Regulatory News:

Air Liquide (Paris:AI):

Key Figures (in millions of

euros)

FY 2019

2019/2018 as published

2019/2018 comparable

(a)

Group Revenue

21,920

+4.3%

+3.2%

of which Gas & Services

21,040

+4.6%

+3.5%

Operating Income Recurring

(OIR)

3,794

+10.0%

+7.5%

Group OIR Margin

17.3%

+90 bps

Variation excluding energy

+70 bps

Net Profit (Group Share)

2,242

+6.1%

Net Profit Recurring (Group Share) (b)

2,307

+9.2%

+11.1%

Earnings per Share (in euros)

4.76

+5.9%

2019 proposed Dividend per Share (in

euros) (c)

2.70

+12.4%

Cash Flow before change in working capital

requirements (d)

4,859

+14.5%

Net Debt

€ 12.4 Bn

Recurring ROCE (e)

8.6%

+60 bps

(a) Change excluding the currency, energy

(natural gas and electricity) and significant scope impacts, see

reconciliation in appendix. (b) Excluding exceptional and

significant transactions that have no impact on the operating

income recurring, see reconciliation in appendix. (c) 2018 figures

restated for the impact of the free share attribution in October

2019. (d) Excluding IFRS16, the change would be +8.3%. (e) Based on

the recurring net profit, see reconciliation in appendix.

Commenting on the results for 2019, Benoît Potier, Air

Liquide Chairman and CEO, stated:

“2019 is a landmark year, characterized simultaneously by a

significant improvement in performance, a high level of investments

to serve our customers and strengthen our efficiency, and the

operational implementation of our climate action plan.

2019 sales were driven by the development of Gas & Services

and Global Markets & Technologies. On a comparable basis,

all Gas & Services activities, which account for

96% of Group revenue, progressed over the

year, with particularly dynamic Electronics and

Healthcare. Geographically, every region grew, notably the

Europe and Asia-Pacific regions.

Overall, and despite the expected global economic slowdown

observed in the 4th quarter, the Group delivered robust

results, confirming the relevance of its economic model and

strategy.

The improvement in the Group’s operating margin reflects

the dynamic management of both pricing and product mix, the asset

portfolio, and efficiencies. The latter reached 433

million euros. Cash flows were high and the debt to equity

ratio declined substantially. The Group’s balance sheet is solid.

ROCE continues to improve. 2019 performance is in

line with all of the targets of the NEOS program and the

Group’s Climate objectives.

In a context where industrial opportunities remain high,

investment decisions rose sharply, to 3.7 billion euros. The

new projects that have been signed with our clients in Large

Industry and Electronics will allow us to further strengthen our

position in our major industrial basins.

Assuming no major change in the environment and the

international health situation is under control, Air Liquide is

confident in its ability to further increase its operating margin

and to deliver net profit growth in 2020, at constant exchange

rates.”

2019 Highlights

- Large Industries: Signature of numerous long-term

contracts, in Russia with Severstal, in the Gulf Coast with

Marathon Petroleum Company, Gulf Coast Growth Ventures (GCGV),

LyondellBasel and Methanex, and in Kazakhstan with Kazakhstan

Petrochemical Industries (KPI). Sale to Fujian Shenyuan of the

production center.

- Industrial Merchant: Acquisition by Airgas of Tech Air

in the United States and acquisition of Southern Industrial Gas in

Malaysia. Launch of Qlixbi, a disruptive innovation that combines

technical and digital innovation in the field of welding.

Inauguration of the first robotic order preparation line at Feyzin

(France).

- Healthcare: Acquisitions in home healthcare of Megamed

AG in Switzerland, of Dialibre in Spain, and of Medidis in the

Netherlands. E-health: deployment in France of Chronic Care

Connect, a remote medical monitoring system.

- Innovation: Inauguration in Japan of the new Tokyo

Innovation Campus. Inauguration of Accelair, the deep tech start-up

accelerator of the Paris Innovation Campus. Signature of more than

30 contracts for cryogenic equipment based on the Turbo Brayton

technology, which lowers LNG boil-off and the greenhouse gas

emissions of LNG carriers.

- Climate: Participation in three innovative projects

designed to fight climate change: the Northern Lights project for

the capture and storage of CO2 in Norway, with thyssenkrupp Steel

for the use of hydrogen to reduce carbon emissions in steel

production, and with ArcelorMittal for the capture and recycling of

carbon emissions related to the production of steel.

- Hydrogen Energy: Acquisition of a nearly 20% equity

stake in the Canadian company Hydrogenics Corporation, which

specializes in equipment used to produce hydrogen by electrolysis.

Construction in Canada of the largest membrane electrolysis plant

in the world. Development of hydrogen mobility in China with the

creation of the joint venture Air Liquide Houpu Hydrogen Equipment

Co. and a memorandum of understanding with Sinopec. Partnership in

France with Engie and the Durance Luberon Verdon urban area to

produce green hydrogen on an industrial scale (HyGreen

project).

- Corporate: Appointment of 4 new members of the Executive

Committee effective September 1. 500 million dollar bond issue at a

historically low rate to finance long-term growth. Inclusion of a

correlation mechanism in the Group’s 2 billion euro syndicated

line, between its financial costs and three of its CSR targets, in

the areas of carbon intensity, gender diversity, and safety.

Group revenue for 2019 totaled 21,920 million euros, up

+3.2% on a comparable basis. Gas & Services enjoyed

robust comparable sales growth of +3.5% despite the slowing

economic environment in the 4th quarter of 2019. In Engineering

& Construction, sales to third-party customers were down

compared with 2018, with resources mainly allocated to internal

projects. Global Markets & Technologies continued its dynamic

development with growth of +14.9%. The currency impact was

positive at +2.1%, whereas the energy impact was unfavorable

(-1.4%). The acquisition of Tech Air in the United States at the

end of the 1st quarter of 2019 and the disposal of Fujian Shenyuan

in September generated a significant scope impact of +0.4% over the

year. The Group's published revenue growth was therefore up

+4.3% for 2019.

Gas & Services revenue reached 21,040 million euros

in 2019, up +3.5% on a comparable basis. As published

sales were up +4.6% in 2019, with the unfavorable

energy impact (-1.5%) more than offset by the favorable currency

(+2.1%) and significant scope (+0.5%) impacts.

- Revenue in the Americas totaled 8,460 million

euros in 2019, an increase of +1.5% in comparable

growth. Large Industries sales were stable in 2019, due to several

customer maintenance turnarounds in the United States during the

2nd half of the year. Industrial Merchant revenue growth was

resilient at +0.7%, driven mainly by higher prices. Electronics

growth stood at +2.1% and Healthcare continued to improve strongly

(+9.7%), in particular in Medical Gases in the United States and

Latin America.

- Revenue in Europe reached 7,172 million euros

over 2019, up +3.4% on a comparable basis driven mainly by

good Healthcare sales momentum (+5.2%) and a solid growth in

Industrial Merchant (+3.4%), notably thanks to high price impacts

and robust volumes. Large Industries sales (+1.7%) were driven by

higher hydrogen volumes for refineries in Benelux, whereas demand

remained weaker in the Steel and Chemical sectors.

- Revenue in the Asia Pacific zone totaled 4,794

million euros in 2019, up +7.7% on a comparable basis.

Large Industries sales grew strongly (+9.7%) thanks to the ramp-up

of several units in China. Industrial Merchant growth was solid

(+3.7%), in particular in China and South-East Asia. Electronics

revenue maintained its very dynamic growth momentum in 2019

(+10.4%) despite a major decline in Equipment & Installations

sales in the 4th quarter compared with record high sales in

2018.

- Revenue in the Middle East and Africa zone amounted to

614 million euros, up +1.5% over 2019 on a comparable

basis. Industrial Merchant remained very dynamic in the Middle

East, Egypt and India, with strong helium sales in particular.

