbus's

best-selling jet at a time when Boeing is scrambling.

Airbus is also well ahead of Boeing in terms of jet deliveries,

typically a more important metric for investors because plane

makers usually don't get paid until they hand over the aircraft.

Airbus has delivered 571 planes this year, compared with 301 by

Boeing. That puts the European plane maker on track to deliver more

jets than Boeing this year, for the first time since 2011.

This year, Boeing has been largely sidelined by the grounding of

its 737 MAX, which like the A320neo, had been a hit among airlines.

The two "narrow bodies" have been popular for their fuel efficiency

and versatile range. They and the planes' earlier variants have

become the workhorses of the airline industry.

Earlier this year, Boeing grounded its 737 MAX fleet after two

deadly crashes were blamed in part on its flight control system.

Eight months into the grounding, Boeing has yet to submit plans for

software upgrades and training fixes to regulators, who need to

review them before allowing the MAX back into service.

While some airlines have canceled 737 MAX orders, most haven't

yet given up on the jet. In June, Boeing secured a critical

commitment for the aircraft from London-based IAG SA, owner of

British Airways. It signed a letter of intent for 200 of the MAX

jets despite the grounding.

Included in the IndiGo deal is an order for Airbus's new "XLR"

variant of the A320neo, which offers an extended range. The model

was unveiled earlier this year in part to cut into the market

potential for an all-new model that Boeing has been studying.

Airbus also has had some less significant technical issues with

its new jet. Indian regulators on Tuesday said they may ground some

of the oldest A320neo jets because of problems with some of the

engines, made by Pratt & Whitney, a unit of United Technologies

Corp.

IndiGo, which was told to modify 16 of its A320neo aircraft in

the next 15 days, in June said it was switching to Pratt-rival CFM

International for a portion of the outstanding orders. An Airbus

spokesman said it was working with Pratt "to support our customer

in daily operations." A spokeswoman for Pratt said it was working

to "ensure minimal disruption during the fleet retrofit."

For IndiGo, the deal brings its total orders for Airbus jets to

730, making it the planemaker's biggest customer. The carrier,

which has been rapidly growing in one of the industry's most

important markets, was also one of the launch customers for the neo

in 2011.

(END) Dow Jones Newswires

October 29, 2019 13:26 ET (17:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

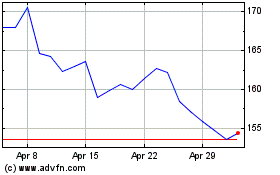

Airbus (EU:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airbus (EU:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024