MakerDAO Maintains Trust In USDC Despite Depeg Debacle

March 26 2023 - 12:15AM

NEWSBTC

MakerDAO, the governance community of the popular DeFi lending

platform Maker, has decided to keep using USD coin (USDC) as the

primary reserve asset for the DAI stablecoin. Although USDC

experienced a temporary depeg earlier this month, an overwhelming

majority of the MakerDAO have chosen to retain their faith in the

world’s second-largest stablecoin, dismissing any other viable

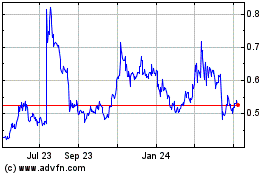

options. USDC Depegged Following SVB’s Collapse On

March 10, news broke out about the collapse of the Silicon Valley

Bank (SVB), one of America’s largest banks and a major banking

partner of Circle, the issuing company of the USDC

stablecoin. The following day, Circle released a statement

saying that about $3.3 billion of the USDC reserves were stuck with

SVB, leading to much panic among investors. Although Circle

provided much assurance that the company would cover all potential

shortfalls using personal resources, it was not enough to

neutralize the negative sentiment around USDC, causing the

stablecoin to depeg from its $1 mark. While USDC soon regained its

peg, its value initially fell as low as $0.87, causing much concern

for other stablecoins and DeFi protocols, including Maker.

USDC De-pegs On March 11 | Source: USDCUSD Chart on Tradingview.com

Related Reading: Bitcoin Price Action Mirrors Q1 2021, Volatility

Ahead? MakerDAO Rejects Plan To Diversify From USDC In response to

the depegging event, the MakerDAO was forced to review its DAI

reserves which were all stored in USDC. This is because the

DAI token is considered vital to the multi-collateral lending

operation of the Maker. In addition, DAI also serves as the native

stablecoin of the protocol. To protect investors’ assets from

similar depegging debacles in the future, the Risk Core Unit of the

Maker protocol proposed on March 17 that the DAI reserves be

diversified into other stablecoins, nominating the Gemini Dollar

(GUSD) and Paxos Dollar (USDP) as viable alternatives with lower

market risks. Source: vote.makerdao.com In a poll on March

20, the MakerDAO strongly rejected the proposal, with 79.02% voting

to “Maintain USDC as the Primary Reserve” as against the mere 20%

that voted in favor of diversification. These poll results are

highly welcomed, especially during a time when many investors’

confidence in USDC is shaken. The Maker protocol remains the second

largest DeFi platform in the market, with a TVL of $7.65 billion.

It was launched back in 2017 and is widely regarded as the

first-ever successful DeFi project. Related Reading: XRP

Might Target $0.50 If It Continues To Trade Above This Level State

Of The Crypto Market Currently, the general crypto market

appears to be bearish, with most assets recording an overall loss

in the last week. For example, data from Coingecko shows that

Ethereum (ETH), Binance Coin (BNB), and Polygon (MATIC) have all

suffered losses to the tune of 1.8%, 4.0% and 9.9% in the last

seven days. Meanwhile, Bitcoin has managed to stay afloat, gaining

by only 0.9% in the same period. However, some tokens have been

able to pull off a remarkable uptrend in the last few days. For

example, Ripple (XRP) has recorded an overall profit of 18.0% in

the last week as optimism concerning the Ripple vs. SEC court case

continues to grow, with a ruling expected in the first half of

2023. Featured image: The Block, Chart from Tradingview

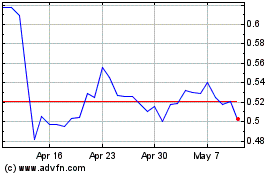

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024