Activity was up slightly in Large Industries, with the major units

in the region, located in Saudi Arabia and South Africa, now

operating at full capacity. The Healthcare business continued to

grow in Egypt and Saudi Arabia.

All businesses contributed to growth in 2019, in particular

Healthcare and Electronics. Large Industries (+3.4%)

benefited notably from sustained hydrogen volumes in Europe and

Asia and from the ramp-up of several new units. In a less favorable

economic environment in the 4th quarter 2019, Industrial Merchant

growth reached +1.9% over the year, driven mainly by

efficient price management (+3.6%), including helium. Strong

healthcare growth (+5.7%) was due to organic sales growth,

in particular in Home Healthcare in Europe and Latin America and in

Medical Gases in the United States. Electronics revenue maintained

a very dynamic growth momentum over the year (+7.9%) with

double-digit growth for Carrier Gases and Advanced Materials

sales.

Consolidated Engineering & Construction revenue, at

328 million euros, was down compared with 2018, with

resources mainly allocated to internal projects in Large Industries

and Electronics. Total sales including Group projects were up,

boosted by a record-high level of investment decisions, in

particular in Large Industries.

Global Markets & Technologies revenue was up

+14.9% in 2019 on a comparable basis, at 552 million

euros. Biomethane grew strongly thanks to the ramp-up of

several units in Europe. Sales of equipment related to the Turbo

Brayton technology, which reduces greenhouse gas emissions when

transporting natural gas by sea, also strongly contributed to this

growth.

In 2019, efficiencies increased markedly by +23.4%

to 433 million euros, compared with 351 million euros in

2018. These represented savings of 2.7% of the cost base and

largely exceeded the objective, which had been set at more than 400

million euros after the reinforcement of the program at the

beginning of the year. The main drivers of this increase in

efficiencies are the roll-out of digital tools, the continuation of

the realignment plans and the ramp-up of Airgas within the

program.

The Group’s operating income recurring (OIR) reached

3,794 million euros for 2019, a published increase of

+10.0%, or +7.5% on a comparable basis. The operating margin

(OIR to revenue) stood at 17.3%, a marked improvement of

+90 basis points compared to 2018 and of +70 basis

points excluding the energy impact, including +10 basis points

from the application of IFRS 16. The Gas & Services

operating margin stood at 19.1%, an improvement

+60 basis points compared with 2018 excluding the energy

impact.

Net profit (Group share) amounted to 2,242 million

euros in 2019, an increase of +6.1% as published and

+6.7% excluding the application of IFRS 16.

Excluding the capital loss on the disposal of the Fujian

Shenyuan units in 2019 and the non-recurring financial gain in

2018, recurring net profit1 Group share was up

+11.1%.

Cash flow from operating activities before changes in working

capital requirement totaled 4,859 million euros and

stood at 22.2% of Group sales (21.0% excluding the

application of IFRS 16). This represented strong published growth

of +14.5% (+8.3% excluding the application of IFRS 16).

In 2019, gross industrial capital expenditure for the

Group amounted to 2,636 million euros, a major increase of

+17.2% compared to 2018. It represented 12.0% of

sales. The net debt-to-equity ratio stood at

64.0% at the end of December 2019, an improvement of -480

basis points compared to the end of 2018.

Industrial and financial investment decisions represented

a total of 3.7 billion euros in 2019, a +19.8%

increase compared with 2018. Industrial investment decisions

reached a record high of 3,157 million euros, with major

investments for long-term contracts with Large Industries

customers, mainly in strategic basins where the Group is already

present. The 12-month portfolio of opportunities remained

strong and totaled 2.9 billion euros, an increase compared

with 2.6 billion euros at the end of 2018.

Recurring ROCE(2) which excludes the capital loss on the

disposal of the Fujian Shenyuan units on net profit, stood at

8.6%, i.e. a +60 basis points improvement compared to

the end of December 2018. This improvement is in line with the

Group’s NEOS target of returning to a ROCE of above 10% by

2021-2022.

Regarding to the extra financial performance of the

Group, lost time accident frequency improved and reached 1.2 at the

end of 2019. This represents the lowest employees lost time

accident frequency rate of the last 20 years. In 2019, the

Group’s carbon intensity declined further and reached 4.6

kg of CO2 equivalent per euro of EBITDA(3). It is lower than

the initial forecast, notably from the disposal of the Fujian

Shenyuan units but also because of several customer maintenance

turnarounds, leading to lower production volumes. In January 2020,

the Group's commitment has been rewarded twice by the

CDP(4), who gave Air Liquide the highest grade "A"

both for its actions in favor of climate and its sustainable

management of water. In addition, Air Liquide had 29% of

women among engineers and managers in 2019 and aims to reach

35% by 2025.

Air Liquide’s Board of Directors, which met on February

10, 2020, approved the audited financial statements for the 2019

fiscal year. The Statutory Auditors are in the process of issuing a

report with an unqualified opinion.

At the next Annual General Meeting the payment of a dividend of

2.70 euros per share will be proposed. Following the free

share attribution of 1 for 10 in October 2019, the proposed

dividend shows a strong growth of +12.4% compared with last

year. The ex-dividend date is scheduled for May 11, 2020 and the

payment is scheduled for May 13, 2020.

The Board also approved the draft resolutions that will be

submitted for a vote by the General Meeting on May 5, 2020,

concerning in particular:

- the proposed reappointment, for a four-year term, of Mr.

Brian Gilvary, a member of the company’s Board of Directors

since 2016 and a member of the Audit and Accounts Committee since

2017;

- the proposed appointment, for a four-year term, of Ms.

Anette Bronder and Ms. Kim-Ann Mink. Ms.

Bronder will bring to the Board her strong digital expertise, as

well as her experience of large international groups in the fields

of IT and telecom. Ms. Mink will bring to the Board, in addition to

her scientific academic background and her experience in research

and innovation, her strong leadership skills and deep understanding

of the chemical sector.

The Board of Directors has, moreover, taken note that the terms

of office of Mr. Pierre Dufour and Ms. Karen Katen will expire at

the close of the 2020 General Meeting. The Board thanked them

warmly for their considerable contribution to the work of the Board

and its Committees. The Board stated its intention, furthermore, to

appoint Ms. Annette Winkler as a replacement for Mr.

Pierre Dufour as Chairman of the Environment and Society Committee,

Mr. Xavier Huillard as a member of the Appointments

and Governance Committee as a replacement for Ms. Karen Katen, and

Mr. Brian Gilvary as a member of the Remuneration Committee

as a replacement for Ms. Annette Winkler, with effect from that

date.

At the close of the General Meeting on May 5 , 2020, the Board

of Directors would thus have 12 members, of whom 11 are

elected and one is an employee Director. The Board of Directors

would include 6 women and 6 foreign members.

Furthermore, the Board of Directors will propose that the

General Meeting bring the articles of association into line with

the provisions of the PACTE law, in order to provide for the

appointment of a second employee Director, if the number of

Directors is more than 8 members, the said Director to be appointed

by the European Works’ Council.

Finally, in accordance with the new provisions resulting from

the PACTE law, the Board of Directors will submit for the vote of

the General Meeting the elements of Mr. Benoît Potier’s

remuneration for 2019, in his capacity as Chairman and Chief

Executive Officer, together with the information relating to the

remuneration for all the corporate officers. The General Meeting

will also be invited to decide upon the remuneration policy for the

corporate officers which will apply to Mr. Benoît Potier and to the

Company’s Directors.

1 See definition and reconciliation in

Appendix.

2 See definition and reconciliation in the

Appendix.

3 At 2015 exchange rate.

4 A non-profit organization that evaluates

companies based on their climate action.

