Back Into Crab Mode, Bitcoin Bullish Potential Capped For The Coming Months?

July 12 2022 - 11:00AM

NEWSBTC

Bitcoin is back below $20,000 and seems on track to re-test the

bottom of its current range. The cryptocurrency was showing signs

of recovery, but it was rejected near the critical resistance zone

at around $22,000. Related Reading | Tezos (XTZ) Nears 3-Week

High – Can Bulls Barrel Towards $1.80? At the time of writing,

BTC’s price trades at $19,800 with a 3% and 2% loss in the last 24

hours and 7 days respectively. In a recent market update, trading

desk QCP Capital addressed the factor that might contribute to

BTC’s price moving sideways for the foreseeable future. These

included the upcoming Mt. Gox redemptions, and global inflation. On

the probability of the Mt. Gox repayments negatively impacting

Bitcoin and the crypto market, QCP Capital wrote: It is impossible

to be certain about the exact impact, given the numerous

cross-arguments and theories surrounding the release. Our main

takeaway is that there is a high chance of BTC supply flooding the

market soon. In the best-case scenario, Bitcoin will face downside

pressure allowing Ethereum and other altcoins to gain some

breathing room. The sector might record some gains after an

extended period of increased Bitcoin dominance. The worst-case

scenario is additional selling pressure for Bitcoin, as QCP Capital

said, and the entire crypto market pushing prices to their yearly

lows or deeper into bear market territory. A lot depends on Mt.

Gox’s unlock schedule, and if the victims will succumb to market

uncertainty or wait for BTC’s price to reclaim previous highs. QCP

Capital made the following prediction on what could be in store for

Bitcoin in the short term. We’re not outrightly bearish at these

spot levels but we think the sudden demand for call structures

might have pushed the risk reversal levels a bit too much to the

topside. Our base case continues to be sideways trading with the

risk of sharp dips and upside capped (…). What Could Push Bitcoin

Back Into The Green Tomorrow, the U.S. will publish a new Consumer

Price Index (CPI) print. After an aggressive shift in monetary

policy from the U.S. Federal Reserve (Fed), market participants

expect a decline in this metric. If the CPI print signals a decline

in inflation, the crypto market could see some relief. $18,600 and

$22,000 will continue to operate as major support and resistance

levels. Related Reading | Are North Korean IT Remote Workers

Targeting Crypto Firms? Here’s What We Know In addition, analyst

Ali Martinez indicated that Bitcoin is sitting at an “important

demand wall”. There are 570,000 addresses that purchased BTC around

its current levels, to the upside $20,900 is the next level to

watch in case of bullish momentum, as seen in the chart below.

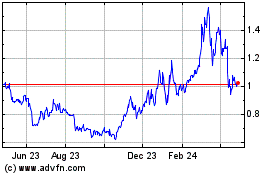

Tezos (COIN:XTZUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tezos (COIN:XTZUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024