EarthRenew Announces $5 Million Private Placement

June 09 2020 - 8:30AM

EarthRenew Inc. (CSE:ERTH) (“

EarthRenew” or the

“

Company”) is pleased to announce that it intends

to complete a best efforts partially brokered private placement

financing of up to 16,666,667 units (each, a

“

Unit”) at a price of $0.30 per Unit for gross

proceeds of up to $5,000,000 (the “

Offering”).

Each Unit will consist of one common share of the Company (each, a

“

Common Share”) and one-half of

one Common Share purchase warrant (each whole warrant, a

“

Warrant”), entitling the holder to acquire one

additional Common Share at an exercise price of $0.45 for a period

of 24 months from issuance. If at any time after four months and

one day from the closing of the Offering, the Common Shares trade

at $0.90 per Common Share or higher on the Canadian Securities

Exchange (“

CSE”) for a period of 30 consecutive

days, the Company will have the right (but not the obligation) to

accelerate the expiry date of the Warrants to the date that is 30

days after the Company issues a news release announcing that it has

elected to exercise this acceleration right. The Company expects

that certain members of its management team and board of directors

will, in the aggregate, subscribe for at least 10% of the Units

sold under the Offering.

All securities issued in connection with the

Offering will be subject to a statutory hold period of four-months

and one day. Completion of the Offering is subject to a number of

conditions. The Company intends to use the net proceeds of the

Offering for capital equipment purchases, engineering and

construction costs for the redevelopment of the Strathmore

facility, feasibility studies on future projects, field and

research trials, market development activities, working capital for

the ramp-up of our operations at the Strathmore facility and

general corporate purposes. The Offering is expected to close on or

about June 30, 2020.

Finder’s fees may be paid to eligible finders in

accordance with the policies of the CSE consisting of a cash

commission equal to up to 7% of the gross proceeds raised under the

Offering and finder warrants (“Finder

Warrants”) in an amount equal to up to 7% of the

number of Units sold pursuant to the Offering. Each Finder Warrant

will entitle the holder thereof to purchase one Common Share at a

price of $0.45 per Common Share for a period of 24 months following

the closing date of the Offering.

About EarthRenew

EarthRenew transforms livestock waste into a

high-performance organic fertilizer to be used by organic and

traditional growers in Canada and the United States. Located on a

25,000 head cattle feedlot, our flagship Strathmore plant is

capable of producing up to four megawatts (MW) per hour of low-cost

electricity powered by a natural gas fired turbine. The exhausted

heat from the turbine is used to convert manure into certified

organic fertilizer.

For additional information, please contact:

Keith Driver CEO of EarthRenew Phone: (403) 860-8623

E-mail: kdriver@earthrenew.ca

Cautionary Note Regarding

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, but is not

limited to, statements with respect to the Offering, including the

Company’s intended use of proceeds, closing conditions and timing,

the participation in the Offering by certain members of the

Company’s management team and board of directors, and other matters

related thereto. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or statements that certain actions, events or results

“may”, “could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; regulatory risks; and other risks of the

energy, fertilizer and cryptocurrency industries. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

Neither the Canadian Securities Exchange nor its

Market Regulator (as that term is defined in the policies of the

Canadian Securities Exchange) accepts responsibility for the

adequacy or accuracy of this release.

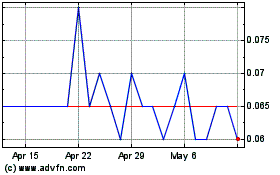

Replenish Nutrients (CSE:ERTH)

Historical Stock Chart

From Nov 2024 to Dec 2024

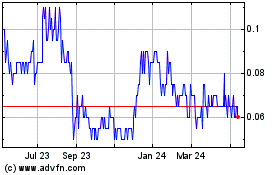

Replenish Nutrients (CSE:ERTH)

Historical Stock Chart

From Dec 2023 to Dec 2024