Management Report’s Table of

Content

PERFORMANCE

7

Key Figures

7

Income Statement

8

2019 Cash Flow and Balance Sheet

18

Environment and society

20

INVESTMENT CYCLE AND FINANCING

21

Investments

21

2019 Financing

24

OUTLOOK

26

APPENDICES

27

Impact of IFRS16

27

Performance indicators

27

4th Quarter 2019 Revenue

31

Geographic and Segment Information

31

Consolidated Income Statement

32

Consolidated Balance Sheet

33

Consolidated Cash Flow Statement

34

Performance

Unless otherwise specified, all variations

on revenue commented below are made on a comparable basis,

which excludes the currency, energy (natural gas and electricity)

and significant scope impacts. The reference to Airgas

corresponds to the Group Industrial Merchant and Healthcare

activities in the United States.

Key Figures

(in millions of euros)

FY 2018

FY 2019

2019/2018 published

change

2019/2018 comparable change

(a)

Total Revenue

21,011

21,920

+4.3%

+3.2%

Of which Gas & Services

20,107

21,040

+4.6%

+3.5%

Operating Income Recurring

3,449

3,794

+10.0%

+7.5%

Operating Income Recurring (as % of

Revenue)

16.4%

17.3%

+90 bps

Variation excluding energy

+70 bps

Other Non-Recurring Operating Income and

Expenses

(162)

(188)

Net Profit (Group Share)

2,113

2,242

+6.1%

Recurring Net Profit (Group Share) (b)

2,113

2,307

+9.2%

+11.1%

Adjusted Earnings per Share (in euros)

4.49

4.76

+5.9%

Adjusted Net Dividend per Share (in

euros) (c)

2.40

2.70

+12.4%

Cash Flow before change in working capital

requirements (d)

4,242

4,859

+14.5%

Net Capital Expenditure (e)

2,272

2,616

Net Debt

12,535

12,373

Net Debt to Equity ratio

68.8%

64.0%

Recurring ROCE (f)

8.0%

8.6%

+60 bps

(a) Change excluding the currency, energy

(natural gas and electricity) and significant scope impacts, see

reconciliation in appendix.

(b) Excluding exceptional and significant

transactions that have no impact on the operating income recurring,

see reconciliation in appendix.

(c) 2019 proposed dividend. 2018 figures

restated for the impact of the free share attribution in October

2019.

(d) Data from 2018 restated. Excluding

IFRS16, the change would be +8.3%.

(e) Including transactions with minority

shareholders.

(f) Based on the recurring net profit, see

reconciliation in appendix.

Income Statement

REVENUE

Revenue

(in millions of euros)

FY 2018

FY 2019

2019/2018 published

change

2019/2018 comparable

change

Gas & Services

20,107

21,040

+4.6%

+3.5%

Engineering & Construction

430

328

-23.7%

-25.0%

Global Markets & Technologies

474

552

+16.5%

+14.9%

TOTAL REVENUE

21,011

21,920

+4.3%

+3.2%

Revenue by quarter

(in millions of euros)

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Gas & Services

5,237

5,299

5,242

5,262

Engineering & Construction

93

83

81

71

Global Markets & Technologies

111

129

131

181

TOTAL REVENUE

5,441

5,511

5,454

5,514

2019/2018 Group published

change

+8.6%

+7.0%

+3.5%

-1.1%

2019/2018 Group comparable

change

+5.0%

+4.7%

+3.5%

-0.1%

2019/2018 Gas & Services comparable

change

+4.8%

+5.0%

+3.5%

+0.9%

Group

Group revenue for 2019 totaled 21,920 million euros, up

+3.2% on a comparable basis. Gas & Services enjoyed

robust comparable sales growth of +3.5% despite a slowing

economic environment in the 4th quarter of 2019. In Engineering

& Construction, sales to third-party customers were down

compared with 2018, with resources mainly allocated to internal

projects, industrial investment decisions having reached a record

high in 2019, in particular in Large Industries. Global Markets

& Technologies continued its dynamic development with growth of

+14.9%.

The currency impact was positive at +2.1%, whereas the energy

impact was unfavorable (-1.4%). The acquisition of Tech Air in the

United States at the end of the 1st quarter of 2019 and the

disposal of Fujian Shenyuan in September generated a significant

scope impact of +0.4% over the year. The Group's published

revenue growth was therefore up +4.3% for 2019.

Gas & Services

Gas & Services revenue reached 21,040 million euros

in 2019, up +3.5% on a comparable basis. All activities

contributed to growth, in particular Healthcare and Electronics.

Large Industries (+3.4%) benefited notably from sustained

hydrogen volumes in Europe and Asia and from the ramp-up of several

new units. In a less favorable economic environment in the 4th

quarter 2019, Industrial Merchant growth reached +1.9%,

driven mainly by efficient price management (+3.6%),

including helium. Strong healthcare growth (+5.7%) was due

to organic sales growth, in particular in Home Healthcare in Europe

and Latin America and in Medical Gases in the United States.

Electronics revenue maintained a very dynamic growth momentum over

the year (+7.9%) with double-digit growth for Carrier Gases

and Advanced Materials sales.

As published sales were up +4.6% in 2019,

with the unfavorable energy impact (-1.5%) more than offset by the

favorable currency (+2.1%) and significant scope (+0.5%) impacts

which included the consolidation of Tech Air and the disposal of

Fujian Shenyuan.

Revenue by geography and business

line

(in millions of euros)

FY 2018

FY 2019

2019/2018 published

change

2019/2018 comparable

change

Americas

7,982

8,460

+6.0%

+1.5%

Europe

7,111

7,172

+0.9%

+3.4%

Asia-Pacific

4,359

4,794

+10.0%

+7.7%

Middle East & Africa

655

614

-6.3%

+1.5%

GAS & SERVICES REVENUE

20,107

21,040

+4.6%

+3.5%

Large Industries

5,685

5,629

-1.0%

+3.4%

Industrial Merchant

9,181

9,754

+6.3%

+1.9%

Healthcare

3,486

3,693

+6.0%

+5.7%

Electronics

1,755

1,964

+11.9%

+7.9%

Americas

Gas & Services revenue in the Americas totaled 8,460

million euros in 2019, an increase of +1.5%. Large

Industries sales were stable in 2019, due to several customer

maintenance turnarounds in the United States during the 2nd half of

the year. Industrial Merchant revenue growth was resilient at

+0.7%, driven mainly by higher prices. Electronics growth stood at

+2.1% and Healthcare continued to improve strongly (+9.7%), in

particular in Medical Gases in the United States and Latin

America.

- Large Industries revenue was stable compared with 2018.

Activity was dynamic throughout the year in Latin America, in

particular with the start-up of a hydrogen-supply contract in

Mexico in the 2nd quarter, and the ramp-up of Air Separation Units

in Brazil and Columbia. The situation in North America was more

contrasted. The solid growth in oxygen volumes during the 1st half

of 2019 did not offset the high prices of the 1st half of 2018, due

to severe weather conditions. The 2nd half saw a decline in

hydrogen sales, as the numerous customer maintenance turnarounds

penalized sales growth by more than 4% over the half year.

Cogeneration sales strongly improved over the year.

- Industrial Merchant sales growth was resilient at

+0.7% in a slower industrial environment, driven by high

prices, which were up +4.3% over the year. In North America, sales

grew strongly in consumer-related markets such as Food and

Pharmaceuticals as well as in the Research sector. In contrast,

hardgoods revenue declined significantly in the United States, due

to the slowdown in industrial sectors such as Construction and

Metal Fabrication. In South America, double-digit growth was driven

in particular by a strong increase in liquid gas volumes in

Brazil.

- Healthcare revenue grew strongly by +9.7%, with

no significant contribution from acquisitions. Medical Gases sales

growth was high in the United States, in particular to proximity

care players, where the digital interface cylinder offering has

enjoyed significant success. Activity remained very dynamic in

Latin America, in particular in Colombia.

- Electronics sales were up +2.1% over the year,

driven by strong Carrier Gases growth, whereas Equipment &

Installation sales in the 4th quarter were down markedly, compared

with record level seen in the same period in 2018.

Americas

- Mid-June, Air Liquide announced the signature of two

long-term supply agreements with Marathon Petroleum Company for

a total of up to 900 tonnes per day of oxygen for Marathon

Petroleum’s Refineries in Texas City, Texas and Garyville,

Louisiana. The two agreements nearly double the amount of

oxygen that Air Liquide will supply to Marathon Petroleum in

total. Both sites are located on the Gulf Coast.

- Air Liquide and Shell Chemicals announced in late July

the renewal of contracts for the supply of oxygen,

nitrogen, steam and electricity to Shell’s Scotford facility in

Alberta, Canada. To support this renewed long‑term

commitment, Air Liquide will further enhance its Scotford site

operations, which will support future growth in this key industrial

basin and create additional operational efficiencies.

Europe

Revenue in Europe reached 7,172 million euros over 2019,

up +3.4% on a comparable basis driven by good Healthcare

sales momentum (+5.2%) and a solid growth in Industrial Merchant

(+3.4%), notably thanks to high price impacts and robust volumes.

Large Industries sales (+1.7%) were driven by higher hydrogen

volumes for refineries in Benelux, whereas demand remained weaker

in the Steel and Chemical sectors.

- Large Industries revenue was up +1.7% over the

year. Hydrogen sales were boosted by high demand among refiners

connected to the pipeline network in the Benelux. Activity was

weaker in the Steel sector in Germany and Italy and in Chemicals in

Germany. Sales growth continued in the East, in particular with

final contributions from the ramp-up of an oxygen unit in Turkey

and the takeover of a hydrogen unit in Kazakhstan.

- Industrial Merchant sales growth was very solid in 2019

(+3.4%), driven mainly by high prices (+3.2%) and the

further development of the Food and Pharmaceuticals markets.

Several initiatives creating significant value for both customers

and the Group were launched, focusing the customer portfolio on

applications which justify higher price impacts. At the same time,

the carbon dioxide market recovered from a difficult 2018. Almost

all countries contributed to growth, in particular Eastern Europe

and the United Kingdom which enjoyed double-digit growth.

- Healthcare sales enjoyed strong, fully organic growth of

+5.2%. Growth momentum in Home Healthcare was very dynamic,

notably thanks to a strong increase in the number of patients

treated for diabetes in Scandinavia and France, and for sleep apnea

in France and Spain. Sales of Medical Gases for hospitals improved

despite constant pressure on pricing. The Hygiene activity grew

strongly, through the German subsidiary Schülke.

Europe

- Air Liquide and PAO Severstal, a steel and mining company and

long-term partner of the Group, have announced the signature, in

March, of a new long-term contract for the supply of oxygen,

nitrogen and argon in Cherepovets (Russia). Air Liquide will

invest around 50 million euros in the construction of a

state-of-the art Air Separation Unit (ASU), which will improve

significantly the energy efficiency of the production process and

reduce CO2 emissions by 20,000 tons per year. The new

signature illustrates the Group’s development strategy in key

industrial basins and demonstrates its ability to create value for

its customers.

- In October, Air Liquide announced the signature of a

long-term contract in Kazakhstan. Air Liquide

Munay Tech Gases, a company jointly owned by Air Liquide (75%)

and the Kazakhstan national oil & gas company (25%), will

build, own and operate a new nitrogen unit in a growing chemical

basin, requiring a 15 million euros investment. This new

unit will supply up to 8,000 Nm3/h nitrogen and should be

operational in 2021.

- Air Liquide is pursuing its development in home healthcare

in Europe by broadening its range of services for diabetes

patients in Germany, Belgium, the Netherlands and Luxembourg. The

Group provides home care for 1.7 million patients with

chronic diseases around the world. Air Liquide leverages its

experience in the support of patients with respiratory

diseases, which combines expertise in medical equipment,

personalized patient follow-up and development of associated

digital services.

Asia Pacific

Revenue in the Asia Pacific zone totaled 4,794 million

euros in 2019, up +7.7%. Large Industries sales grew

strongly (+9.7%) thanks to the ramp-up of several units in China.

Industrial Merchant growth was solid (+3.7%), in particular in

China and South-East Asia. Electronics revenue maintained its very

dynamic growth momentum in 2019 (+10.4%) despite a major decline in

Equipment & Installations sales in the 4th quarter compared

with record high sales in 2018.

- Large Industries sales (+9.7%) were driven in

particular by the recent ramp-up of three production units in

China, including the contribution from Fujian Shenyuan, which was

disposed of in early September. Hydrogen sales to refiners also

rose strongly in Singapore.

- In Industrial Merchant, revenue was up by +3.7%

thanks notably to the strong increase in cylinder gas volumes in

China. Liquid gas volumes were up in the Chinese market but did not

offset prices that are now returning to normal levels compared with

high previous years. In South-East Asia, revenue also enjoyed

sustained growth, particularly in Singapore and Malaysia, whereas

the Japanese and Australian markets remained more challenging. The

region benefited from a positive price impact of +1.1%, partly

driven by helium.

- Electronics revenue was up +10.4%, thanks to the

double-digit growth of Carrier Gases which benefited from the

ramp-up of several units, and the growth of Advanced Materials with

the success of the new enScribe™ offering for the etching of

electronic chips, in particular in Korea. Following a strong 1st

half-year, Equipment & Installation sales were down towards the

end of the year compared with the record level seen during the 4th

quarter of 2018.

Asia-Pacific

- In mid-September, Air Liquide announced the signature of a

long-term contract for the supply of hydrogen to Shell’s

Tabangao refinery in the Philippines. Air Liquide will

invest 30 million euros in the construction of a

state-of-the-art Hydrogen Manufacturing Unit (HMU) that will be

fitted with a CO2 recovery unit that mitigates direct carbon

emission levels by capturing and liquifying the CO2 for other

uses.

- Air Liquide announced in late-October the acquisition of

Southern Industrial Gas Sdn Bhd (SIGSB), a key Malaysian

industrial gas player with approximately 20 million euros of

annual revenue. This operation doubles Air Liquide’s Packaged

Gases filling capacity in Malaysia and is expected to deliver

significant synergies with its current operations in the country,

which now covers most of Malaysia.

Middle East and Africa

Revenue in the Middle East and Africa zone amounted to 614

million euros, up +1.5% over 2019. Industrial Merchant

remained very dynamic in the Middle East, Egypt and India, with

strong helium sales in particular. Activity was up slightly in

Large Industries, with the major units in the region, located in

Saudi Arabia and South Africa, now operating at full capacity. The

Healthcare activity continued to grow in Egypt and Saudi

Arabia.

Engineering & Construction

Consolidated Engineering & Construction revenue, at

328 million euros, was down compared with 2018, with

resources mainly allocated to internal projects in Large Industries

and Electronics. Total sales including Group projects were up,

boosted by a record-high level of investment decisions, in

particular in Large Industries.

Order intake for Group projects and third-party customers

totaled 838 million euros at the end of December 2019, a

slight increase compared with 2018. They came from Asia, followed

by Europe and the Americas. These orders are mainly related to Air

Separation Units for the Chemicals and Metals industries, and

ultra-pure nitrogen production units for the semiconductor

industry.

Global Markets & Technologies

Global Markets & Technologies revenue was up +14.9%

in 2019 at 552 million euros. Biomethane grew strongly

thanks to the ramp-up of several units in Europe. Sales of

equipment related to the Turbo Brayton technology, which reduces

greenhouse gas emissions through the reliquefaction of natural gas

when transported by sea, also strongly contributed to this

growth.

Order intake for Group projects and third-party customers was up

+13.7% and totaled 523 million euros, of which more than 100

million euros are for equipment based on the Turbo Brayton

technology.

Innovation and Global Markets & Technologies

- Air Liquide inaugurated in March its Tokyo Innovation Campus

in Japan. This newest Campus, representing an investment of

50 million euros, illustrates the Group’s open innovation

approach, with a focus on energy transition and environment,

healthcare, digital transformation and development of Advanced

Materials for Electronics. It will gather nearly 200

employees in a state-of-the art new 8,000‑square-meter

site.

- In April, Air Liquide announced having signed more than 20

contracts worth a total of 100 million euros thanks to a

solution that reduces greenhouse gas emissions for the maritime

industry. The Group developed a refrigeration and liquefying

technology based on the Turbo-Brayton physical principle, which

reliquefies the evaporated natural gas in LNG (Liquefied Natural

Gas) vessels and keeps it under its liquid form in the container.

With these contracts, Air Liquide is helping to prevent more

than 120,000 tonnes of CO2‑equivalent emissions per year.

- Air Liquide and Houpu (Chengdu Huaqi Houpu Holding co.)

announced at the end of April the finalization of the creation of

Air Liquide Houpu Hydrogen Equipment, a joint venture for the

development, production and distribution of hydrogen refueling

stations for Fuel Cell Electric Vehicles. This collaboration

will combine Air Liquide’s global technological expertise in clean

hydrogen mobility solutions with Houpu’s leadership in the

production and construction of natural gas refilling stations on

the Chinese market.

- In early September, Air Liquide signed a Memorandum of

Understanding with Equinor and its partners (Shell and Total) to

explore collaboration in a CO2 capture and storage project,

Northern Lights. The Northern Lights project is aimed to mature

the development of offshore carbon storage on the Norwegian

Continental Shelf and has the potential to be the first storage

project site in the world receiving CO2 from industrial sources in

several European countries.

- In mid-September, Air Liquide announced the launch of

Qlixbi, a breakthrough packaged gas offer including a new

generation of gas cylinder and a suite of digital solutions

designed to revolutionize the customer experience in welding.

Developed in collaboration with more than 700 welding customers,

this innovation will improve the way they use and manage gases in

their daily operations thanks to a revolutionary connector (“Click

& Weld”), a reserve indicator on the cylinder combined with an

IoT (“Internet of Things”) system and a digital application.

- In November, Air Liquide and Sinopec have signed a

Memorandum of understanding in order to accelerate the

deployment of hydrogen mobility solutions in China. Under

the agreement, Air Liquide will provide its expertise so as to

develop competitive hydrogen solutions for the world’s largest

mobility market. It will reinforce the long-term partnership

between Air Liquide and Sinopec.

- Air Liquide, the Durance, Luberon, Verdon urban area (DLVA)

and Engie have entered into an ambitious partnership in

November to develop the “HyGreen Provence'' project, which

aims at producing, storing and distributing green hydrogen.

Initiated in 2017, it will make possible the production of 1,300

GWh of solar electricity as well as the production of

renewable hydrogen on an industrial scale through water

electrolysis. It will meet a very broad spectrum of needs from

transportation to heating. The first deliverable stages should

occur by the end of 2021.

OPERATING INCOME RECURRING

Operating income recurring before depreciation and

amortization reached 5,932 million euros, up by a strong

+13.7% as published compared with 2018 and +8.6%

excluding the application of IFRS 16. Under IFRS 16, operating

expenses linked to lease contracts are now accounted for as

depreciation and amortization and financial expenses, which

explains the minor increase of +1.5% in other operating expenses

and income. Purchases were down -1.5%, thanks mainly to the

decrease in natural gas prices, lower hardgoods sales and the

impact of the efficiency program. Personnel costs were up

+6.4%, mainly due to acquisitions, in particular that of Tech Air

in the United States, and the increase in the number of employees

to support the growth of Home Healthcare which is a labor-intensive

business.

Depreciation and amortization reached 2,138 million

euros, up markedly by +21.0% due to the application of IFRS 16.

Despite the impact of the start-up and ramp-up of new production

units, the increase in depreciation and amortization was limited to

+4.5% excluding the currency impact and the application of IFRS

16.

In 2019, efficiencies increased markedly by +23.4%

to 433 million euros, compared with 351 million euros in

2018. These represented savings of 2.7% of the cost base and

largely exceeded the objective, which had been set at more than 400

million euros after the reinforcement of the program at the

beginning of the year. The main drivers of this increase in

efficiencies are the roll-out of digital tools, the continuation of

the realignment plans and the ramp-up of Airgas within the program.

In total, more than 60% of efficiencies are from industrial

projects, which target in particular a decrease in logistics costs

and the optimization of production units, around 30% relate to

purchasing gains and almost 10% to transformation initiatives,

notably the restructuring of operations. The contribution from the

roll-out of digital tools is increasing. In addition, employee

training on continuous improvement initiatives supported the

efficiency program.

Efficiencies

- Early May, Air Liquide and STMicroelectronics announced a

collaborative initiative on digital transformation to

accelerate the development of digital solutions for industrial

applications. This cooperation will extend the long-standing

business relationship established over the past decades between

both companies.

The Group’s operating income recurring (OIR) reached

3,794 million euros for 2019, a published increase of

+10.0%, or +7.5% on a comparable basis. The operating margin

(OIR to revenue) stood at 17.3%, a marked improvement of

+90 basis points compared to 2018 and of +70 basis

points excluding the energy impact, including +10 basis points

from the initial application of IFRS 16.

The improvement in operating margin was driven by three factors:

an increase in prices as part of a process to create value for

customers and measures in favor of the product mix; the first

results from the strengthening of the efficiencies program; and

active business portfolio management.

Gas & Services

Operating income recurring for Gas & Services amounted to

4,028 million euros, an increase of +9.5% as published, and

+7.2% on a comparable basis compared to 2018. The Gas &

Services operating margin stood at 19.1%, an

improvement of +80 basis points and of +60 basis

points excluding the energy impact, including +10 basis points

from the initial application of IFRS 16.

Gas & Services Operating margin

(a)

2018

2019

2019, excluding energy

impact

2019/2018 change, excluding

energy impact

Americas

17.2%

18.2%

18.1%

+90 bps

Europe

19.2%

20.0%

19.5%

+30 bps

Asia-Pacific

19.2%

19.8%

19.8%

+60 bps

Middle East & Africa

16.0%

17.9%

16.1%

+10 bps

TOTAL

18.3%

19.1%

18.9%

+60 bps

(a) Operating income recurring/revenue, as

published figures

Operating income recurring for the Americas region stood

at 1,537 million euros for 2019, a strong increase of

+12.2% as published due in particular to the acquisition of

Tech Air in the United States at the end of the 1st quarter of

2019. Excluding the energy impact, the operating margin stood at

18.1%, an increase of +90 basis points. This improvement was

notably thanks to Airgas, which deployed a voluntarist price

management approach in Industrial Merchant as well as major

efficiencies generated in all business lines, and to portfolio

management. The decrease in hardgoods sales in the United States

generated a positive mix impact on the margin.

Operating income recurring in Europe reached 1,431

million euros, an increase of +4.6%. Excluding the

energy impact, the operating margin stood at 19.5%, a +30 basis

points increase mainly due to the rollout of applications

offering higher added value which generated stronger price impacts

in Industrial Merchant as well as efficiencies generated across all

business lines.

Operating income recurring in Asia Pacific stood at

951 million euros, an increase of +13.6%. The

operating margin excluding the energy impact reached 19.8%, up

+60 basis points. Price impacts were sustained in Industrial

Merchant, in particular for helium, and all business lines

contributed to margin improvement with high levels of efficiencies.

Several Large Industries and Electronics start-ups also contributed

to the margin improvement.

Operating income recurring for the Middle East and Africa

region amounted to 109 million euros, representing an

increase of +4.5%. Excluding the energy impact, the

operating margin was 16.1%, an increase of +10 basis points

due to high price impacts, in particular in Healthcare.

Engineering & Construction

Engineering & Construction generated an operating income

recurring of 9 million euros in 2019. The business line

benefited from the Group’s investment momentum and the increase in

order intake. The operating margin stood at 2.7% and should

continue to improve progressively to reach a medium-term margin of

between 5% and 10%.

Global Markets & Technologies

Operating income recurring for Global Markets & Technologies

stood at 67 million euros with an operating margin at 12.2%,

representing a significant increase of +170 basis points

compared to 2018. A portion of these activities is in the start-up

phase and the margin level, which depends on the nature of the

projects carried out during the period, may vary significantly.

Research & Development and Corporate costs

Research & Development expenses and Corporate costs stood at

311 million euros, a +12.3% increase compared to 2018, due

mainly to the development of innovation and the ramping-up of the

Group’s digital transformation.

Research & Development

- Early June, Air Liquide inaugurated, at its new Paris

Innovation Campus, Accelair, an entity dedicated

exclusively to deeptech start-ups. In line with its open

innovation strategy, the Group will welcome approximately twenty

start-ups, which will benefit from dedicated workspaces and a

support program with Air Liquide experts.

- Three winners of the 2018 Scientific Challenge were

rewarded at the end of June by Air Liquide out of more than 132

proposals from 34 countries. Teams of researchers, start-ups and

private or public institutes were invited to submit scientific

research projects aimed at improving air quality and fighting

climate change. The three winners received the “Air Liquide

Scientific Prize” endowed with 50,000 euros and have signed a

partnership agreement with the Group that will enable them to

receive 1.5 million euros in funding, shared between the three

projects.

NET PROFIT

Other operating income and expenses showed a net

balance of -188 million euros. This notably included 95 million

euros in expenses relating to realignment plans in various

countries and businesses as well as the capital loss on the

disposal of the Fujian Shenyuan units which was completed in

September 2019.

The financial result amounted to -468 million

euros compared with -353 million euros in 2018. Cost of net

debt, at -362 million euros, was up 58 million euros, mainly

due to a non-recurring gain of around 55 million euros relating to

debt restructuring in the United States in 2018. The average

cost of net debt, at 3.0%, was stable compared to 2018

and down slightly excluding the impact of hyperinflation in

Argentina. Other financial income and expenses amounted to

-106 million euros compared with -49 million euros in 2018. This

increase was mainly due to the application of IFRS 16 for close to

40 million euros.

Income tax expense stood at 802 million euros,

which corresponds to an effective tax rate of 25.5% in 2019.

This +60 basis points increase compared to 2018 was notably due to

the non-deductibility of the capital loss on the disposal of the

Fujian Shenyuan units.

The share of profit of associates amounted to 1 million euros

and the share of minority interests in net profit reached

96 million euros, stable compared to 2018 excluding the

currency impact.

Net profit (Group share) amounted to 2,242 million

euros in 2019, an increase of +6.1% as published and

+6.7% excluding the application of IFRS 16.

Excluding the capital loss on the disposal of the Fujian

Shenyuan units in 2019 and the non-recurring financial gain in

2018, recurring net profit(5) Group share, was up

+11.1%.

Net earnings per share, at 4.76 euros, were up

significantly (+5.9%) compared to 2018, in line with the

increase in net profit (Group share). The average number of

outstanding shares used for the calculation of net earnings per

share as of December 31, 2019 was 471,214,966.

5 See definition and reconciliation in the

Appendix.

Change in the number of shares

2018

2019

Average number of outstanding shares

(a)

426,674,123

471,214,966

Number of shares as of December 31,

2018

429,423,434

Options exercised during the year, prior

to the free share attribution

430,376

Cancellation of treasury shares

(953,000)

Free shares issued

44,117,721

Options exercised during the year, after

the free share attribution

86,983

Number of shares as of December 31,

2019

473,105,514

(a) Used to calculate net earnings per

share and adjusted in 2018 for the free share attribution that took

place on October 9, 2019.

DIVIDEND

At the Annual General Meeting on May 5, 2020, the payment of a

dividend of 2.70 euros per share will be proposed to

shareholders for the fiscal year 2019. Following the free share

attribution of 1 for 10 in October 2019, the proposed dividend

shows a strong growth of +12.4% compared with last year. The total

estimated pay-out taking into account share buybacks and

cancellations would amount to 1,311 million euros,

representing a pay-out ratio of 58% of the published

net profit. The ex-dividend date is scheduled for May 11, 2020 and

the payment is scheduled for May 13, 2020.

2019 Cash Flow and Balance

Sheet

(in millions of euros)

2018 restated (a)

2019

Cash flow from operating activities

before change in working capital

4,242

4,859

Change in working capital requirement

613

(37)

Other cash items

(139)

(110)

Net cash flow from operating

activities

4,716

4,712

Dividends

(1,234)

(1,237)

Purchases of property, plant and equipment

and intangible assets, net of disposals (b)

(2,271)

(2,616)

Increase in share capital

138

39

Purchase of treasury shares

(64)

(148)

Lease liabilities repayments and net

interests paid on lease liabilities

(287)

Impact of exchange rate changes and net

indebtedness of newly consolidated

companies & restatement of net finance

costs

(449)

(301)

Change in net debt

836

162

Net debt as of December 31

(12,535)

(12,373)

Debt-to-equity ratio as of December

31

69%

64%

(a) The adjustment for income and expenses

with no cash impact related to IAS19 and IFRS2 have been

reclassified from Other cash items to Other non cash items in 2018.

See data published in 2018 in appendix.

(b) Including transactions with minority

shareholders.

NET CASH FLOW FROM OPERATING ACTIVITIES AND CHANGES IN

WORKING CAPITAL REQUIREMENT

Cash flow from operating activities before changes in working

capital requirement totaled 4,859 million euros and stood at

22.2% of Group sales (21.0% excluding the application of

IFRS 16). This represented strong published growth of +14.5%

(+8.3% excluding the application of IFRS 16).

Working capital requirement (WCR) increased by 37 million

euros in 2019. In Engineering & Construction, advances from

third-party customers were lower due to a refocus of the activity

on internal projects. Gas & Services WCR also increased, in

line with the growth of the activity. Working capital requirements

excluding tax came to 4.4% of sales, in line with the 2018

level.

Net cash flow from operating activities after changes in

working capital requirement amounted to 4,712 million

euros and reached 21.5% of sales. Note that working

capital requirements had been reduced markedly in 2018 due to the

implementation of a program to dispose of significant receivables,

in particular at Airgas. These programs stabilized in 2019.

Therefore, in 2019, the strong growth in cash flow from operating

activities coupled with the marginal change in WCR has allowed to

generate a high level of net cash flow from operating activities

after changes in working capital requirement, stable compared

with 2018.

CAPITAL EXPENDITURE

Gross capital expenditure totaled 3,205 million

euros, including transactions with minority shareholders. This

reflects a marked increase in industrial investments and the

acquisition of Tech Air, which contributes significantly in

expanding Airgas’ geographical coverage in the United States.

(in millions of euros)

Industrial investments

Financial

investments(a)

Total capital

expenditures(a)

2015

2,028

395

2,423

2016

2,259

12,180

14,439

2017

2,183

144

2,327

2018

2,249

131

2,380

2019

2,636

568

3,205

(a) Including transactions with minority

shareholders

Proceeds from the sale of fixed assets totaled 584

million euros, mainly due to the disposal of Fujian Shenyuan’s

units which was finalized in September. These also included, to a

lesser extent, the disposal of an Airgas safety services business.

A total of six divestitures were completed in 2019, reflecting the

Group’s active business portfolio management.

Net capital expenditure, including the buyout of minority

interests, amounted to 2,616 million euros.

Industrial capital expenditure

In 2019, gross industrial capital expenditure for the Group

amounted to 2,636 million euros, a major increase of +17.2%

compared to 2018. It represented 12.0% of sales. For Gas

& Services, this expenditure totaled 2,411 million euros

and its geographical split is described below.

Gas & Services

(in millions of euros)

Europe

Americas

Asia Pacific

Middle East and Africa

Total

2018

676

861

461

73

2,071

2019

815

946

588

62

2,411

Financial investments

Financial investments reached 537 million euros in 2019,

mainly due to the acquisition of Tech Air in the United States. A

total of 24 acquisitions were completed in 2019.

NET DEBT

Net debt at December 31, 2019 reached 12,373 million

euros. Despite a major increase in the level of investments and

an unfavorable currency impact, net debt was down -162 million

euros compared to the end of 2018, thanks to the marked increase in

cash flow from operating activities in 2019. The net

debt-to-equity ratio stood at 64.0% at the end of

December 2019, an improvement of -480 basis points compared to the

end of 2018.

ROCE

The return on capital employed after tax (ROCE)(6) was 8.4% at

the end of 2019. Recurring ROCE(6) which excludes the

capital loss on the disposal of the Fujian Shenyuan units on net

profit, stood at 8.6%, i.e. a +60 basis points

improvement compared to the end of December 2018. This improvement

is in line with the Group’s NEOS target of returning to a ROCE of

above 10% by 2021-2022.

6 See definition and reconciliation in

Appendix.

Environment and society

SAFETY

Employees lost time accident frequency rate(7) improved and

reached 1.2 at the end of 2019. This represents the lowest lost

time accident frequency rate of the last 20 years. This

improvement is particularly noticeable at Airgas, which has now

deployed the overall Air Liquide protocol.

CLIMATE

Air Liquide announced its Climate objectives on November 30,

2018, including in particular the reduction of its carbon

intensity by 30% between 2015 and 2025. As part of its

global approach to climate, the Group not only seeks to reduce the

carbon intensity of its assets, but also to act with its customers

towards a sustainable industry and to contribute to the development

of a low-carbon society.

In 2019, the Group’s carbon intensity declined further

and reached 4.6 kg of CO2 equivalent per euro of EBITDA(8).

It is lower than the initial forecast, notably from the disposal of

the Fujian Shenyuan units but also because of several customer

maintenance turnarounds, leading to lower production volumes.

In January 2020, the Group's commitment has been rewarded twice

by the CDP(9), who gave Air Liquide the highest grade

"A" both for its actions in favor of climate and its

sustainable management of water. More than 8,400 companies made

data about their environmental impacts available to CDP (with a

focus on climate, water and forests) for independent assessment

purposes. Of those companies, only 38 scored a triple or double

“A”, among which 3 French companies, including Air Liquide.

Climate

- In July, Air Liquide and thyssenkrupp Steel announced to

join forces in a pioneering project to develop lower carbon

steel production. For the first time, hydrogen will be injected

to partially replace pulverized coal at a large scale in the blast

furnace during steel production reducing CO2 emissions. Air Liquide

will ensure to its client a stable supply of hydrogen from its 200

km network in the Rhine-Ruhr Area.

- Air Liquide announced in mid-October a partnership with

ArcelorMittal in a pilot project in Belgium to capture

carbon emissions from the steelmaking process and recycle them into

bioethanol. Air Liquide Engineering & Construction will

provide a technology solution to purify the offgas coming from the

blast furnace. These gases will then be injected into a bioreactor

to produce bioethanol.

HUMAN RESOURCES

As part of its NEOS program, the Group has set objectives that

promote age and gender diversity. With this in mind, the Group

targets to hire 33% of young graduates among managers and

professionals by 2025. In addition, Air Liquide had 29% of women

among engineers and managers in 2019 and aims to reach 35% by

2025.

7 Number of lost-time accidents with at

least one lost day per million hours worked by Group employees.

8 At 2015 exchange rate.

9 A non-profit organization that evaluates

companies based on their climate action.

INVESTMENT CYCLE AND FINANCING

Investments

The strong momentum of investment projects continued and was

reflected in the high level of the main indicators described

below.

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

(in billions of euros)

Industrial investment

decisions

Financial investment decisions

(acquisitions)

Total investment

decisions

2015

1.9

0.5

2.4

2016

2.0

12.2

14.2

2017

2.4

0.2

2.6

2018

3.0

0.2

3.1

2019

3.2

0.6

3.7

Industrial and financial investment decisions represented

a total of 3.7 billion euros in 2019, a +19.8%

increase compared with 2018.

Financial investment decisions totaled 580 million

euros and included the acquisition of Tech Air in the United

States at the end of the 1st quarter, one of the largest

independent distributors of industrial gases and welding supplies

in the United States. The Group also acquired a stake of almost 20%

in the capital of Canada-based Hydrogenics, a leader in equipment

for hydrogen production through PEM (Proton Exchange Membrane)

electrolysis. Other bolt‑on acquisitions were carried out, in

particular in Industrial Merchant in Asia and North America and in

Healthcare in Europe.

Financial Investment decisions

- Airgas, an Air Liquide company, completed in March the

acquisition of Tech Air, one of the largest independent

distributors of industrial gases and welding supplies serving

various geographies in the United States. Serving more than

45,000 customers and generating annual revenue of

approximately 190 million US dollars, Tech Air will allow

Airgas to further strengthen its network in the United States with

a complementary footprint to better serve customers while

generating very significant efficiencies.

- In January 2019, Air Liquide announced the acquisition of a

nearly 20% stake in the capital of the Canadian company Hydrogenics

Corporation, representing an investment of 20.5 million US

dollars (18 million euros). In February, the Group announced

the construction in Canada of the largest membrane-based

electrolyzer in the world to develop its carbon-free

hydrogen production. This 20 megawatts electrolyzer,

with Hydrogenics technology, allows the Group to reaffirm

its long-term commitment to the hydrogen energy markets and its

ambition to be a major player in the supply of carbon-free

hydrogen.

- Mid-June, Air Liquide announced the acquisition of Medidis

in the Netherlands, a major player for the treatment of

respiratory diseases at home and the production and supply of

medical oxygen. The acquisition of this Dutch actor, employing more

than 70 people and generating revenue of approximately 11

million euros in 2017, allows Air Liquide, present in the home

healthcare market in the Netherlands for more than 20 years, to

strengthen its position in a growing market.

- Air Liquide continues to develop its home healthcare activity

in Europe with the acquisition of Sleep & Health SA and

Megamed AG, two historic players in this sector and based in

Switzerland. These acquisitions enable the Group to serve more than

3,000 new patients and strengthen the position of Air

Liquide, leader in home healthcare in Europe, in a growing market

within a mature healthcare system.

- Air Liquide, Europe’s leader in home healthcare, announced in

April the acquisition of the Spanish startup DiaLibre. With

this acquisition, the Group reinforces its service offering

throughout the diabetic patient's care pathway, from the

distribution of medical equipment to the personalized support of

diabetic patients. DiaLibre’s offering combines personalized

therapeutic support programs and medical follow‑up for patients

using innovative technologies.

Industrial investment decisions reached a record high of

3,157 million euros, with major investments for long-term

contracts with Large Industries customers, mainly in strategic

basins where the Group is already present. More than 410 million US

dollars were invested in the United States for new Air Separation

Units and the development of the Gulf Coast pipeline

network. Between 2015 and 2022, Air Liquide will have almost

doubled its oxygen production capacity in the United States.

Investments in Electronics continued, mainly in Asia, and those

contributing to efficiencies were up by nearly +45%

compared with 2018. Investments contributing to efficiencies now

represent more than 10% of the amount of industrial

decisions. The number of decisions relating to contract renewals

also increased. Finally, close to 30% of industrial

investment decisions contributed to the Group’s Climate

objectives.

Industrial investment decisions

- Air Liquide has signed a long-term agreement with Gulf Coast

Growth Ventures (GCGV) at the beginning of July, a 50/50 joint

venture between ExxonMobil and SABIC. The Group will supply

2,000 tons per day of oxygen and 900 tons per day of nitrogen

from its industrial gas pipeline network to GCGV’s planned

ethane cracker facility located near Corpus Christi, in Texas. To

support the new agreement and additional volumes, Air Liquide plans

to invest nearly 140 million US dollars to build a new

world-scale Air Separation Unit and related infrastructure

investments.

- In mid-September, Air Liquide announced an investment of

more than 270 million US dollars in the U.S. Gulf Coast to

support a new long-term agreement with Methanex Corporation

to supply oxygen, nitrogen and utilities. To serve Methanex

and its other customers in the industrial basin that encompases

Geismar and Baton Rouge, Air Liquide will build two new Air

Separation Units with a capacity of 2,500 tons/day of oxygen

each and invest in connected infrastructure assets -

increasing the company’s Mississippi River Pipeline’s

supply capacity by more than 25%.

The total investment backlog amounted to 2.8 billion

euros, a marked increase of more than 600 million euros

compared with the end of 2018, as new investment decisions more

than offset the start-up of new units. These investments should

lead to a future contribution to annual sales of approximately

0.9 billion euros per year after the full ramp-up of the

units.

START-UPS

There were 18 start-ups during 2019. These included

several production units for Electronics in Asia and for

Large Industries in most regions. A new pipeline network at

a major industrial basin in Saudi Arabia was also commissioned in

2019.

The contribution to sales of unit start-ups and ramp-ups

totaled 336 million euros for 2019. This mainly included

additional sales for Large Industries in China particularly

with the final contributions from Fujian Shenyuan, the disposal of

which was finalized in September 2019, in Mexico with the start-up

of a hydrogen-supply contract, and in Eastern Europe.

Electronics sales also benefited from several unit start-ups

and ramp-ups in Asia.

For 2020, the contribution to sales of unit start-ups and

ramp-ups is forecasted at around 230 million euros, and

should be higher in 2021, boosted by several major start-ups.

INVESTMENT OPPORTUNITIES

The 12-month portfolio of opportunities remained strong

and totaled 2.9 billion euros, an increase compared with 2.6

billion euros at the end of 2018. New projects entering the

portfolio exceeded those signed by the Group, awarded to the

competition or delayed.

The portfolio of opportunities is fairly well balanced

geographically: Europe and Asia are the leading regions within the

portfolio, followed by the Americas and Middle East & Africa

with similar levels of opportunities. Almost two‑thirds of the

portfolio of opportunities came from projects in Large Industries,

in particular for Chemicals; Electronics was the second largest

contributor, followed closely by Global Markets &

Technologies.

Around half the value of the portfolio came from projects with

investment amounts of less than 50 million euros, and several

projects are above 100 million euros. The portfolio included some

asset takeover opportunities that would have a faster contribution

to growth. A positive contribution to the Group’s Climate

objectives was identified for around a quarter of the amount of

investment opportunities.

2019 Financing

“A” CATEGORY FINANCIAL RATING CONFIRMED

Air Liquide is rated by two

main rating agencies, Standard & Poor’s and Moody’s. The

long-term rating from Standard & Poor’s is “A-” and from

Moody’s is “A3”. These are in line with the Group’s strategy. The

short-term ratings are “A2” for Standard & Poor’s and “P2” for

Moody’s. Standard & Poor’s confirmed its rating on July 22,

2019 and upgraded its outlook from stable to positive. Moody’s

confirmed its ratings on June 28, 2019 and maintained its stable

outlook.

DIVERSIFYING AND SECURING FINANCIAL SOURCES

As of December 31, 2019, financing through capital markets

accounted for 92% of the Group’s total debt, for a total

amount of outstanding bonds of 12.1 billion euros, under

several programs, and 0.2 billion euros of commercial

paper.

The total amount of credit facilities was stable at 3.6

billion euros. At the beginning of December, five bilateral

credit facilities, for a total amount of 500 million euros, were

included in the syndicated credit facility negotiated in 2018 for

an initial amount of 2 billion euros. The first one-year extension

option has been applied to this facility, which now amounts to

2.5 billion euros, maturing in December 2024, with a second

extension option possible. On this occasion, this credit facility

was indexed to Corporate Social Responsability (CSR) criteria.

New financing mecanism

- In early December, Air Liquide signed an amendment to its

syndicated credit line that implements from now on a

correlation scheme between its financial costs and three of its

CSR targets regarding its carbon intensity, gender diversity

and safety. Air Liquide testifies through this initiative its

willingness to combine performance and responsibility.

The amount of total debt maturing in the next 12 months is 1.8

billion euros, a marked decrease compared to the amount at December

31, 2018.

2019 issues

In June 2019, under its EMTN program, the Group issued an 11

year public bond for an amount of 600 million euros. In

September 2019, the Group also issued a 10 year bond in 144A format

in the US market, for an amount of 500 million US

dollars.

Moreover, as of the end of 2019, outstanding bonds issued under

the EMTN program amounted to 6.4 billion euros (nominal

amount).

Bonds

- In early September, Air Liquide issued bonds on the American

market for an amount of 500 million US dollars with a 10-year

maturity at a yield of 2.362%. With this transaction, the Group

confirms its willingness to foster long-term relationships with

American credit investors.

Net debt by currency as of December 31

31/12/2018

31/12/2019

Euro

45%

45%

US dollar

37%

40%

Chinese renminbi

3%

0%

Japanese Yen

3%

2%

Other

12%

13%

TOTAL

100%

100%

Investments are generally funded in the currency in which the

cash flows are generated, creating a natural currency hedge.

In 2019, net debt in euros was stable in terms of volume and

percentage. Debt in US dollars increased slightly, mainly due to

currency impact. Net debt in Chinese renminbi decreased, due to the

divestiture of the Fujian Shenyuan units by Air Liquide China. Debt

denominated in Japanese yen decreased in volume and percentage, as

the cash flows generated were used to repay a portion of the

debt.

CENTRALIZATION OF CASH AND FUNDING

Air Liquide Finance pools the cash balances of Group entities.

In 2019, Air Liquide included the New Zealand dollar in its daily

cash pooling, which now covers 15 currencies.

As of December 31, 2019, Air Liquide Finance had granted to

Group entities, directly or indirectly, the equivalent of 15.3

billion euros in loans and received 3.9 billion euros in

excess cash as deposits from them. These transactions were

denominated in 29 currencies (primarily the euro, US dollar,

Singapore dollar and Chinese renminbi). 390 Group entities lend,

borrow or are included in the Group cashpooling, directly or

indirectly (including subsidiaries where cash pooling is carried

out locally before being centralized at Air Liquide Finance).

DEBT MATURITY AND SCHEDULE

The average of the Group’s debt maturity was 6.2 years at

December 31, 2019, an increase compared to December 31, 2018.

Indeed, some bond issues matured in 2019 without renewal, thanks to

the generation of net cash flow in 2019.

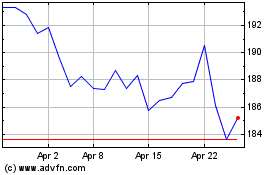

The following chart shows the Group’s debt maturity schedule.

The single largest annual maturity represented approximately 13% of

total debt.

OUTLOOK

2019 is a landmark year, characterized simultaneously by a

significant improvement in performance, a high level of investments

to serve customers and strengthen efficiency, and the operational

implementation of the Group’s climate action plan.

2019 sales were driven by the development of Gas & Services

and Global Markets & Technologies. On a comparable basis,

all Gas & Services activities, which account for

96% of Group revenue, progressed over the

year, with particularly dynamic Electronics and

Healthcare. Geographically, every region grew, notably the

Europe and Asia‑Pacific regions.

Overall, and despite the expected global economic slowdown

observed in the 4th quarter, the Group delivered robust

results, confirming the relevance of its economic model and

strategy.

The improvement in the Group’s operating margin reflects

the dynamic management of both pricing and product mix, the asset

portfolio, and efficiencies. The latter reached 433

million euros. Cash flows were high and the debt to equity

ratio declined substantially. The Group’s balance sheet is solid.

ROCE continues to improve. 2019 performance is in

line with all of the targets of the NEOS program and the

Group’s Climate objectives.

In a context where industrial opportunities remain high,

investment decisions rose sharply, to 3.7 billion

euros. The new projects that have been signed with clients in

Large Industry and Electronics will allow the Group to further

strengthen its position in major industrial basins.

The Group starts the year with confidence in a context